- Japan inflation ex-energy, fresh food accelerates to 3.0% YY

- Swaps price 76% chance of 25bp BoJ hike by year-end

- JGB yields rising, pressuring long-end rates globally

- USD/JPY correlation with Japanese yields strengthens

- Technicals point to more downside—144.00 remains key resistance

Summary

Core inflation in Japan continues to run hot, keeping pressure on the BoJ to tighten policy again despite growing global risks. This analysis breaks down why swaps are ramping up rate hike expectations, how long-end Japanese yields are reshaping USD/JPY drivers, and why the technical setup now favours further downside in the pair.

Japan Inflation Heating Up

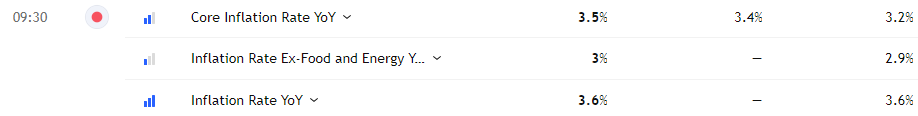

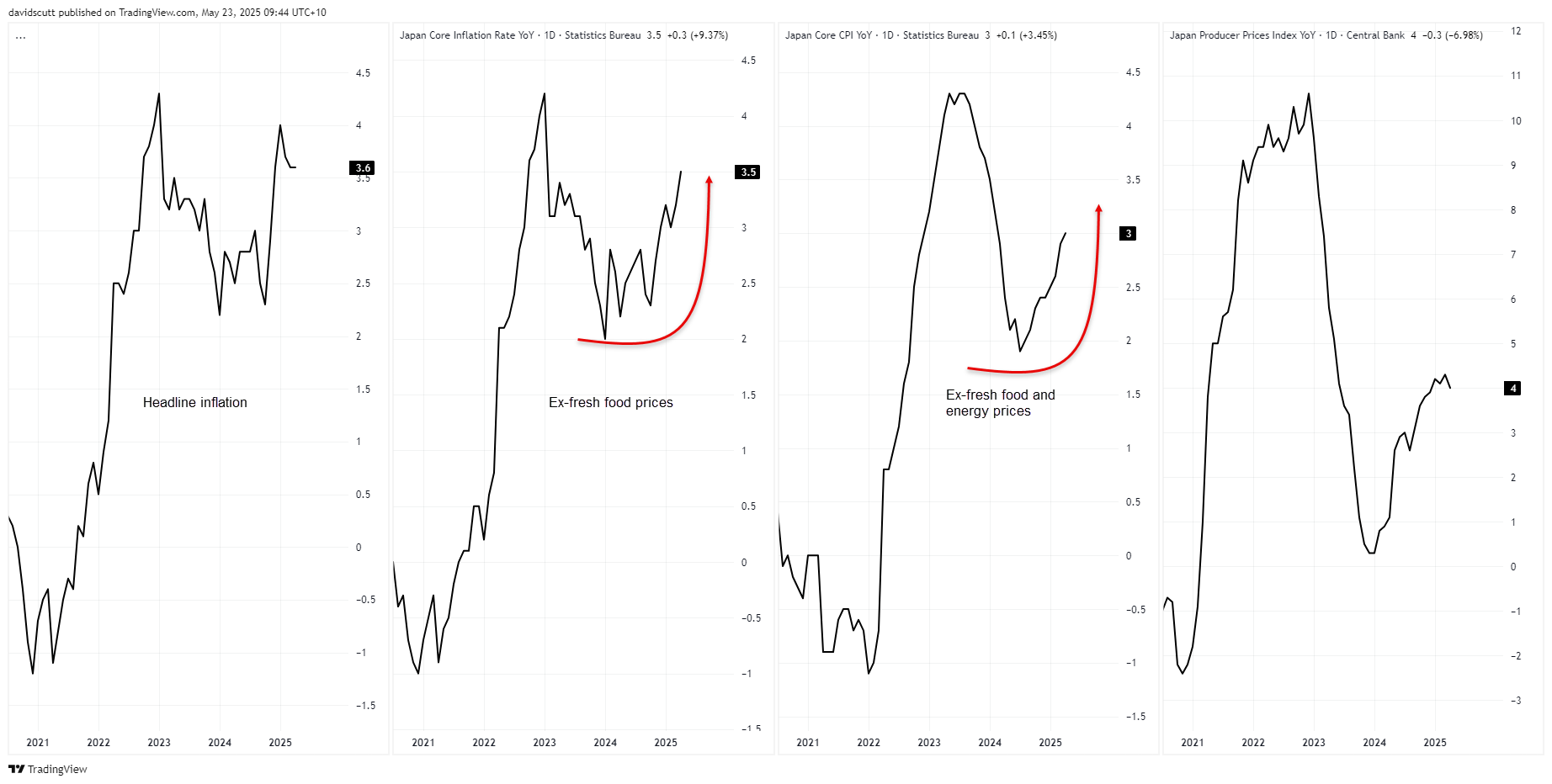

Japan’s core inflation measures are showing no signs of cooling, reinforcing expectations the BOJ may lift interest rates again soon despite risks posed by rapidly shifting U.S. trade policy.

Source: TradingView

April inflation excluding fresh food jumped 3.5% from a year earlier, the fastest pace in over two years and above the 3.4% forecast. More importantly for BOJ policy, the core-core gauge—which excludes fresh food and energy items—rose 3.0% over the year, up from 2.9% in March. That’s well above the BOJ’s 2% target and tracking stronger than the bank’s FY25 forecast of 2.3%.

Next Friday, markets will receive inflation data from Tokyo for May, providing clues on what may be seen nationwide when the figures are released in late June. Put that in the calendar!

Source: TradingView

BOJ Rate Hikes Return on Horizon

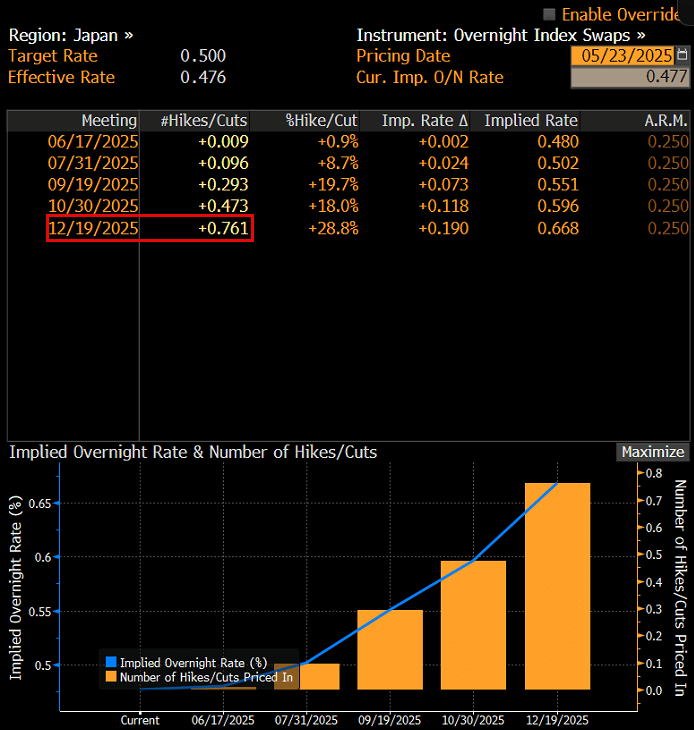

Markets are taking note of underlying inflation trends, with swaps pricing in a 76% chance of a 25bp hike by year-end—a noticeable turnaround from a month ago when such a move was deemed remote at best.

Source: Bloomberg

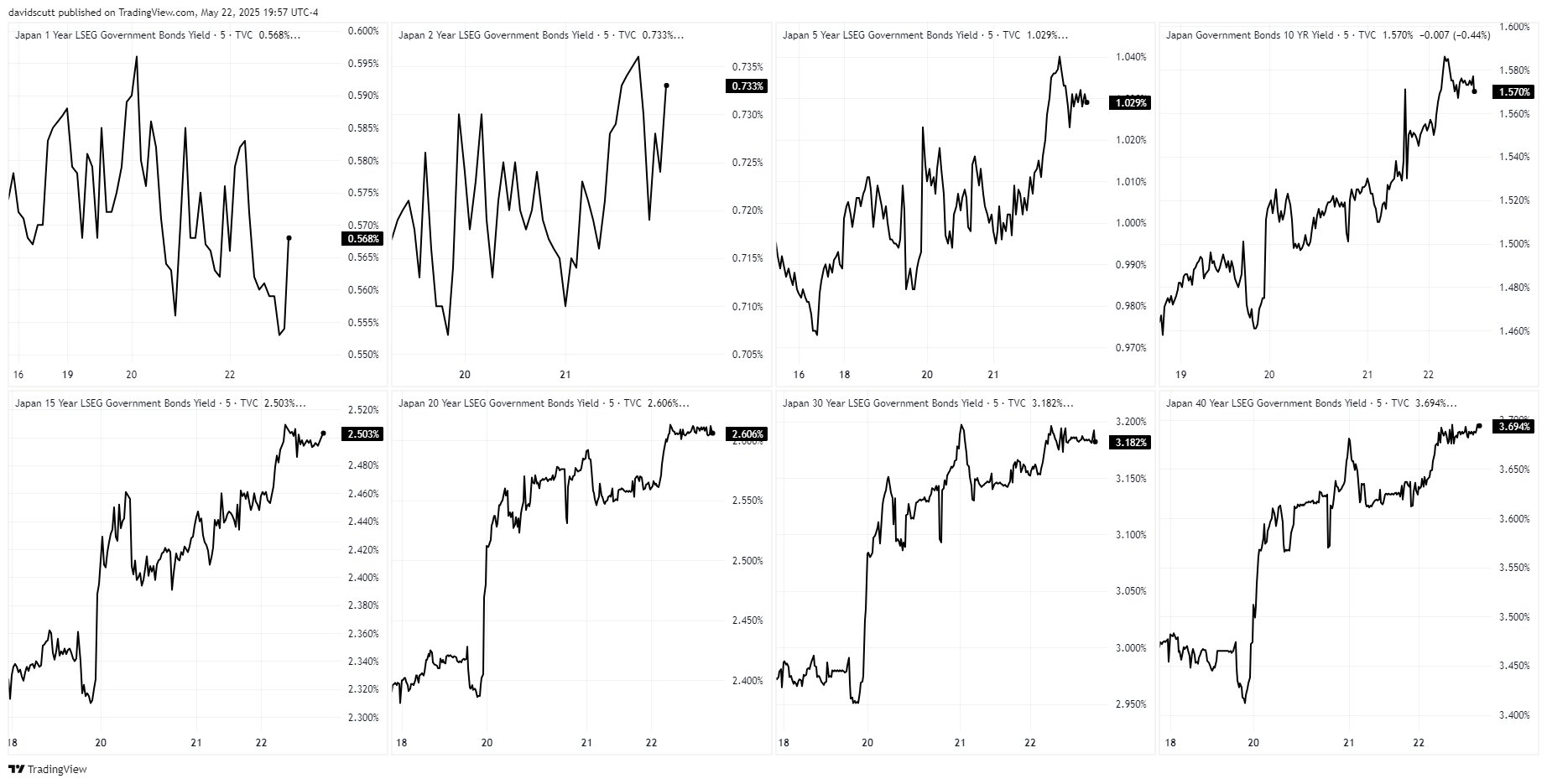

The persistent inflation backdrop—highly unusual for Japan after battling decades of deflation—has contributed to a steep rise in Japanese government bond yields this year, especially for longer-dated securities. That’s pressured long bonds in other nations too, as Japanese investors are tempted to invest domestically rather than abroad, especially with yield differentials narrowing aggressively.

Source: TradingView

Higher Japan Yields Cool Carry Trades?

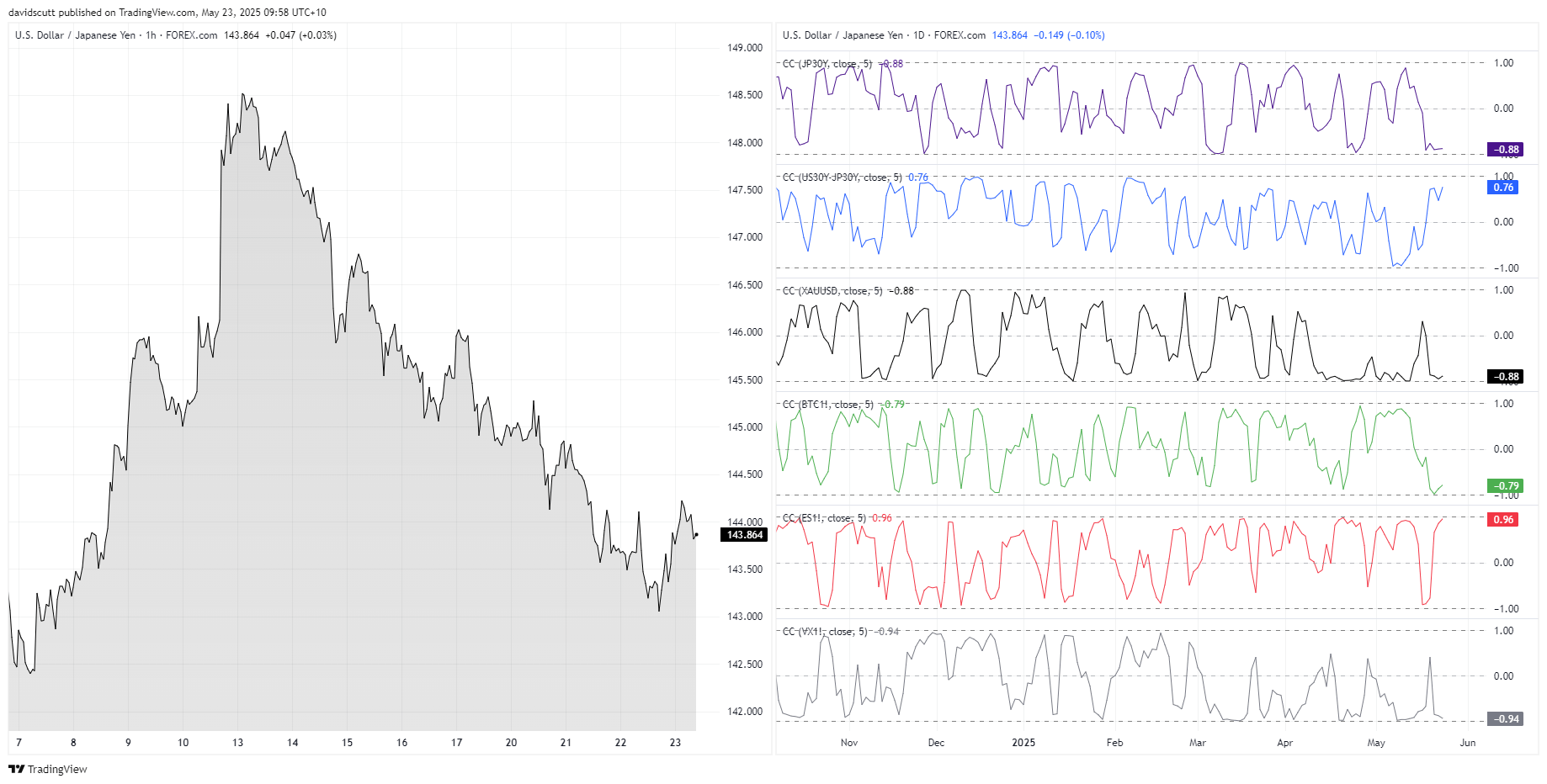

What’s noticeable over the past week is the strong inverse correlation between USD/JPY and moves in Japanese 30-year bond yields, indicated by the purple line below, sitting at -0.88. Historically, USD/JPY has often been tied at the hip with U.S. Treasury yields, but that relationship has vanished in recent months. Instead, moves in Japanese yields have become increasingly important, as shown by the strengthening positive correlation with U.S.–Japan 30-year yield spreads over the same period.

Source: TradingView

While USD/JPY has also been strongly correlated with traditional drivers like S&P 500 (red) futures and VIX (grey), and inversely correlated with safe havens such as gold (black), that likely reflects that investors in other asset classes are also watching long bond yields like a hawk.

USD/JPY: Selling Rallies Preferred

Source: TradingView

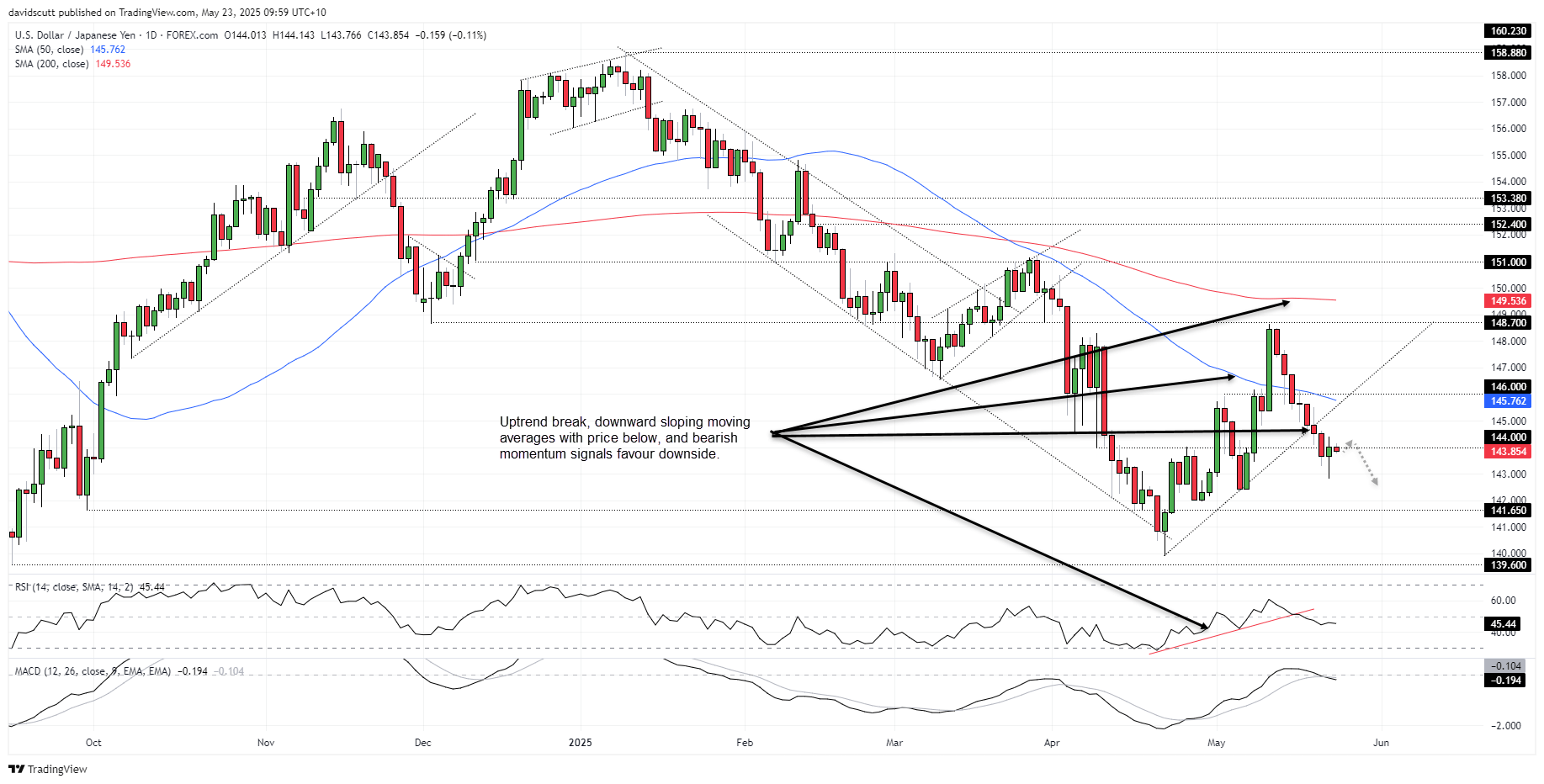

Technicals also favour yen strength against the U.S. dollar near-term, with price and momentum signals combining with moving averages to deliver a backdrop that points to continued downside.

The break of the April 22 uptrend shifted directional risks lower earlier this week, likely prompting fresh shorts and contributing to the unwind to 142.80 before bottoming. Despite the bounce above 144.00 on Thursday, like other recent probes above this level, it failed to stick, with the pair reversing back below early in the Asian session.

With RSI (14) trending lower and below 50, and MACD crossing the signal line from above in negative territory, momentum is turning bearish, favouring downside over upside. With both the 50- and 200-day moving averages sloping downward, selling rallies and downside breaks remains the preferred strategy.

Pushes above 144.00 have been met with renewed selling pressure, making that a level for bears to consider establishing shorts. Beyond 142.80, 142.50 and 142 may see buyers emerge, although more pronounced support is found at 141.65.

If USD/JPY were to close above Thursday’s high, it would shift the bias to neutral on a short-term basis.

-- Written by David Scutt

Follow David on Twitter @scutty