US Dollar Outlook: USD/JPY

USD/JPY seems to be reversing ahead of the April high (150.49) as it gives back the advance from the start of the week, but the pullback in the exchange rate may turn out to be temporary as it trades above the 50-Day SMA (146.22) for the first time since February.

US Dollar Forecast: USD/JPY Reverses Ahead of April High

USD/JPY extends the decline following the softer-than-expected US Consumer Price Index (CPI) to approach the weekly low (145.37), and the US Dollar may continue to face headwinds as the ongoing shift in trade policy clouds the outlook for growth and inflation.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

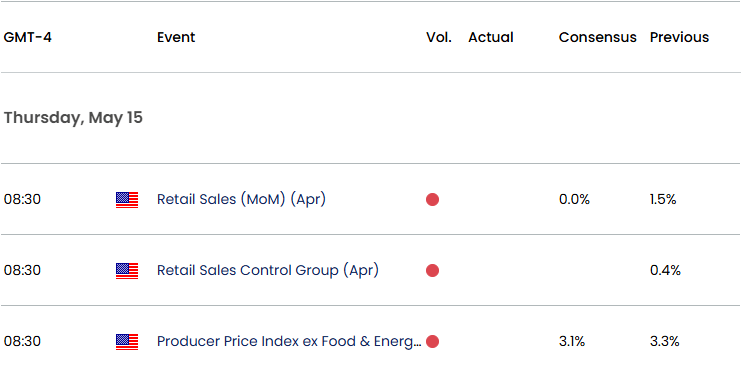

US Economic Calendar

At the same time, signs of a slowing economy may keep the Federal Reserve on track to further unwind its restrictive policy as Vice Chair Philip Jefferson states that ‘recent data are consistent with further progress toward our 2 percent inflation target,’ and data prints coming out of the US may continue to drag on the Greenback as Retail Sales are projected to hold flat in April while the Producer Price Index (PPI) is anticipated to show slowing inflation.

In turn, the weakness in USD/JPY may carry into the end of the week as the threat of a looming recession fuels speculation for an imminent Fed rate cut, but a batch of positive developments may keep the Federal Open Market Committee (FOMC) on the sidelines as Vice Chair Jefferson insists that ‘the current stance of monetary policy is well positioned to respond in a timely way to potential economic developments.’

With that said, swings in the carry trade may continue to sway USD/JPY as the Fed endorses a wait-and-see approach in managing monetary policy, and the exchange rate may attempt to further retrace the April high (150.49) should it defend the advance from the weekly low (145.47).

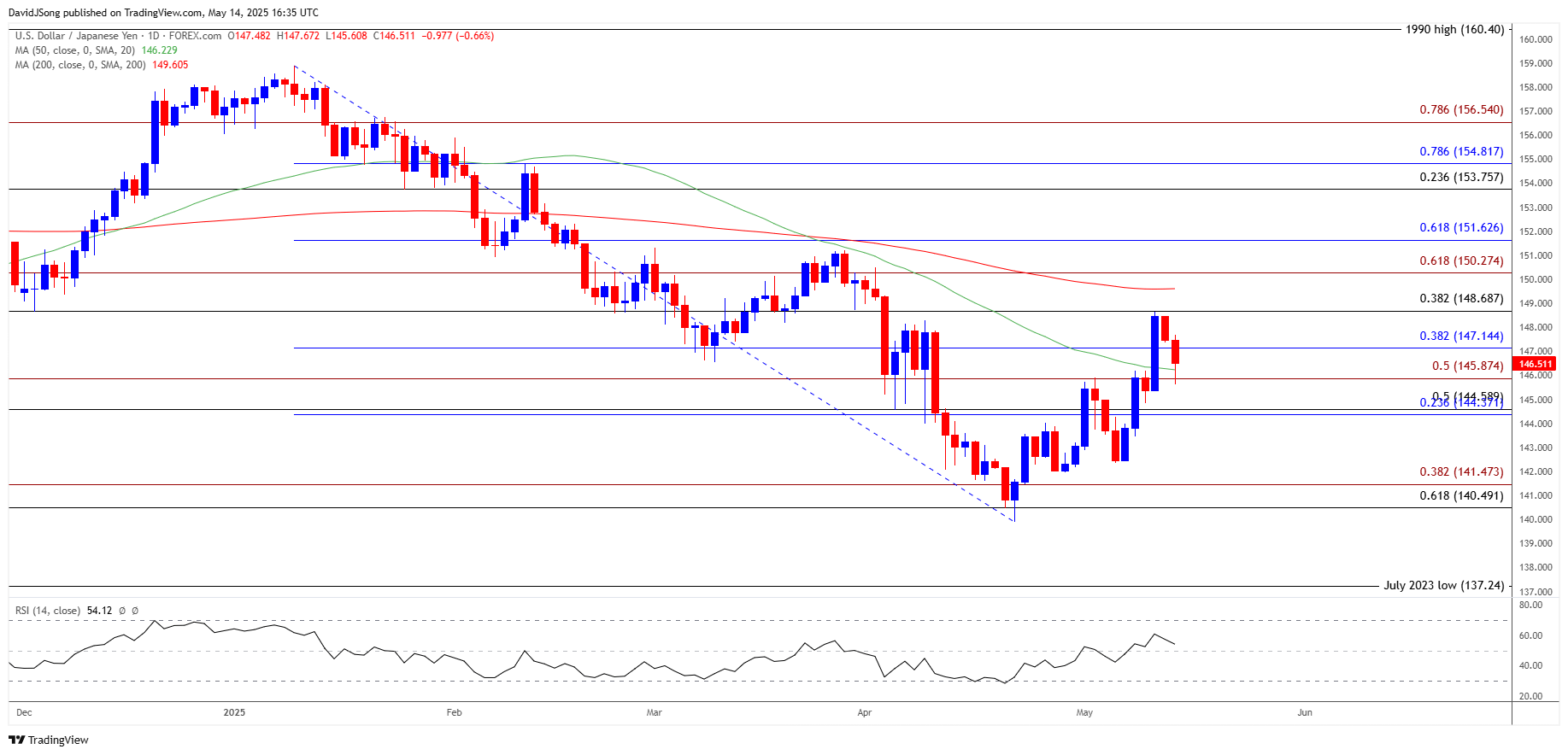

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/JPY on TradingView

- USD/JPY initiates a series of lower highs and lows as it gives back the advance from the start of week, and lack of momentum to hold above the 144.40 (23.6% Fibonacci retracement) to 145.90 (50% Fibonacci extension) region may push the exchange rate toward the monthly low (142.36).

- Next area of interest comes in around 140.50 (61.8% Fibonacci retracement) to 141.50 (38.2% Fibonacci extension), but USD/JPY may extend the recovery from earlier this month should it defend the advance from the weekly low (145.37).

- Need a break/close above the 148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension) zone to bring the April high (150.49) on the radar, with the next area of interest coming in around the March high (151.31).

Additional Market Outlooks

Australian Dollar Forecast: AUD/USD Defends V-Shape Recovery

EUR/USD Rebounds Following Failed Attempt to Close Below 50-Day SMA

GBP/USD on Track to Test Positive Slope in 50-Day SMA

Canadian Dollar Forecast: USD/CAD Breaks Out of Descending Channel

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong