S&P 500, SPX Talking Points:

- April ended up being a long-legged doji for SPX and intra-month reversals of that nature have been rare for the index.

- May has so far been relatively quiet but the FOMC rate decision later this afternoon introduces some motivation into the matter. To date, Chair Powell has endorsed a wait-and-see mode regarding policy and inflation expectations around tariffs and this initially had a negative impact for stocks, until Trump introduced the 90-day delay in tariff implementation in early-April.

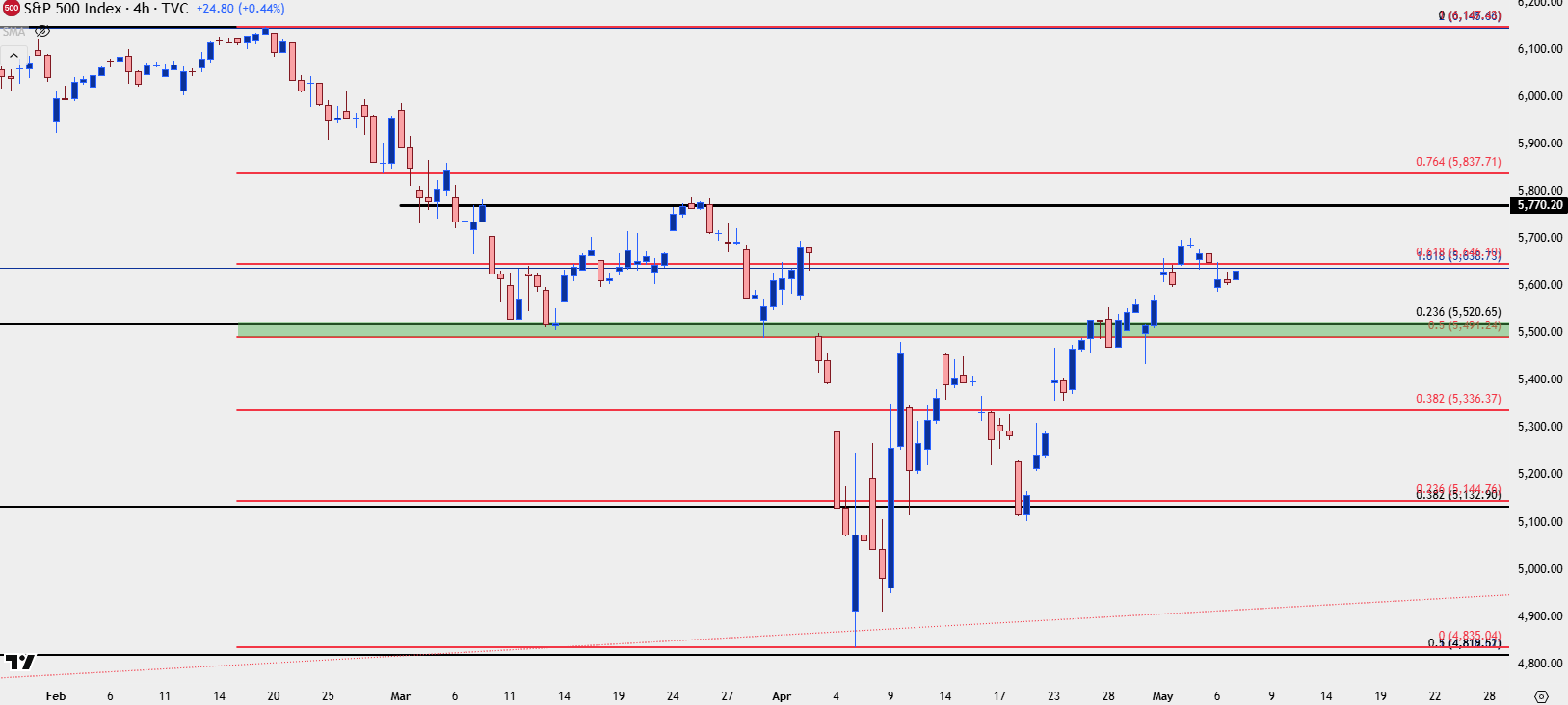

Stocks had a strong final few weeks of April and so far, that strength has remained through the month of May with U.S. equities holding very near recent highs. But, with context it does appear to be at a pivotal fork in the story as resistance has held around the gap produced by the ‘Liberation Day’ announcement of tariffs in early April.

SPX Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

While doom-and-gloom were pervasive in March and early-April, a bit of optimism showed in the second week of April as President Trump delayed tariff implementation on most of the world. To that point, equity investors were in a vulnerable spot, as neither Chair Powell nor President Trump had showed any sensitivity to the equity losses that had started to mount. On the part of Powell and the Fed, the bank refrained from sounding too dovish, instead saying that inflation potential from tariffs was notable enough to avoid cutting rates in the near-term, unless there was a material downturn in the labor market. And for Trump, the prevailing theory is that he was instead trying to force bond yields down and didn’t really care that equity markets were spiraling lower. The theory being that this would bring the Treasury department the ability to re-finance debt later this year and the lower long-term rates would also bring down mortgage rates, helping to boost the real estate area of the U.S. economy. This would also have the impact of forcing the Fed into cuts to address a worsening in economic data and there would even be the ability for Trump to go to Congress with spending and stimulus packages.

It was a ‘short-term pain for long-term gain’ scenario, and for a President who often touted equity market gains as indicators of his performance during his first term, a lack of change even as stocks were selling off gave credence to the above dynamic. And seeing the size of the tariffs announced on ‘Liberation Day,’ which questions behind the calculations as the ‘tariffs imposed on the U.S.’ included ‘trade barriers and currency manipulation,’ there was legitimate fear that the U.S. President didn’t mind if stocks continued their descent.

But that only lasted for about another week, as an announcement in the following week saw tariffs on every country other than China delayed for 90 days. This bought some time, but perhaps more importantly than that, it showed some willingness from Trump to alter policy on the basis of pain, indicating that he didn’t want to see equities smoldering-lower again.

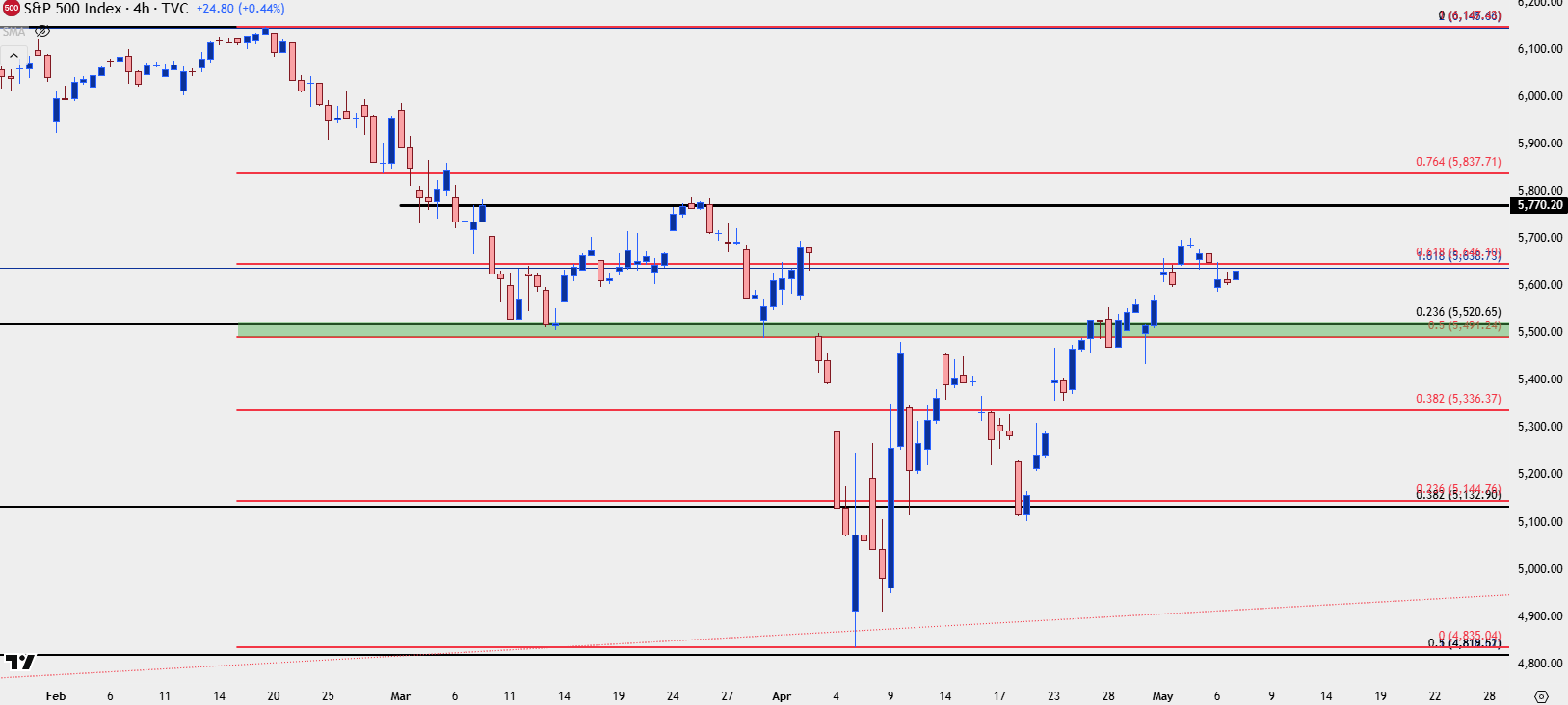

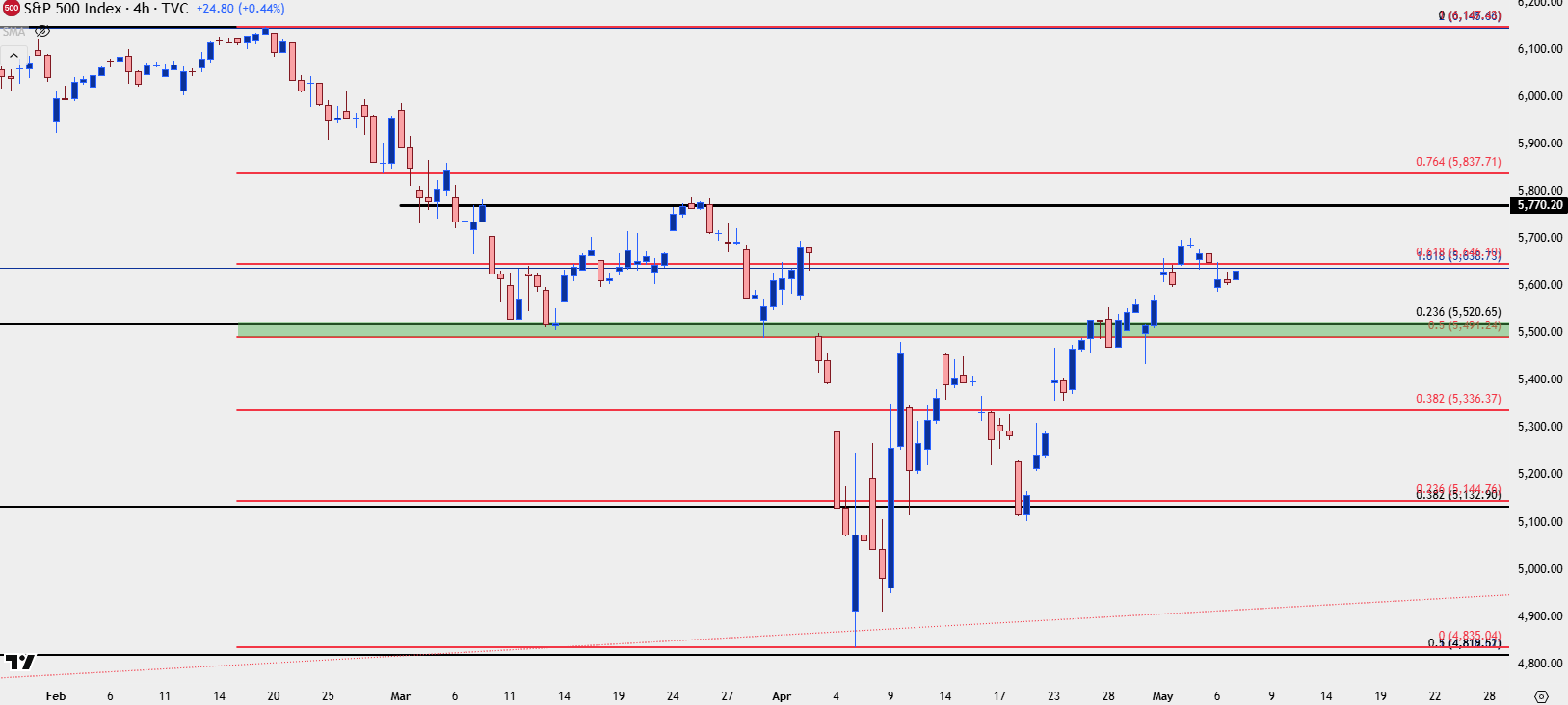

Since then, it’s been a consistent pattern of higher-highs and lows and at this point, we’re right back to where we had started when President Trump displayed the placard showing tariffs on the rest of the world.

SPX Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Powell’s Part

Perhaps one of the most potent variables of the post-GFC backdrop for equities has been Central Bank accommodation. We’ve seen this in multiple ways but after a frightening backdrop in 2008, the FOMC has adopted numerous strategies to keep equity markets running higher.

Communication with the public has been a big part of that, and that shows through both Fed-speak and ‘well sourced journalists’ giving previews or hints of what’s to come. I talked about this in yesterday’s webinar, but if we can remember back to June of 2022, when the Fed had just started to hike rates to address inflation, it was a Monday report from the Wall Street Journal that broadcast the potential for a 75 bp hike two days later. The Fed was in a blackout period, so there was not supposed to be any communication with the public at that time, but clearly someone well-sourced at the bank had spoken to the WSJ and this report helped to soften the blow of the announcement. It’s perhaps no coincidence that stocks bottomed not too long after that.

But even leading into that scenario, the Fed refrained from any rate hikes in 2021 even as inflation jumped higher and higher on the back of Covid-driven stimulus, instead saying that they thought it was ‘transitory’ and ‘supply chain related,’ clearly using monetary policy to prod equity market gains.

Before that, we had multiple rounds of QE in the post-GFC backdrop even as economic data wasn’t all that grim. Collectively, this led to a bloated balance sheet that remains an issue today.

But what’s exceptional about the current circumstance is that it’s seemingly one of the few times that the Fed has appeared to err on the side of hawkish. To be clear we have heard some Fed speakers offer a bit of support, such as Susan Collins remarking that the bank was ‘absolutely’ ready to help stabilize markets if needed, or Christopher Waller saying that he though tariff inflation is transitory and that he’s standing by to support rate cuts if job losses begin to show.

But this doesn’t appear to be the boilerplate for the bank as notable voices at the FOMC, in the form of Chair Powell or Austan Goolsbee or John Williams, have all sounded a bit more cautious while ascribing greater inflation potential to the prospect of tariffs.

For today, there’s no reason for Powell to alter course, especially given the recent rally in equities. I think the wide expectation is for reiteration of the phrase that the FOMC is in a good position to wait for clarity. This will likely come with talking down of a rate cut in June, which currently shows a 30.3% probability of taking place, per CME Fedwatch as of this writing. More pressing will be that June meeting and the Summary of Economic Projections that will be released then, as markets are currently holding out hope for 75 bps in cuts by the end of the year which would mean a hurried pace of softening from the FOMC in the second-half of 2025.

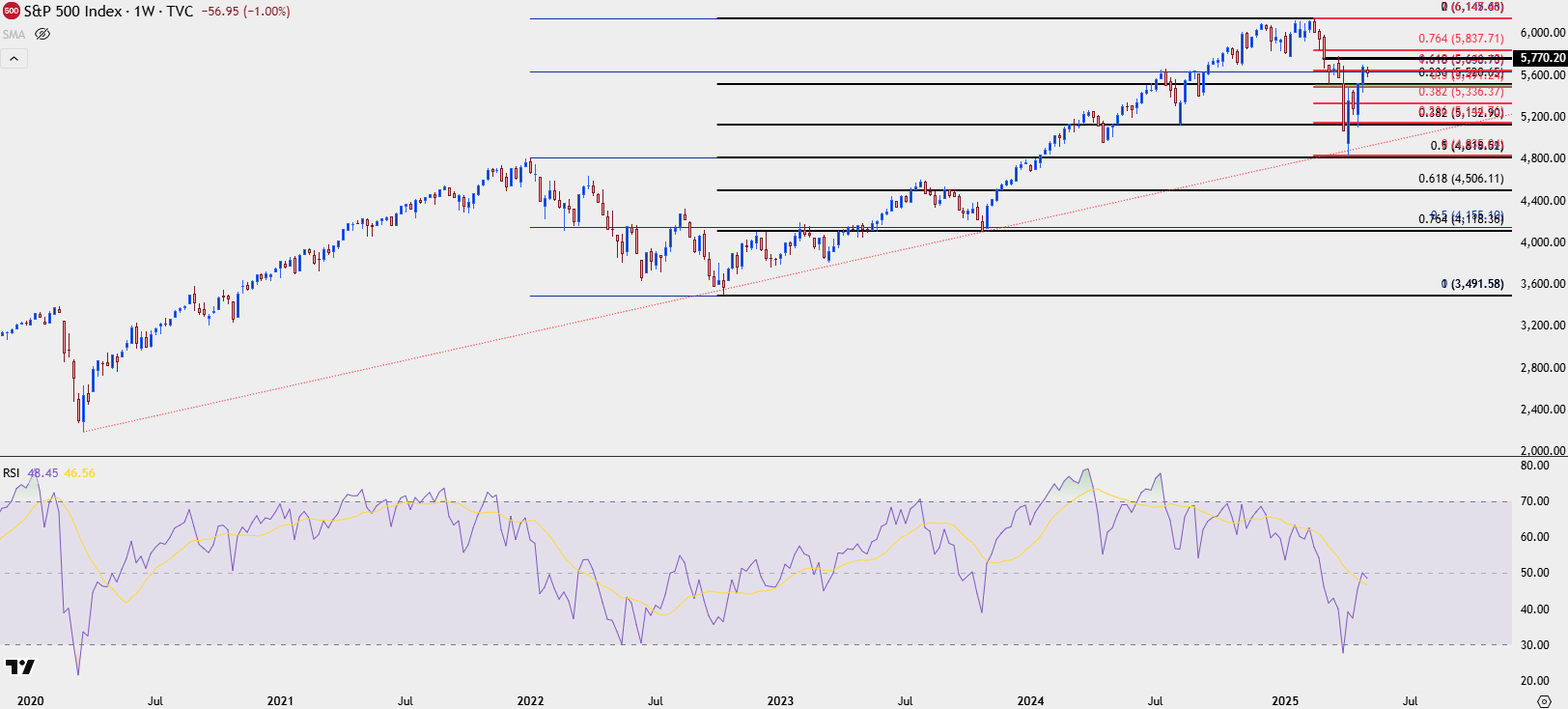

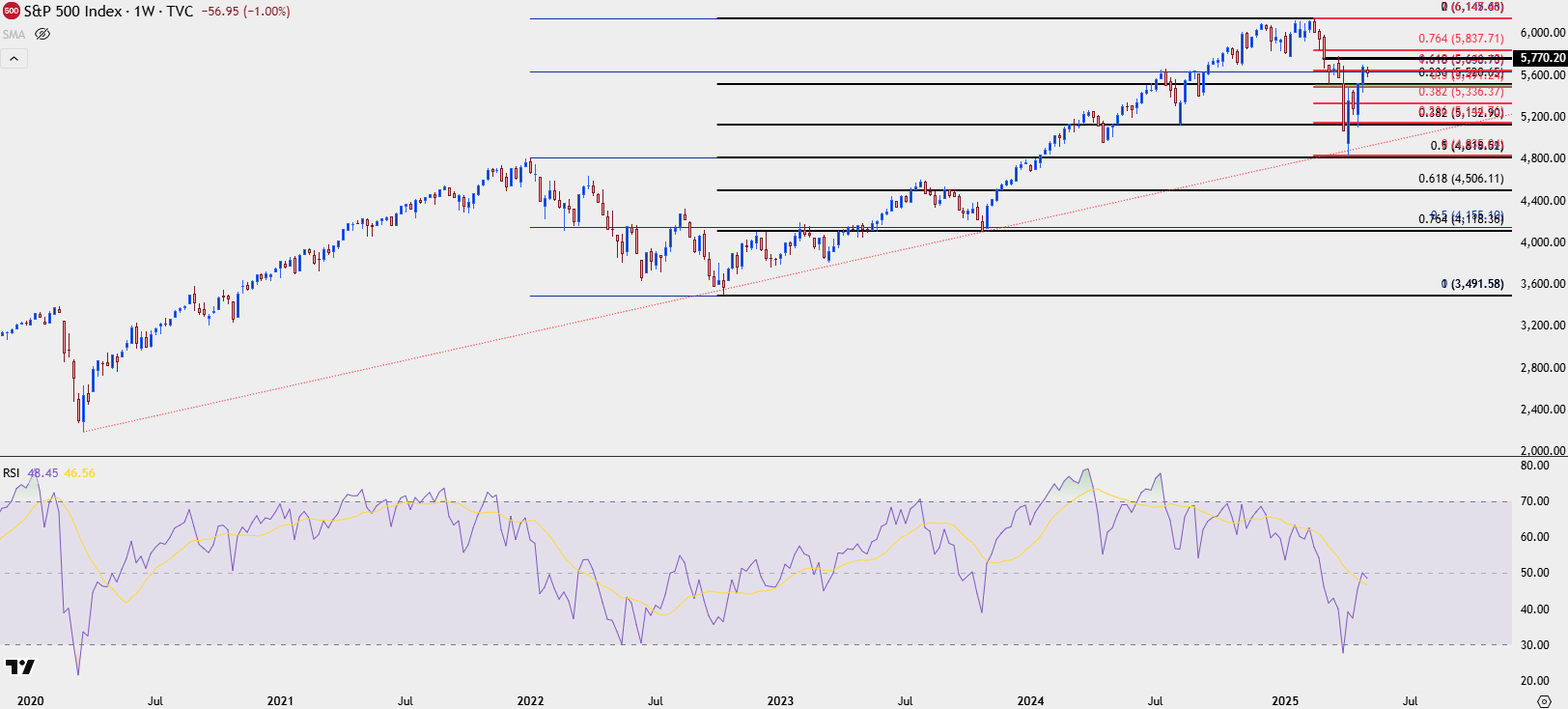

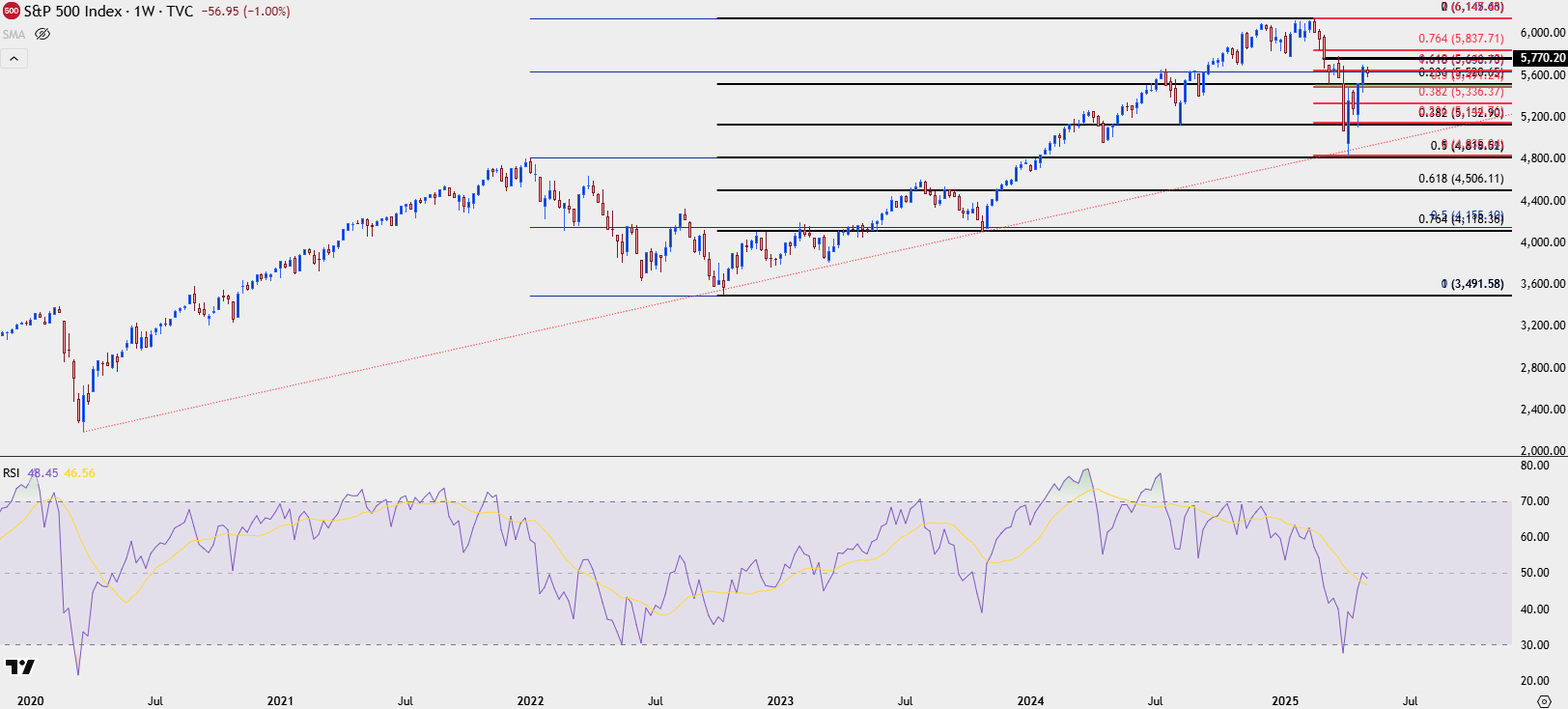

SPX Bigger Picture

It’s been a significant rally in stocks over the past month, but it’s important to remember the context from which that derived. SPX went into oversold territory on the weekly chart for the first time since Covid, and that’s so far led to a vigorous bounce. As noted above, there’s scope for bullish continuation on shorter time frames, and a continuation of higher-highs and lows keeps that door open.

But – we also must call this what it is and what it’s been, which is a bounce from oversold conditions. And while we have seen Trump soften his stance on tariffs, the April announcement that helped to prod this bounce was a delay, and not a nullification. So there remains the prospect of bears coming back into the matter which is why chasing with reckless abandon is probably a sub-optimal way of addressing equities at the moment. For support, there’s a wide area from 5491-5520 and that can serve as a decision point for longer-term trends. A pullback to that zone with an exhibition of support from bulls highlights continuation potential. But if sellers continue to offer prices lower through that, it can serve as a clear indication of the ‘sell the rip’ dynamic after the late-April rally.

SPX Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist

S&P 500, SPX Talking Points:

- April ended up being a long-legged doji for SPX and intra-month reversals of that nature have been rare for the index.

- May has so far been relatively quiet but the FOMC rate decision later this afternoon introduces some motivation into the matter. To date, Chair Powell has endorsed a wait-and-see mode regarding policy and inflation expectations around tariffs and this initially had a negative impact for stocks, until Trump introduced the 90-day delay in tariff implementation in early-April.

Indices AD

Stocks had a strong final few weeks of April and so far, that strength has remained through the month of May with U.S. equities holding very near recent highs. But, with context it does appear to be at a pivotal fork in the story as resistance has held around the gap produced by the ‘Liberation Day’ announcement of tariffs in early April.

SPX Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

While doom-and-gloom were pervasive in March and early-April, a bit of optimism showed in the second week of April as President Trump delayed tariff implementation on most of the world. To that point, equity investors were in a vulnerable spot, as neither Chair Powell nor President Trump had showed any sensitivity to the equity losses that had started to mount. On the part of Powell and the Fed, the bank refrained from sounding too dovish, instead saying that inflation potential from tariffs was notable enough to avoid cutting rates in the near-term, unless there was a material downturn in the labor market. And for Trump, the prevailing theory is that he was instead trying to force bond yields down and didn’t really care that equity markets were spiraling lower. The theory being that this would bring the Treasury department the ability to re-finance debt later this year and the lower long-term rates would also bring down mortgage rates, helping to boost the real estate area of the U.S. economy. This would also have the impact of forcing the Fed into cuts to address a worsening in economic data and there would even be the ability for Trump to go to Congress with spending and stimulus packages.

It was a ‘short-term pain for long-term gain’ scenario, and for a President who often touted equity market gains as indicators of his performance during his first term, a lack of change even as stocks were selling off gave credence to the above dynamic. And seeing the size of the tariffs announced on ‘Liberation Day,’ which questions behind the calculations as the ‘tariffs imposed on the U.S.’ included ‘trade barriers and currency manipulation,’ there was legitimate fear that the U.S. President didn’t mind if stocks continued their descent.

But that only lasted for about another week, as an announcement in the following week saw tariffs on every country other than China delayed for 90 days. This bought some time, but perhaps more importantly than that, it showed some willingness from Trump to alter policy on the basis of pain, indicating that he didn’t want to see equities smoldering-lower again.

Since then, it’s been a consistent pattern of higher-highs and lows and at this point, we’re right back to where we had started when President Trump displayed the placard showing tariffs on the rest of the world.

SPX Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Powell’s Part

Perhaps one of the most potent variables of the post-GFC backdrop for equities has been Central Bank accommodation. We’ve seen this in multiple ways but after a frightening backdrop in 2008, the FOMC has adopted numerous strategies to keep equity markets running higher.

Communication with the public has been a big part of that, and that shows through both Fed-speak and ‘well sourced journalists’ giving previews or hints of what’s to come. I talked about this in yesterday’s webinar, but if we can remember back to June of 2022, when the Fed had just started to hike rates to address inflation, it was a Monday report from the Wall Street Journal that broadcast the potential for a 75 bp hike two days later. The Fed was in a blackout period, so there was not supposed to be any communication with the public at that time, but clearly someone well-sourced at the bank had spoken to the WSJ and this report helped to soften the blow of the announcement. It’s perhaps no coincidence that stocks bottomed not too long after that.

But even leading into that scenario, the Fed refrained from any rate hikes in 2021 even as inflation jumped higher and higher on the back of Covid-driven stimulus, instead saying that they thought it was ‘transitory’ and ‘supply chain related,’ clearly using monetary policy to prod equity market gains.

Before that, we had multiple rounds of QE in the post-GFC backdrop even as economic data wasn’t all that grim. Collectively, this led to a bloated balance sheet that remains an issue today.

But what’s exceptional about the current circumstance is that it’s seemingly one of the few times that the Fed has appeared to err on the side of hawkish. To be clear we have heard some Fed speakers offer a bit of support, such as Susan Collins remarking that the bank was ‘absolutely’ ready to help stabilize markets if needed, or Christopher Waller saying that he though tariff inflation is transitory and that he’s standing by to support rate cuts if job losses begin to show.

But this doesn’t appear to be the boilerplate for the bank as notable voices at the FOMC, in the form of Chair Powell or Austan Goolsbee or John Williams, have all sounded a bit more cautious while ascribing greater inflation potential to the prospect of tariffs.

For today, there’s no reason for Powell to alter course, especially given the recent rally in equities. I think the wide expectation is for reiteration of the phrase that the FOMC is in a good position to wait for clarity. This will likely come with talking down of a rate cut in June, which currently shows a 30.3% probability of taking place, per CME Fedwatch as of this writing. More pressing will be that June meeting and the Summary of Economic Projections that will be released then, as markets are currently holding out hope for 75 bps in cuts by the end of the year which would mean a hurried pace of softening from the FOMC in the second-half of 2025.

SPX Bigger Picture

It’s been a significant rally in stocks over the past month, but it’s important to remember the context from which that derived. SPX went into oversold territory on the weekly chart for the first time since Covid, and that’s so far led to a vigorous bounce. As noted above, there’s scope for bullish continuation on shorter time frames, and a continuation of higher-highs and lows keeps that door open.

But – we also must call this what it is and what it’s been, which is a bounce from oversold conditions. And while we have seen Trump soften his stance on tariffs, the April announcement that helped to prod this bounce was a delay, and not a nullification. So there remains the prospect of bears coming back into the matter which is why chasing with reckless abandon is probably a sub-optimal way of addressing equities at the moment. For support, there’s a wide area from 5491-5520 and that can serve as a decision point for longer-term trends. A pullback to that zone with an exhibition of support from bulls highlights continuation potential. But if sellers continue to offer prices lower through that, it can serve as a clear indication of the ‘sell the rip’ dynamic after the late-April rally.

SPX Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview