US Dollar Outlook: USD/CHF

The recent recovery in USD/CHF seems to be stalling as the exchange rate falls back from the former support zone around the 2023 low (0.8333).

US Dollar Forecast: USD/CHF Falls from Former Support Zone

As a result, USD/CHF may continue to track the descending channel from earlier this year, and the rebound from the monthly low (0.8040) may turn out to be temporary as the ongoing shift in US fiscal policy clouds the outlook for growth and inflation.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

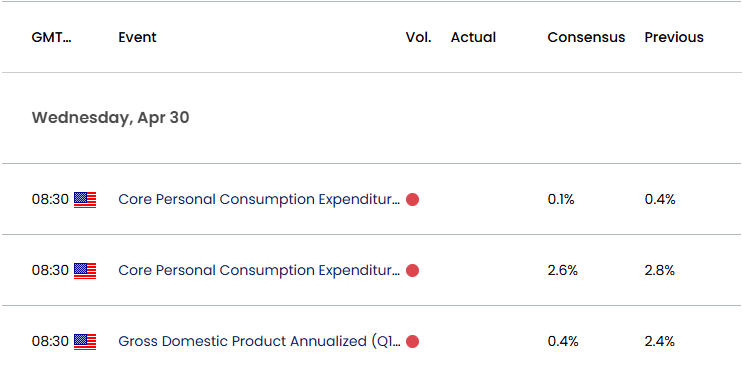

US Economic Calendar

At the same time, data prints coming out of the US may sway USD/CHF as the Gross Domestic Product (GDP) report is anticipated to show a 0.4% rise in the first quarter of 2025, while the core Personal Consumption Expenditure (PCE) Price Index, the Federal Reserve’s preferred gauge for inflation, is seen narrowing to 2.6% in March from 2.8% per annum the month prior.

Indications of a slowing economy may produce headwinds for the US Dollar as it puts pressure on the Fed to further unwind its restrictive policy, but a positive development may generate a bullish reaction in the Greenback as it encourages the Federal Open Market Committee (FOMC) to keep interest rates hold.

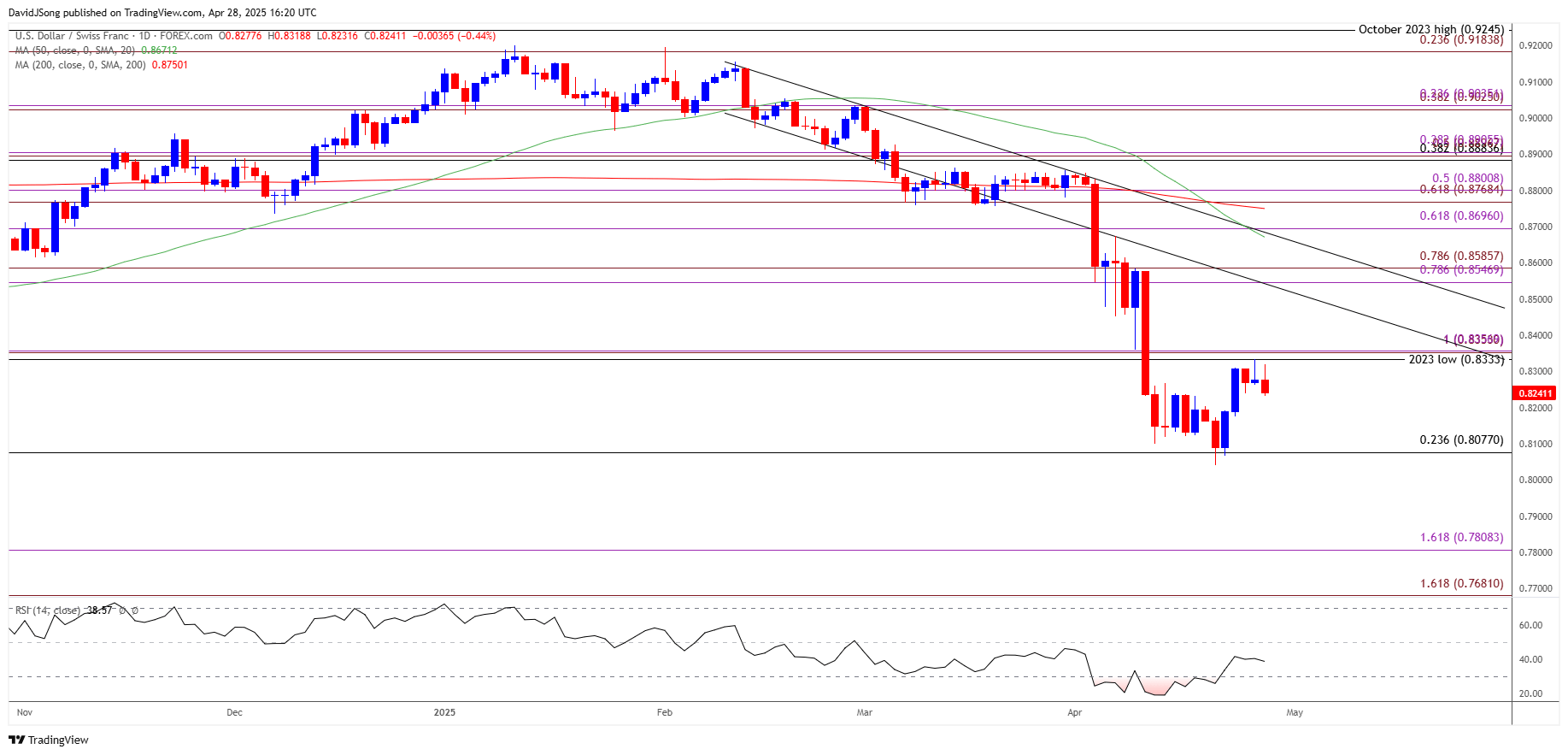

With that said, USD/CHF may continue to wrestle with the former support zone around the 2023 low (0.8333) as the Relative Strength Index (RSI) recovers from oversold territory, but the exchange rate may continue to track the descending channel from earlier this year as the 50-Day SMA (0.8672) establish a negative slope.

USD/CHF Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CHF Price on TradingView

- The recent rebound in USD/CHF seems to be stalling as it trades in a narrow range, and lack of momentum to push/close above the former support zone around the 2023 low (0.8333) may push the exchange rate back towards 0.8080 (23.6% Fibonacci retracement).

- Failure to defend the monthly low (0.8040) opens up 0.7810 (161.8% Fibonacci extension), but a move/close above 0.8360 (100% Fibonacci extension) may push USD/CHF back within the descending channel from earlier this year.

- USD/CHF may threaten the formation should it push/close above the 0.8550 (78.6% Fibonacci extension) to 0.8590 (78.6% Fibonacci extension) zone, with the next area of interest coming in around 0.8700 (61.8% Fibonacci extension).

Additional Market Outlooks

Euro Forecast: EUR/USD Defends Weekly Low Ahead of Euro Area GDP Report

AUD/USD V-Shape Recovery Stalls Ahead of December High

Gold Price Coils Above 50-Day SMA

Canadian Dollar Forecast: USD/CAD Cracks November Low Ahead of Election

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong