The US dollar is likely to come under increased pressure as weakening US data raises the prospects of a sooner-than-expected rate cut by the Federal Reserve. It will be interesting to see if the commodity dollars will now show some strength like we have seen the likes of the EUR, GBP and JPY display in recent trade. I suppose a lot will depend on the direction of stock markets, with major US indices such as the Nasdaq 100 testing some key support levels. Can we see a rebound for risk appetite today, in light of a weaker US jobs report, which increases the likelihood of rate cut by the Fed by May? If so, then watch pairs such as the AUD/USD, NZD/USD and USD/CAD. For the USD/CAD, it has been quite a busy last couple of weeks amid the escalation and then the de-escalation of trade wars. The pair started rising sharply on the back of Trump’s imposition of tariffs on Canada and Mexico, before falling back equally sharply this week when the US President significantly expanded the goods exempted from his new tariffs that were only imposed two days earlier. Then, today, we had jobs data from both North American nations causing even more volatility for the pair. If you think that was enough, the week ahead promising to further impact the USD/CAD forecast, with key US data and a rate decision by the Bank of Canada to come.

NFP disappoints, could send dollar lower

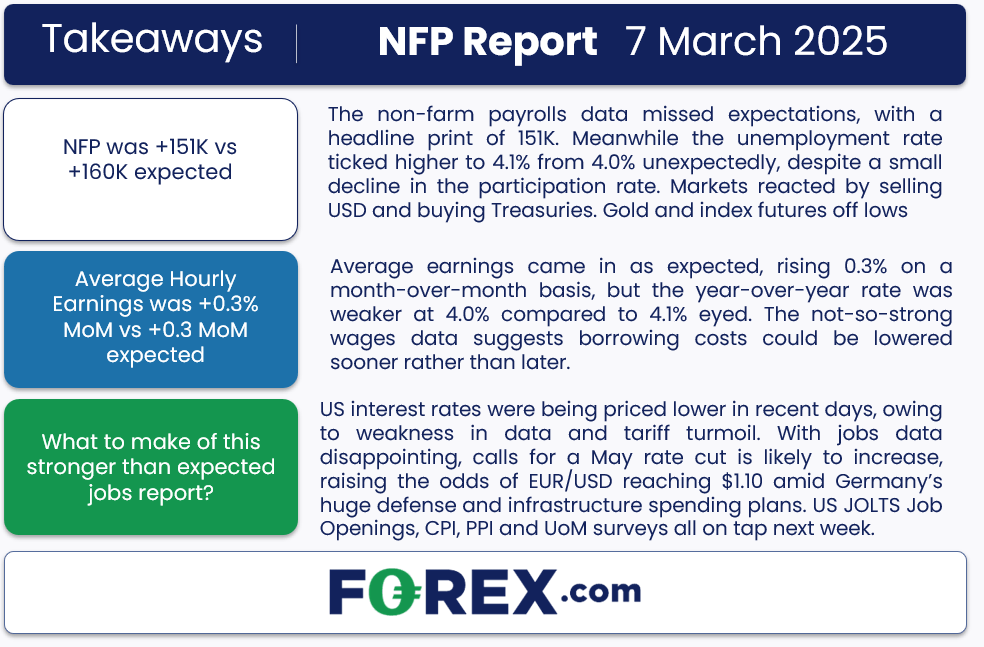

Today’s US jobs report surprised to the downside, coming in at 151K instead of 160K expected. Worryingly, the household survey showed job losses of 588K. Meanwhile the unemployment rate ticked higher to 4.1% from 4.0% unexpectedly, despite a small decline in the participation rate. Markets initially reacted by mildly selling the USD and buying Treasuries. Gold and index futures bounced off their lows. But the USD/CAD pair held onto its earlier gains because we had an even weaker jobs report from Canada. More on that later.

US interest rates were being priced lower in recent days, owing to weakness in data and tariff turmoil. With the February jobs data now disappointing, calls for a May rate cut is likely to increase, raising the odds of EUR/USD reaching $1.10 amid Germany’s huge defense and infrastructure spending plans. But was the US job weak enough to cause a more general dollar sell-off, including against the Canadian dollar?

Canadian jobs report missed forecasts ahead of BOC rate decision

The Canadian employment data released at the same time as the US non-farm payrolls report, showed a grand total of just 1.1K net growth in the economy. That was weaker than 20K expected but comes on the back of forecast-beating job gains in the last three months. Understandably, the Canadian dollar weakened.

Next week, the Bank of Canada will make its rate decision on Wednesday, March 12. The BOC has been cutting interest rates in each of its past 5 meetings, bring the benchmark Overnight Rate down to 3.00% at the end of January from the peak of 5.00% when it started cutting at the start of last summer. Many economists believe the cutting cycle will continue for at least the next few meetings amid trade uncertainty. Though US President Donald Trump has signed orders broadening exemptions on newly imposed tariffs for Canada (and Mexico), this is only adding to business uncertainty and market jitters. Against this backdrop, another 25 bps cut is expected for this meeting. It is all about how many more cuts should we expect heading towards the summer.

What’s next for US dollar?

Well next week, we have at least four key economic reports to look forward to. These include the increasingly important JOLTS jobs openings on Tuesday, followed by the CPI report on Wednesday, PPI data on Thursday, and then the University of Michigan’s consumer confidence and inflation expectations surveys on Friday.

US CPI inflation has been climbing again in the last 5 months and providing a dilemma for the Fed with signs of economic strain emerging in certain sectors of the economy. Worryingly, consumer’s inflation expectations have been rising noticeably with concerns about tariffs and Trump’s tax-cut and spending plans at the forefront of their minds. Let’s see if rising inflation expectations manifest into accelerating inflation, or whether weakness in data and oil prices have helped to ease price levels in February.

Meanwhile, PPI data will be important to watch as it contains a few sub-categories that feed into the Fed’s preferred measure of inflation that comes out towards the end of the month – namely Core PCE Price Index. Therefore, pay close attention to the PPI report, as it could have implications for the Fed’s policy in the months ahead, and it could impact the Dollar Index and pairs such as USD/CAD.

Once inflation data is out of the way, the focus will then turn to the University of Michigan’s surveys on Friday. After last month’s surprise drop to 64.7 from 71.1 in this leading indicator of US consumer sentiment, let’s see if Trump’s protectionist policies have further dented confidence. The UoM report is based on a survey of about 420 consumers, asking respondents to rate the relative level of current and future economic conditions. Of equal importance is the survey on inflation expectations, released at the same time. The latter has been climbing steadily, and last month jumped to 4.3% from 3.3% in a surprise move. Watch this closely as it could have implications for actual future inflation.

Technical USD/CAD forecast: key levels to watch

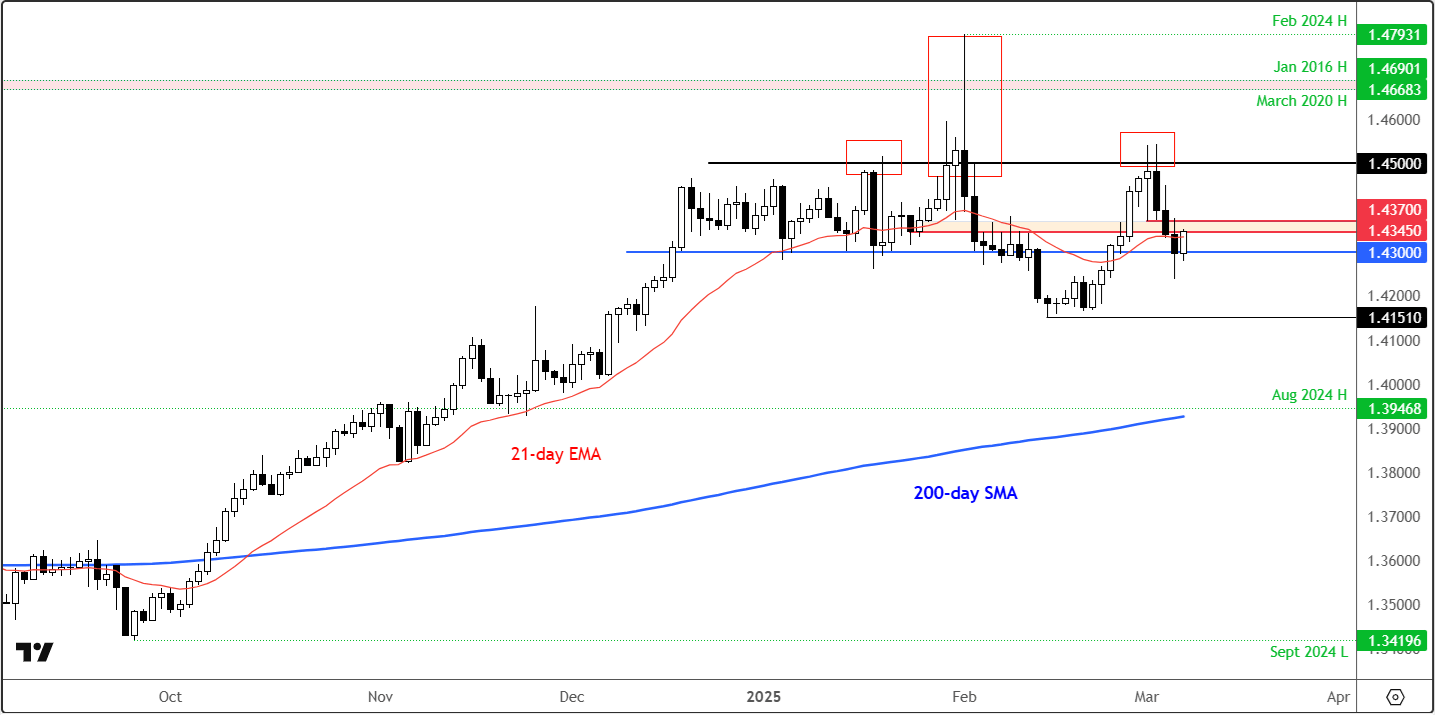

The USD/CAD has been all over the place, making it a trick pair to trade compared to the likes of the USD/JPY and EUR/USD, which have both establish cleaner trends in recent times. Nonetheless, the near-term USD/CAD forecast remains uncertain in light of today’s macro releases from both North American nations (see above) and amid ongoing trade uncertainty.

Source: TradingView.com

The longer-term trend on the USD/CAD seems to have turned bearish, ever since it formed a false break reversal above the highs of 2016 and 2020 at around the 1.4260-1.4690 area in February. The pair made a high of 1.4793 before plunging lower. Interestingly, the psychologically-important 1.45 handle has not been breached decisively, with the USD/CAD potentially creating the two shoulders of a head-and-shoulders reversal pattern around that area. The neckline for this pattern is a bit vague, though, but the recent lower low beneath 1.4300 handle suggests there has already been a breakdown in the longer-term market structure of higher highs and higher lows.

But for the USD/CAD to form a decisive bearish trend, we will now need to see a clean breakdown below the 1.4300 handle on a closing basis. The next downside target is the liquidity beneath last month’s low of 1.4151. Further lower, we have the August 2024 high and the 200-day moving average coming into focus around the 1.39-1.40 area. That, to me, is the main downside objective for this pair.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R