US Dollar, Fed Key Points

- Initial jobless claims remain relatively elevated, while both CPI and PPI came in below expectations.

- Continued yellow flags on inflation and the labor market could prompt the Fed to cut interest rates as soon as July.

- The US Dollar Index (DXY) is testing minor support at 97.70, its lowest level since March 2022, and a break below that level could see the selloff accelerate from here.

Is the long-awaited slowdown in the US economy finally at hand? This morning’s economic data certainly raises some yellow flags heading into the summer!

Initial jobless claims held steady at 248K for the week ending June 7, marking the second consecutive week near an 8-month high and exceeding economists’ expectations. Perhaps more to the point, continuing claims rose to 1.956 million, the highest since November 2021, suggesting that unemployed individuals are facing increased difficulty finding new jobs.

The labor market data over the last couple of weeks paints a clear picture: While layoffs haven’t surged (yet), hiring has slowed considerably, indicating a softening labor market. This slowdown is further evidenced by declining nonfarm payroll growth and downward revisions to prior months' employment data.

Simultaneously, this morning’s wholesale inflation data showed signs of easing. The Producer Price Index (PPI) rose just 0.1% in May—below the 0.2% forecast—while core PPI, excluding food and energy, also increased by 0.1%, undercutting the 0.3% estimate. Year-over-year, the PPI rose 2.6% and core PPI 3.0%, both slightly below expectations.

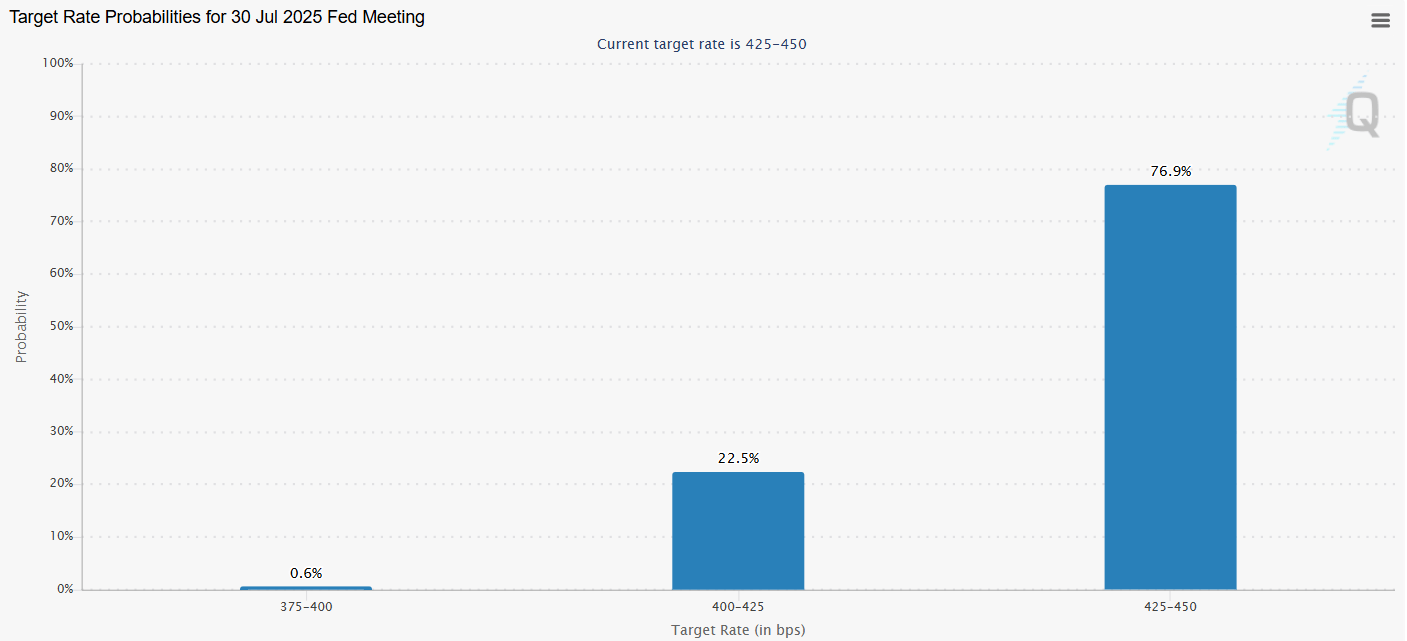

These developments bolster expectations that the recently noncommittal Federal Reserve may adopt a more dovish monetary stance, with traders now pricing in about a 25% chance of an interest rate cut in July, though the Fed is all but certain to leave rates unchanged at its meeting next week:

Source: CME FedWatch

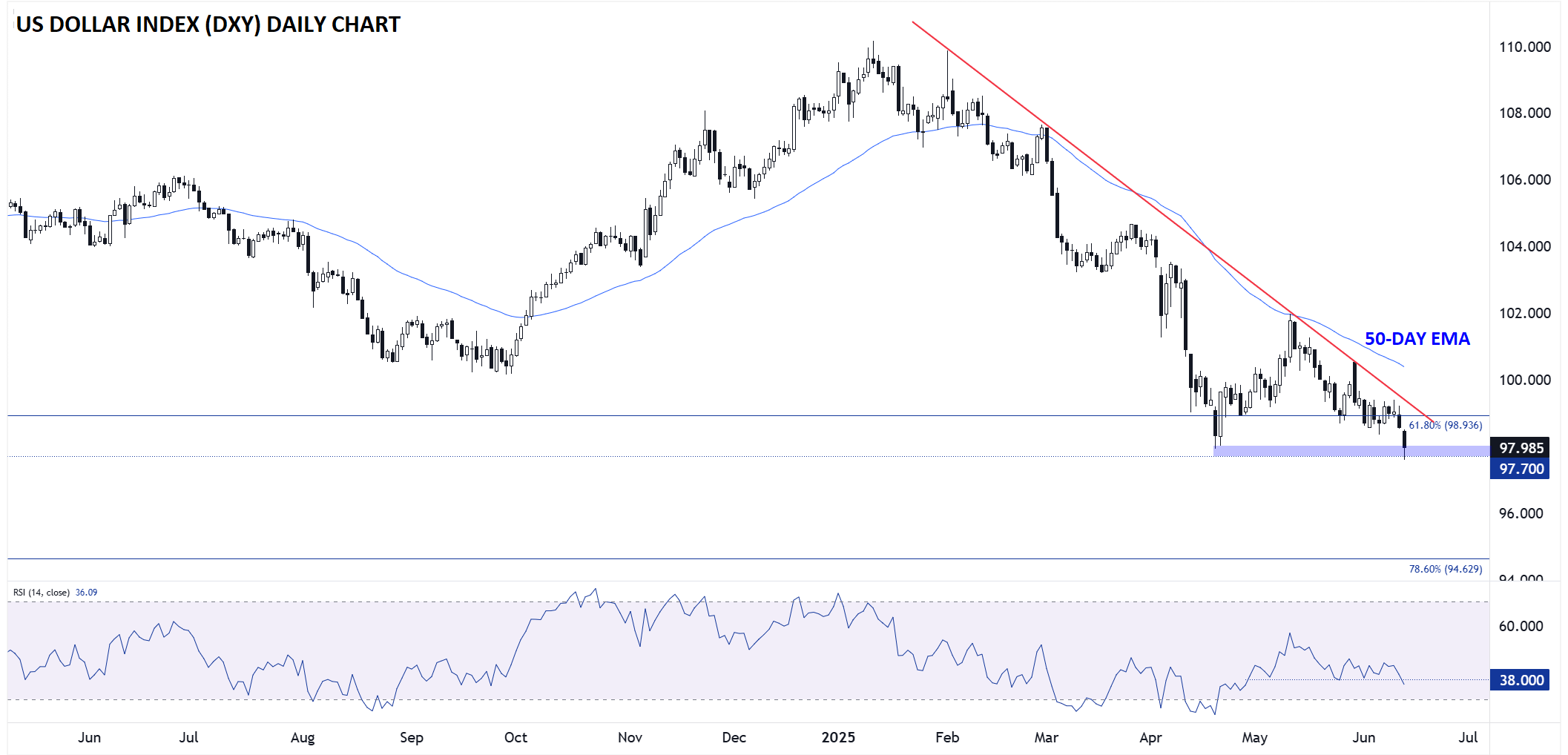

US Dollar Technical Analysis: US Dollar Index Daily Chart

Source: TradingView, StoneX

Perhaps not surprisingly after this morning’s 1-2 punch of soft economic data, the US Dollar is the weakest major currency on the day. As we go to press, the US Dollar Index (DXY) is testing minor support at 97.70, its lowest level since March 2022. As the 14-day RSI in the lower panel shows, the index is far from oversold territory, hinting that the breakdown may have further to run after a low conviction bounce in May.

Below 97.70, there’s little in the way of meaningful support until the next long-term Fibonacci retracement just below 95.00, though we’re likely to see near-term bounces along the way even if that level ultimately comes into play. Only a reversal back above the year-to-date bearish trend line (currently around 99.00) would erase the near-term bearish bias for the world’s reserve currency.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX