Swiss Franc Technical Forecast: USD/CHF Short-term Trade Levels

- USD/CHF recovery exhausts into resistance at multi-week uptrend

- USD/CHF weekly range intact heading into Friday- breakout imminent

- Resistance 8416/30, 8480/84 (key), 8620- Support 8316/33, 8264 (key), 8207

The US Dollar rallied more than 5.4% off the yearly low vs the Swiss Franc with the advance responding to uptrend resistance on Monday. It’s decision time for the bulls with the immediate focus on a breakout of the weekly opening-range. Battles lines drawn on the USD/CHF short-term technical charts.

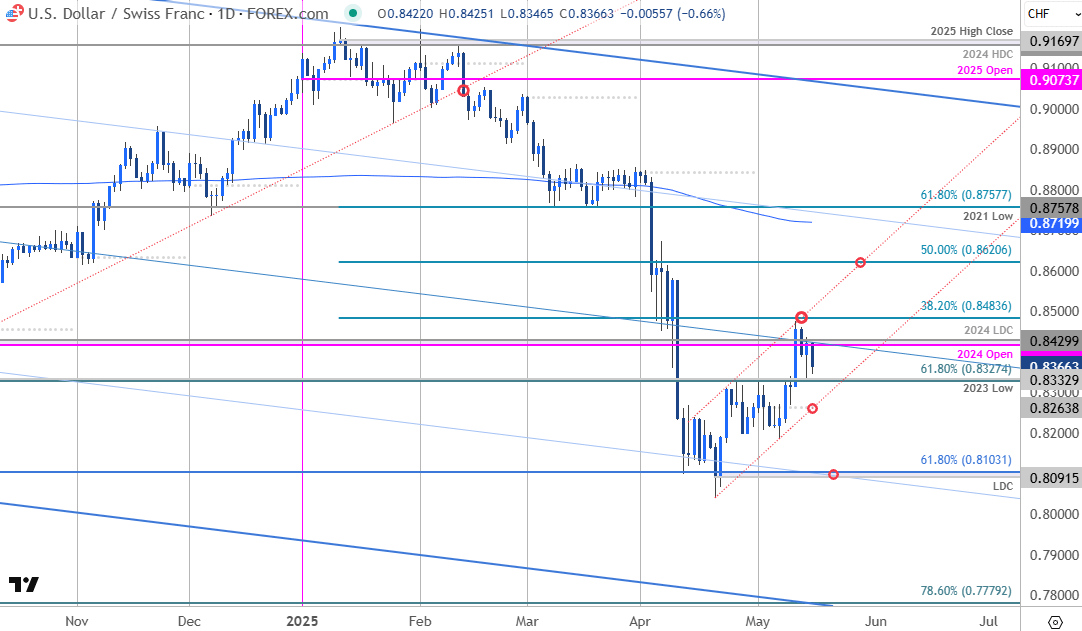

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this USD/CHF setup and more. Join live on Monday’s at 8:30am EST.Swiss Franc Price Chart – USD/CHF Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CHF on TradingView

Technical Outlook: In my last Swiss Franc Short-term Outlook we noted that, “A rebound of technical support threatens a larger recovery within the broader USD/CHF downtrend… From a trading standpoint, the risk is weighted to the topside while within this near-term formation- rallies would need to be limited to 8493 IF price is going to ultimately resolve lower with a break below 8091 needed to mark trend resumption.” USD/CHF registered an intraday high at 8476 on Monday before reversing off slope resistance and the focus now shifts to a breakout of the weekly opening-range for guidance.

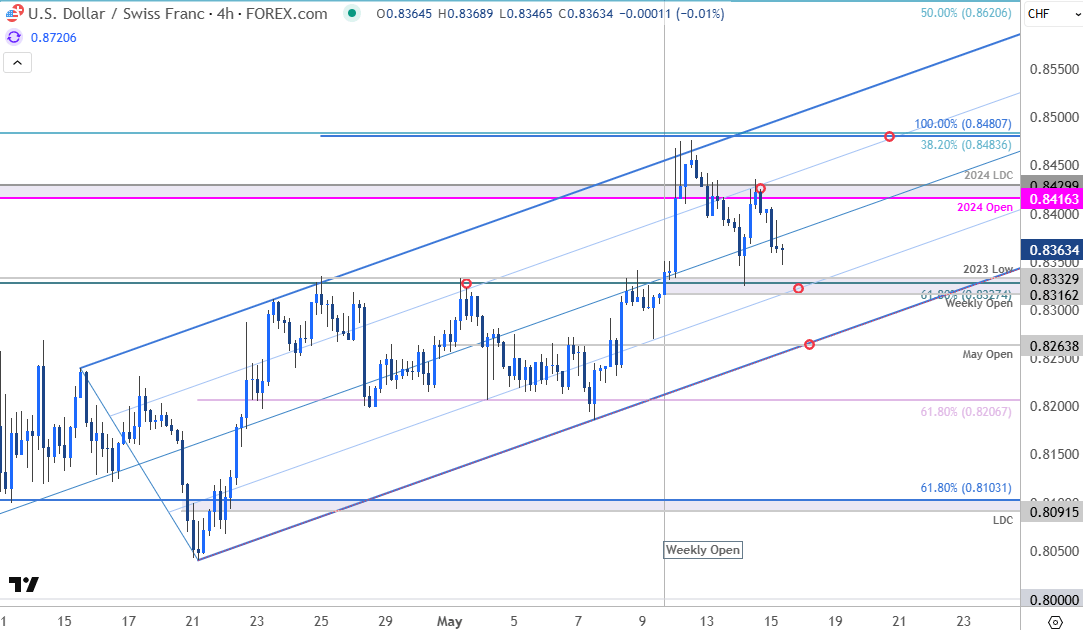

Swiss Franc Price Chart – USD/CHF 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CHF on TradingView

A closer look at Swisse price action shows USD/CHF continuing to trade within the confines of an ascending pitchfork extending off the April lows. The weekly opening-range is defined by the Monday candle just above support at 8313/33- a region defined by the objective weekly open, the 61.8% retracement of the 2011 advance and the 2023 swing low. Key support / near-term bullish invalidation rests with the May open at 8264 with a break below the lower parallel needed to suggest a more significant high is in place / threaten resumption of the broader downtrend towards 8206 and 8100.

Initial resistance is eyed with the 2024 yearly open / low-day close (LDC) at 8416/30 and is backed by a major Fibonacci confluence at 8480/84- a topside breach / close above this threshold is needed to fuel the next major leg of the advance. The next technical considerations eyed at 8620 and the 1.618% extension at 8663.

Bottom line: USD/CHF responded to near-term uptrend resistance on Monday with the weekly opening-range preserved just below. From a trading standpoint, losses would need to be limited to the monthly open IF price is heading higher on this stretch with a close above 8484 needed to mark trend resumption. Review my latest Swiss Franc Weekly Forecast for a closer look at the longer-term USD/CHF technical trade levels.

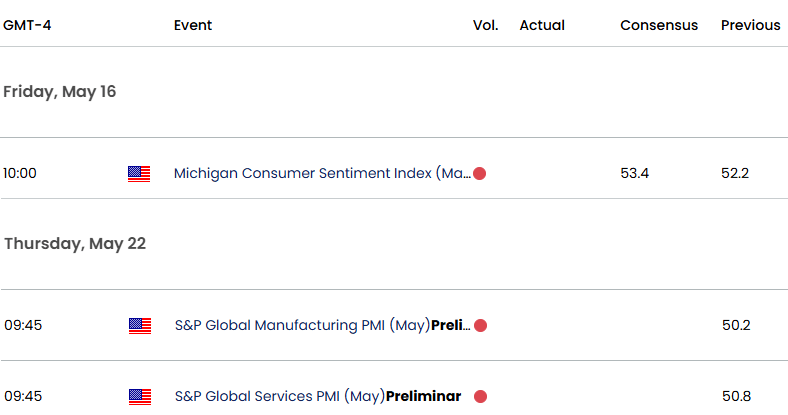

USD/CHF Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Japanese Yen Short-term Outlook: USD/JPY Rejected at Trend Resistance

- Gold Short-term Outlook: XAU/USD Drops to Multi-month Trend Support

- Canadian Dollar Short-term Outlook: USD/CAD Surges off Support

- US Dollar Short-term Outlook: USD Bulls Steady After Fed Decision

- Euro Short-term Outlook: EUR/USD Poised for Breakout Ahead of Fed

- British Pound Short-term Outlook: GBP/USD Bulls Eye 2024 High

- Australian Dollar Short-term Outlook: AUD/USD Halted at Resistance

--- Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex