Key Events

- DXY tests 99.30 support, USD/CAD approaches 1.38 key level

- Silver climbs back above 33, Gold above 3,300, fueled by haven and tech momentum

- Trump policies unsettle markets, latest shock: Harvard international student ban

Markets have shifted back to risk-off mode as optimism from trade headlines fades and broader concerns about U.S. fiscal policy and Trump’s political agenda dominate. The latest disruptions—including the proposed international student ban from Harvard—are eroding the recently revived risk appetite that followed tariff pauses and trade progress.

In market terms, the U.S. dollar has returned to critical lows, pushing major currency pairs closer to their 2025 extremes. While indices are in a pull back mode, only the Nasdaq is maintaining its bullish hold, supported by tech sector resilience.

Meanwhile, precious metals are back in focus, with silver above $33 and gold above $3,300, signaling renewed haven demand.

What are the key levels to watch?

USDCAD Outlook: Weekly Time Frame – Log Scale

Source: Tradingview

In line with broad DXY weakness, USD/CAD is testing the critical 1.3800 support. A confirmed break below this level could trigger further downside toward 1.3750, 1.3600, and—if momentum builds—1.3400.

This would likely align with a continued decline in the DXY toward the 96.00 and 92.00 zones. On the upside, if 2025 support levels hold, a recovery above 1.3930 and 1.4020 could send USD/CAD back toward resistance at 1.4080, 1.4160, and potentially 1.4280.

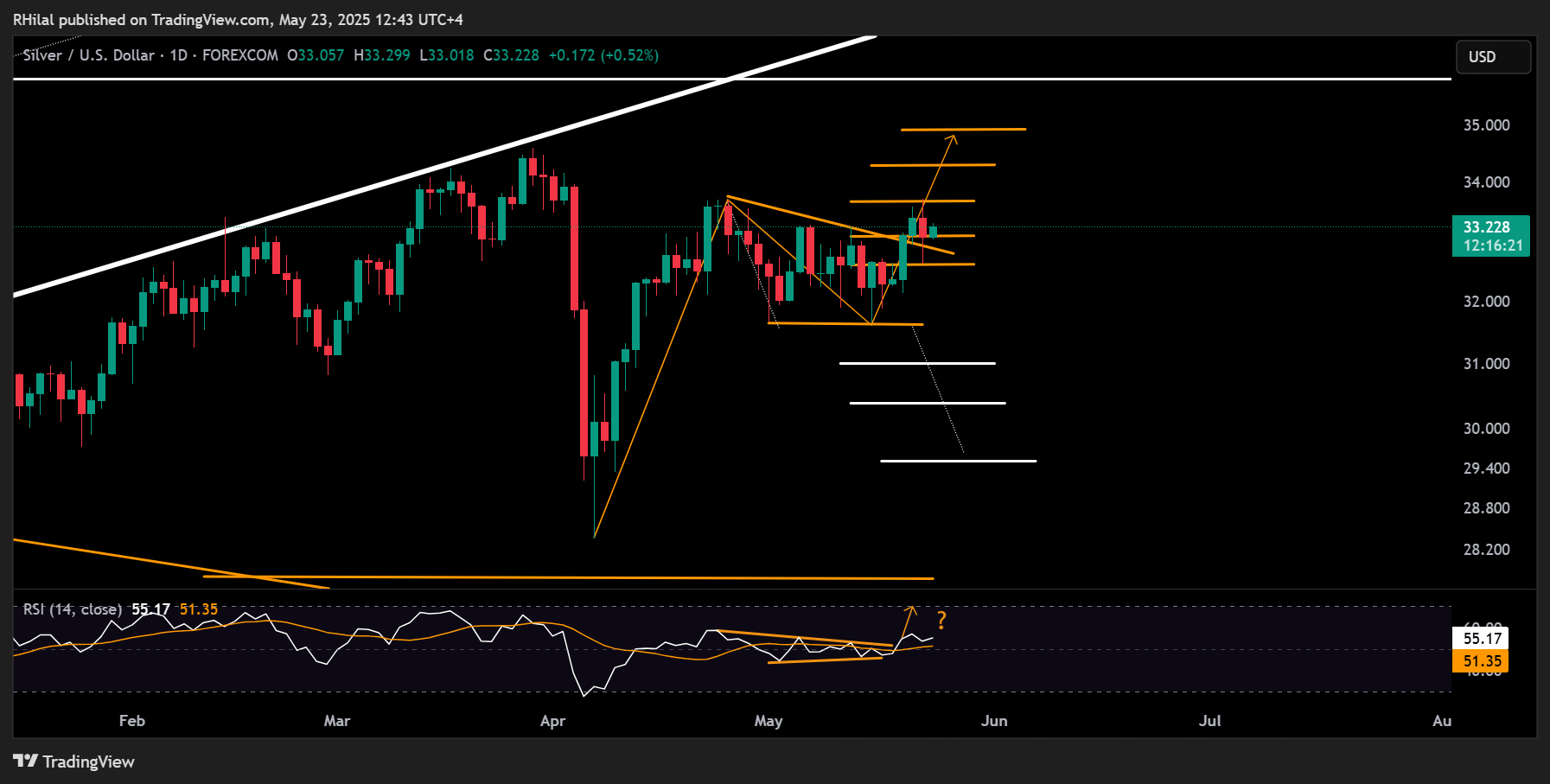

Silver Outlook: Daily Time Frame – Log Scale

Source: Tradingview

Supported by dollar weakness, economic uncertainty, and tech-sector resilience, silver has broken out of a one-month consolidation pattern, now holding above the 32.60–33.00 support zone.

A sustained move above 33.70 would confirm bullish continuation toward 34.30 and 35.00, with a broader target of 37.50 based on the pattern’s projection. However, if silver drops back below 32.60, the breakout may fail, exposing the metal to a retracement toward 31.60, 31.00, and 30.30.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves