Today, the Japanese yen appreciated by nearly 1% against the U.S. dollar, introducing a notable bearish bias in the current movements of the USD/JPY pair. The release of the Non-Farm Payroll (NFP) report increased short-term volatility, and for now, it has repositioned the yen against the dollar as investors digest the data.

NFP Day Has Arrived

The U.S. employment report surprised markets with the creation of 177,000 new jobs, significantly above the 138,000 expected. However, the figure remains below the 185,000 reported in April, which was revised downward.

Markets reacted quickly—despite being above expectations, the report reinforces the downward trend in job creation seen over the past year. Although positive on the surface, investors appear to interpret the data as a sign of a gradual economic slowdown, rather than consistent acceleration. This could reduce expectations for the Federal Reserve (FED) to maintain high interest rates in future decisions. Additionally, the recent trade war has impacted market confidence in the U.S., and the sharp downward revision to the previous NFP further supports the idea of a steady slowdown in job growth.

Source: Forex Factory

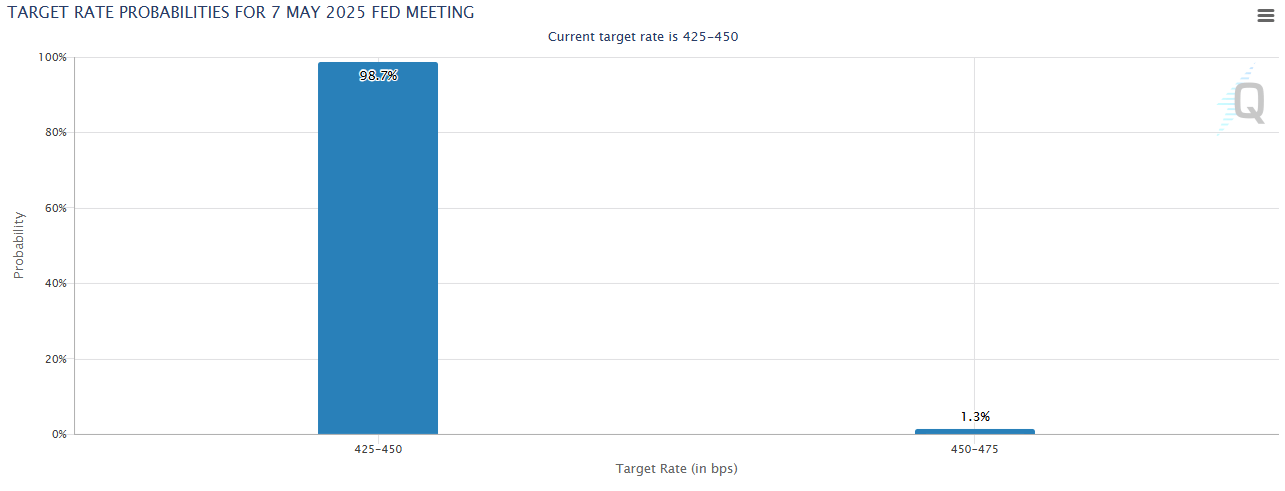

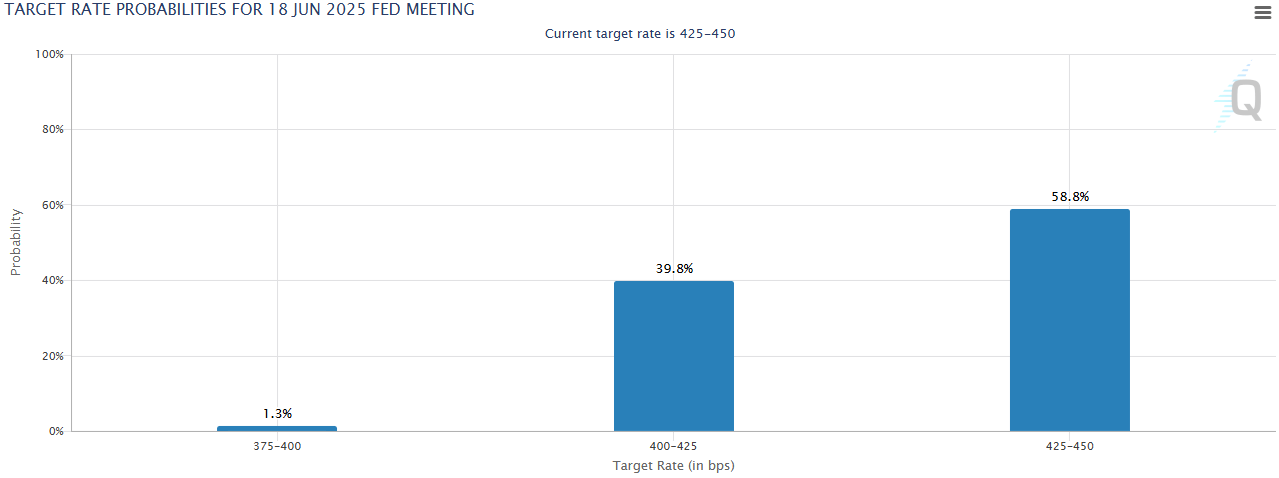

Currently, the CME Group’s FedWatch Tool indicates a 98.7% probability that the Fed will maintain its rate in the 4.25%–4.5% range at its upcoming meeting on May 7. However, the outlook for the June 18 decision has started to shift, now showing just a 58.8% chance of maintaining the current range and a 39.8% chance of a rate cut to 4.00%–4.25%.

Source: CME Group

Source: CME Group

Meanwhile, in its latest meeting, the Bank of Japan (BoJ) decided to keep its interest rate at 0.25%. While some comments have hinted at a potential policy shift, the BoJ has stated that it will continue monitoring the domestic economy before confirming any changes. For now, no additional rate reductions are being considered.

In this context, the new U.S. employment data has led to increased short-term volatility against the dollar, as the labor market trend remains bearish. If this trend continues, the probability of rate cuts by the FED could rise, potentially weakening demand for U.S. dollars. Additionally, if the Bank of Japan maintains a stable monetary policy, this could increase demand for the yen in the coming weeks, further weakening the dollar and intensifying selling pressure on USD/JPY.

Market Sentiment

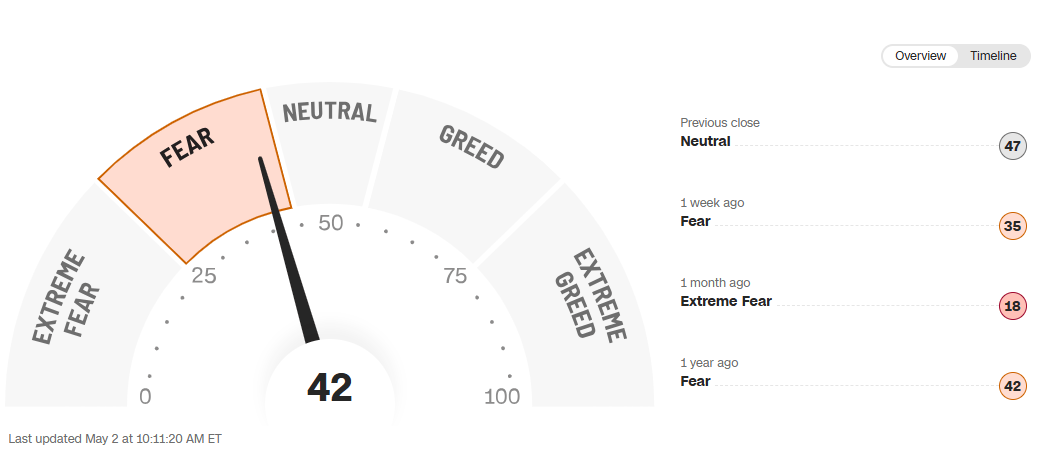

The Fear and Greed Index from CNN currently stands at 42 points, placing it still within the "fear" zone and reflecting that market uncertainty persists, with investors remaining cautious.

Source: CNN

In this environment, it's important to remember that the Japanese yen continues to be considered a safe-haven asset, and while confidence remains low, some investors may prefer the yen to protect capital in the short term. If these conditions persist, selling pressure on USD/JPY could intensify.

USD/JPY Technical Outlook

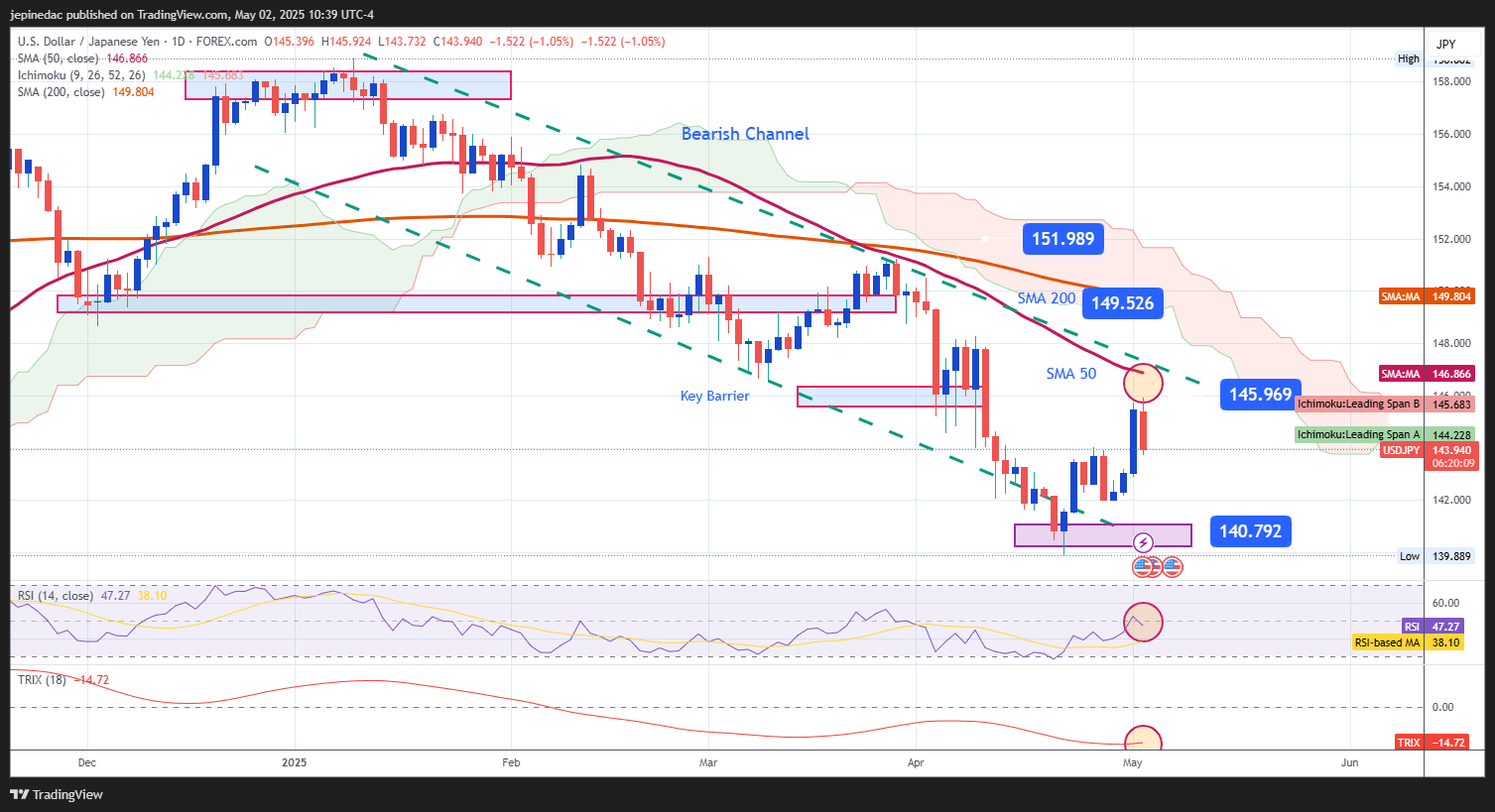

Source: StoneX, Tradingview

- Ongoing Bearish Channel: Since January 2025, USD/JPY has been trading within a clearly defined downward channel, with bullish attempts failing to break this structure. The bullish correction observed this week has also fallen short of key resistance zones within the channel, reaffirming the relevance of this bearish formation in the short term.

- RSI: The RSI line is oscillating around the midpoint of 50, but has begun to show a slight downward slope, which may indicate increasing bearish momentum. If this slope steepens, selling pressure on USD/JPY could gain strength.

- TRIX: The TRIX line continues to oscillate below the neutral 0 level, indicating that the underlying strength based on moving averages remains consistently bearish. As long as TRIX maintains this behavior, downward pressure on USD/JPY could persist in the sessions ahead.

Key Levels:

- 149.526 – Distant Resistance: This level coincides with the 200-period simple moving average. Bullish moves toward this zone could pose a technical threat to the current bearish structure.

- 145.969 – Current Resistance: This level corresponds to the top of the descending channel and aligns with the 50-period simple moving average. It could act as a barrier to bullish corrections in the short term.

- 140.792 – Key Support: This is the recent low reached by price movements. A sustained drop to this level could reinforce the bearish bias and extend the ongoing downtrend.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25