Reciprocal Tariffs Key Points

- President Trump’s April 2 “Liberation Day” plan will introduce reciprocal tariffs on countries with high trade surpluses and barriers to US goods.

- Analysts expect average tariffs of 9–15%, but fear steeper levies could be used as negotiating tools.

- Uncertainty has already dragged down markets, and any post-announcement relief may be short-lived if further measures loom.

Reciprocal Tariff Overview

President Trump is preparing to unveil a sweeping new wave of trade tariffs on April 2—what he’s calling “Liberation Day.” The plan centers on so-called “reciprocal tariffs,” designed to match or exceed the duties other nations place on US goods. The administration argues that for too long, the US has allowed lopsided trade relationships to persist, leading to trade deficits and unfair competitive disadvantages. Trump’s new approach aims to “level the playing field,” though some analysts fear it may spark retaliation and heighten global economic instability.

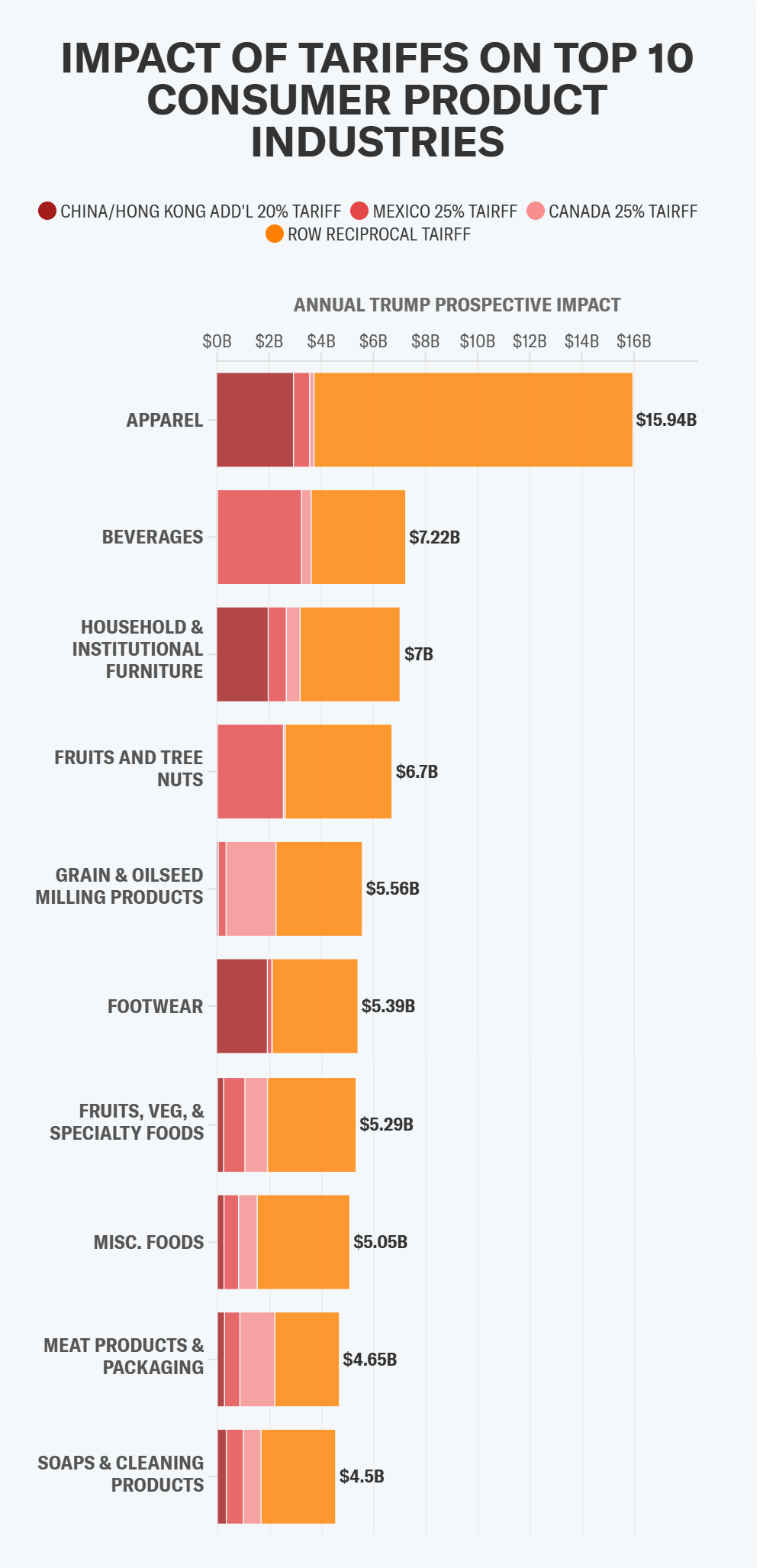

The tariffs come atop existing levies imposed earlier this year on steel, aluminum, and key imports from China, Mexico, and Canada. The April 2 announcement is expected to target countries with large trade surpluses against the US and barriers to American goods, possibly resulting in tariffs of 10%–50% or more on hundreds of products.

Source: PWC Tariff Industry Analysis

When Will Reciprocal Tariffs Be Announced?

The administration’s formal plan will be released April 2, one day after the conclusion of a multi-agency investigation into global trade practices. According to Treasury Secretary Scott Bessent, each country will receive a “tariff number” that reflects not just existing tariffs, but also non-tariff barriers like VAT taxes and wage suppression—although officials say some of those factors may be omitted to maintain flexibility.

Readers should note that the inclusion of VAT taxes will be a critical consideration for traders as it could result in a substantially higher tariff rate, with an accompanying increase in the downside risk to the global economy.

Tariffs are expected to take effect immediately after April 2. However, Trump has left room for selective exemptions, suggesting that some U.S. allies may be spared or face reduced rates. Still, he warned in a recent interview, “I don’t want to have too many exceptions.”

What Are the Expectations?

Investor sentiment remains volatile as markets try to gauge the scope and intensity of the tariffs. Early reports had suggested sweeping, across-the-board levies, but recent leaks from White House insiders suggest the focus may be narrower—targeting the so-called “Dirty 15” countries with the most unfavorable trade balances.

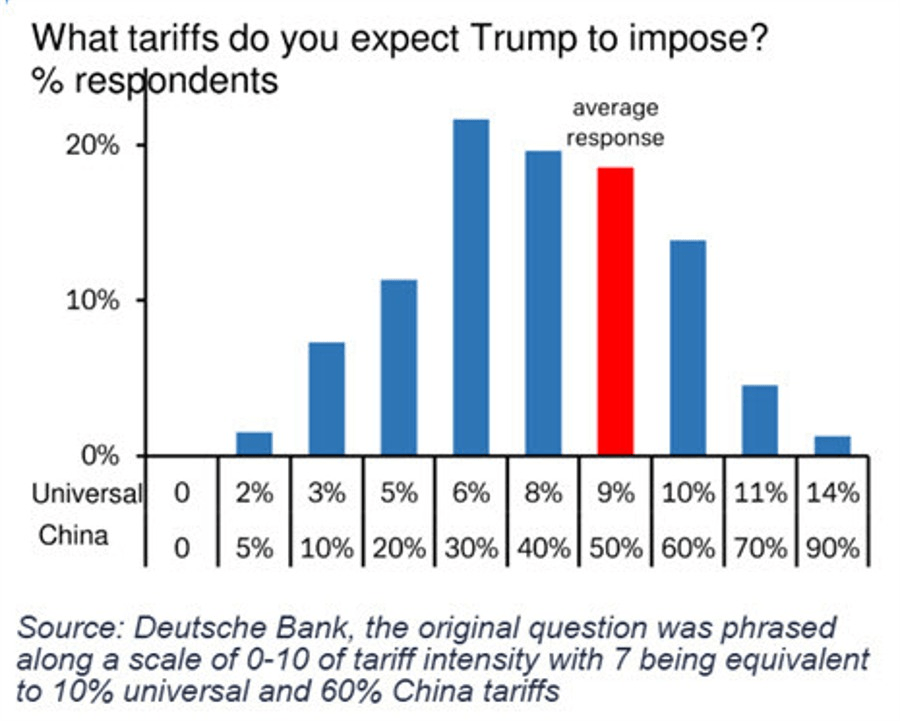

Analysts from Goldman Sachs and Deutsche Bank expect reciprocal tariff rates to average around 9%–15%, though some fear rates of up to 50% could be used as a bargaining chip. Trump has hinted that autos, copper, aluminum, semiconductors, lumber, and pharmaceuticals could see targeted duties later this year.

Source: Deutsche Bank

Global Reaction and Economic Concerns

The EU, Canada, and China have already issued retaliatory tariffs in response to earlier U.S. measures. Canada imposed $20 billion in duties and suspended EV rebates for Tesla over Musk’s ties to the Trump administration. The EU delayed but still plans a 50% tariff on American whiskey, prompting Trump to threaten a 200% tariff on European wines and spirits.

U.S. retailers and manufacturers are also voicing alarm. Companies like Walmart and Target have begun renegotiating supplier contracts amid rising input costs. Analysts warn that the consumer impact could be severe, with PwC estimating up to $134 billion in annual disruption if tariffs remain in place.

What Traders Should Expect

In anticipation of April 2, markets have already reacted to the uncertainty surrounding “Liberation Day,” with major indices falling into correction territory and the US dollar losing ground against all of her major rivals so far this year.

It’s a common maxim that “markets hate uncertainty,” and the ambiguity around the tariff announcement has undoubtedly hit risk sentiment already, so we may see a small relief rally in risk assets and the greenback once the announcement is behind us. That said, the aforementioned hints of further tariffs to come and likelihood that punitive tariffs may be used as negotiating levers in the coming months mean that any risk rally may be short-lived until traders are confident that the relentless stream of economy-disrupting policies are fully behind us.