U.S. Dollar Talking Points:

- This webinar normally takes place on Tuesdays but for this week, we hosted on Friday which enabled a closer look at the weekly bar nearing completion. This is key for a USD move that’s working on its fourth consecutive weekly gain following an oversold reading in April, which has impact on EUR/USD, USD/JPY and USD/CAD strategy.

- If you’d like to join the next webinar on Tuesday, the following link will allow for registration: Click here to register.

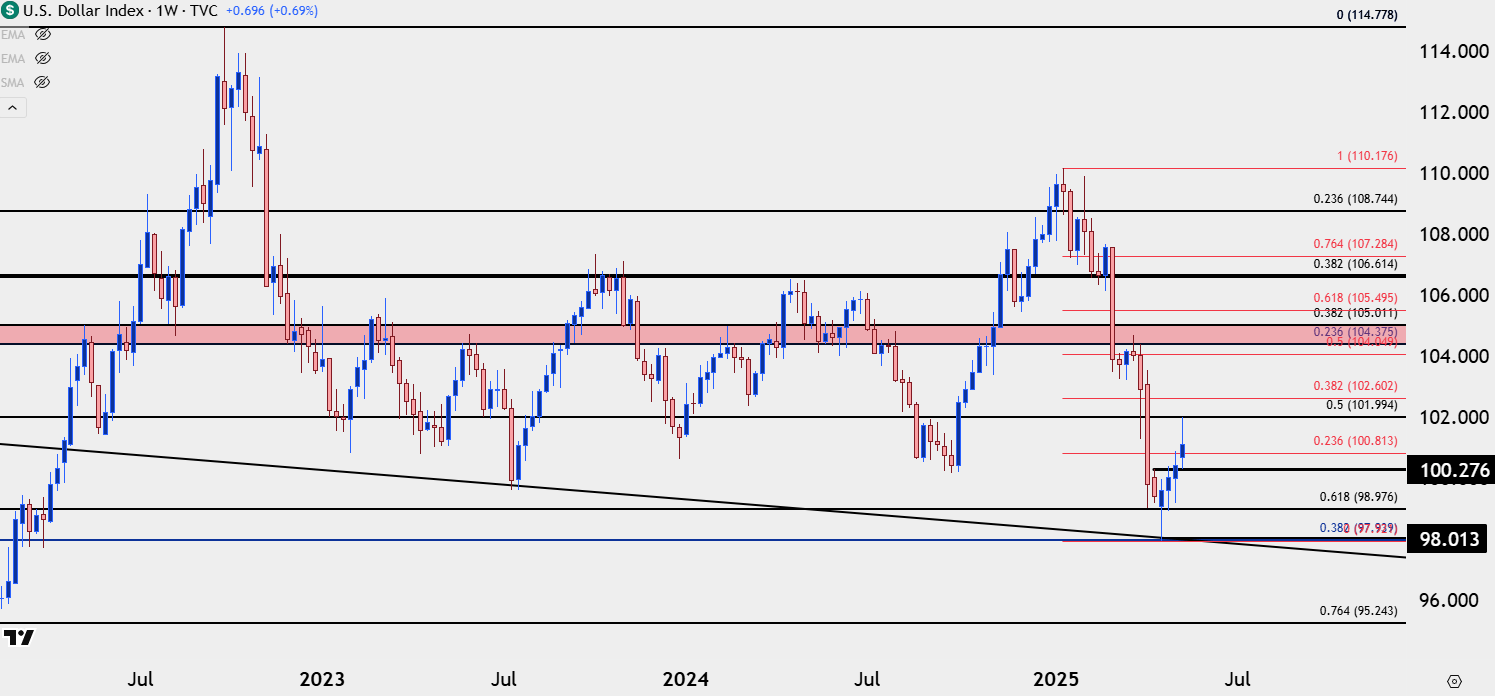

From the weekly bar the U.S. Dollar trend doesn’t look very decisive. Shorter-term, the details matter and this retains some bullish scope. But notably, the Greenback is working on its fourth consecutive green week after going oversold in April, and hitting a fresh multi-year low on Easter Monday.

U.S. Dollar Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

USD Daily

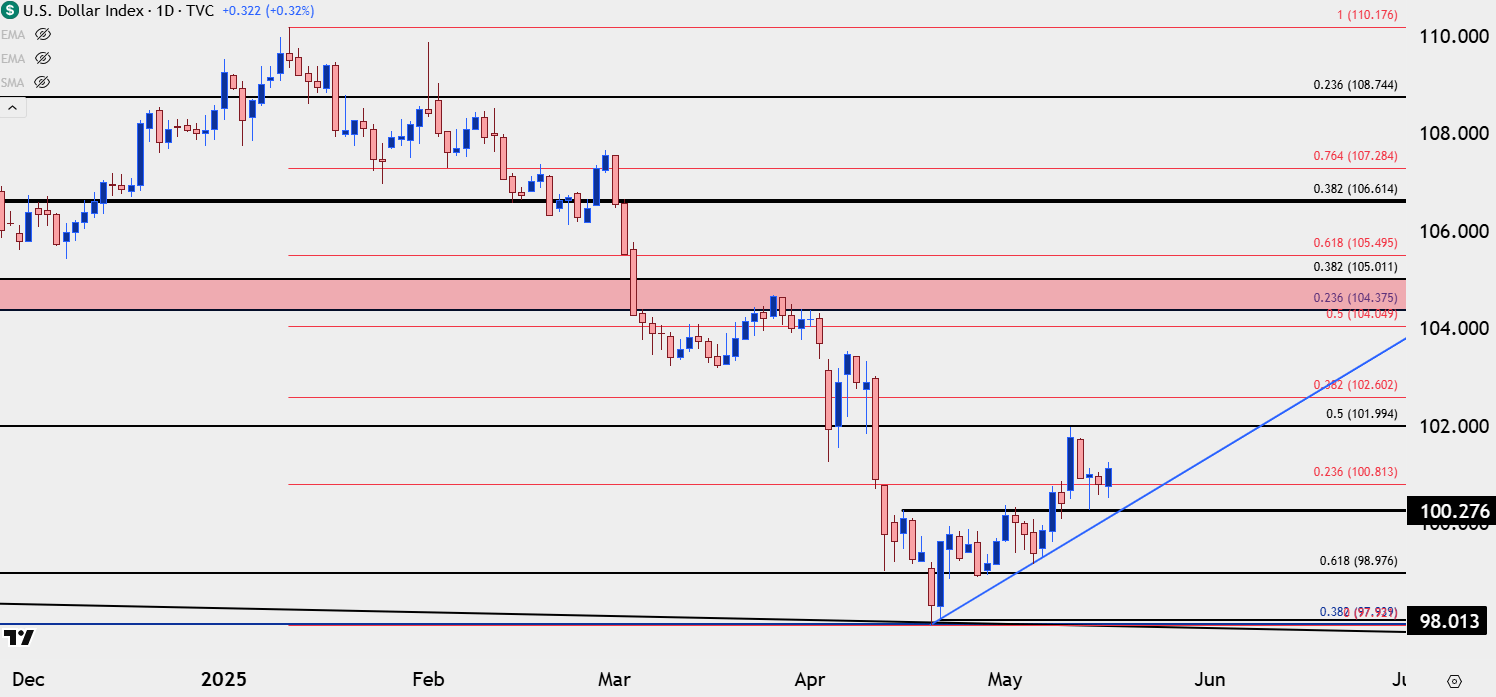

While that weekly bar above doesn’t look all that strong, context is important here. There was a lot of high impact U.S. data on the slate for this week and that had a generally negative tone, with below-expected U.S. CPI on Monday and a MoM PPI contraction on Thursday. U of M sentiment disappointed on Friday so USD bears had a lot to work with. There was also the resistance test at 102.00 on Monday – the same level I highlighted in the prior webinar as a major decision point.

Sellers had a lot to work with yet all they could do was prod a pullback to support at prior resistance. This keeps the door open for bulls into next week.

U.S. Dollar Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD

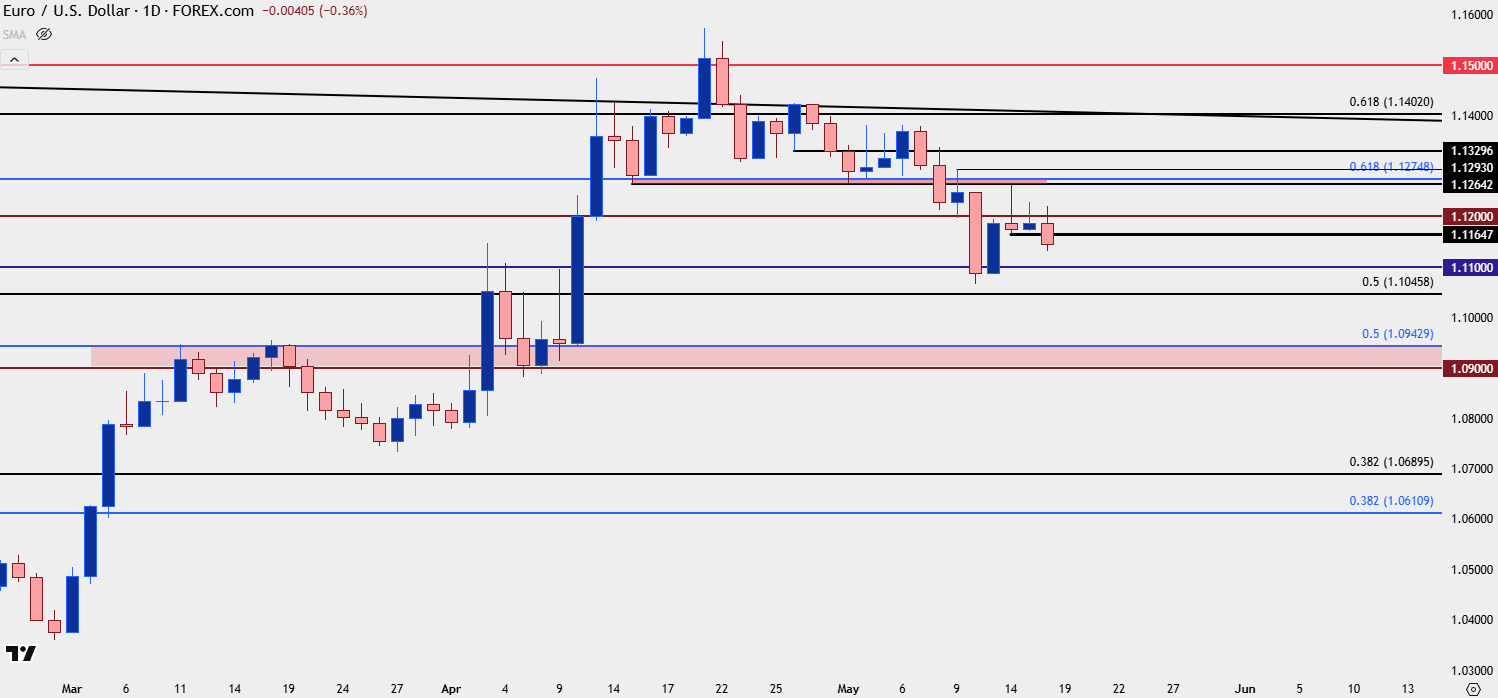

EUR/USD remains of interest for USD-strength setups. Ahead of the FOMC meeting in the prior week the pair had set up a descending triangle formation, with 1.1275 support leading into a series of lower-highs.

Bears broke that down after the Fed meeting and 1.1200 support then came in – leading to a pullback to 1.1275. This week opened with another extension in the sell-off, down to next support of 1.1100. As we had the pullback in the USD from 102 in DXY, EUR/USD snapped back but notably, it held below the resistance that I wrote of on Monday at 1.1275, keeping the door open for USD-bears. Since then, there’s been another hold of a lower-high at the 1.1200 handle, keeping the door open for bears (and conversely, USD bulls) as we move into next week.

EUR/USD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

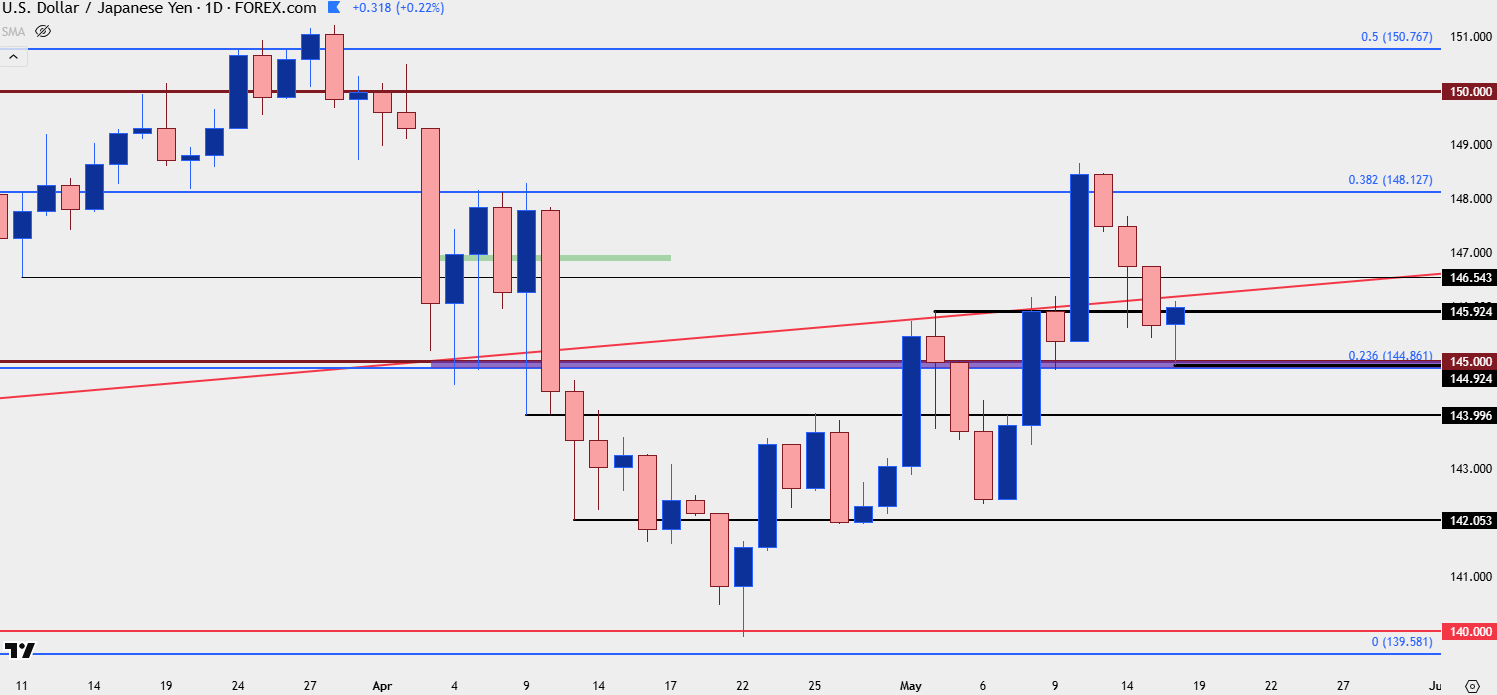

USD/JPY 145.00 Test

USD/JPY still seems to be doing a lot of the driving on the USD move. The strong breakout to start the week in DXY was coupled with a 148 test in USD/JPY. But the next three days saw bulls pull back on the throttle from both markets, allowing for a 145.00 re-test in USD/JPY, which I had highlighted in the Thursday article. I still think there’s more amenable pastures for both Yen-strength and Yen-weakness, but as we go into next week I’m considering USD/JPY at a higher-low given the hold of 145.00 and, notably, above the swing-low from the prior Friday.

USD/JPY Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

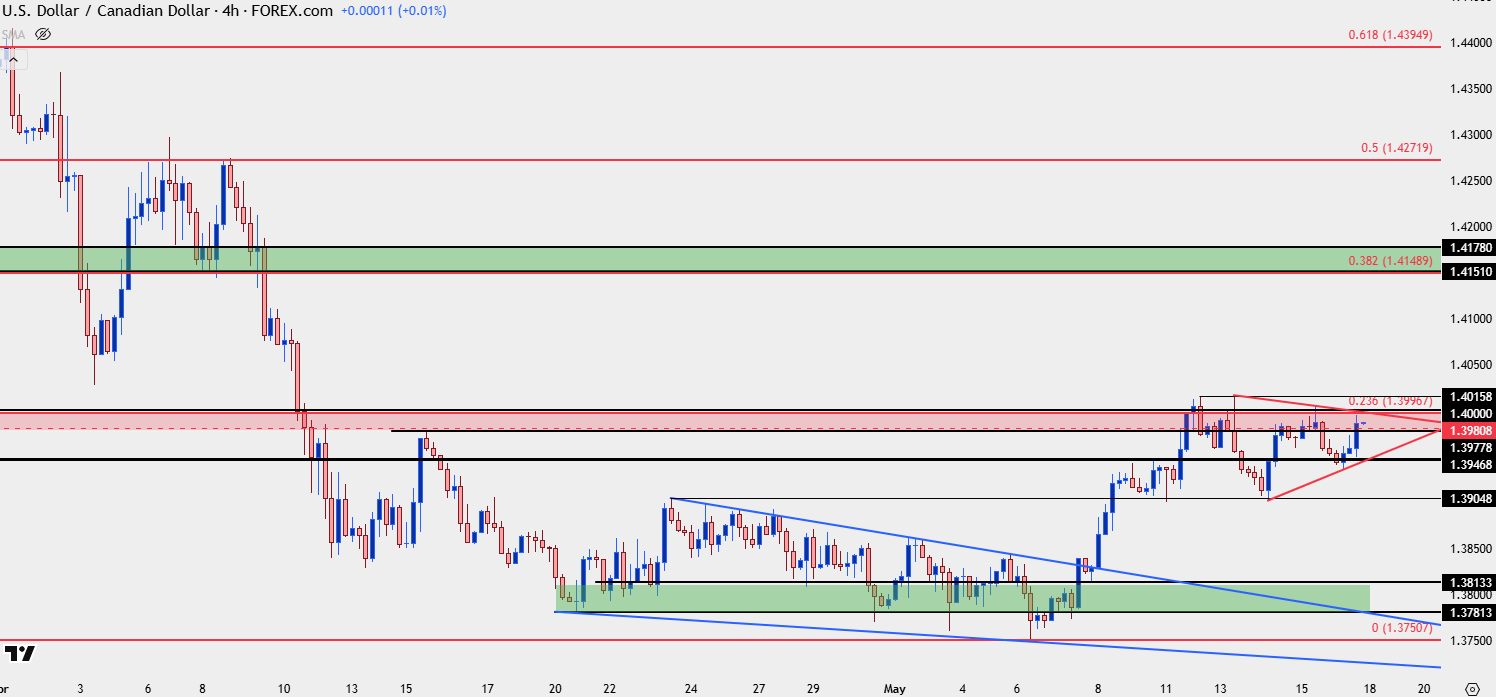

USD/CAD

For USD-weakness, I still prefer USD/CAD amongst major FX pairs. I wrote about this extensively in the Wednesday article with reference to the USD relationship and much of that remains the same as of this writing. Since then, we have seen another 1.4000 test and the pair has held below the prior swing high at 1.4016 thus far. The reaction to that, however, has held a higher-low so we’re essentially looking at digestion. I have supports at 1.3947 and 1.3905 and if USD-strength does push another wave, then I’m tracking next resistance in USD/CAD at 1.4149-1.4178, which would remain a valid spot for lower-high resistance in the bigger picture move.

USD/CAD Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

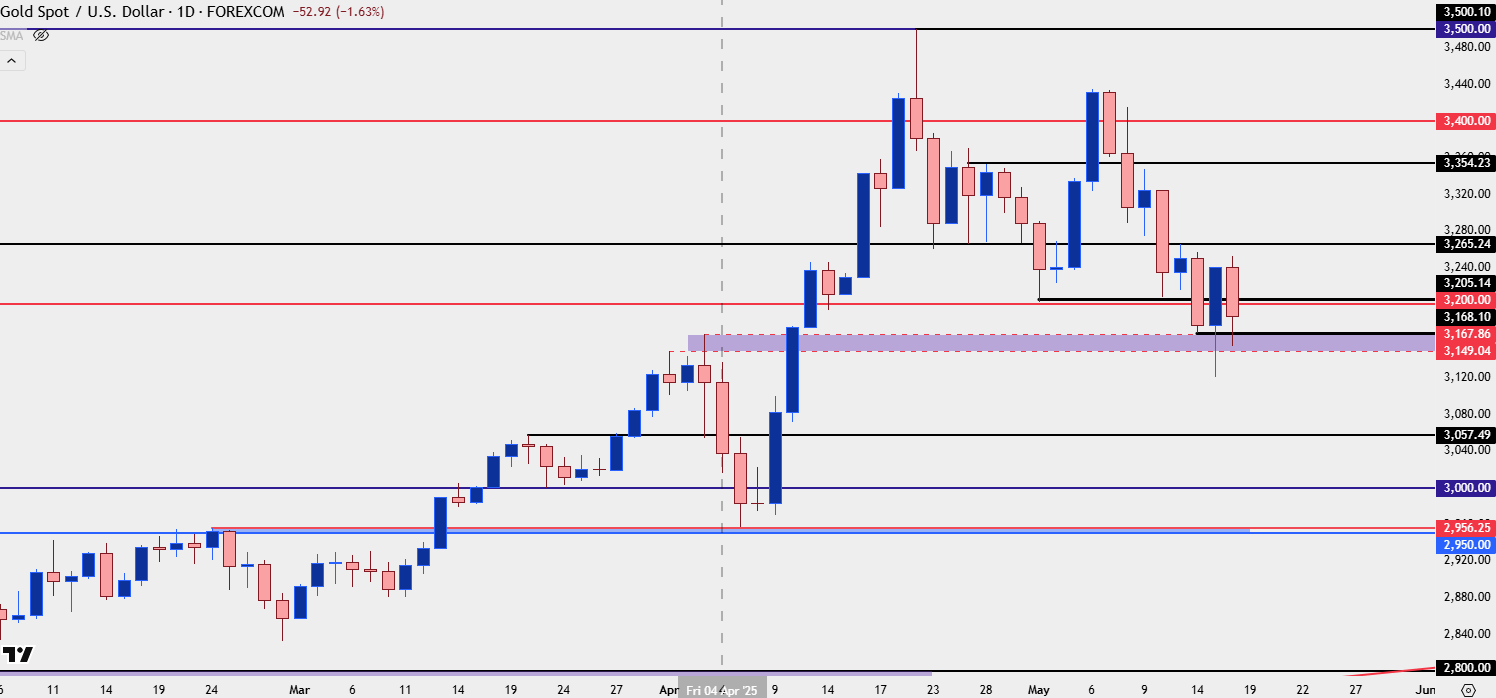

Gold

I spoke about gold for a while in this week’s session as there’s been a more notable pullback develop so far this week. I still want to bias this as bullish, however, given the broader backdrop and as we move towards the end of the week, there’s the prospect of higher-low support on a short-term basis at a big spot of long-term interest.

It was the 3149-3167 zone that held the highs in early-April, and that zone traded this week as it had helped to hold support, as shown on the below daily chart.

Gold Daily

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

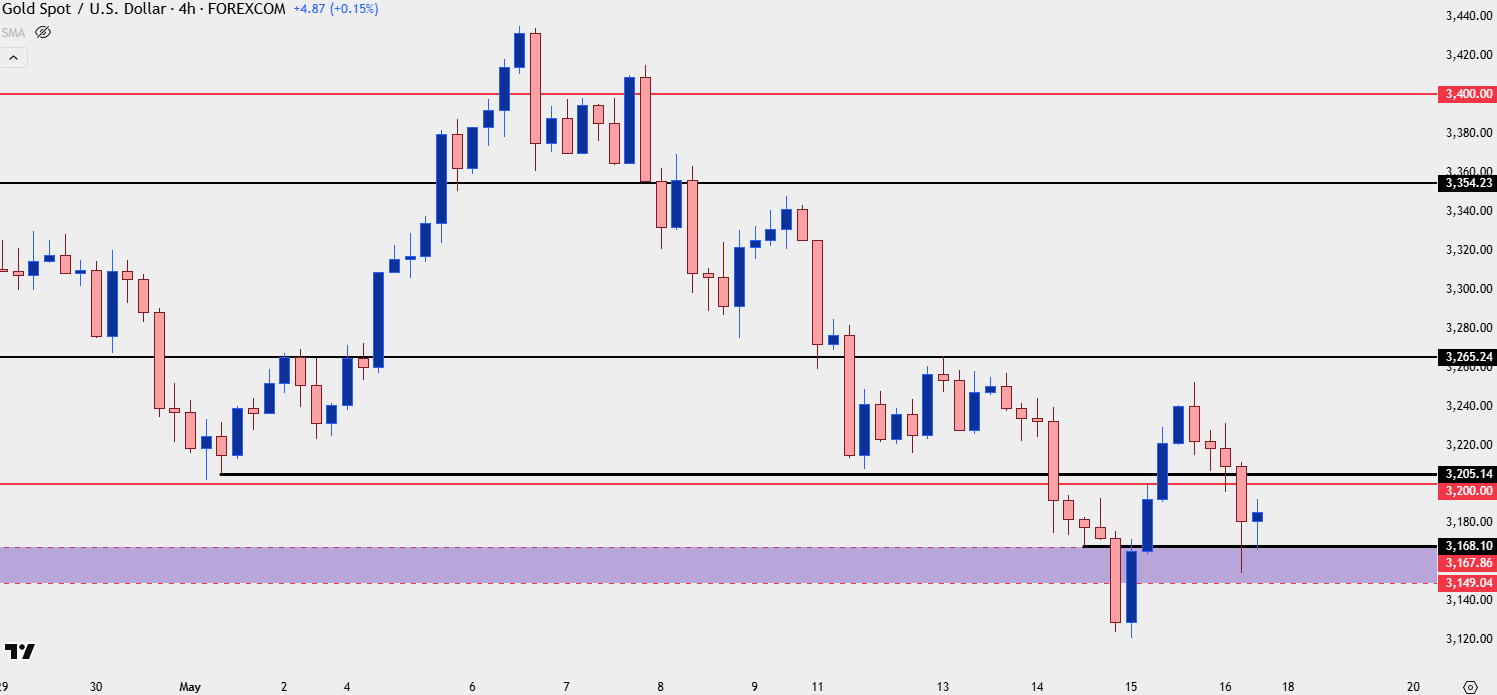

From that above move, bearish context can be argued given the lower-low that printed on the week. But, as noted above, shorter-term, there’s a prospect of higher-low support with that 3149-3167 zone coming into play on the four-hour chart.

Gold Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist