US Dollar Outlook: USD/JPY

USD/JPY approaches the monthly low (142.36) as US President Donald Trump plans to impose a 50% tariff on the European Union starting on June 1, and the exchange rate may struggle to retain the rebound from the yearly low (139.89) as it extends the series of lower highs and lows carried over from last week.

USD/JPY Approaches Monthly Low as Trump Plans 50% Tariff for Europe

USD/JPY falls to a fresh weekly low (142.46) as the ongoing transition in US trade policy raises the threat of recession, and the Federal Reserve may come under pressure to support the economy as President Trump also states that ‘a tariff of at least 25% must be paid by Apple to the US.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, the US Dollar may continue to face headwinds ahead of the next Fed meeting in June as the central bank keeps the door open to implement lower interest rates, and it remains to be seen if Chairman Jerome Powell and Co. will retain the current course for monetary policy as households and businesses brace for higher tariffs.

Until then, the change in US fiscal policy may lead to increased volatility in foreign exchange markets as the Trump administration continues to negotiate with its trading partners, and swings in the carry trade may also sway USD/JPY especially as the Bank of Japan (BoJ) keeps interest rates on hold.

With that said, USD/JPY may depreciate over the remainder of the month as it continues to carve a series of lower highs and lows, but the bearish price series may unravel should the exchange rate defend the rebound from the monthly low (142.36).

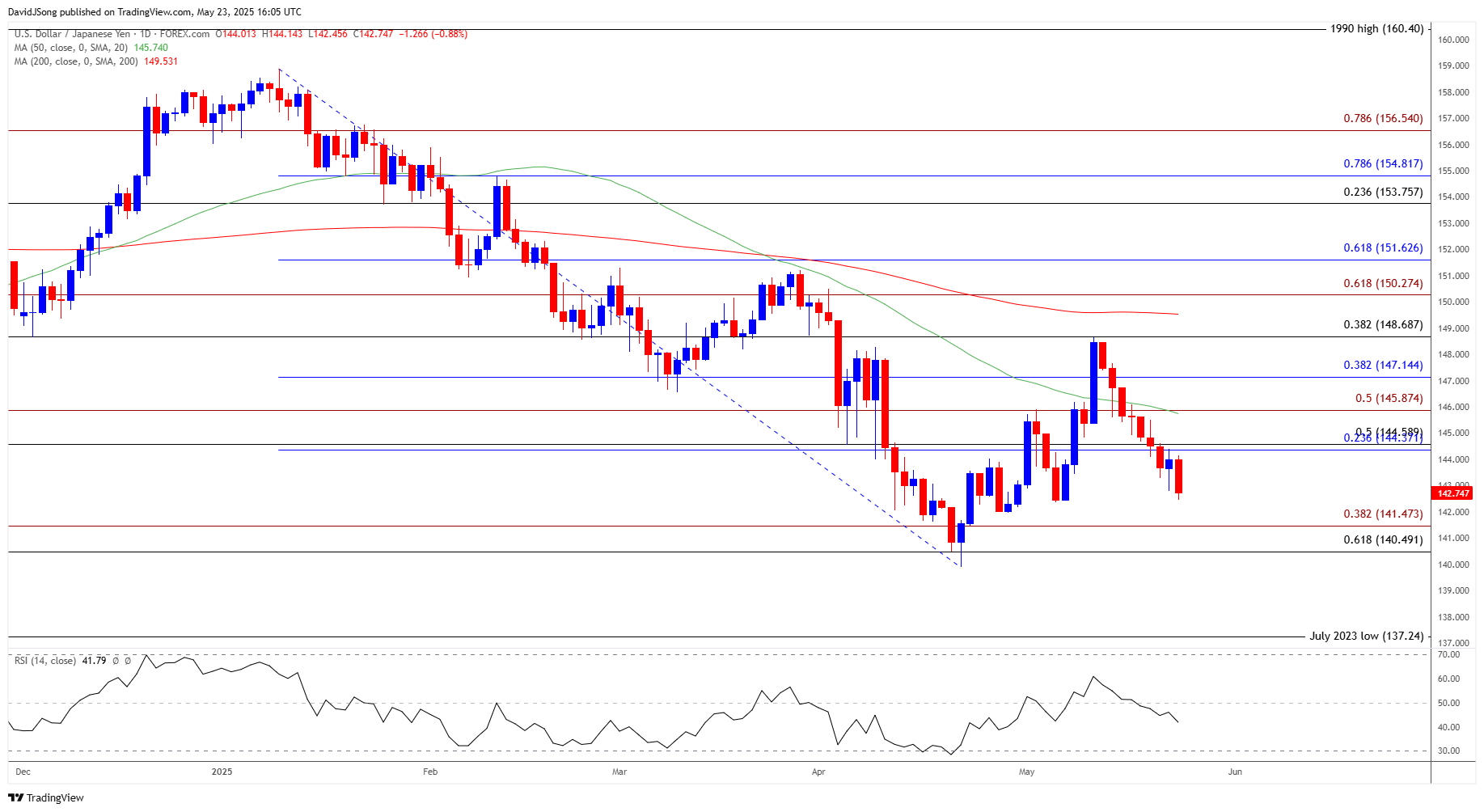

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/JPY on TradingView

- USD/JPY continues to carve a bearish price series as it extends the decline from the start of the week, with a breach of the monthly low (142.36) raising the scope for a move toward the 140.50 (61.8% Fibonacci retracement) to 141.50 (38.2% Fibonacci extension) zone.

- Next area of interest comes in around the yearly low (139.89), but USD/JPY may hold with the April range should it defend the rebound from the monthly low (142.36).

- Need a move back above the 144.40 (23.6% Fibonacci retracement) to 145.90 (50% Fibonacci extension) region to bring 145.90 (50% Fibonacci extension) on the radar, with the next area of interest coming in around the monthly high (148.65).

Additional Market Outlooks

Australian Dollar Forecast: AUD/USD Struggles Following RBA Rate Cut

Canadian Dollar Forecast: USD/CAD Bounces Back Ahead of Monthly Low

US Dollar Forecast: USD/CHF Falls Toward Monthly Low

GBP/USD Rallies to Fresh Yearly High as UK CPI Shoots Higher

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong