- S&P 500 forecast clouded by Middle East tensions and oil price volatility

- Powell’s inflation warning also tempers sentiment

- Key levels tested on S&P 500 futures as cash markets remain closed

The S&P 500 forecast remains murky as markets grapple with rising geopolitical tensions and renewed inflation anxieties. Sentiment soured across European and Asian bourses in the first half of Thursday, with traders unnerved by the growing spectre of US military involvement in the Israel–Iran conflict. That concern, combined with a hawkish undertone from Federal Reserve Chair Jerome Powell, has put equity bulls on the back foot. While US cash markets were closed for the Juneteenth holiday, futures drifted lower, and the dollar firmed on safe-haven flows. Oil, unsurprisingly, surged — Brent crude clawed back nearly 4% at its peak after Wednesday’s dip, rising near the $77 per barrel level. Traders are clearly getting concerned about potential supply shocks if regional instability intensifies. The Iran-Israel conflict will remain the focus for markets in the near-term.

Geopolitics and inflation: The twin threats

The macro backdrop is hardly calming. Reports from Bloomberg indicate that senior US officials are bracing for a possible military strike on Iran — potentially as early as the weekend. Such a move would mark a dangerous escalation and throw further fuel on oil prices, which are already tense with risk premium.

Donald Trump, meanwhile, has kept markets second-guessing. On Wednesday, he implied that the US wasn’t planning military action for now, though he added, characteristically, “I may do it. I may not do it. Nobody knows what I’m going to do.” Hardly the sort of clarity investors crave.

Adding to the tension was Powell at the FOMC presser yesterday, where he noted upside risks to inflation. His remarks served as a reality check for those hoping for imminent rate cuts, especially with the Middle tensions sending oil prices surging higher in the last week or so.

S&P 500 technicals analysis and trade ideas

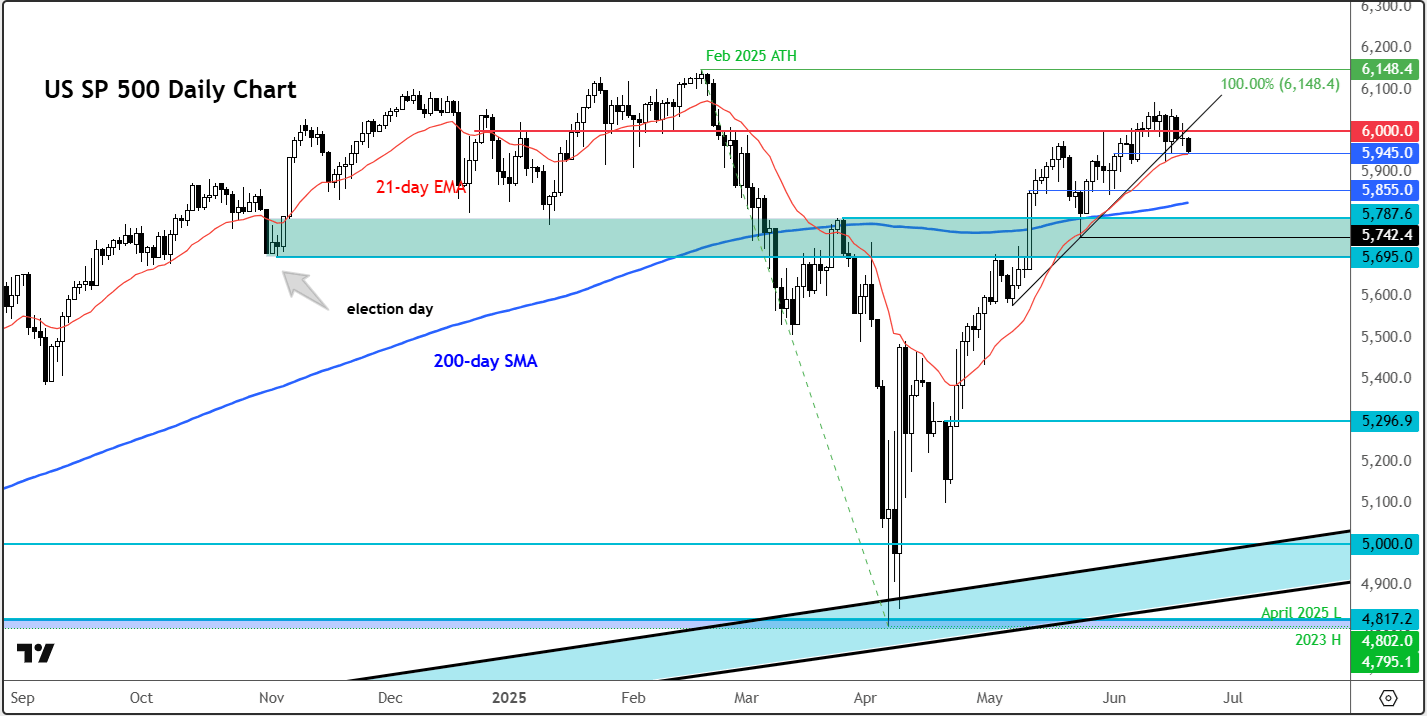

Source: TradingView.com

Turning to the charts, our US SP 500 chart, which is based on the underlying S&P 500 futures, has turned flat. After a promising start on Monday, gains were quickly unwound as geopolitical jitters took hold. The index broke below the psychologically significant 6,000 level this week, which was a key technical floor that coincides with a short-term rising trend line. At the time of writing, the index was testing support at 5945, where the 21-day EMA comes into play as well. A potential close below that could weaken the bullish structure further.

Should that support give way decisively, expect a technical slide towards 5,900 initially, ahead of 5855 next. A deeper retracement could target the 200-day average at 5825, and eventually the confluence zone between 5,695 and 5,787 (shaded in blue on the chart).

On the upside, resistance sits initially at 6,000, followed by Monday’s high around 6,051. A move above that would signal that bulls still have some fight left, despite macro headwinds.

S&P 500 forecast: Caution still the dominant theme

All told, the S&P 500 forecast remains delicately poised. Traders must weigh mounting geopolitical risks against a stubborn inflation narrative and a Federal Reserve that appears in no rush to ease. With oil prices rising, bond markets nervous, and political rhetoric unpredictable, the outlook for equities — especially at current highs — demands a cautious stance.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R