It looks like FX investors are in no rush to chase anything, although they have shown preference for higher-yielding currencies of late again thanks to a firmer risk appetite across the financial markets. Although some of the major European indices fell and US futures traded mixed, risk appetite remained mildly positive in the first half of Tuesday’s session with the likes of crude oil, silver and FTSE 100 all gaining ground. That helped to keep the USD/JPY in a tight range near this week’s highs, albeit flat on the session. Unless we now see some significantly weak US inflation data or another flare up in the trade war, the USD/JPY forecast could improve a little. Investors may warm towards the US dollar again should trade uncertainty eases further. But if the bearish scenario plays out, the key support around 142.00-142.50 needs to give way this time before we turn bearish on the USD/JPY again.

USD/JPY has firmed up in recent days

Although flat-ish today, the USD/JPY forecast as turned a little more bullish in recent sessions, as improving risk appetite helped the currency pair hold key technical support around the 142.00 level. This region was tested multiple times last week, but optimism surrounding a potential US-China trade deal kept market sentiment buoyant, providing support for the dollar and pressuring the safe-haven yen.

With global equities on the rise and risk sentiment firming, further weakness in the Japanese yen is a possibility. This could pave the way for renewed strength in USD/JPY, especially if the dollar also regains ground against other major currencies such as the pound and the euro—both of which had benefited during periods of heightened trade uncertainty.

That said, upcoming US economic data could also play a crucial role in shaping the USD/JPY forecast in the short term.

Key US data to watch: CPI and Consumer Sentiment

After a volatile, data-heavy stretch last week, the macroeconomic calendar is relatively lighter this week. However, two important US economic indicators—Consumer Price Index (CPI) on Wednesday and University of Michigan (UoM) Consumer Sentiment on Friday—could influence the USD/JPY outlook.

Last month, US CPI surprised slightly to the downside, coming in at 2.3% versus expectations of 2.4%. Other economic data have also been on the softer side, increasing pressure on the Federal Reserve to consider rate cuts. Nevertheless, easing concerns over trade tensions—thanks to the resumption of US-China negotiations—have helped lift the greenback, shifting the USD/JPY forecast to a more constructive stance.

The UoM Consumer Sentiment index will close out the week on Friday, June 13. With US stock markets rebounding in recent weeks and trade war fears subsiding, analysts are watching closely to see if this optimism is reflected in consumer confidence. The previous reading showed only a modest improvement, but further gains could bolster the dollar and lend additional support to USD/JPY.

Should these data points surprise to the upside, they may provide the fuel needed for the dollar to break higher, reinforcing the current bullish trend in the USD/JPY forecast. However, if we see surprisingly weak numbers then this could trigger another bout of selling in the dollar, even if ultimately this proves to be short-lived.

Technical USD/JPY forecast: Key levels to watch

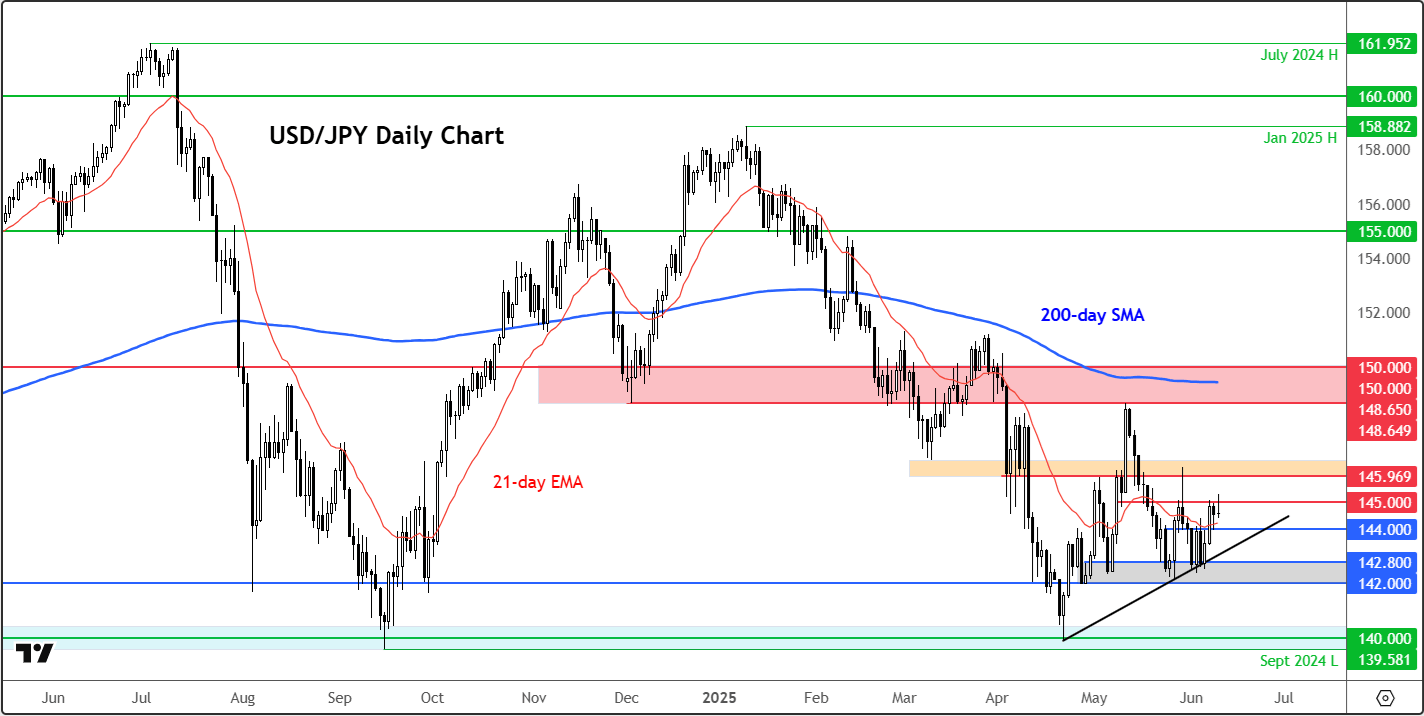

Source: TradingView.com

It may not feel like it but over the past 7 weeks, the USD/JPY weekly chart (not shown) has closed down only on one occasion. Those gains have, admittedly, been modest and were almost wiped out a couple of weeks ago when rates threatened to break that 142.00 handle. But the bulls prevailed, and the USD/JPY eked out some gains instead. However, it has struggled each time it has attempted to break north of the 145.00 handle. And that is where we are at again today. With a lack of any major news today, we might have to wait a little longer – perhaps until Wednesday’s release of US CPI – before the USD/JPY makes its next move.

All told however, the technical USD/JPY forecast doesn’t appear as bearish as it did a few weeks ago, and looking at a few other yen crosses, it looks like investors are using the yen as a carry currency once again. There’s clear preference for currencies where interest rates are higher – including in the US dollar, but more so the ComDolls and pound – although the latter took a hit today following some weaker wages data out of the UK.

Anyway, the next key resistance on the USD/JPY above 145.00 comes in at around 146.00, and above that there is nothing significant until 148.00. On the downside, below 144.00 support, 142.80 is the next focus, followed by 142.00.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R