US Dollar Outlook: USD/CHF

USD/CHF pulls back ahead of the 50-Day SMA (0.8282) as the US Consumer Price Index (CPI) prints at 2.4% in May versus forecasts for a 2.5% reading, and the exchange rate may continue to track the negative slope in the moving average if it fails to hold within the opening range for June.

US Dollar Forecast: USD/CHF Falls Toward Monthly Low amid Soft US CPI

USD/CHF falls toward the monthly low (0.8157) as the softer-than-expected CPI report fuels speculation for lower US interest rates, and the US Dollar may continue to face headwinds ahead of the Federal Reserve interest rate decision on June 18 as higher tariffs appear to be having a limited impact on inflation.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

With that said, the rebound from the year low (0.8040) may continue to unravel as USD/CHF holds below the 50-Day SMA (0.8282), but the range bound price action may persist should the exchange rate defend the advance from the monthly low (0.8157).

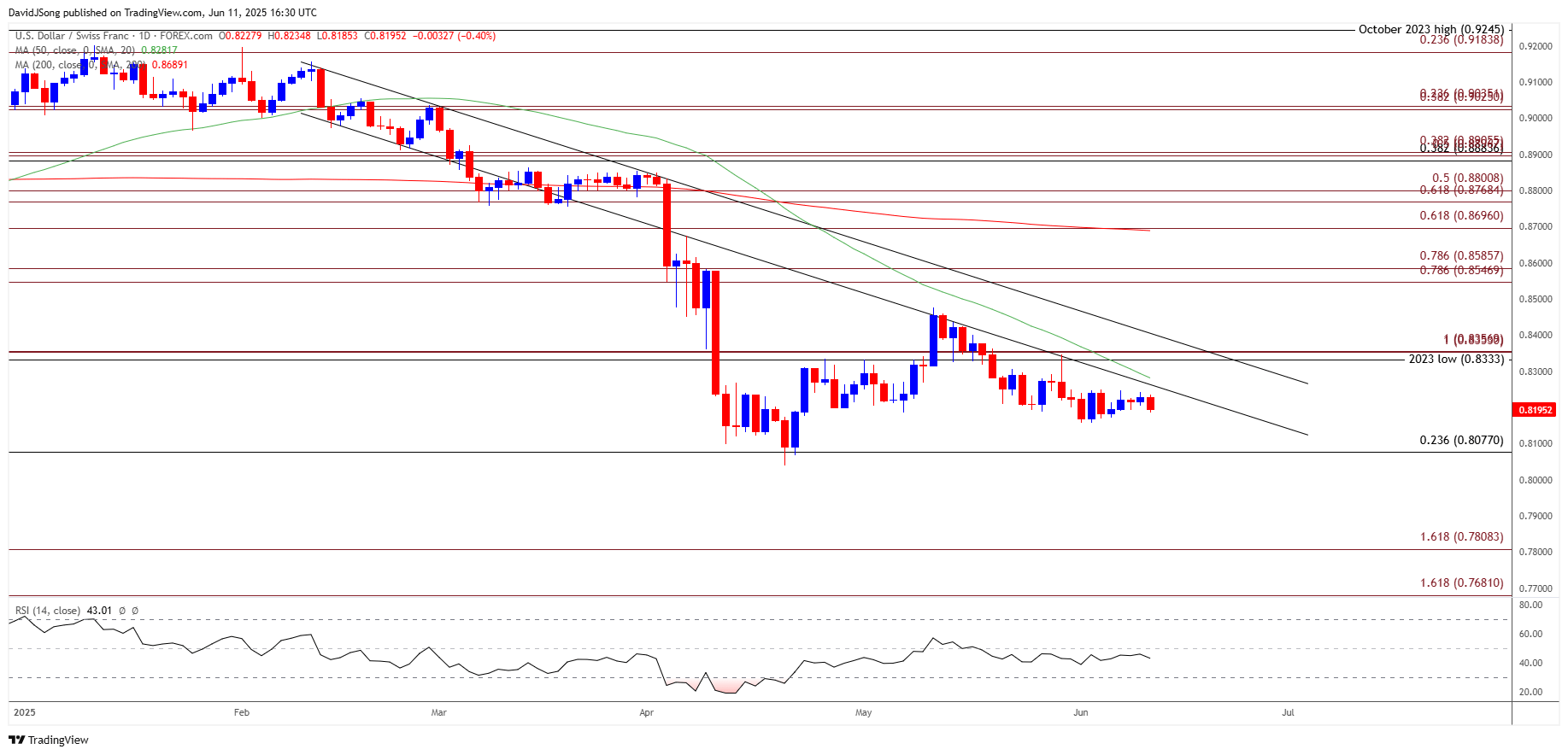

USD/CHF Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CHF Price on TradingView

- USD/CHF pulls back ahead of the 50-Day SMA (0.8282) to hold within the opening range for June, but failure to defend the monthly low (0.8157) may push the exchange rate toward 0.8080 (23.6% Fibonacci retracement).

- A breach below the yearly low (0.8040) opens up 0.7810 (161.8% Fibonacci extension), but USD/CHF may track the April range should it continue to hold above the monthly low (0.8157).

- Need a breach above the monthly opening range to bring 0.8360 (100% Fibonacci extension) on the radar, with the next area of interest coming in around the May high (0.8476).

Additional Market Outlooks

US Dollar Forecast: EUR/USD Holds Above Monthly Low Ahead of US CPI

Canadian Dollar Forecast: USD/CAD Coils Within June Opening Range

AUD/USD Climbs Toward Monthly High amid US-China Trade Talk

GBP/USD Vulnerable to Rise in UK Unemployment Rate

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong