- Monday’s rally unwinds to .8336 breakout zone

- Uptrend intact but increasingly fragile

- Michigan inflation expectations in focus Friday

Summary

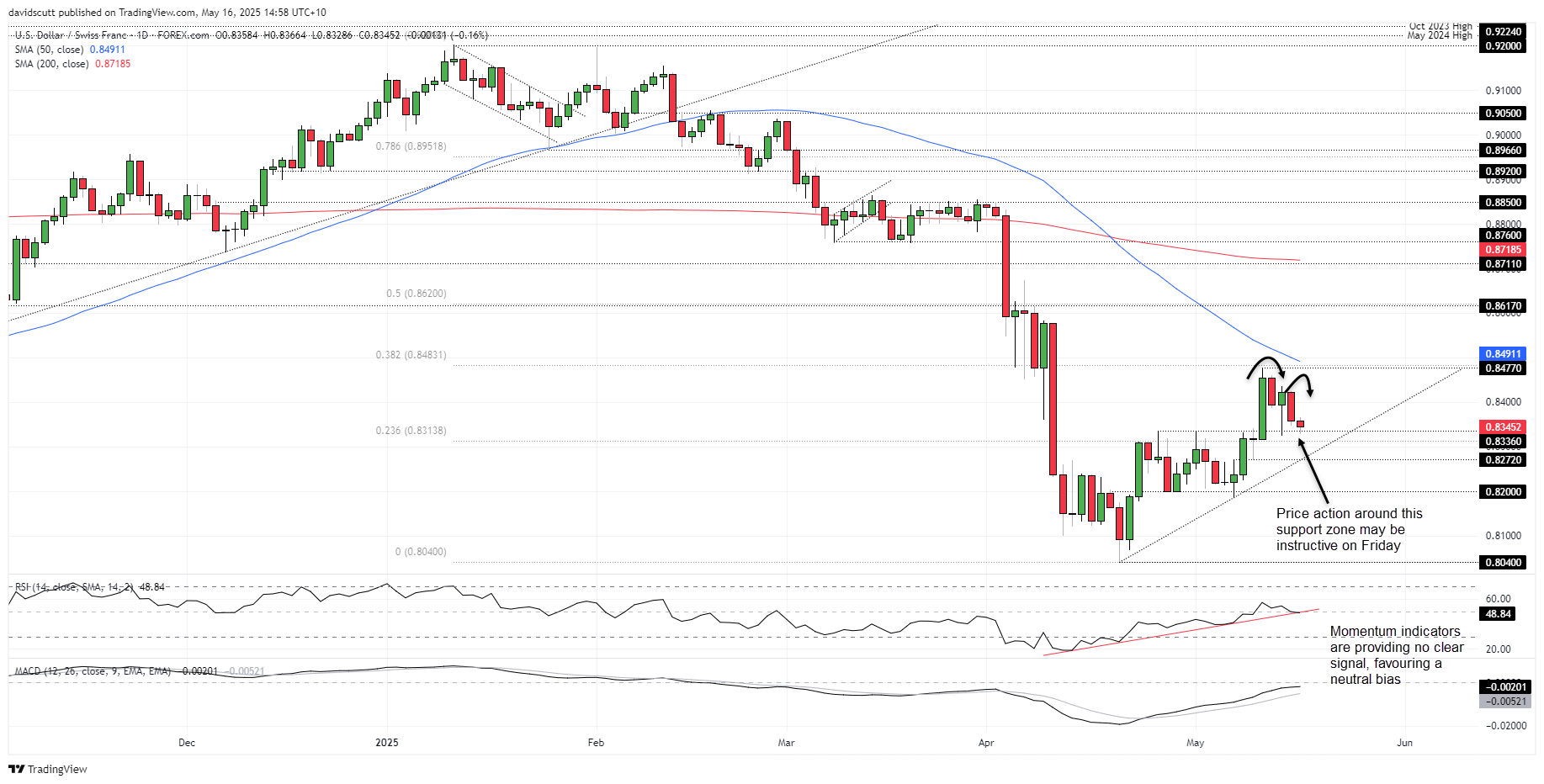

Technical levels in USD/CHF have been as precise as a Swiss timepiece this week, with Monday’s bullish breakout stalling at familiar resistance before completing a full roundtrip back to where it began. Rather than being driven by rate differentials or haven demand, recent franc moves have mirrored the yen, euro and pound, suggesting broader US dollar sentiment is steering day-to-day fluctuations.

USD/CHF: Week of Selling Rallies

The rally on Monday—sparked by news of a surprise trade deal framework between the US and China—was sharp but short-lived. USD/CHF ran into sellers just below the 38.2% Fib retracement of the 2025 range, before reversing course and bouncing off .8336, the breakout point. That bounce also fizzled, leaving the pair largely unchanged from a week ago.

Source: TradingView

While the broader uptrend from the April 21 low remains intact—set during the peak of the ‘sell America’ trade—this week’s pattern of selling into strength raises the risk the trend may be losing steam. That test may not come today, however, with weekend trade headlines still a potential wildcard for shorts.

On the downside, .8314–36 remains key with horizontal support converging with the 23.6% Fib retracement of the 2025 range. A clean break below would expose .8272, where minor horizontal support intersects with the April 21 uptrend. Below that, .8200 and .8040 emerge as potential bear targets.

Should .8336 continue to hold, upside interest may re-emerge around Wednesday’s high at .8435 and resistance at .8477—levels that may also appeal to fresh shorts.

Momentum indicators are offering few clear cues, with both RSI (14) and MACD looking slightly heavy following a sluggish recovery from oversold extremes hit in late April.

The data calendar is light on Friday with only the University of Michigan’s inflation expectations worth watching. A surprise cooling in the long-run measure could weigh on the dollar if it shifts Fed expectations.

-- Written by David Scutt

Follow David on Twitter @scutty