- USD/JPY and USD/CHF break uptrend support from April lows

- Momentum indicators favour further downside as MACD and RSI shift bearish

- Sell-on-rallies bias reinforced by 50DMA downtrend in USD/CHF

The U.S. dollar is on the nose again in Asia, with USD/JPY and USD/CHF breaking uptrends established from the April lows. With geopolitical tensions flaring in the Middle East and risk assets struggling to extend recent gains, the environment looks ripe for further downside.

USD/JPY: Bearish Trend Resuming?

Source: TradingView

Downside risks for USD/JPY flagged last weekend following Moody’s downgrade of the U.S. sovereign rating on Friday have materialised, resulting in the pair breaking the uptrend it had been trading in from the lows set on April 22. The unwind has since extended in Asian trade on Wednesday, with the pair breaking beneath horizontal support at 144.00.

Should the break stick, shorts could be established below 144.00 with a stop above for protection. 142.40 looms as an initial target, coinciding with where the pair bounced from earlier this month. Below, 142 and 141.65 screen as other potential targets.

Momentum indicators are shifting bearish, with RSI (14) trending lower while MACD is about to cross the signal line below zero, bolstering the signal. That favours selling rallies and downside breaks—something to keep in mind if we see pops towards 144 or the former uptrend.

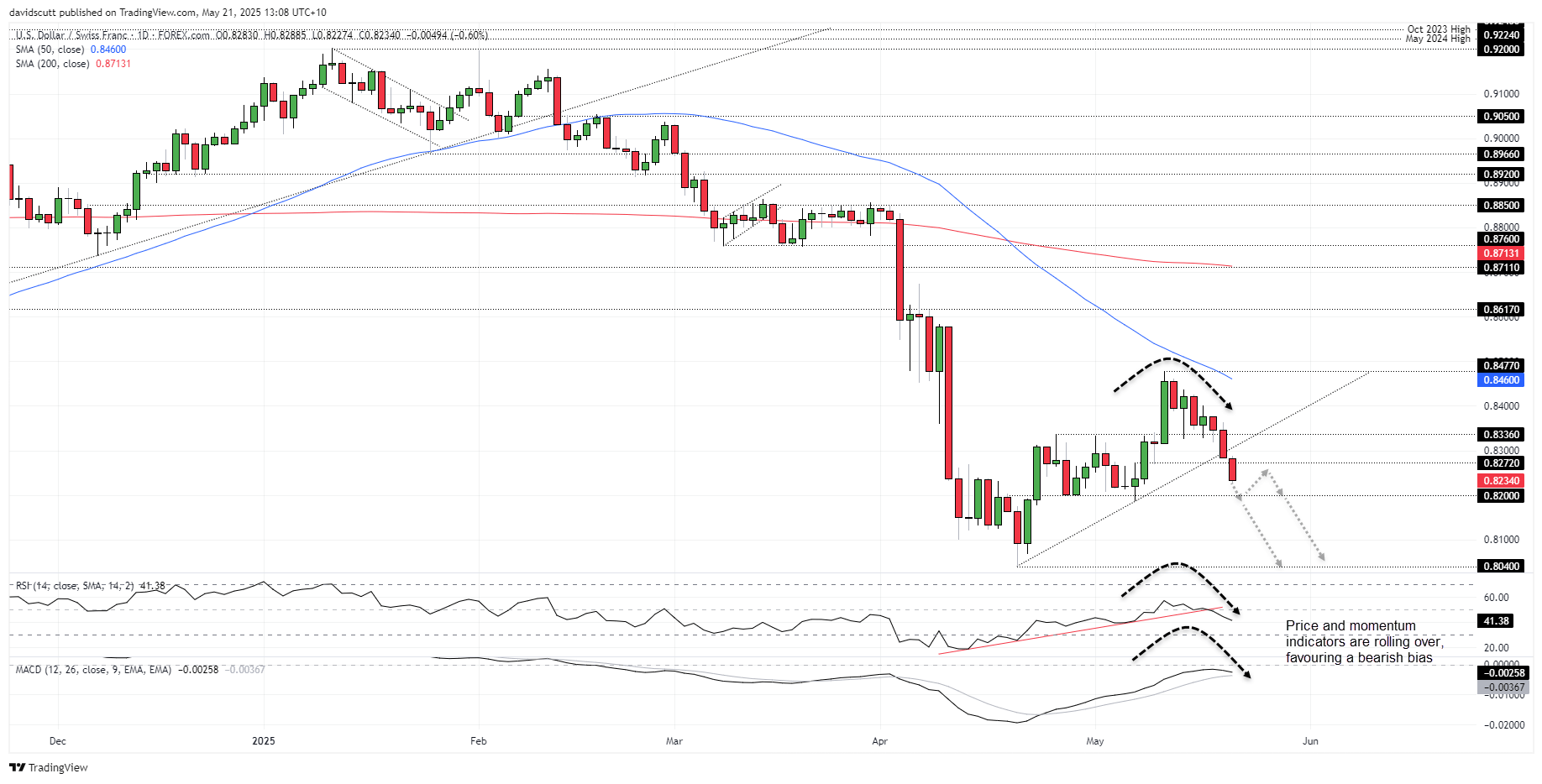

USD/CHF: April Lows Loom

Source: TradingView

The picture for USD/CHF is similar with the price breaking the uptrend it was trading in from the lows set in April. Having done away with minor support at .8272 on Wednesday, bears will now be eyeing a retest of support at .8200. A break there would open the door for a run towards the April swing low of .8040.

RSI (14) is shifting lower but not yet oversold, while MACD is on the cusp of crossing the signal line below zero. The overall momentum picture is therefore skewing bearish, favouring downside over upside. With the 50DMA trending lower, the Swissie remains an obvious sell-on-rallies play.

-- Written by David Scutt

Follow David on Twitter @scutty