- Tokyo core CPI hits 3.4% in April, highest in two years

- BOJ likely to stay on hold next week despite sticky inflation

- U.S. trade risks cloud timing of next BOJ hike

- USD/JPY tracking risk sentiment, not rate differentials

Summary

If not for elevated levels of uncertainty surrounding U.S. trade policy, the Bank of Japan (BoJ) would likely be readying to lift interest rates again following the release of consumer price inflation (CPI) data from Tokyo on Friday.

Arriving three weeks ahead of the national report, it revealed across-the-board strength in April, hinting that large wage increases are helping to foster a virtuous cycle where stronger domestic demand is underpinning price growth. For now, domestic considerations continue to be trumped by heightened uncertainty abroad, keeping the BOJ on the sidelines.

For the Japanese yen, USD/JPY has reverted to being more of a play on risk appetite than interest rate differentials or safe haven flows over the past fortnight, placing increased emphasis on the performance of riskier asset classes near-term.

Tokyo Inflation Heats Up, Keeping BoJ Hikes on Standby

Tokyo core inflation picked up sharply in April, surging to a two-year high of 3.4% as the unwinding of energy subsidies and another round of food price hikes kicked in at the start of the fiscal year. The reacceleration was well above forecasts and led by sticky services prices.

A broader measure of underlying inflation, which excludes fresh food and energy prices, also accelerated sharply, lifting 3.1%, up from 2.2% in the year to March. That’s important as it’s closely watched by BOJ policymakers.

While the outcome keeps rate hikes in play, especially if inflation stays hot, the reemergence of U.S. tariff risks and potential downgrades to Japan's growth outlook suggest the BOJ may need to tread more carefully when it comes to monetary policy normalisation.

The BOJ is widely expected to hold fire at next week’s meeting, but with underlying inflation running well above target, the door to a second hike later this year remains open if external shocks fail to materialise. Currently, Japan’s key overnight policy rate stands at 0.5%.

USD/JPY Resumes Risk Proxy Role

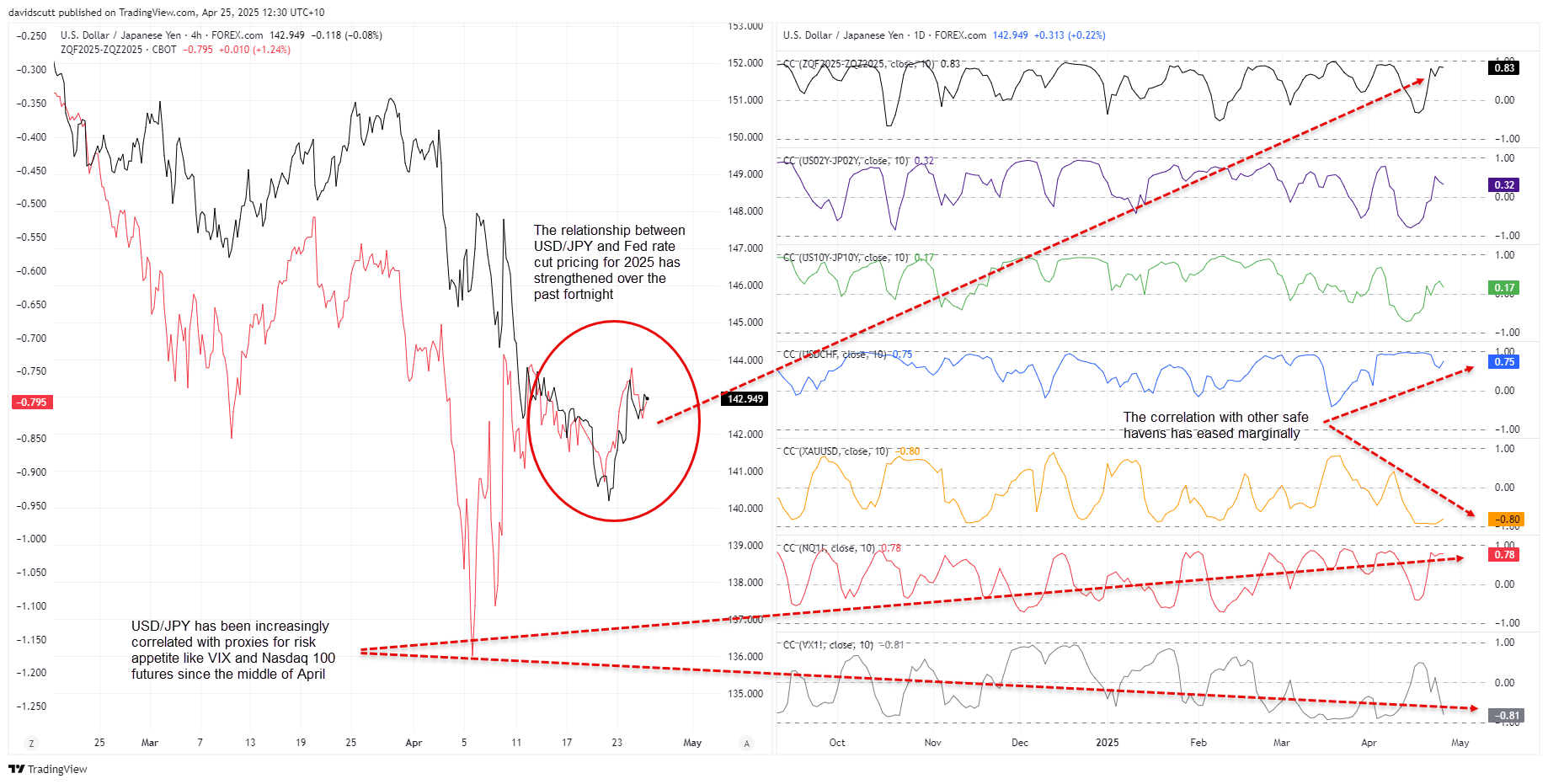

Source: TradingView

Despite the hot inflation print from Japan’s capital, domestic factors remain a distant secondary consideration for USD/JPY traders right now, superseded by continued uncertainty surrounding U.S. trade policy and the spillover effects on global economic activity.

As seen in the graph above, the strong correlation between the Japanese yen and other safe haven assets such as gold and the Swiss franc has weakened marginally over the past fortnight, surpassed by strengthening relationships with 2025 Fed rate cut pricing and indicators on risk appetite such as VIX and Nasdaq 100 futures.

For now, linkages to interest rate differentials—which often drive movements in USD/JPY—remain negligible.

USD/JPY Range Trade Favoured

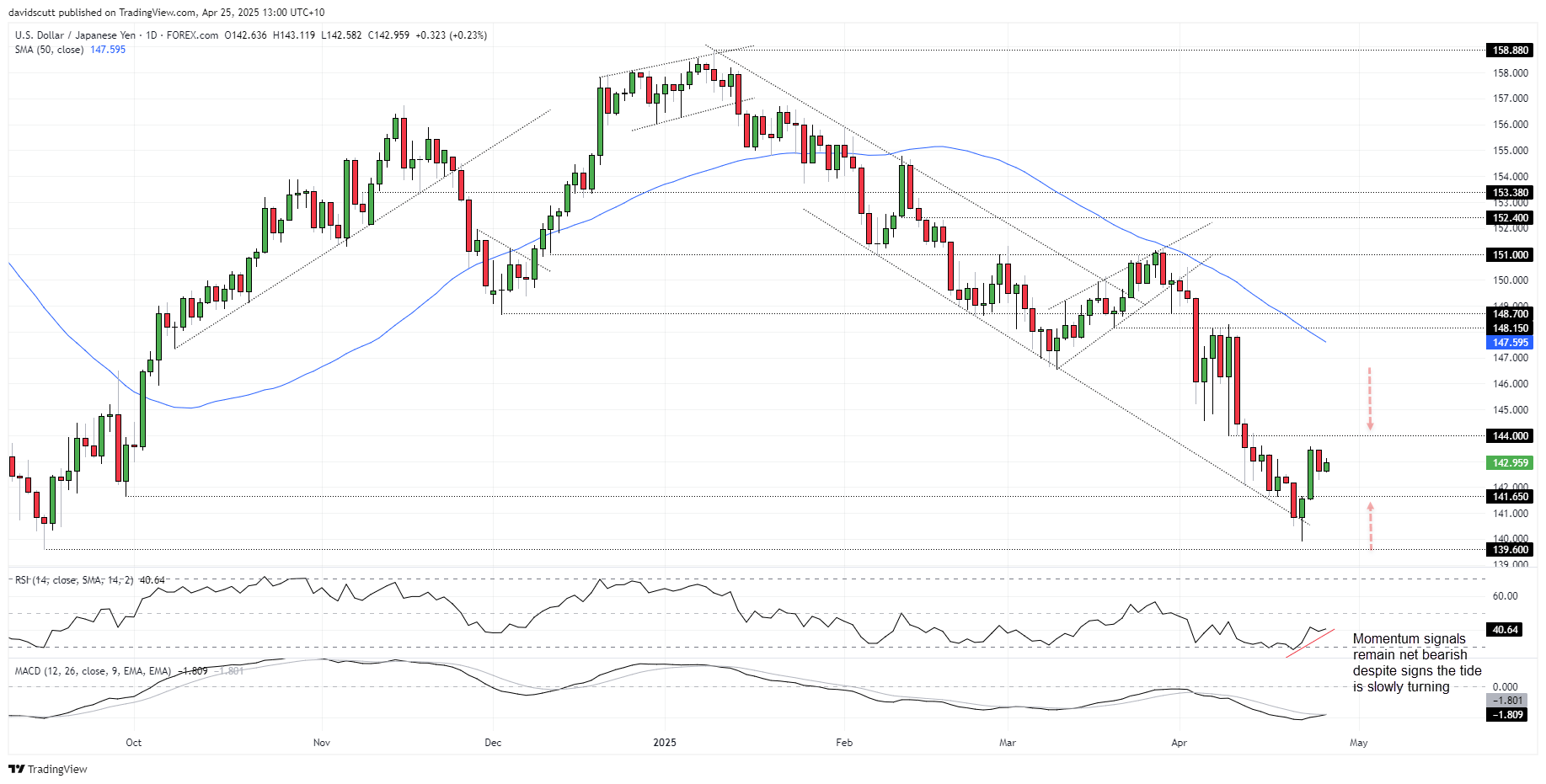

Source: TradingView

The rebound in USD/JPY this week comes across as corrective rather than the start of a longer bullish trend.

That view is backed by momentum indicators like RSI (14) and MACD, which remain in bearish territory despite evidence downside momentum is ebbing near-term. For now, range trading between 141.65 and 144.00 is favoured until we see a decisive break.

Zooming in further, offers have emerged recently on moves above 143.60, with bids noted on dips towards 142.60.

-- Written by David Scutt

Follow David on Twitter @scutty