- S&P 500 forecast improves as weak macro data fuels rate cut expectations

- Tech earnings lead the charge; all eyes on Apple and Amazon next

- Trade, Fed policy and earnings remain key drivers for sentiment

The S&P 500 staged an impressive comeback after an early stumble, bouncing back from around 2% down to finish the session higher—before adding to gains in overnight futures trading. Buoyant earnings from US tech giants and fading fears over harsh trade measures have helped turn the tide, with traders now seriously considering the likelihood of rate cuts by the Federal Reserve in the near future. Unless Trump now undoes all this by making another U-turn on trade policy, resulting in more tariffs or elongates the uncertainty, the S&P 500 forecast is likely to remain modestly positive. Indeed, a poor showing from US GDP and a flat core PCE print have certainly played their part in helping to increase the likelihood of a sooner-than-expected Fed rate cut. Today’s data docket brings ISM Manufacturing PMI and jobless claims into view, along with the next wave of earnings, including heavyweight names Apple and Amazon. Meanwhile, much of Europe is enjoying a bank holiday break, leaving US markets to do the heavy lifting.

Microsoft and Meta deliver, with more tech earnings on tap

Futures on the S&P 500 pushed up more than 1.2% during the first half of Thursday’s session, driven by stellar updates from Microsoft and Meta. Microsoft beat top-line estimates, while Meta also surpassed forecasts, helping to calm investor nerves rattled by weaker macro figures. So far, this earnings season has offered markets the reassurance they craved, particularly from the tech behemoths. That has been enough to underpin the broader S&P 500 forecast and improve overall risk sentiment, at least for now. The spotlight now shifts to post-close reports from Apple and Amazon, which could either reinforce the current rally or introduce fresh uncertainty.

Trade optimism and policy pivot speculation bolster sentiment

Away from corporate earnings, the bigger picture remains firmly tied to trade and policy. There’s growing talk that the US is nearing preliminary trade deals that could scale back some of President Trump’s earlier tariff threats. Reports of renewed diplomatic outreach to China have further buoyed hopes of a more conciliatory stance. That said, Trump has shown little inclination to hurry negotiations merely to calm markets. Still, investors appear willing to give him the benefit of the doubt—for now—especially with recession signals blinking more insistently on the macro dashboard.

Recession fears rising, but a dovish Fed may be just what equities need

Wednesday’s data rekindled concerns over stagflation, as several firms withdrew forward guidance amid trade uncertainty. However, softer-than-expected core PCE—widely seen as the Fed’s inflation bellwether—alongside stronger data on personal income and pending home sales, helped flip the mood late in the day.

The overall S&P 500 forecast remains constructive, even as recession risk increases. Ironically, such risks could hasten rate cuts, a development equity markets often welcome with open arms. With President Trump openly pressuring the Fed to act and the economic optics growing more negative, a dovish pivot may well be on the cards—further bolstering equities in the process.

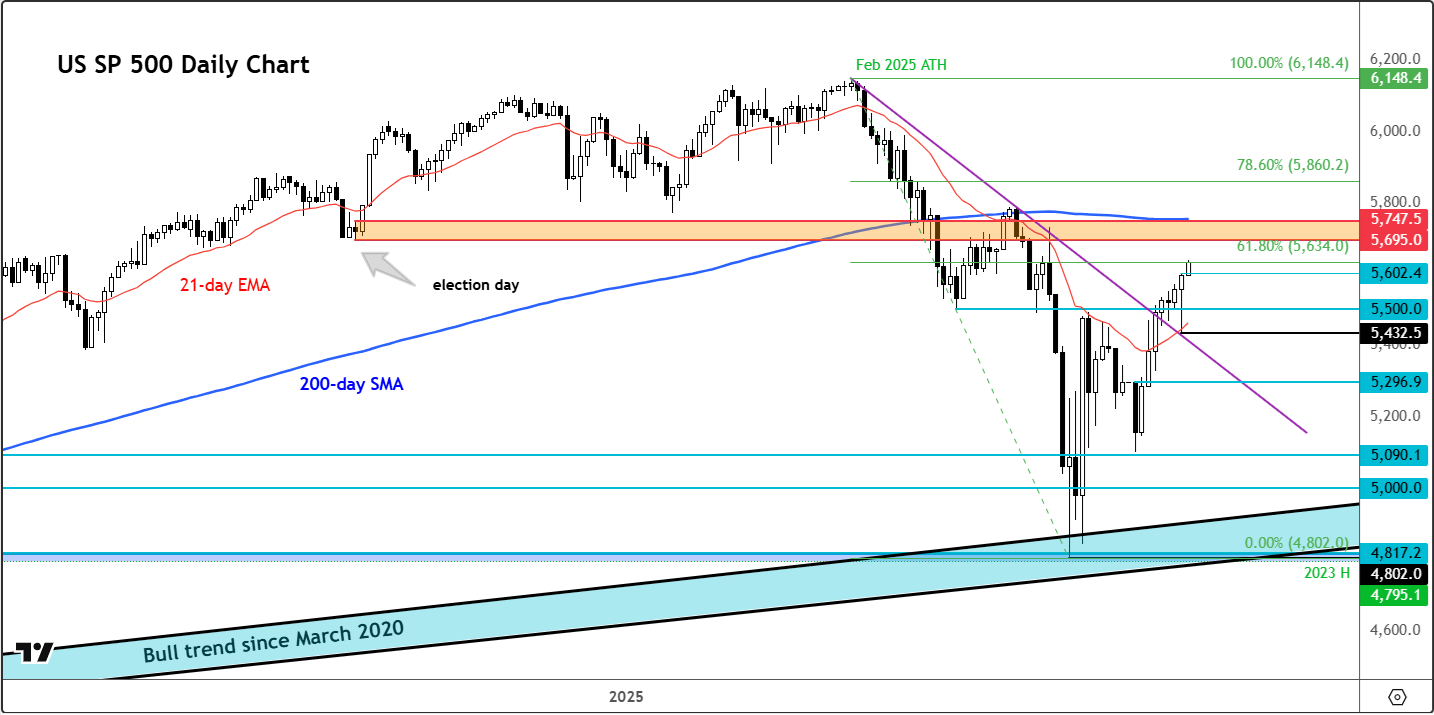

Technical S&P 500 forecast: Key trends and levels to watch

Source: TradingView.com

Technically, the S&P 500 forecast remains bullish. After slicing through resistance at 5500, the index has reclaimed this key level that could now act as support on any retracement. Dip-buying remains the strategy of choice for many traders. Interim support comes in at 5602, marking the high from yesterday when the index formed a hammer candle on the daily after reversing a 2% loss into a positive finish.

Unless we see a decisive close below 5455—the low from Wednesday—the bullish case holds firm. The next potential hurdle is at 5634, marking the 61.8% Fibonacci retracement from February’s high. Should momentum continue, the zone between 5695 and 5747 will come into play, representing the launchpad of the post-election rally (which ultimately failed and reversed in February).

Encouragingly, the S&P 500 has also held its retest of a broken trendline dating back to February, lending further weight to the upside narrative. All told, the path of least resistance remains upwards—though volatility could spike around Friday’s non-farm payrolls or should earnings from Apple and Amazon miss expectations.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R