US futures

Dow futures -0.54% at 42402

S&P futures -0.95% at 5898

Nasdaq futures -1.4% at 21130

In Europe

FTSE -0.63% at 8630

DAX 0.01% at 23766

- Stocks fall after strong gains last week

- Moody’s downgrades US credit rating to Aa1

- Concerns over the US $36 trillion grow

- Oil falls after weaker China data

Moody’s lowers US credit rating

U.S. stocks are heading for a lower start while treasury yields rise after Moody's downgraded the U.S. sovereign rating, heightening the attention on the country's mounting debt pile.

Moody’s cut the US sovereign credit rating to Aa1 from Aaa late Friday amid growing concerns over $36 trillion in debt, making it the last of the three major credit agencies to downgrade the US rating.

The downgrade overshadows some of the recent good news momentum. However, this is headline risk and is not expected to have a major impact on the financial markets.

Concerns over the rising US deficit are even more prominent after Trump's sweeping tax cut bill won approval from a key congressional committee on Sunday, after days of Republican infighting over spending cuts.

Yields on U.S. government bonds are rising, with the 10-year note rising 10.9 basis points and the 30-year note touching 5.02%.

Tech stocks are bearing the brunt of the sell-off pre-market as rising rates tend to discount the present value of future profits.

Trade continues to be a focus after Treasury Secretary Scott Bessent said over the weekend that Trump would impose tariffs at the rate he had threatened on Liberation Day if trading partners do not negotiate in good faith.

Earnings season is coming to an end with 90% of the S&P 500 companies having reported.

No major U.S. economic data will be released today. This week has been relatively quiet for US data.

Corporate news

Nvidia CEO Jensen Huang unveiled a host of new AI technology for enterprise and consumer applications when delivering the keynote address to the Computex AI exhibition in Taiwan.

Walmart is falling 1.8% after Trump said the retail giant should absorb price increases from import tariffs.

Netflix is falling 1.7% after JP Morgan Dane graded it starts on the streaming giant to neutral from overweight and made renewed risk reward appeal following its recent rally.

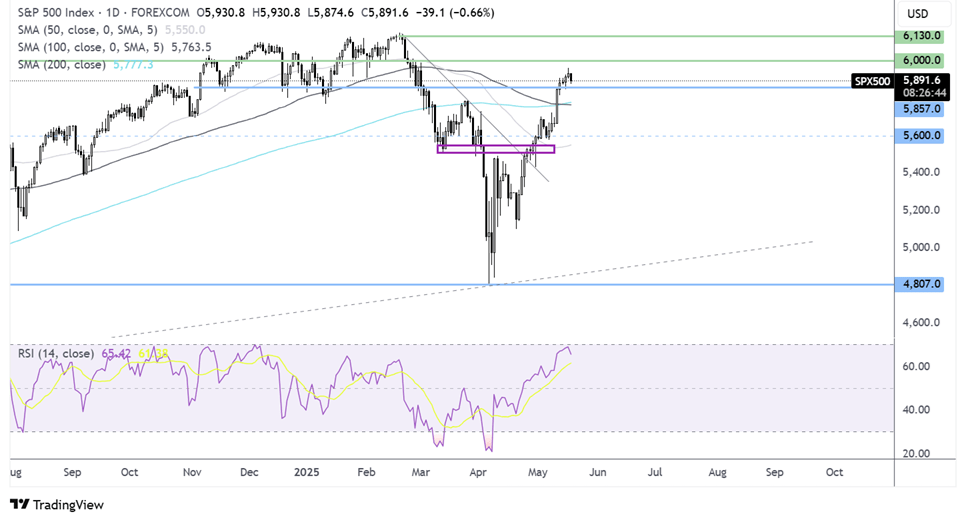

S&P 500 forecast – technical analysis.

The S&P500 recovered from its 2025 low of 4800, extending above its 200 SMA to a peak of 5960, its highest level since March 3. The price has eased lower, pulling the RSI away from overbought territory. However, the uptrend remains intact for now with no concrete signs of reversal. Support is seen at 5850, with a break below here exposing the 200 SMA at 5767. Below here sellers could gain momentum. Buyers will look to rise above the 5960 level towards 6000.

FX markets – USD falls, EUR/USD falls

The USD is falling after four straight weeks of gains. The USD is plunging after Moody’s downgraded the US credit rating. The USD had risesn over the past 4 weeks due to improved mood surrounding trade.

The EUR/USD is rising amid a weaker USD. Eurozone inflation eased to 2.2% YoY, heading towards the ECB target of 2%. The central bank cut rates by 25 bps in April and is set to cut rates again by 25 bps in June.

GBP/USD is rising, capitalising on the weaker USD, as the UK agrees to reset Brexit trade ties with the EU. A deal said to be worth £9 billion to the UK has been agreed amid a concession on fishing, which opened the way to deals including security, defence, and agriculture.

Oil falls after Chinese data, US trade tensions

Oil prices are falling at the start of the week, weighed down by the downgrade of the US credit rating and after official data showed a slowdown in China's industrial output. These latest developments have raised concerns about the health of the world's two largest economies and oil consumers.

Chinese industrial production slowed to 6.1% year over year in April, down from 7.7% in May; however, this was above the forecast of 5.5%.

Comments by U.S. Treasury Secretary Scott Bessent also hurt the fragile demand outlook for oil. Bessent warned that Trump will impose tariffs at the rate he threatened last month on trading partners who do not negotiate in good faith.

The market will also watch the nuclear talks between Iran and the US. Signs of progress could raise concerns about an increased oil supply if oil restrictions are removed.