A small rebound in bond yields, firmer risk appetite and profit-taking ahead of key central bank rate decisions have all helped to provide support for the USD/JPY and other yen crosses in recent days. But are we going to see renewed strength for the yen as we head towards the middle and latter parts of the week? With both the Bank of Japan and US Federal Reserve to make policy announcements, the USD/JPY forecast could take a new direction in the near-term outlook, as the pair tests a major resistance zone near the 150.00 hurdle.

Bank of Japan unlikely to hike rates at this meeting

The Bank of Japan will kick off the big central bank rate decisions on Wednesday, although it remains to be seen whether there will be any policy changes from the BoJ or indeed the other two major central banks – Federal Reserve and Bank of England. Still, if the BoJ turns out to be more hawkish than expected, then this could weigh on the dollar and undermine the USD/JPY.

Speculation has been rife about further tightening of policy in Japan, owing to strong wage growth and inflation.

Last week, major Japanese companies agreed to significant wage hikes for the third year running. They are aiming to help workers cope with high inflation and address labour shortages. With wages rising, this is not only expected to boost consumer spending but also further fuel inflationary pressures.

A recent Bloomberg survey of 52 economists suggested the next rate increase from the Bank of Japan is coming between June and September. But 13% of surveyed economists now think the next increase is on May 1, up from 4% in the last survey. So, this week’s meeting is all about potential guidance on future policy from the BoJ, with the central bank likely to keep rates unchanged at 0.5% for now.

Could Federal Reserve tilt towards a cut sooner than expected?

Once the BoJ is out of the way, the focus will turn to the US Federal Reserve. While significant policy shifts are highly unlikely, any dovish surprises from the Fed could cause the dollar to move. The Fed is widely expected to keep rates steady on Wednesday, leaving the Federal Funds Rate between 4.25% to 4.5%. Traders will dissect every line of the Fed’s policy statement, economic projections, and Powell’s press conference for clues. In particular, investors will watch chairman Jerome Powell's comments closely regarding the economic and inflation outlook amid Trump's trade tariff policies. Should Powell signal a tilt towards cuts sooner than expected, the dollar could weaken, undermining the USD/JPY.

US dollar index hovers near 5 month lows

The Fed’s meeting comes with the US dollar index hovering around a five-month low near 103.40 support. The greenback has fallen on concerns President Trump's higher tariffs could drag down growth in the US while driving up inflation.

With uncertainty lingering over Trump’s economic agenda and labour market policies, households appear increasingly inclined to pocket their cash rather than splash it. This was evidenced in the latest US retail sales data for February, which rose by just 0.2% month-over-month vs. 0.6% expected and last month’s print was revised lower to -1.2% m/m. However, it was not all bad news: the control group measure of retail sales was much stronger than expected at 1.0% vs. +0.3% eyed.

On top of retail sales, the Empire State Manufacturing Index also came in weaker on Monday with a print of -20.0 vs. -1.9 eyed. These data releases followed softer-than-expected CPI and PPI prints from last week, when we also had a disappointing University of Michigan consumer sentiment survey, which fell for the third consecutive month. But the UoM’s Inflation Expectations rose again sharply, jumping from last month’s 4.3% to a hefty 4.9% in March. The UoM data points to stagflation.

Technical USD/JPY forecast: Key levels to watch

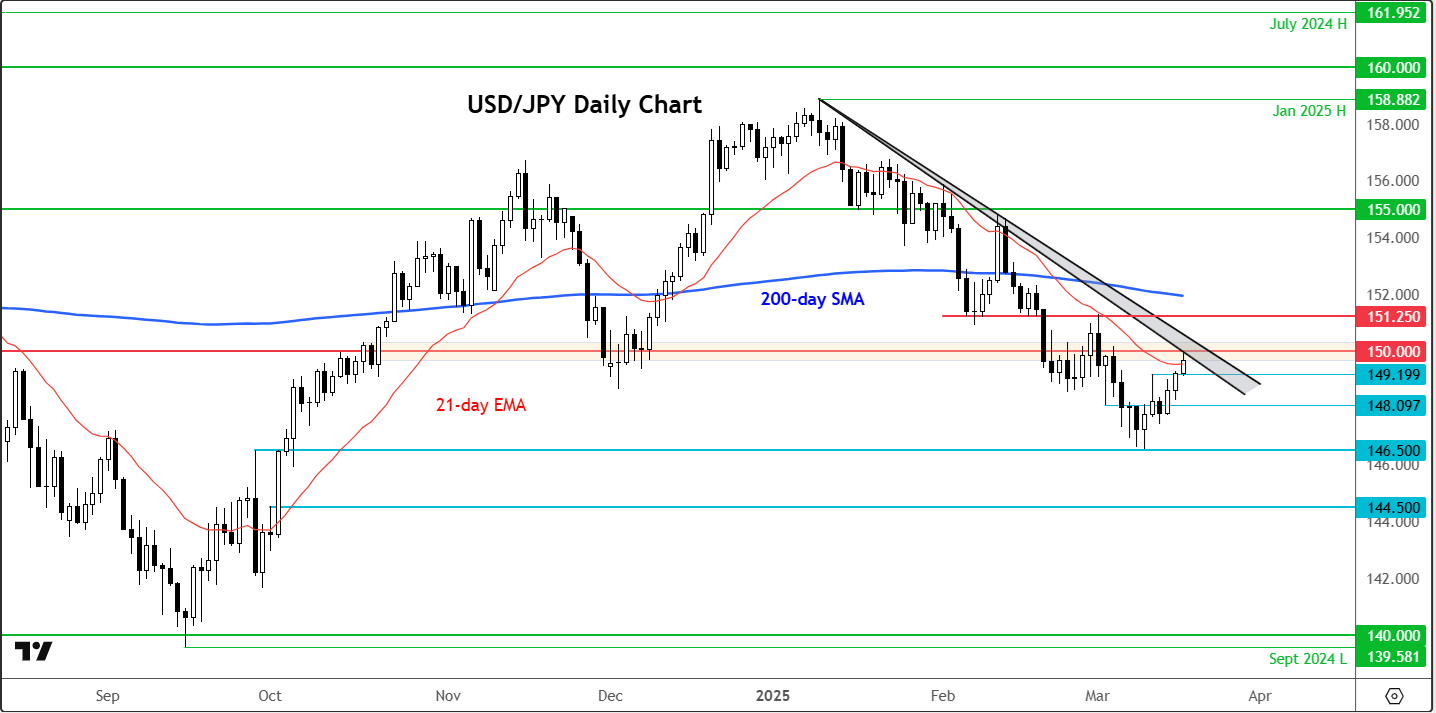

Source: TradingView.com

The USD/JPY was testing the lower bound of a major trend resistance around the 150.00 area at the time of writing. This area was also previously a key support zone that gave way last week. Now the UJ is testing this former support from underneath, we could see the pair resume lower soon. However, a clean break above 150.00 area would tip the balance back in bulls’ favour and erode the bearish USD/JPY forecast in the short-term outlook.

If the selling resumes around the abovementioned key resistance of 150.00, then we could see a pit stop at initial support at 149.20, then at 148.10, before the pair potential drops to test liquidity below last week’s low at 146.50 next. Then we have 145.00, the next big psychological level, followed by 144.50.

However, if the above-mentioned resistance in the 150.00 area gives way instead, then this could pave the way for a potential squeeze towards the 151.25 resistance, followed by the 200-day moving average at 152.00 next.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R