Over the past two trading sessions, the USD/CAD pair has posted a slight gain of 0.5% in favor of the U.S. dollar, although the overall bias remains bearish due to the greenback’s continued weakness in recent weeks. For now, the market remains cautious, as the election of Canada’s next Prime Minister approaches.

What to Expect from the Elections?

Early voting has already begun in Canada, with a record 7.3 million voters participating over the four-day advance polling period. This suggests a high turnout in the April 28 election.

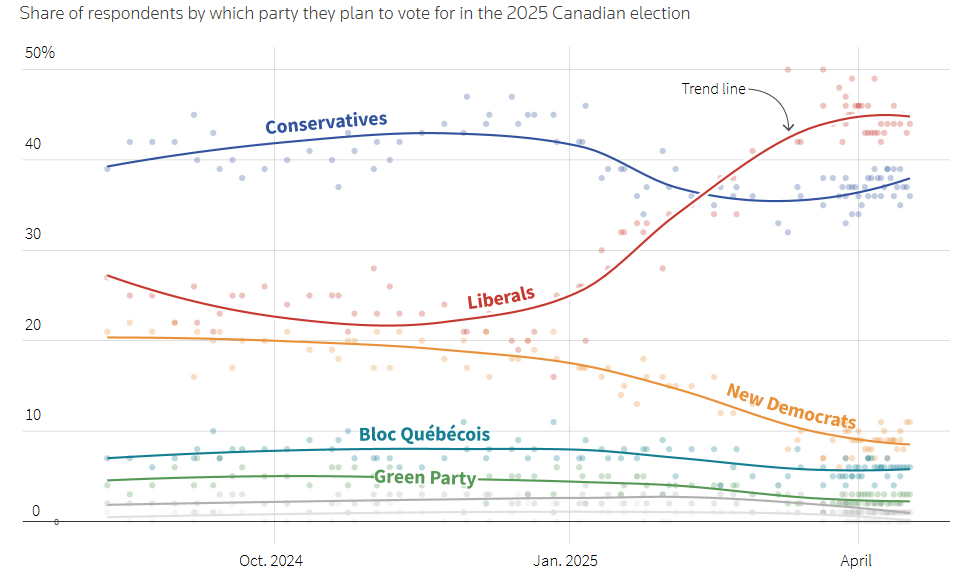

In recent weeks, the Liberal Party has gained ground over the Conservative Party, currently polling above 40%, while the opposition remains below that level. This trend has held steady just days before the election.

Source: Reuters

The leading candidate, Mark Carney, has enhanced his reputation thanks to his leadership during the 2008 financial crisis as Governor of the Bank of Canada, as well as his role managing economic uncertainty during the Brexit period. The market sees a potential victory for Carney as supportive of the Canadian dollar, given his technical profile and crisis-management experience, which may lead to concrete proposals to address the ongoing trade dispute with the United States.

It’s important to note that Canada still faces a 25% tariff on exports to the U.S. However, recent White House statements suggesting potential tariff relief have opened a window of negotiation optimism. Regardless of the election outcome, it will be crucial for the next prime minister to maintain a collaborative dialogue with the U.S. to avoid additional tariffs that could harm the Canadian dollar.

That said, monitoring tariff developments will remain essential, as the loonie has shown high sensitivity to this issue in recent months. If the election results bring no major surprises and trade policy stays favorable for now, this could continue to support the recent downward pressure on USD/CAD.

The Role of Central Banks

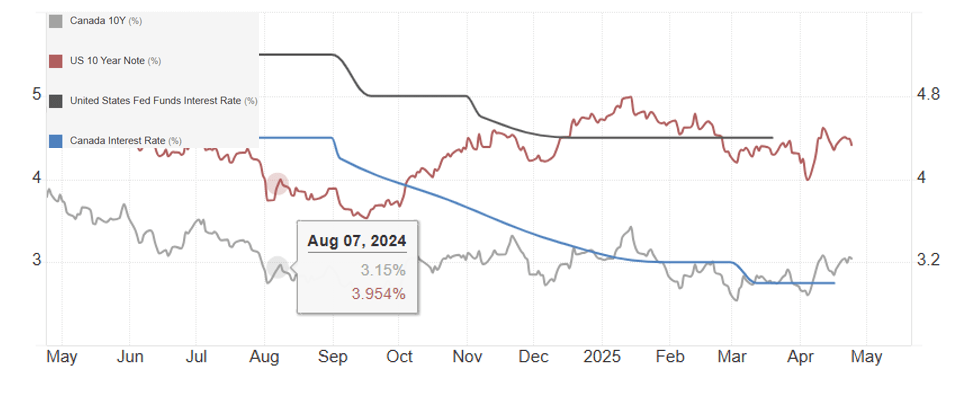

In terms of monetary policy, the contrast in interest rates between the two countries stands out. The Federal Reserve currently holds its benchmark rate at 4.5%, while the Bank of Canada maintains its rate at 2.75%.

Source: Trading Economics

This disparity has significantly influenced 10-year bond yields. Currently, U.S. Treasury bonds yield 4.3%, compared to 3.2% for Canadian bonds. This gap has remained steady, reflecting the Fed’s stable policy stance, while the Bank of Canada has started a rate-cutting cycle.

In the long term, this yield differential may impact the relative strength of both currencies. Although USD/CAD has recently been affected by trade tensions, investor preference for higher-yielding and safer U.S. assets could eventually revive demand for the dollar, putting upward pressure on the pair if Canadian securities become less attractive.

USD/CAD Technical Outlook

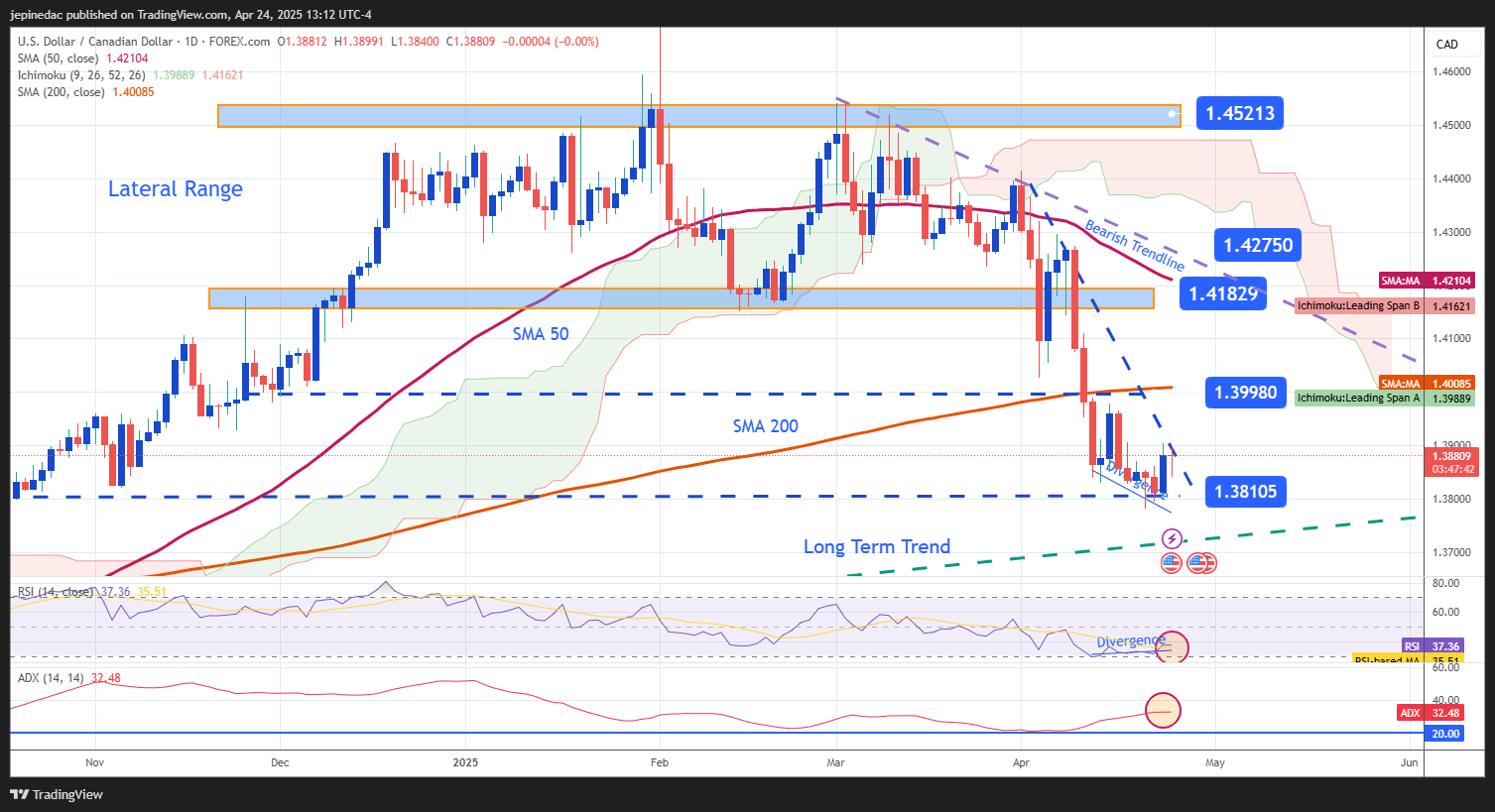

Source: StoneX, Tradingview

- Bearish Trend Remains Intact: Since early March, the pair has followed a clear downward trend, which has become more pronounced in recent sessions. While the loonie’s recent strength could spark short-term bullish corrections, there are no clear signs yet of a trend reversal, and the bearish structure remains dominant on the daily chart.

- ADX: The ADX line remains above the neutral 20 level, though it has begun to flatten, suggesting possible exhaustion in the current selling pressure and a transition into a neutral phase.

- RSI: The RSI is hovering near the 30 level, signaling oversold conditions. Moreover, a bullish divergence has formed, with lower lows in price and higher lows in the RSI, pointing to a potential imbalance in bearish momentum due to the sharp recent decline. This could open the door for a technical rebound in the short term.

Key Levels:

- 1.38105 – Key Support: This level aligns with the pair’s recent lows. A break below this support could reinforce the bearish trend and lead USD/CAD to new multi-month lows, further strengthening short-term selling momentum.

- 1.39980 – Near Resistance: A technical level aligned with the 200-period simple moving average, which may serve as a key barrier against short-term bullish corrections.

- 1.41829 – Major Resistance: A previous consolidation zone and long-standing technical ceiling. A return to this level would challenge the current bearish structure and may open space for a potential bullish trend driven by renewed U.S. dollar strength.

Written by Julian Pineda, CFA – Market Analyst

Follow him on: @julianpineda25