Swiss Franc Outlook: USD/CHF

USD/CHF extends the rebound from the monthly low (0.8056) as the Federal Reserve appears to be in no rush to implement lower interest rates, and the exchange rate may face increased volatility as the Swiss National Bank (SNB) is expected to deliver another 25bp rate-cut.

USD/CHF Recovery Persists Ahead of SNB Rate Decision

Keep in mind, USD/CHF bounced back ahead of the April low (0.8040) to carve a series of higher highs and lows, and the exchange rate may threaten the negative slope in the 50-Day SMA (0.8239) as it trades to a fresh weekly high (0.8190).

Meanwhile, it seems as though the Federal Open Market Committee (FOMC) will stick to the sidelines as Chairman Jerome Powell insists that ‘we are well-positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance,’ and the Fed may keep US interest rates higher for longer as the central bank pledges to ‘make sure that a one-time increase in inflation doesn't turn into an inflation problem.’

Switzerland Economic Calendar

In turn, USD/CHF may further retrace the decline from the monthly high (0.8250) amid fading expectations for an imminent Fed rate-cut, and the SNB meeting may also sway the exchange rate as the central bank is expected to lower its benchmark interest rate to zero.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

A reduction in the policy rate along with a dovish forward guidance may produce headwinds for the Swiss Franc as Governor Martin Schlegel and Co. open the door for a negative interest rate policy (NIRP), but a hawkish SNB rate-cut may curb the recovery in USD/CHF as the central bank appears to be at or nearing the end of its easing cycle.

With that said, USD/CHF may continue to track negative slope in the 50-Day SMA (0.8239) as long as it holds below the moving average, but the exchange rate may stage a larger recovery as it extends the recent series of higher highs and lows.

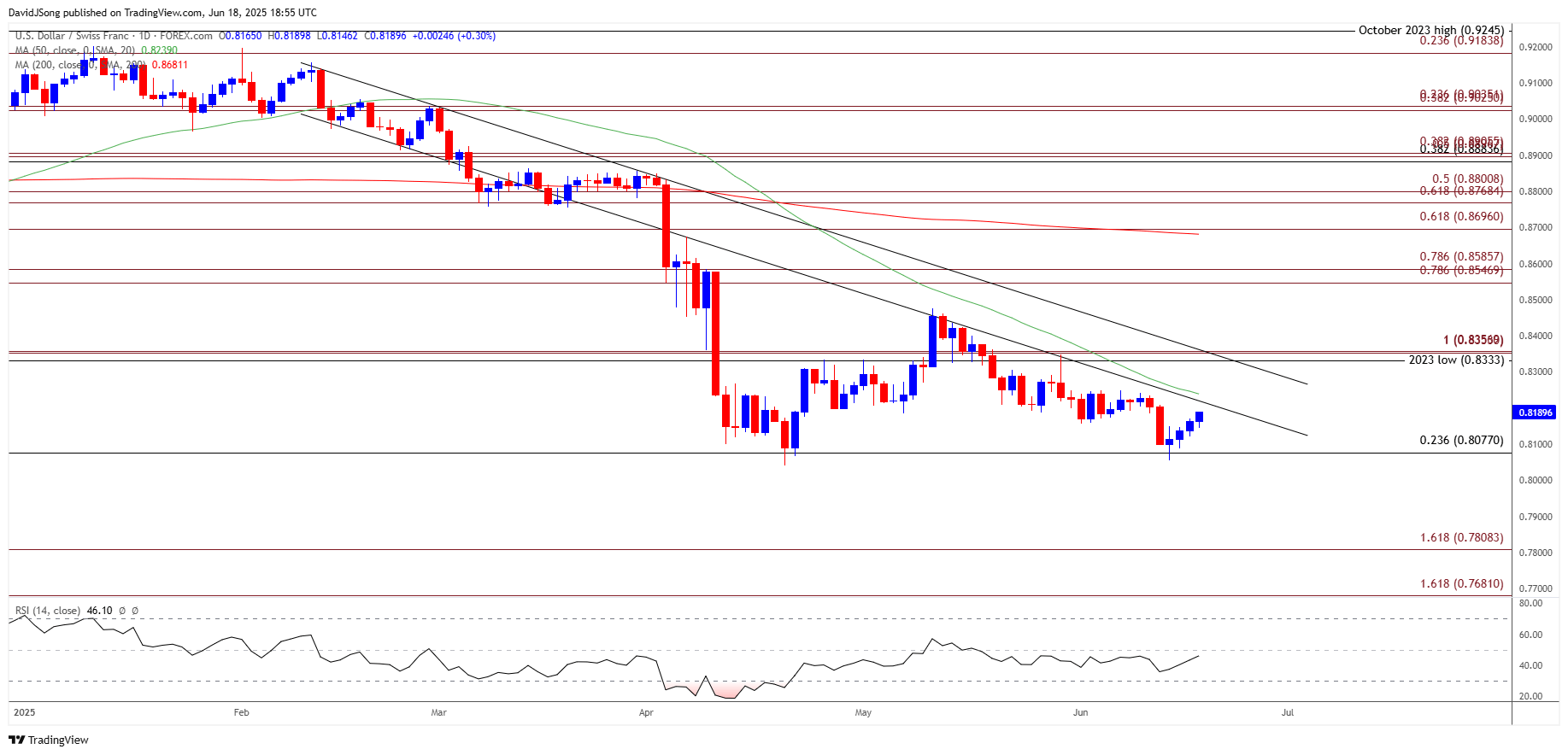

USD/CHF Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CHF Price on TradingView

- USD/CHF climbs to a fresh weekly high (0.8190) as it extends the recent series of higher highs and lows, with a breach above the monthly high (0.8250) raising the scope for a move toward 0.8360 (100% Fibonacci extension).

- Next area of interest comes in around the May high (0.8476), but lack of momentum to test the monthly high (0.8250) may keep USD/CHF below the 50-Day SMA (0.8239).

- Failure to defend the rebound from the monthly low (0.8056) may lead to test of the April low (0.8040), with the next area of interest coming in around 0.7810 (161.8% Fibonacci extension).

Additional Market Outlooks

USD/JPY Consolidates with Fed Expected to Keep US Rates on Hold

Canadian Dollar Forecast: USD/CAD Reverses Ahead of October Low

AUD/USD Coils After Trading to Fresh 2025 High

GBP/USD Susceptible to Slowing UK CPI Ahead of BoE Meeting

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong