US futures

Dow futures -0.86% at 42305

S&P futures -0.66% at 5900

Nasdaq futures -0.7% at 21222

In Europe

FTSE 0.06% at 8780

DAX 0.66% at 23983

- Stocks fall as the mood turns cautious

- Trump’s tax cut bill is in focus after Moody’s rate cut

- US retailers post earnings

- Oil rises as Middle East geopolitical tensions ramp up

Stocks fall amid concerns over US debt levels

U.S. stocks are opening lower as investors digest earnings from major retailers and monitor developments on Trump's key budget bill.

Trump urged Republicans to support his big and beautiful bill, which includes increased spending for immigration enforcement and sweeping tax cuts. Investors await the outcome of a pivotal vote which has fueled worries of the US debt pile.

This comes after Moody's lowered the US credit rating, citing concerns over its mounting debt. Economists warned that Trump's sweeping tax cuts could add $3 to $5 trillion to the deficit. U.S. Treasury yields are moving higher, with the 10-year treasury climbing to 4.54% and the 30-year rate rising to 5.03%.

The US economic calendar is quiet today. Attention will be on Richmond Fed President Thomas Barkin, who is due to speak. Yesterday, Saint Louis Fed President Alberto Musalem warned that tariffs could dampen economic activity and soften the labour market.

On the trade front, investors are watching out for more trade deals between the US and major economies. More high-level talks with Japan are set to resume this week. However, comments from China warning that the US chip export controls threatened to undermine a trade truce unnerved risk sentiment.

Corporate news

Lowe’s is rising over 1.5% premarket after the home improvement chain posted net sales in Q1 that were roughly in line with estimates, even though it flagged near-term uncertainty.

Target is falling 4% after the retailer slashed its annual sales forecast after posting a sharp drop in quarterly same-store sales. Management highlighted weaker consumer confidence and a pullback in discretionary spending.

NVIDIA is falling after CEO Jensen Huang noted that US export controls on AI chips to China have failed to prevent Beijing's advancements in the industry, as they source locally.

Palo Alto Networks is falling over 3% after the cybersecurity firm posted a 12% increase in operating expenses and in-line revenue in Q3.

XPeng is rising 5% after the Chinese EV maker posted a narrower-than-expected loss in Q1 and revenue and delivery figures beat forecasts.

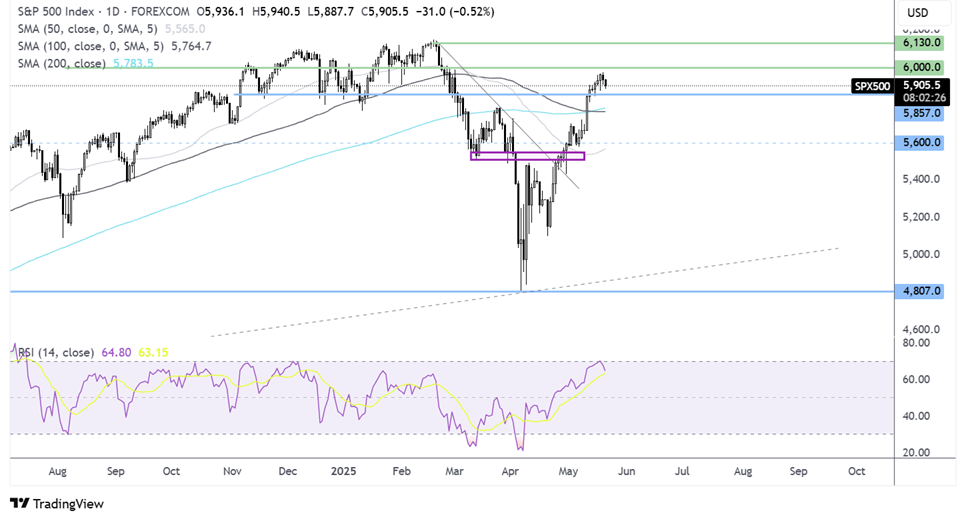

S&P 500 forecast – technical analysis.

The S&P 500 extended its recovery from the 4800 low to a peak of 5975 yesterday before easing lower to 5900 at the time of writing. The uptrend remains intact with no concrete signs of reversal. The move lower is bringing the RSI away from overbought territory. Immediate support is at 5850, with a break below here exposing the 200 SMA at 5775. Buyers will look to extend gains above 5975 and 6000 to bring 6130 and fresh record highs into focus.

FX markets – USD falls, EUR/USD rises

The USD is falling for a third straight day amid concerns over the US debt pile and rising trade worries. Concerns that the US could advocate for a weaker dollar in the G7 finance ministers meeting in Canada are also weighing on the USD.

The EUR/USD is rising to a two-week high, benefiting from USD weakness. However, newer gains could be limited following the ECB's financial stability review, which warned over a weak economic outlook and trade disruptions impacting business and household spending. Recent data support the view that the ECB will be cutting interest rates again by 25 basis points in June.

GBP/USD is rising after hotter-than-expected inflation. UK CPI rose to 3.5% YoY in April, jumping from 2.6% in March. This was ahead of the three-point 3% forecast and marks the hottest level of inflation since January 2024. The data supports a more hawkish stance from the Bank of England and a cut in June is unlikely.

Oil rises on rising Middle East tensions

Oil prices are rising over 1% on Wednesday amid reports of rising geopolitical tensions in the Middle East, which could disrupt supply.

Reports that Israel could be preparing to strike Iranian nuclear facilities is unnerving the market as the move could put Iranian supplies at risk. Iran exports 1.5 million barrels per day, and it's the third largest producer among APEC members.

Separately, discussions between U.S. officials and Iran over the latter's nuclear programme are still a considerable distance from a resolution, easing concerns on increased supply.

API data showed that US stocks rose last week while gasoline and distillate inventories fell. EIA data is due shortly.