S&P 500 Key Points

- Correlations among usually divergent US dollar, stock and bond markets are all trending toward 1.

- Traders are rejecting the US administration’s tariff-driven strategy, as well as the threats to Fed independence.

- S&P 500 traders may soon turn their eyes toward the key psychological level at 5,000, followed by the post “Liberation Day” lows under 4900.

“In a crisis, all correlations go to 1”

While I’d argue the outlook for the US economy isn’t at crisis levels yet per se, it’s hard to deny that the correlations among usually divergent US assets are all trending toward 1 in the current environment. Historically, when the US stock market falls, traders will rotate funds into the perceived safety of the US dollar or Treasury bonds. Or in stereotypical “risk on” environments, traders will rotate out of safer investments like Treasuries to buy US stocks.

However, as the chart below shows, each of the US stock market (S&P 500), Treasury bond futures (ZN) and the US Dollar (DXY) are trading lower over the last 2+ weeks, showing a broad desire to sell all US assets regardless of their risk orientation:

Source: StoneX, TradingView

Put simply, markets are categorically rejecting the US administration’s economic strategy, and the longer the US goes without reaching trade deals with key partners (and ideally China), the worse the damage could get. At the same time, the apparently intense focus on removing – or at least influencing – Federal Reserve Chairman Jerome Powell has spooked global traders, who view the political independence of central banks as sacrosanct. While we’re still a long ways from that type of crisis, it appears more likely than it has been in decades, giving global traders another key flashpoint to fret about.

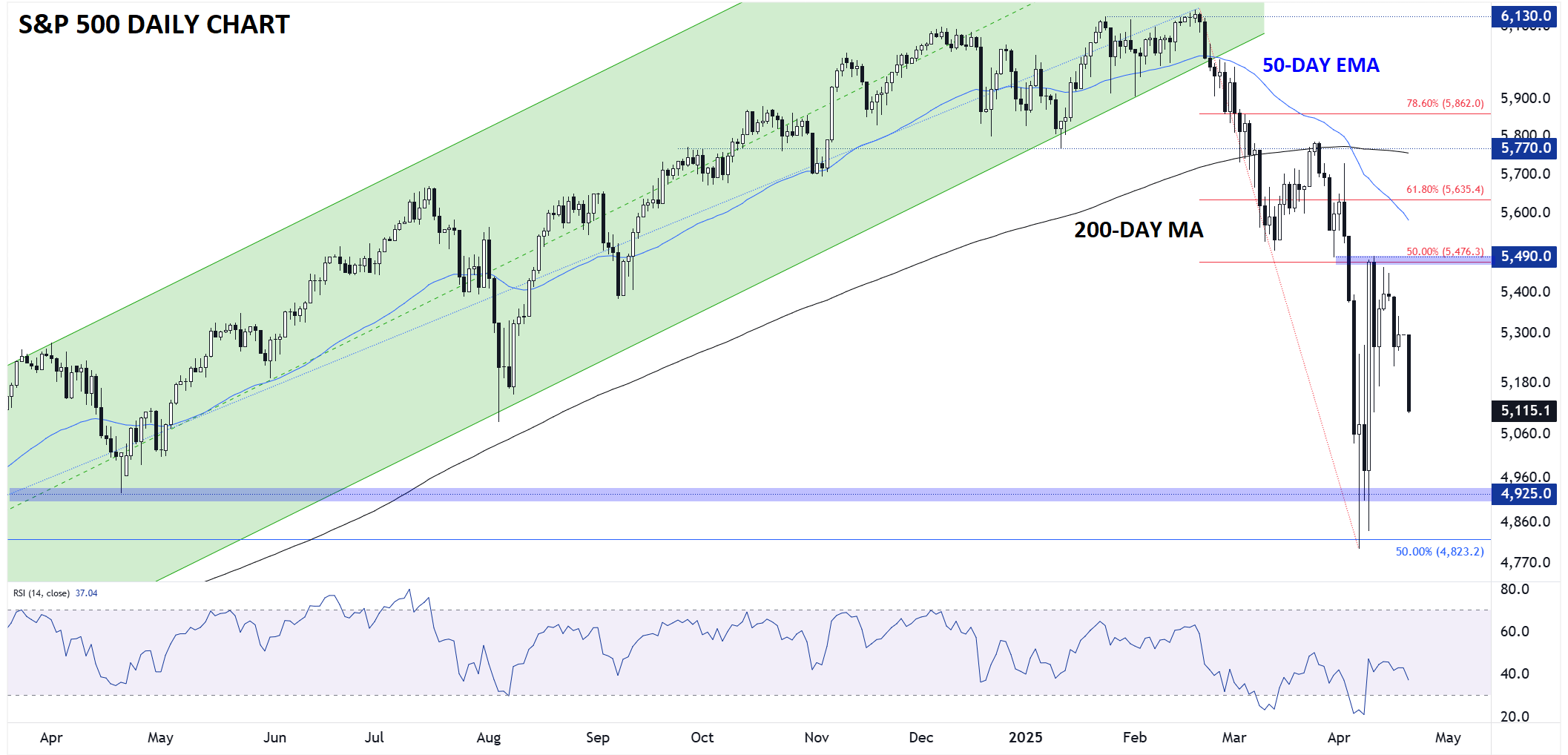

S&P 500 Technical Analysis: SPX Daily Chart

Source: StoneX, TradingView

Keying in on the S&P 500, the broad-based index of US large cap stocks appears to be rolling over after bouncing through the middle of the month. As we go to press, the index is leaking down toward 5100 with nary an intraday bounce to be seen. Unless we can get some positive news on the trade front, traders will quickly turn their eyes toward the key psychological level at 5,000, followed by the post “Liberation Day” lows under 4900.

While the focus will remain on the potential for trade deals, it’s also worth watching earnings reports from heavy-hitters Tesla (tomorrow) and Alphabet/Google (Thursday) for any signs of pre-tariff weakness.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX