- USD/JPY correlations with rates and risk assets have broken down

- USD behaving more like a risk asset than a safe haven

- Moody’s downgrade highlights growing concerns over U.S. fiscal outlook

- Japan’s April CPI looms as key event risk this week

- Momentum signals turning, with downside levels back in focus

Summary

USD/JPY’s traditional drivers—rate differentials and risk appetite—have gone missing, with recent price action showing little correlation to bonds or equities. Instead, the pair is behaving more like a barometer of confidence in the U.S., just as Moody’s joins S&P and Fitch in downgrading its sovereign rating. With the dollar already being sold on strength, the move could reinforce doubts over its haven credentials. Japan’s inflation data and U.S. debt concerns loom large, with technicals offering key signposts as the macro environment gets murkier.

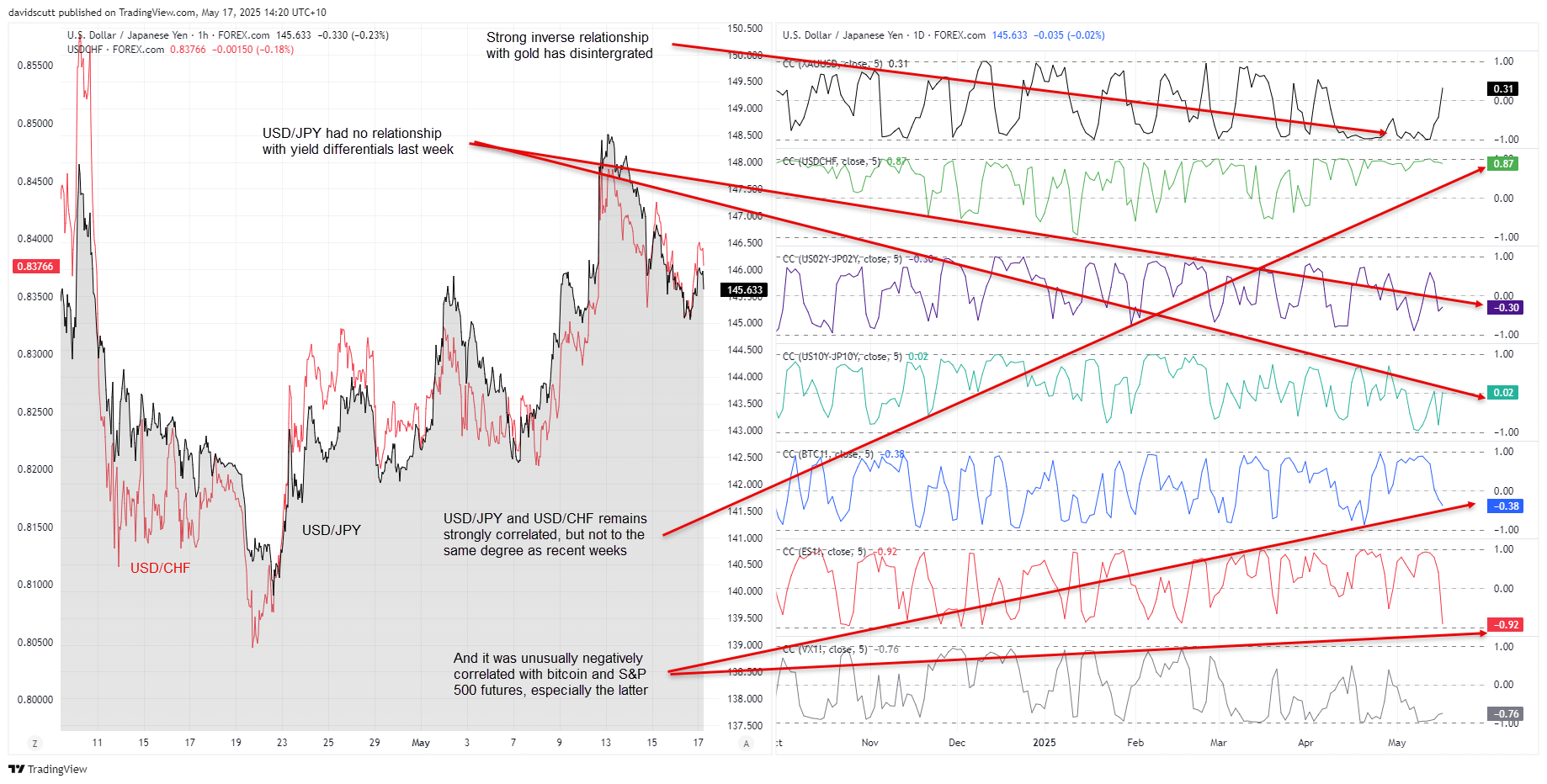

USD/JPY Correlations Break Down

USD/JPY is known for its historical relationship with interest rate differentials and risk appetite, but those drivers are nowhere to be seen at present. The correlation coefficient scores below underline that point, revealing no major relationship between USD/JPY with either short or longer-dated interest rate differentials between the United States and Japan, and unusual inverse correlation with riskier asset classes such as bitcoin and S&P 500 futures. Curiously, the ultra-tight relationship with gold has totally disappeared, while its relationship with the Swiss franc and VIX futures has also started to weaken.

Source: TradingView

The yen really is doing its own thing, with its broader movements generally in line with low beta G10 currencies like the euro and British pound. The USD/JPY comes across as a bit of a barometer of trust in the United States, be it towards the government, fiscal outlook, or foreign policy. Plenty have picked up on it, but the U.S. dollar is behaving more like a risk asset than the ultimate safe haven.

Moody’s Move May Pressure USD Further

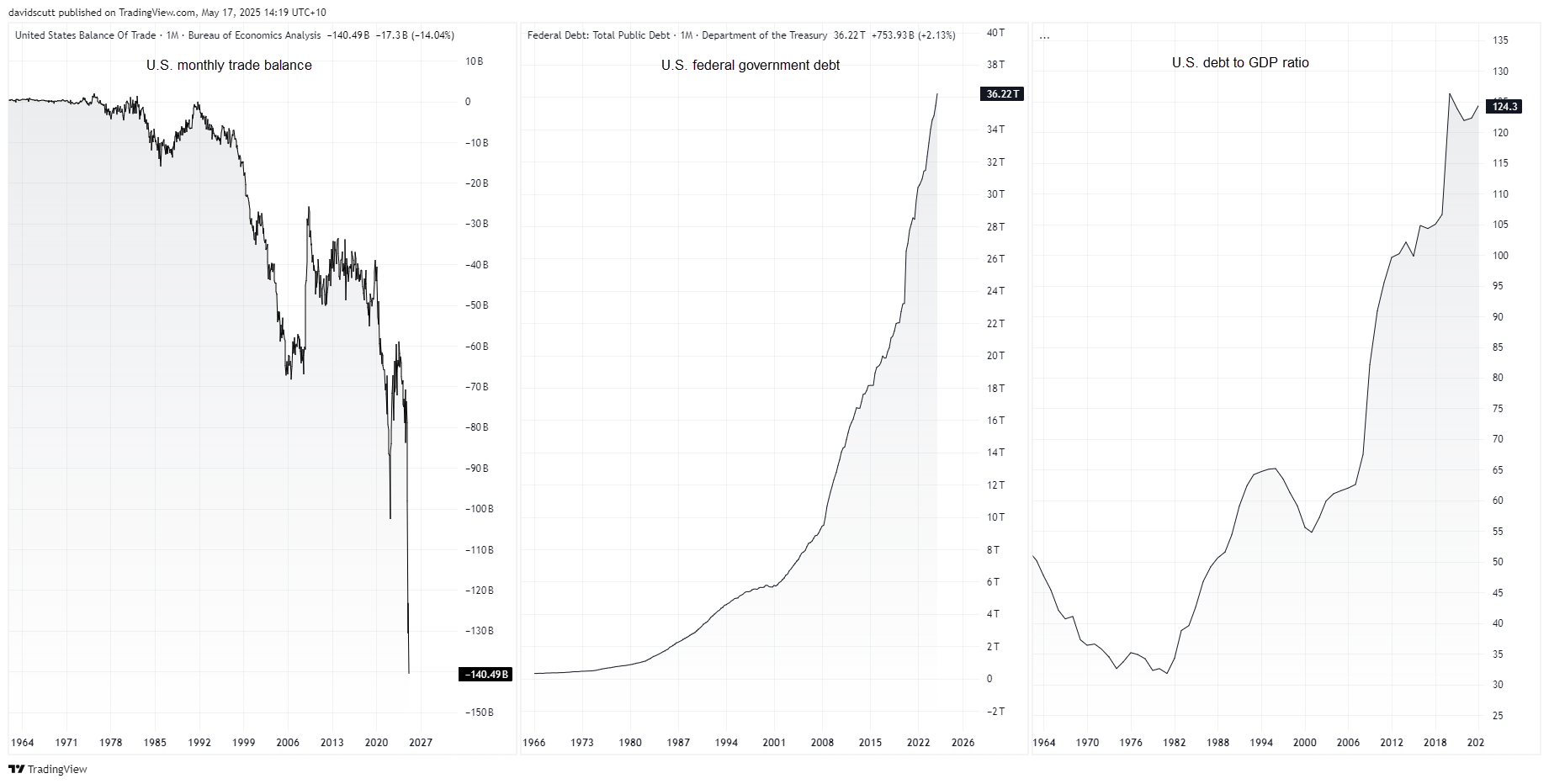

That point is important in the context of Moody’s decision to strip the United States government of its prized Aaa rating late Friday, reducing it to the second-highest rung of Aa1 with a stable outlook. The decision really comes as no surprise, especially as S&P and Fitch—the other two main ratings agencies—had already done the same in 2011 and 2023 respectively.

And to be frank, looking at trends in the U.S. trade balance, federal debt accumulation and the debt-to-GDP ratio, you could ask why the move didn’t arrive much sooner.

Source: TradingView

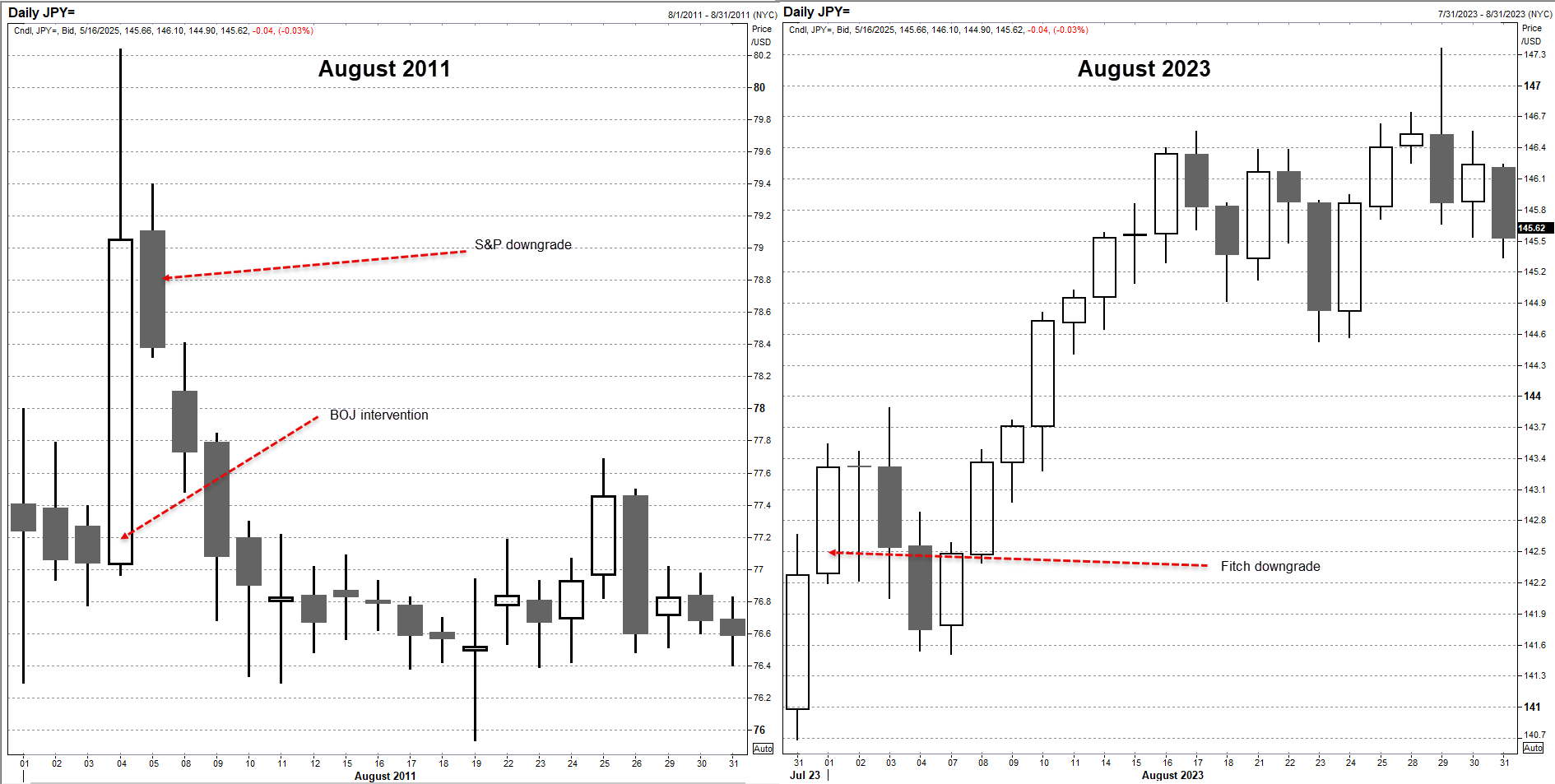

USD/JPY Performance During Past Downgrades

Naturally, traders often like to look to history for clues as to how markets may behave in response to the ratings cut, including when it comes to USD/JPY. To save you the time, the chart below reveals how the pair traded the last two times the U.S. rating was cut.

Source: Refinitiv

The information may only provide limited insight on what may greet us when we log on at the start of the week, and that’s probably being kind.

August 2011 was wild for those who weren’t trading at the time. The worst of the U.S. Great Recession may have been over, but the Euro debt crisis was just firing up, resulting in a mad scramble for anything resembling a haven. To give you a sense as to what it was like, the spike in USD/JPY the day before the S&P cut was the Bank of Japan intervening to counter rampant yen strength. While USD/JPY reversed the spike in the days following the S&P cut, it’s not definitive that was the catalyst behind the move.

Fast forward to 2023 when Fitch pulled the trigger and again we don’t receive an obvious message on what to expect. That period was characterised by rampant U.S. economic exceptionalism, higher U.S. yields, U.S. dollar strength and extreme monetary policy easing being conducted by the Bank of Japan. Rather than weaken on the Fitch decision, the dollar surged, looking straight through the downgrade like it was either expected or totally insignificant.

Some may say the same about the Moody’s call, and you can understand why they would dismiss it, but this environment is unusual for the U.S. dollar. It’s not being treated as a haven like it was in 2011 and 2023. Instead, what we’ve seen recently has been rallies in the dollar sold, not chased. The ratings cut from Moody’s may amplify those forces.

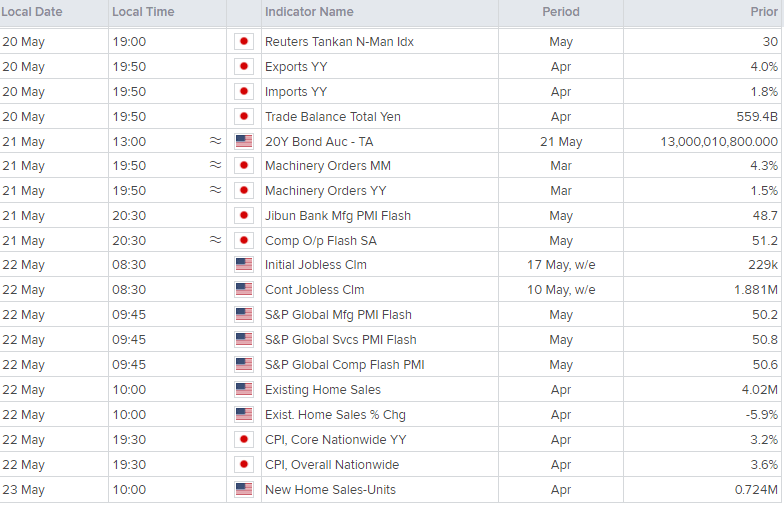

Quiet Calendar puts Focus on Debt, Trade Deals

It’s lucky Moody’s made its ratings announcement, as otherwise there would be very little else to cover this week from a fundamental perspective. The U.S. economic calendar is devoid of major economic data, with only second-tier releases like jobless claims and housing sales to navigate. Soft survey data should be treated as insignificant and largely irrelevant in the current environment.

Source: Refinitiv

If anything, Japan’s April inflation report is arguably the most important known data event, especially with pricing for another Bank of Japan hike this year starting to build again. The ex-fresh food measure is seen accelerating to an annual rate of 3.4%, up from 3.2% in March and well above the BOJ’s 2% target. The ex-fresh food and energy measure last printed at 2.9% in March. They are the ones to watch as they’re the ones the BoJ cares about.

Source: Refinitiv

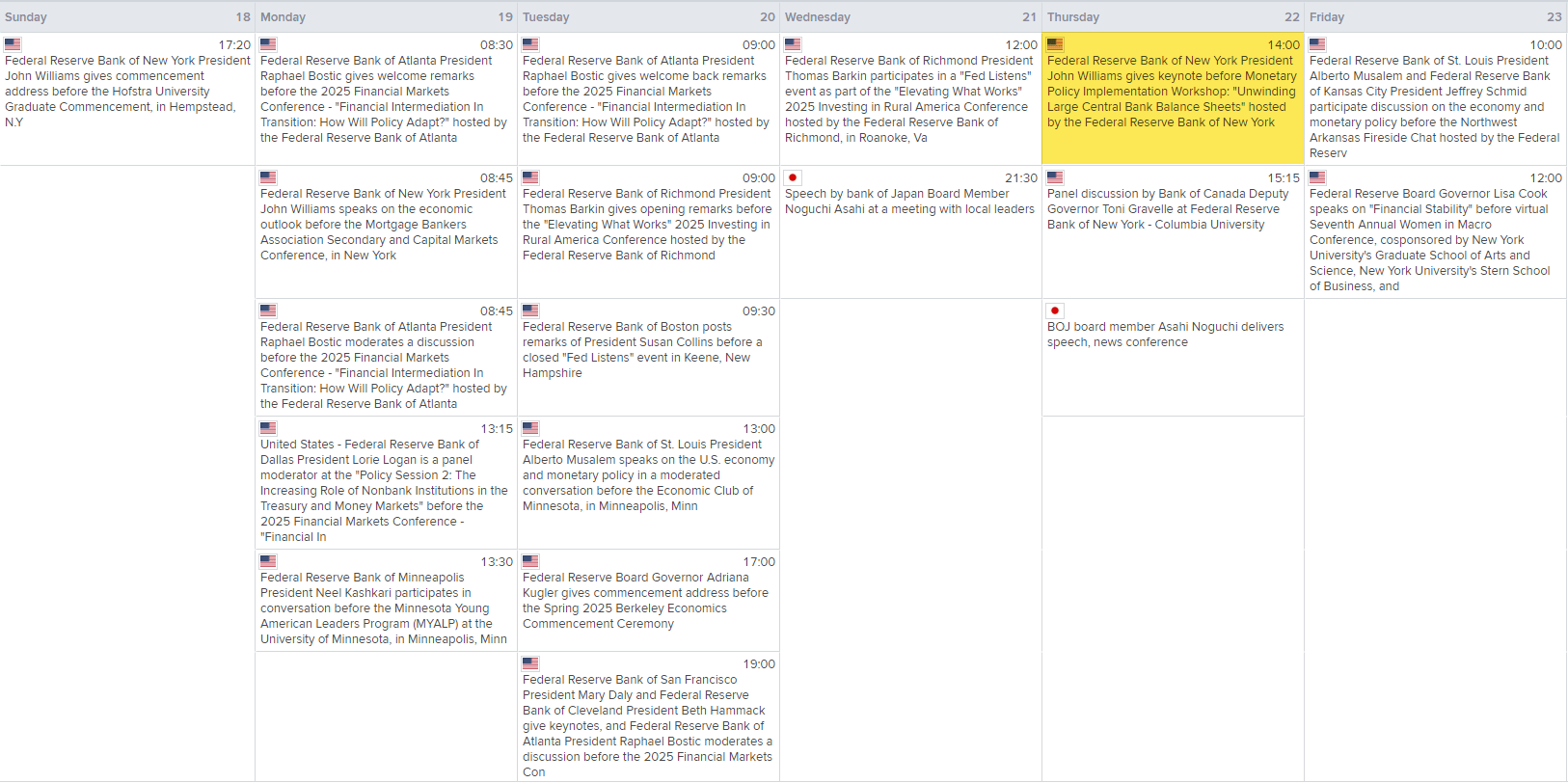

There may be more interest in the central bank speakers’ calendar, especially New York Fed President John Williams’ speech on Thursday about ‘unwinding large central bank balance sheets’—a very relevant topic considering focus on the U.S. debt will receive ample airtime this week.

Outside of known events, commentary and sentiment towards trade agreements remains relevant for USD/JPY traders, although the impact of good news may start to lessen given a lot has already been priced in. The key U.S negotiations to monitor remain China and the European Union—the remainder are small fry in comparison.

USD/JPY Risks Skew Lower

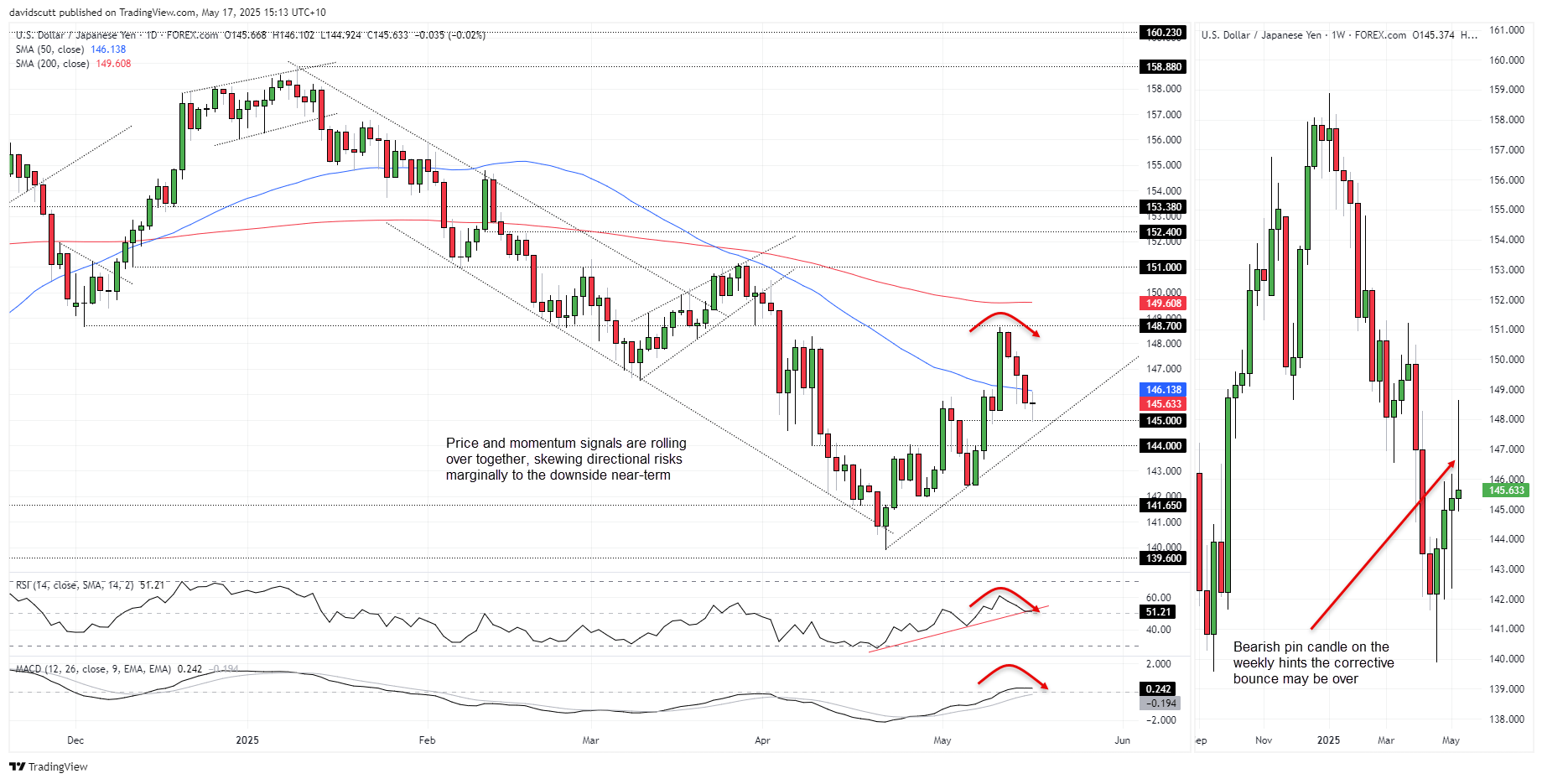

In an environment of heightened uncertainty, USD/JPY is thankfully remaining respectful of known technical levels, providing something to work with when assessing potential setups.

Source: TradingView

Before looking at the daily timeframe, the last candle on the weekly chart on the right could be described as a bearish pin, with the price reversing hard after running into sellers at 148.70. The candle hints that medium-term directional risks may be skewing lower following the corrective bounce from the April lows.

Zooming in to the daily timeframe on the left, you can see the pair has bounced from 145.00 on several occasions, including Friday. That’s the immediate focus should we see USD/JPY open offered on Monday, with the April 22 uptrend, 144.00 and 141.65 other levels of note before the April low. On the topside, sellers may be encountered at the 50DMA. A push above that level would put a retest of 148.70 in play, if it were to occur.

The momentum picture remains neutral but the uptrends in RSI (14) and MACD from deeply negative levels struck in April have stalled, hinting bearish presume may be starting to build again.

-- Written by David Scutt

Follow David on Twitter @scutty