- RBA cuts cash rate 25bp to 3.85% as expected

- Growth and inflation projections both revised lower

- Board judged inflation risks more balanced

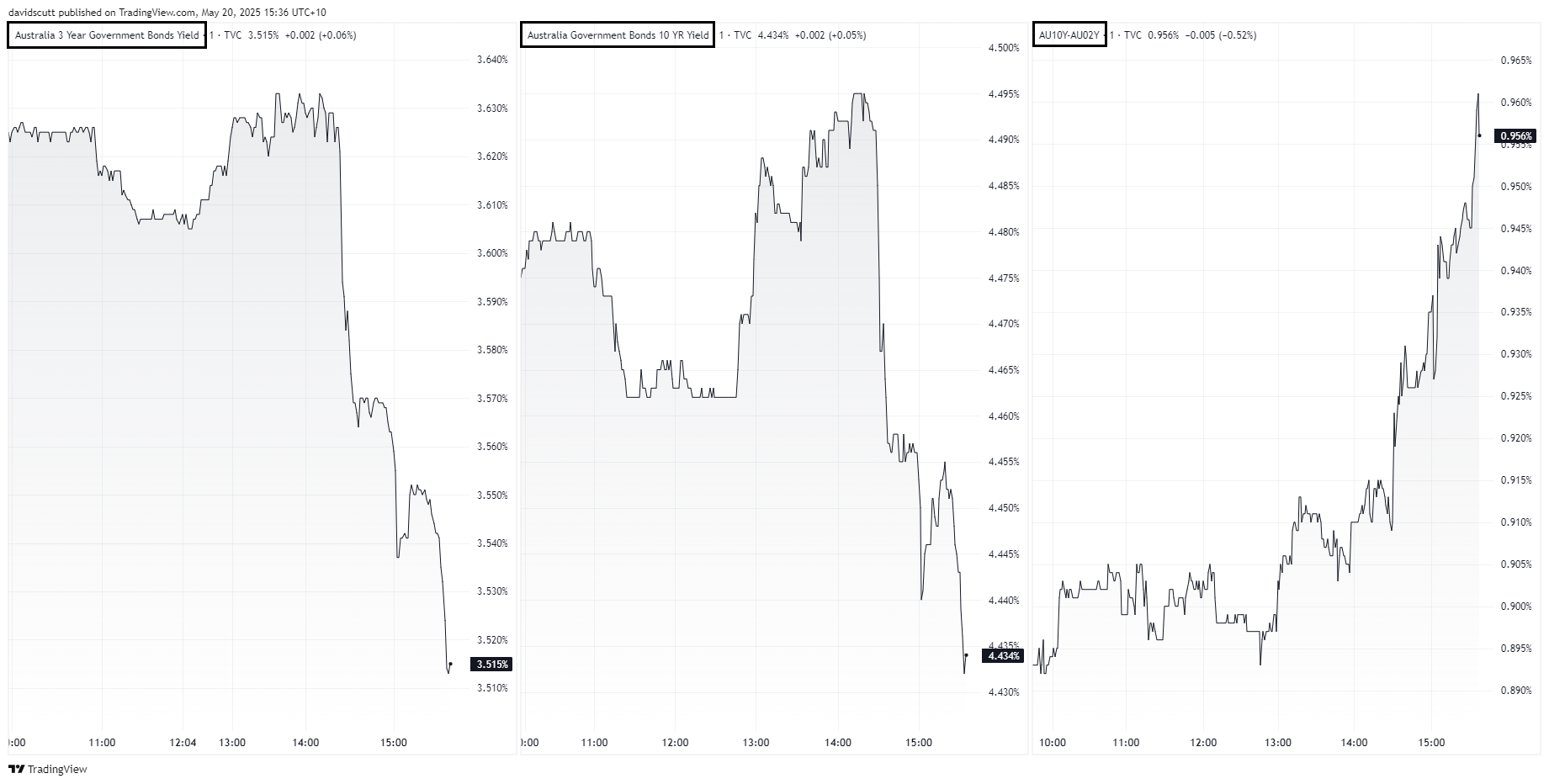

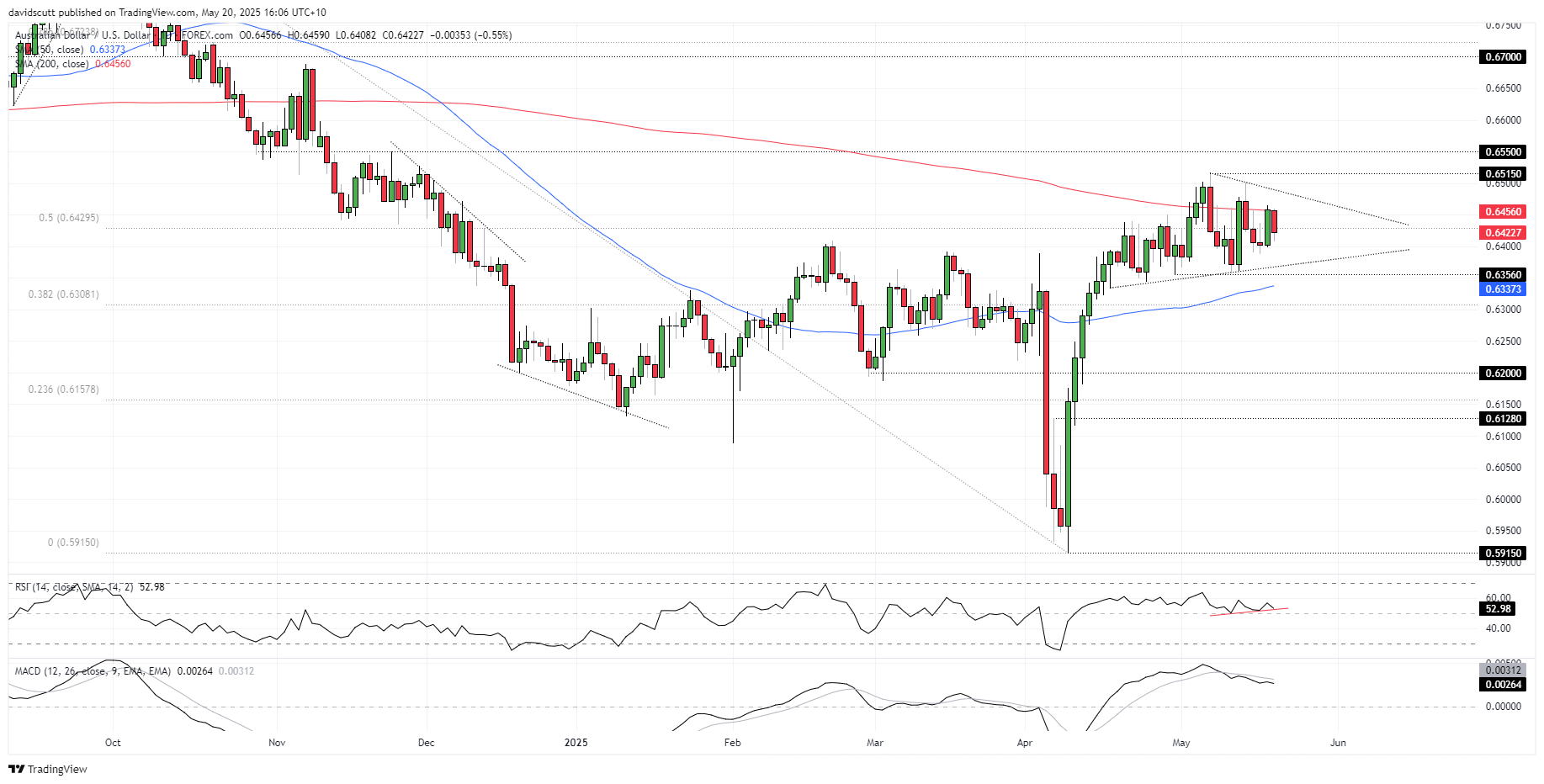

- AUD/USD dipped as short-end yields led bull steepening

The RBA sees slower economic growth, higher unemployment, and underlying inflation continuing to move back towards the midpoint of its 2–3% target, making it an easy decision to deliver its second cut of the easing cycle in May, taking the cash rate to 3.85%.

With the 25bp reduction entirely priced in, and guidance on the rates outlook absent—as is usually the case when the cash rate is moved—it was always going to come down to the commentary and updated forecasts to dictate market direction.

RBA Forecasts Slower Growth, Higher Unemployment, Lower Inflation

On balance, they were marginally more dovish than three months ago, with elevated uncertainty resulting in slower economic growth, slightly higher unemployment, and softer inflation.

Source: RBA

While the revisions make perfect sense given the tricky macroeconomic climate, the question was always going to be how the forecasts would shift based on another interest rate cut being added to the 2025 profile relative to three months ago. Back then, the RBA argued three cuts this year would be too stimulatory to push trimmed mean inflation back to the 2.5% midpoint of its target band. On this occasion, it judged heightened uncertainty more than offset the risk that an additional cut could spark another unwelcome pickup in inflationary pressures.

“The Board judged that the risks to inflation have become more balanced,” the bank said in its statement. “Inflation is in the target band and upside risks appear to have diminished as international developments are expected to weigh on the economy.”

Adding context, it noted that “while the central projection is for growth in household consumption to continue to increase…recent data suggest that the pick-up will be a little slower than was expected three months ago.”

“There is a risk that any pick-up in consumption is even slower than this, resulting in continued subdued growth in aggregate demand and a sharper deterioration in the labour market than currently expected,” it said.

It was telling the board also considered a “severe downside scenario” to its forecasts, providing additional fuel to the broader dovish assessment. In her press conference following the decision, Governor Michele Bullock acknowledged both a 25 and 50 basis point cut were discussed at the meeting, along with keeping policy stable.

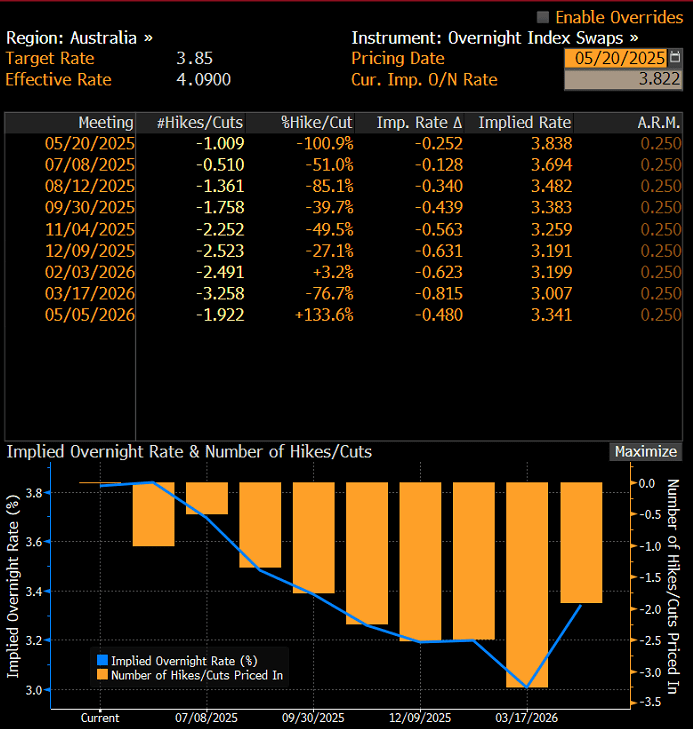

A 25bp cut at the RBA’s next meeting in July is deemed a coin flip, with a move in August fully priced. A second cut seen by November.

Source: Bloomberg

Dovish Market Reaction

Source: TradingView

The Australian 3s10s curve bull steepened following the statement, led by a larger decline in shorter-dated yields. That acted to drag AUD/USD lower, with the pair adding to losses during Bullock’s press conference. AUD/USD attracted bids below .6400 in each of the past three sessions, putting that on the radar for traders following the RBA-led reversal. Uptrend support at .6370 and .6356 are levels of note found below. The 200DMA remains the key topside level near-term.

Source: TradingView

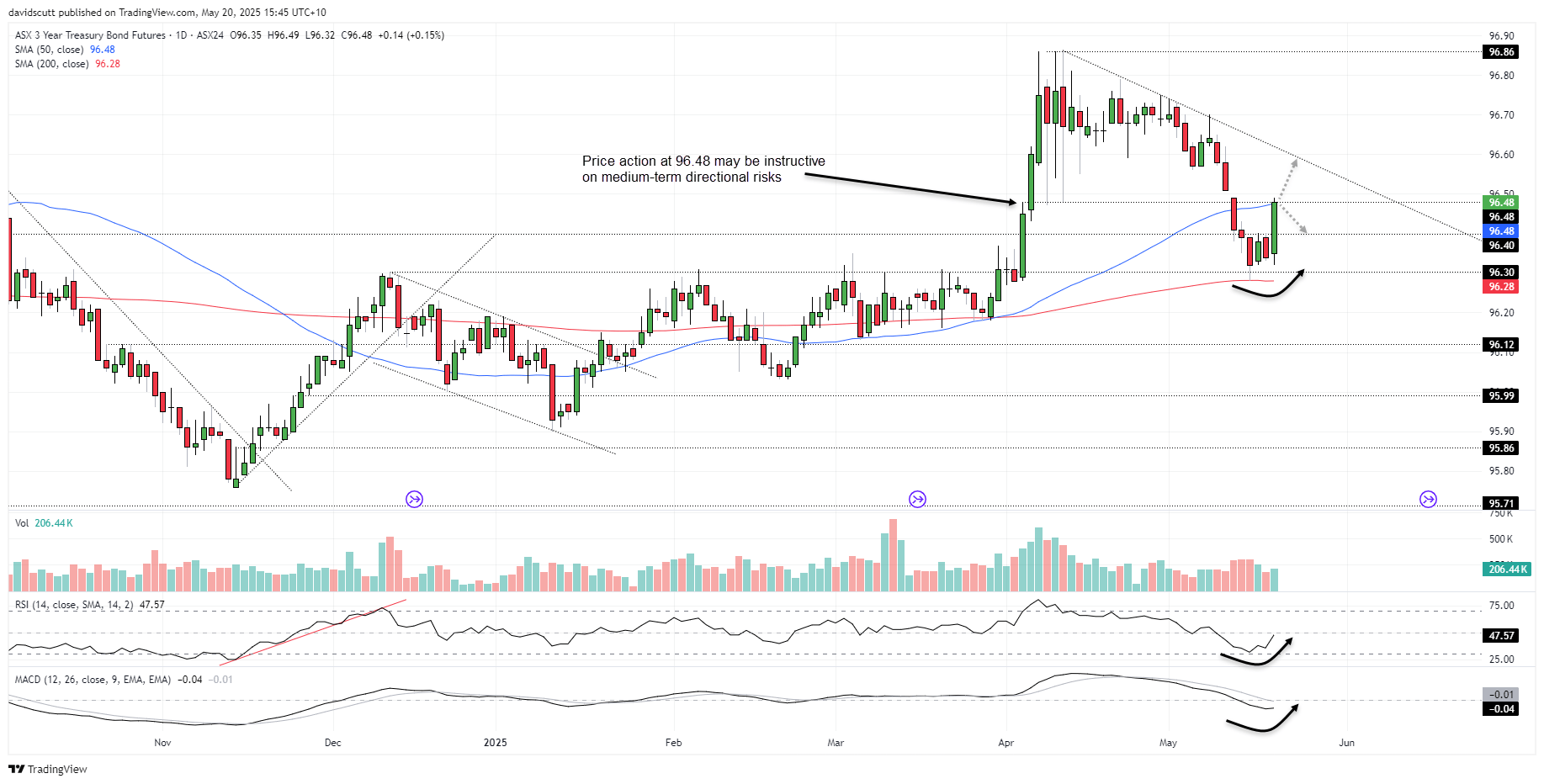

Bond Bulls Back in Control

Source: TradingView

Australian three-year bond futures hit one-week highs as markets shifted forward the expected timing of rate cuts, seeing the price testing the 50DMA and minor horizontal resistance at 96.48. A break above this level would bring the downtrend dating back to the April highs into play. If the price remains around these levels into the close, it would also deliver a key bullish reversal candle, pointing to the risk of lower three-year yields ahead. Momentum indicators are also showing signs of turning higher, although the overall signal remains neutral for the moment.

On the downside, a support zone between 96.30 and the 50DMA remains the one to watch.

-- Written by David Scutt

Follow David on Twitter @scutty