Key Events

- Canadian election polls lean toward a Liberal victory

- DXY holds a tentative bullish setup ahead of key U.S. economic indicators

- U.S.-China tariff negotiations keep markets flat at critical levels

Canadian Election Updates: Liberals Leading as of April 27, 2025

Source: CBC Polls

Snap Canadian elections have gained attention amid Trump’s territorial and tariff threats against Canada, with the Liberals leading in a tight race against the Conservatives. The Liberals are promoting an agenda of retaliatory tariffs, while the Conservatives are advocating for mutual tariff removal.

The likelihood of a Liberal victory appears largely priced into the markets at this stage. Conversely, a Conservative win could introduce higher volatility, deviating from market expectations. Several factors, including leading U.S. economic growth indicators, may influence the prevailing trend in the USD/CAD pair this week.

Macro Events for the Week Ahead

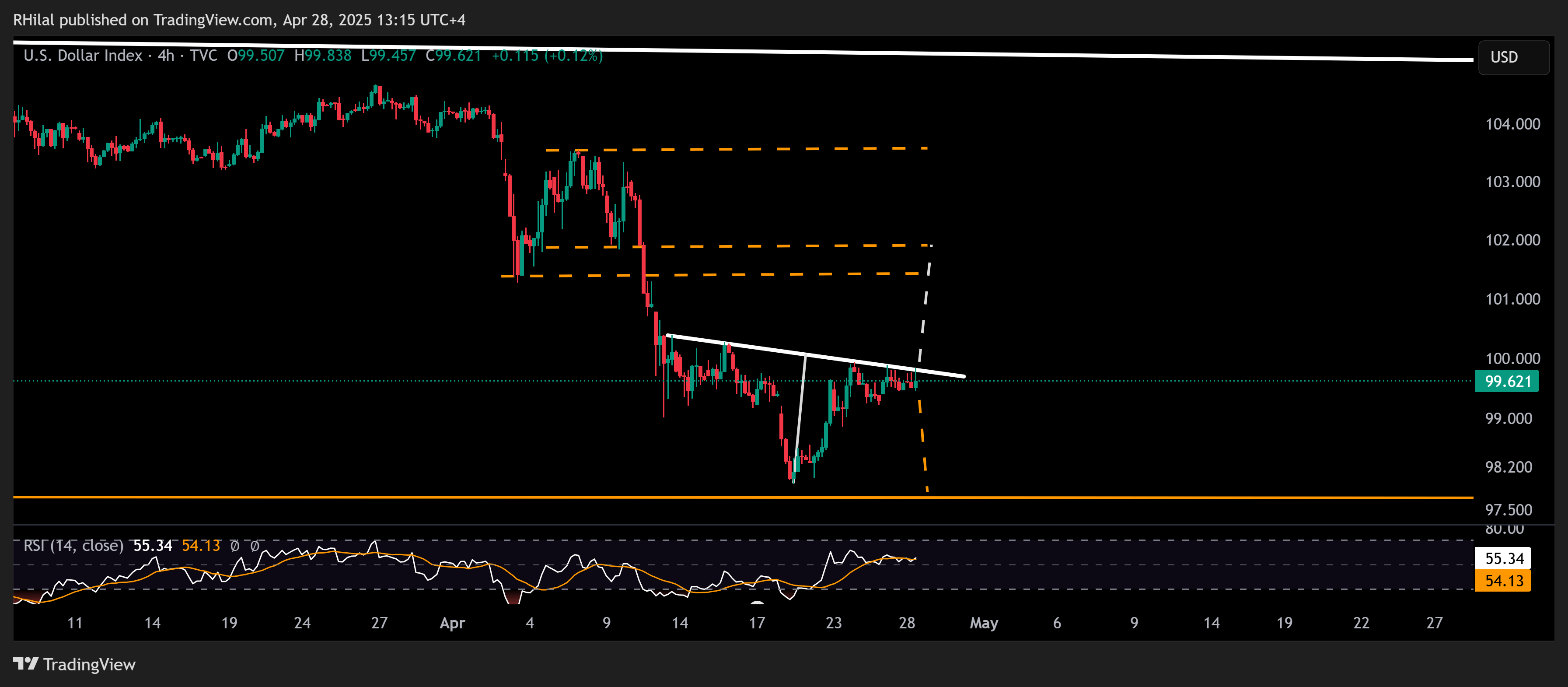

DXY Outlook: 4 Hour Time Frame – Log Scale

Source: Tradingview

The DXY is currently balancing a bullish setup amid trade negotiations, election developments, and anticipation of key leading U.S. economic indicators this week. An inverted head-and-shoulders formation is visible on the 4-hour time frame.

A decisive catalyst and a breakout above the 100.00 and 100.30 levels are needed to confirm a more sustained bullish bounce from multi-year lows. While the longer-term (monthly) chart remains biased to the downside, shorter-term time frames suggest a potential reversal.

As a result, broader markets are consolidating below key levels: EUR/USD under 1.1500, GBP/USD under 1.3400, USD/CAD above 1.3800, and gold below $3,500.

The sustainability of these technical patterns will largely depend on upcoming economic reports, including Wednesday's ADP Employment Report, Advance GDP, and Core PCE indicators — all critical for early assessments of tariff impacts.

Additionally, the ISM Manufacturing PMI on Thursday and the Non-Farm Payrolls report on Friday could inject broader volatility into the markets, assuming tariff negotiations remain unresolved.

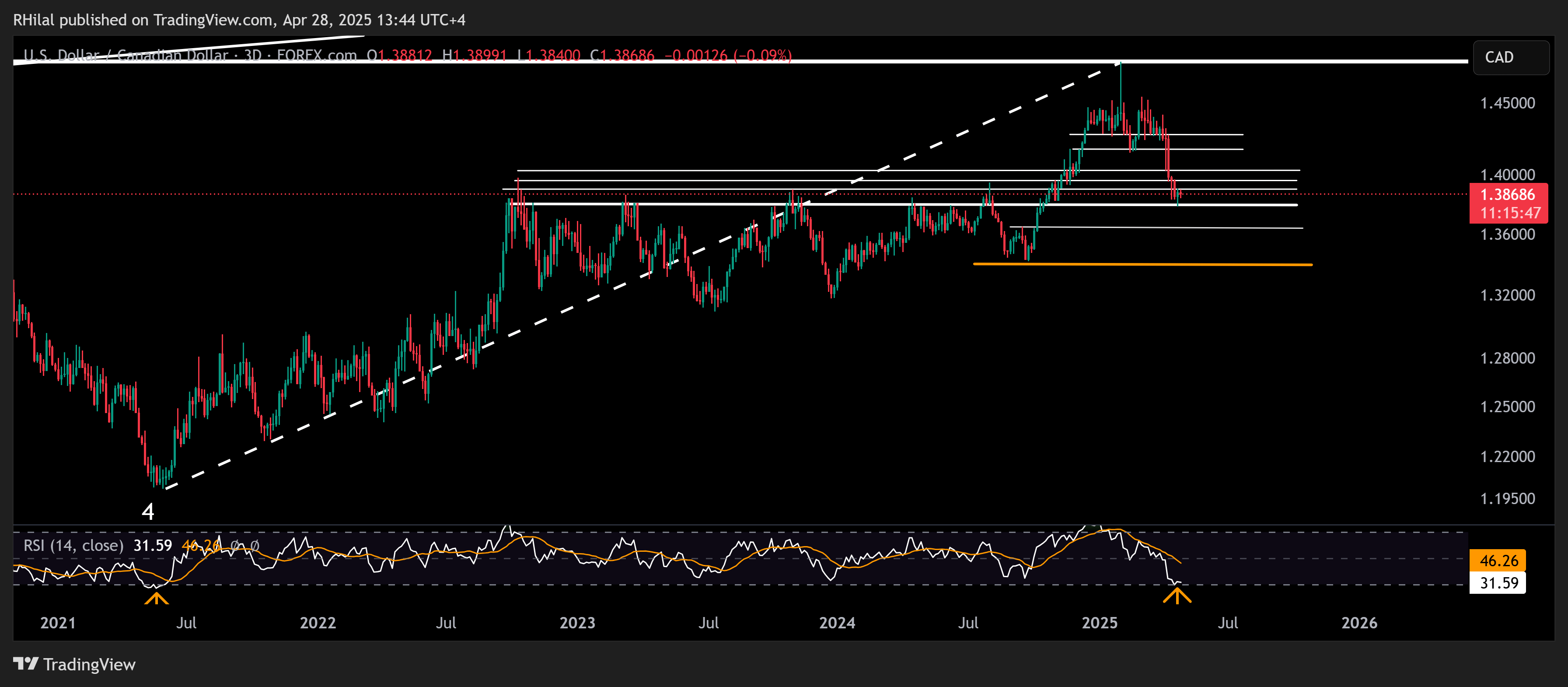

USDCAD Outlook: 3-Day Outlook – Log Scale

Source: Tradingview

The USD/CAD pair is currently holding above a major multi-year resistance-turned-support zone at the 1.3800 level, rebounding from oversold momentum levels not seen since 2021. If a short-term bullish outlook for DXY materializes, a sustained move above 1.3900 could extend gains toward 1.3960, 1.4040, and 1.4170, respectively. On the downside, the 1.3780 support level remains pivotal; a breach could trigger further declines toward 1.3640 and 1.3400.

Written by Razan Hilal, CMT

Follow on X: Rh_waves