US futures

Dow futures 0.12% at 42,813

S&P futures 0.18% at 6009

Nasdaq futures 0.10% at 21780

In Europe

FTSE -0.15% at 8816

DAX -0.66% at 24135

- US stocks are muted near record highs

- US-China trade talks take place in London

- Tesla falls after broker downgrade

- Oil holds onto last week’s gains

US-China trade talks in focus

U.S. stocks are subdued on Monday as investors await news surrounding renewed U.S.-China trade talks and look ahead to key inflation data later in the week.

All three leading indices point to muted gains after solid gains last week.

U.S. Treasury Secretary Scott Bessent and two other U.S. officials are expected to hold trade talks with representatives from China in London today. These talks came after Trump and Chinese President Xi Jinping spoke at the end of last week, mending a rift that had stalled talks. Any sense of improving relations or moves towards a trade deal between the two sides could help boost U.S. stocks, which trade just 2% lower from record highs.

The US economic calendar is quiet today, but investors will focus on the May CPI report on Wednesday, followed by PPI inflation on Thursday.

Data last week showed the US economy showed the job creation slowed and made 239k, but this was still above the 130k that was expected.

The market currently expects 46 basis points worth of rate cuts by the end of 2025 and is pricing in a 55% chance of a 25 basis point cut in September.

Corporate news

Robinhood is falling 5% after the S&P 500 kept its index constituents unchanged in its latest rebalancing, disappointing some who had expected the online brokerage to join the benchmark index.

Warner Bros Discovery jumped 9% pre-market after it said it would split into two companies, separating its studios and streaming business from its fading cable television networks.

Tesla is set to open lower after Baird downgraded the stock to neutral from buy. The firm said CEO Elon Musk's comments on robo-taxi plans are too optimistic and that Musk's relationship with President Trump adds uncertainty.

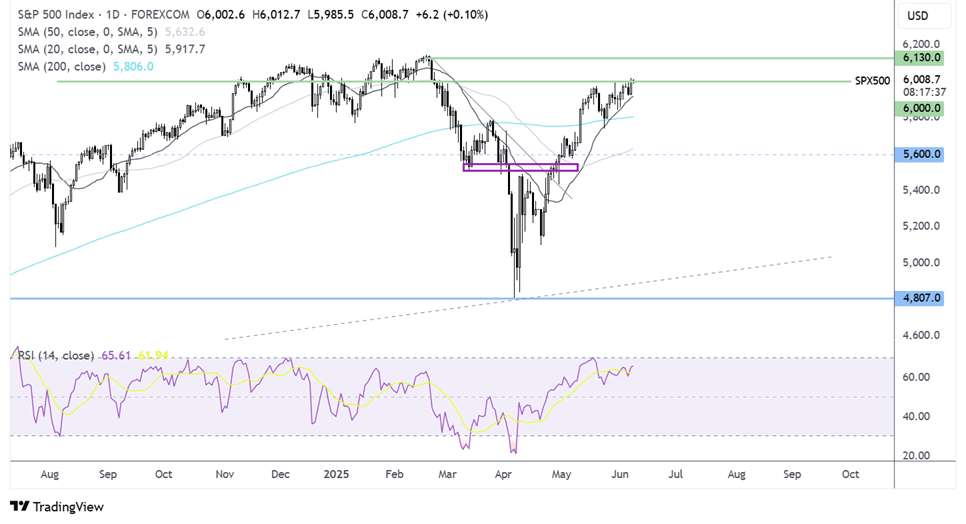

S&P 500 – technical analysis.

The S&P 500 continues to test the 6000 resistance after extending its recovery from 4800 in April. The 100 SMA is guiding the price higher. Buyers will need to rise meaningfully beyond the 6000 level to bring 6130, the record high, into play. Support can be seen at 5915, the 100 SMA. A break below here exposes the 200 SMA at 5800.

FX markets – USD falls, EUR/USD rises

The USD is falling, extending losses from last week as attention turns to the US-China trade in London. The USD rebound on Friday following the NFP report was short lived.

The EUR/USD is rising amid USD weakness. The ECB cut rates last week by 25 basis points, and ECB President Lagarde noted that the central bank is close to ending its rate-cutting cycle. Today, ECB Kazimir suggested that the rate-cutting cycle was done. Eurozone Senix economic sentiment data is due shortly.

GBP/USD is rising towards 1.36 ahead of a busy week for sterling, with UK unemployment and CPI data as well as Chancellor Reeve’s spending review on Wednesday. The pound remains supported by expectations that the BoE will continue to cut rates but only gradually and carefully.

Oil holds last week’s gains

Oil prices remain steady, maintaining last week’s gains, as the market anticipates renewed trade talks between the US and China. The possibility of a US-China trade agreement contributed to the increase in oil prices last week.

Three of Donald Trump's top aides are scheduled to meet with their Chinese counterparts to restart trade discussions that had stalled a few weeks ago. An additional call between Trump and President Xi Jinping at the end of last week further boosted WTI, which rose by 6% during the week, marking its first weekly gain in three weeks.

Chinese export growth decelerated in the three months leading to May due to U.S. trade tariffs impeding shipments. Factory-gate deflation reached a level not experienced in two years. The data indicates that China's crude oil imports decreased in May to their lowest daily rate in four months.