- Swiss inflation expected to dip, fuelling SNB rate cut bets

- U.S. job openings eyed ahead of payrolls; quits may matter more

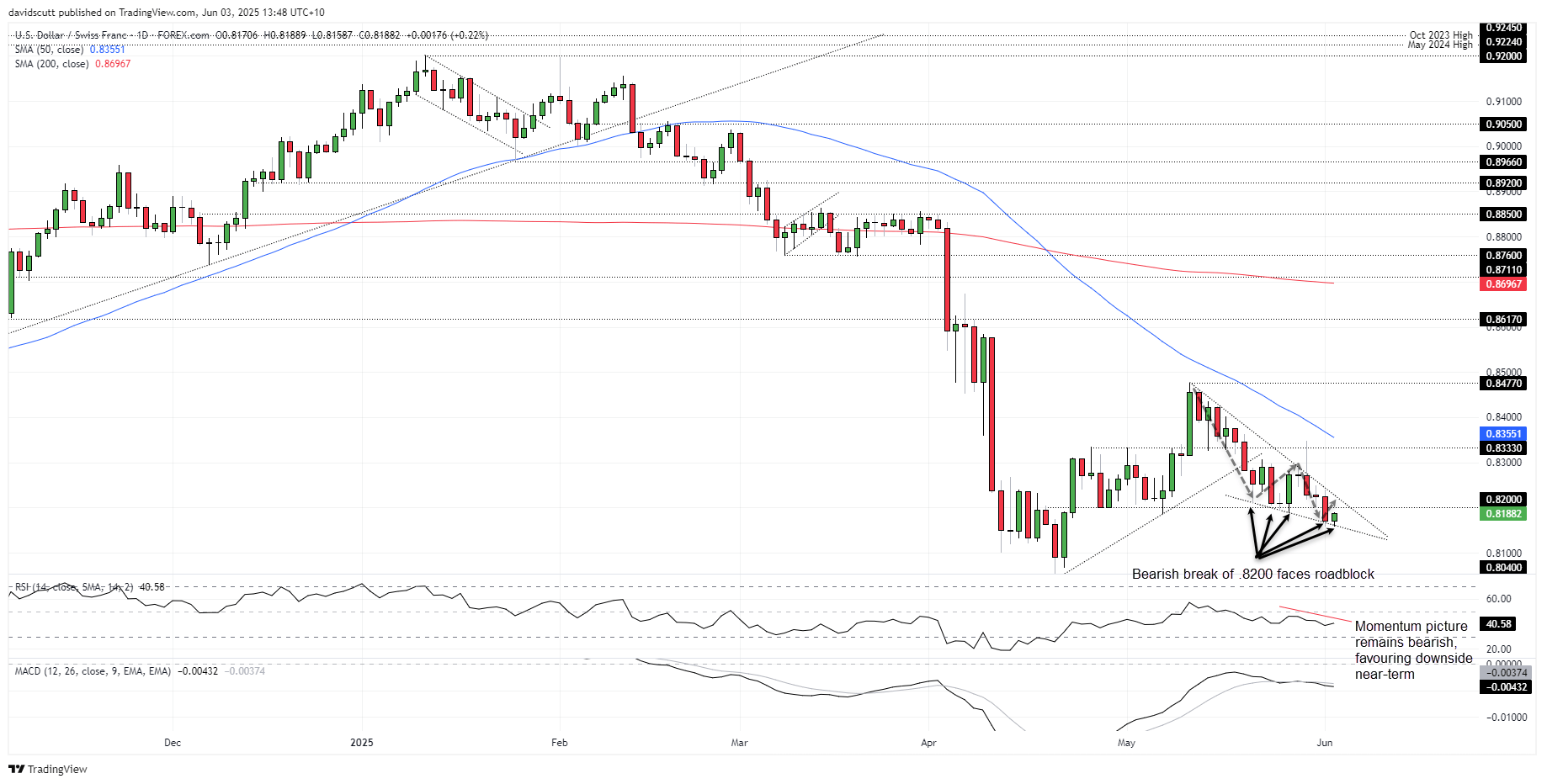

- USD/CHF hits six-week low but finds support at falling wedge base

- Broader dollar sentiment still dictating Swissie direction

Summary

Swiss inflation data and U.S. job openings dominate the data docket for USD/CHF traders on Tuesday, but whether either will have a lasting impact on price remains debatable given recent shifts have largely reflected broader dollar risk-on, risk-off moves. While USD/CHF broke to six-week lows on Monday after bears overran bulls at .8200 support, with the pair coiling in what resembles a falling wedge, the coast is not entirely clear for a run towards the lows set in April.

USD/CHF Data Flow Quickens

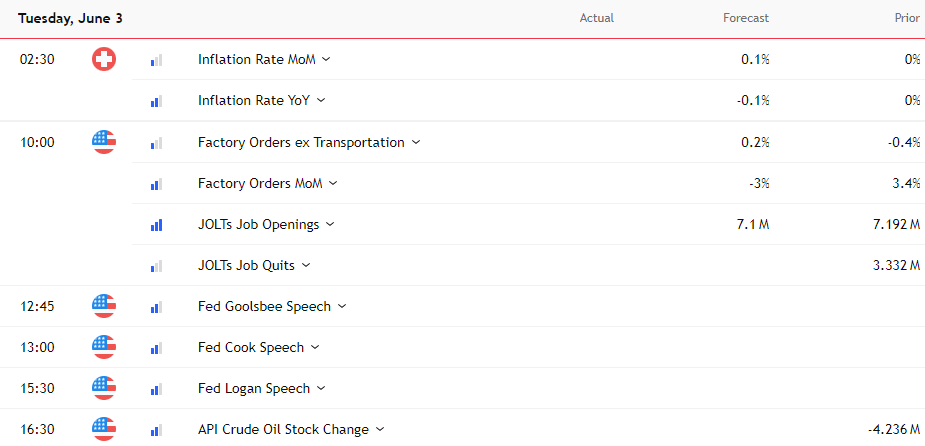

The data calendar picks up on Tuesday with Swiss inflation for May and the volatile-yet-influential U.S. JOLTS report for April.

Source: TradingView

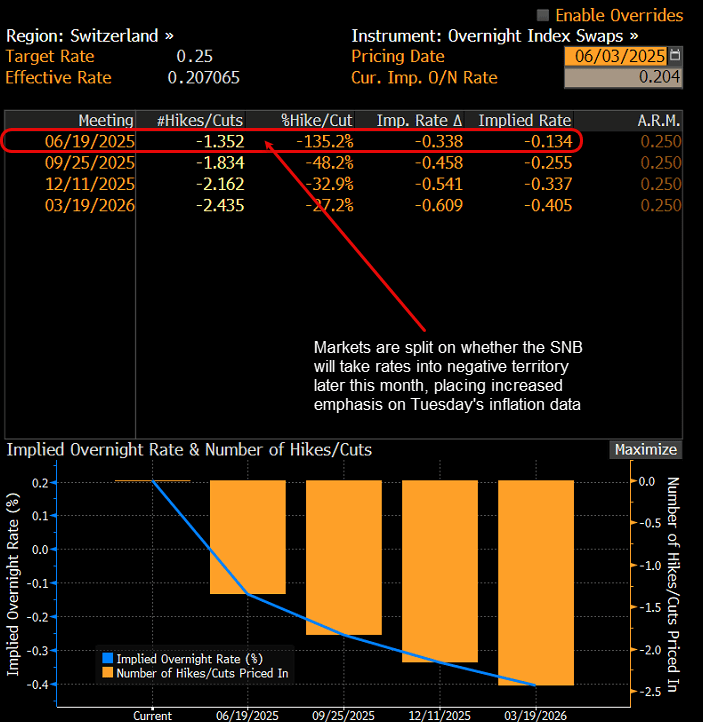

In Switzerland, deflation is expected to return with a flat monthly outcome forecast to push the annual rate down 0.1%, below the unchanged reading in April. A result in line with or weaker than expected would only reinforce market expectations that the Swiss National Bank (SNB) may take interest rates back into negative territory as soon as June 19.

Source: Bloomberg

In the United States, job openings in April are seen slipping from 7.192 million to 7.1 million. While consistent with the prevailing trend, it's worth noting openings have already fallen in the past two JOLTS reports. A third straight monthly decline hasn’t occurred since mid-2023, and the survey is notoriously noisy month-to-month. Realistically, the quits and layoffs figures may offer more insight than the headline number, especially ahead of Friday’s payrolls.

Elsewhere, durable goods orders are expected to reverse much of March’s 3.4% aircraft-driven surge, with the median forecast pointing to a 3% decline. Ex-transport, orders are seen inching up 0.2%. Given ongoing tariff headlines and backflips, the release lends itself to surprise outcomes, creating opportunities for scalpers to fade any data-driven moves if anomalies emerge.

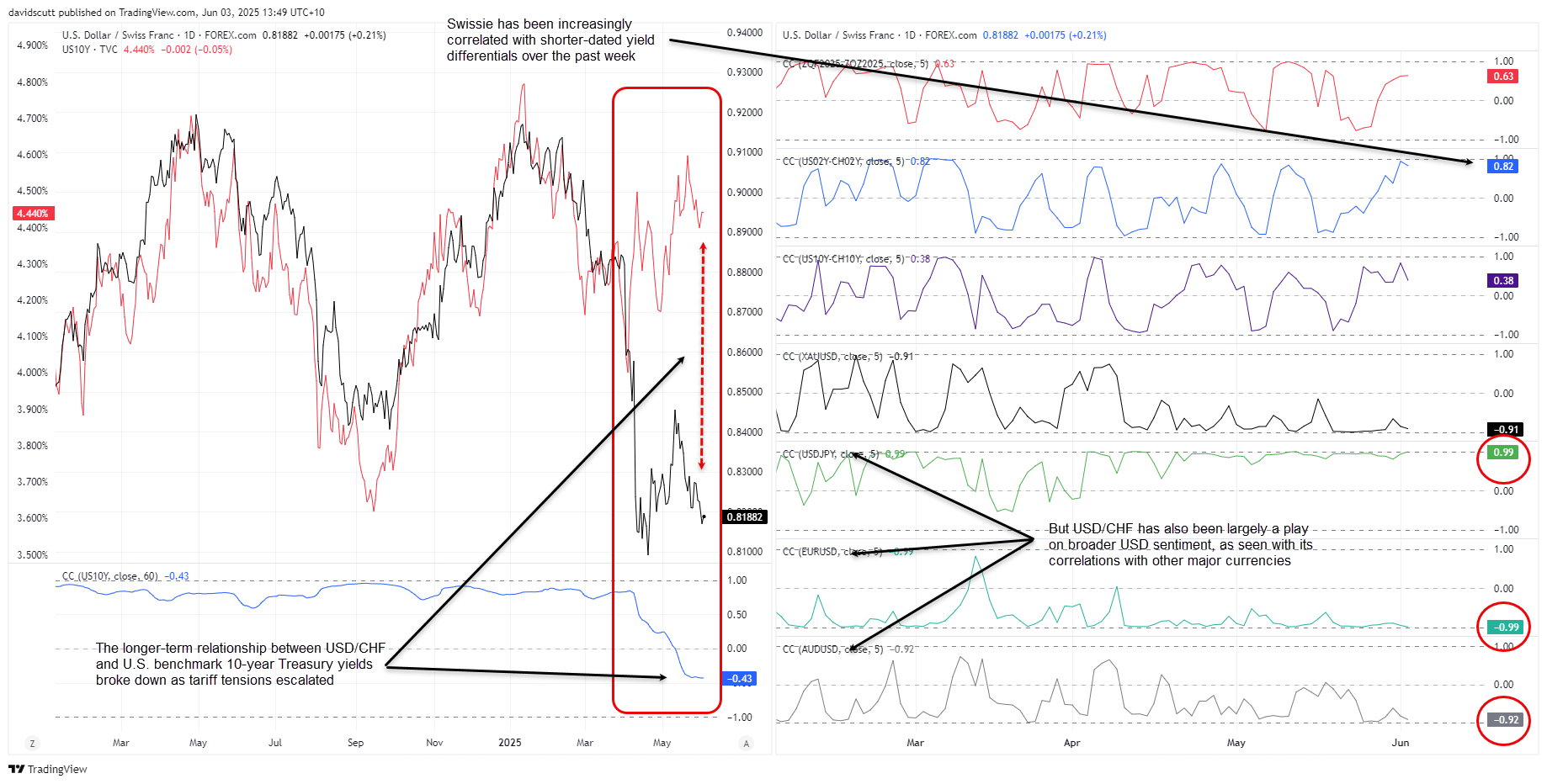

Not Just a Dollar Sentiment Play

Source: TradingView

Looking at correlations between USD/CHF and other markets, it's clear the pair's once-solid link to U.S. Treasury yields has broken down over the past quarter. On shorter timeframes, USD/CHF has moved closely with the JPY, EUR, gold, and even the AUD against the USD over the past five sessions—underlining that recent moves have been more about broader dollar positioning than idiosyncratic drivers.

Interestingly, the pair’s positive correlation with the immediate front end of the U.S. rates curve has strengthened lately, although not to extreme levels. The same can be said of short-dated interest rate differentials between the U.S. and Switzerland, reinforcing why the upcoming data shouldn’t be ignored.

USD/CHF: Bearish Break Hits Roadblock

Source: TradingView

USD/CHF hit its lowest level since April 22 on Monday after bears broke support at .8200, taking out the May 27 low in the process. While momentum remains firmly bearish—RSI (14) is trending lower beneath 50 and MACD is in negative territory having crossed below the signal line—the price has now bounced off downtrend support established in late May on five separate occasions, including in Asia today. That may deter bears from doubling down on shorts and raises the risk of an eventual topside break, given the pair is coiling in what resembles a falling wedge pattern.

For those considering bearish setups, it may pay to wait for a break and close below Monday’s low before establishing positions. That would allow for stops to be placed above the downtrend, targeting a retest of the April 21 low of .8040.

However, if the price cannot break the downtrend sustainably, watch for a potential retest of .8200 and, beyond that, downtrend resistance dating back to the May highs. If the latter is broken, as the wedge pattern would conventionally suggest, watch for a potential squeeze back toward resistance at .8333—where the pair was comprehensively rejected following a failed bullish break last week.

-- Written by David Scutt

Follow David on Twitter @scutty