US Dollar Outlook: EUR/USD

EUR/USD bounces back ahead of the monthly low (1.1066) to hold above the 50-Day SMA (1.1124), and the exchange rate may continue to track the positive slope in the moving average as it attempts to extend the advance from the start of the week.

US Dollar Forecast: EUR/USD Bounces Back Ahead of Monthly Low

In turn, EUR/USD may defend the bullish trend from earlier this year as the ongoing adjustment in US fiscal policy clouds the outlook for growth and inflation, and the US Dollar may continue to underperform against its European counterpart especially as the EU signs a new deal with the UK.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

With that said, EUR/USD may further retrace the decline from the monthly high (1.1381) as it attempts to extend the advance from the start of the week, but developments coming out of the White House may lead to a shift in US Dollar sentiment as the Trump administration avoids a trade war.

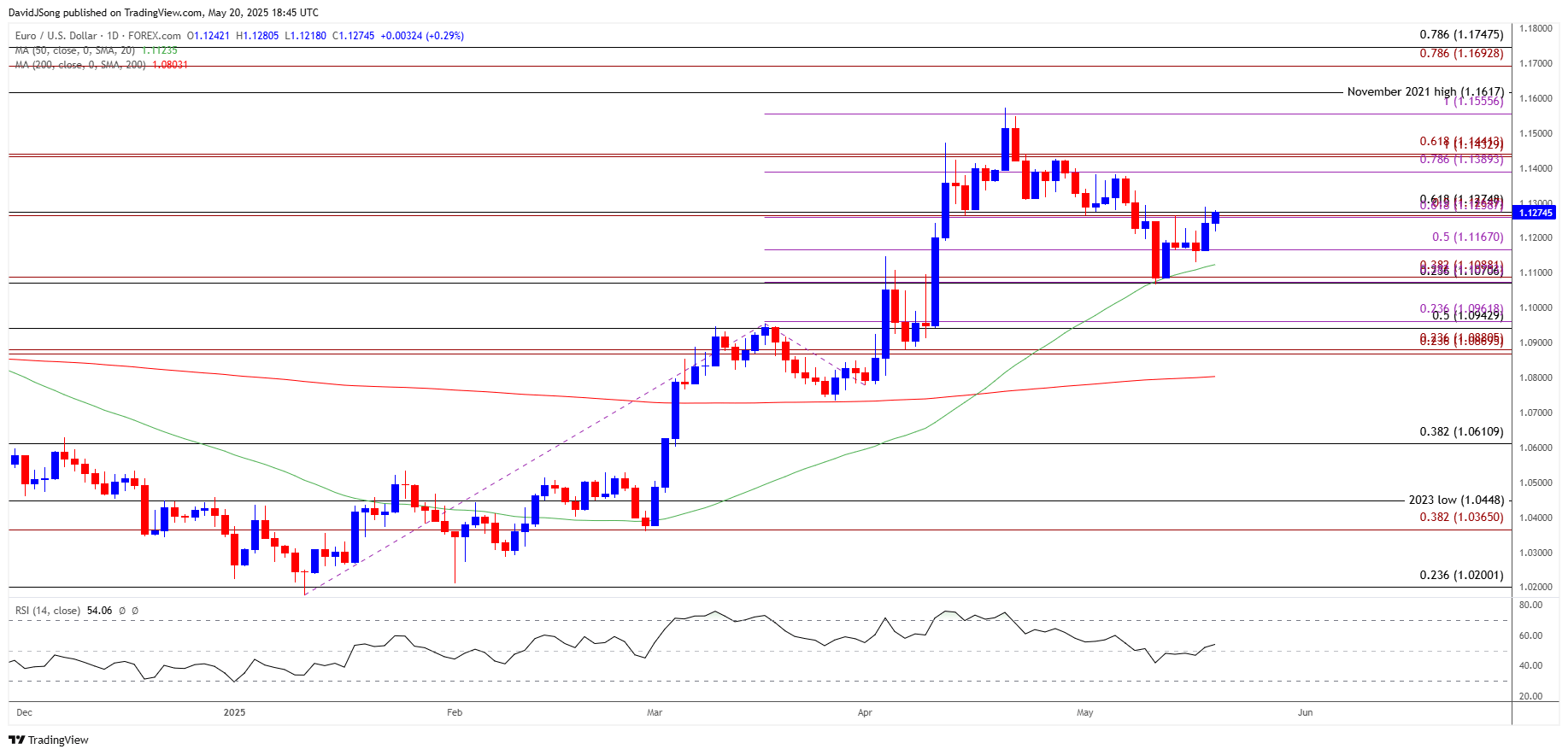

EUR/USD Chart – Daily

Chart Prepared by David Song, Senior Strategist; EUR/USD on TradingView

- EUR/USD holds above the 50-Day SMA (1.1124) after failing to close below the moving average earlier this month, and a close above the 1.1260 (61.8% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement) zone may push the exchange rate toward the monthly high (1.1381).

- A break/close above the 1.1390 (78/6% Fibonacci extension) to 1.1440 (61.8% Fibonacci extension) region brings 1.1560 (100% Fibonacci extension) on the radar, but EUR/USD may no longer reflect the bullish trend from earlier this year should it struggle to hold above the moving average.

- Lack of momentum to close above 1.1260 (61.8% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement) zone may push EUR/USD back toward 1.1170 (50% Fibonacci retracement), with a break/close below the 1.1070 (23.6% Fibonacci retracement) to 1.1090 (38.2% Fibonacci extension) region opening up the 1.0940 (50% Fibonacci retracement) to 1.0960 (23.6% Fibonacci extension) area.

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Falls amid Sticky Canada Inflation

USD/JPY Decline Persists amid US Credit Rating Downgrade

Gold Price Struggles to Close Below 50-Day SMA

GBP/USD Defends Rebound from Weekly Low to Hold Above 50-Day SMA

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong