USD/JPY Talking Points:

- USD/JPY has pushed back above the critical 145.00 psychological level following last week’s rally after the BoJ meeting.

- This week’s JPY-fueled sell-off has hastened since the FOMC rate decision and I remain of the mind that JPY-weakness could be more attractive against the British Pound, while JPY-strength more attractive in EUR/JPY.

- I look at each of these markets in the weekly webinar and you’re welcome to join the next in real-time. Click here for registration information.

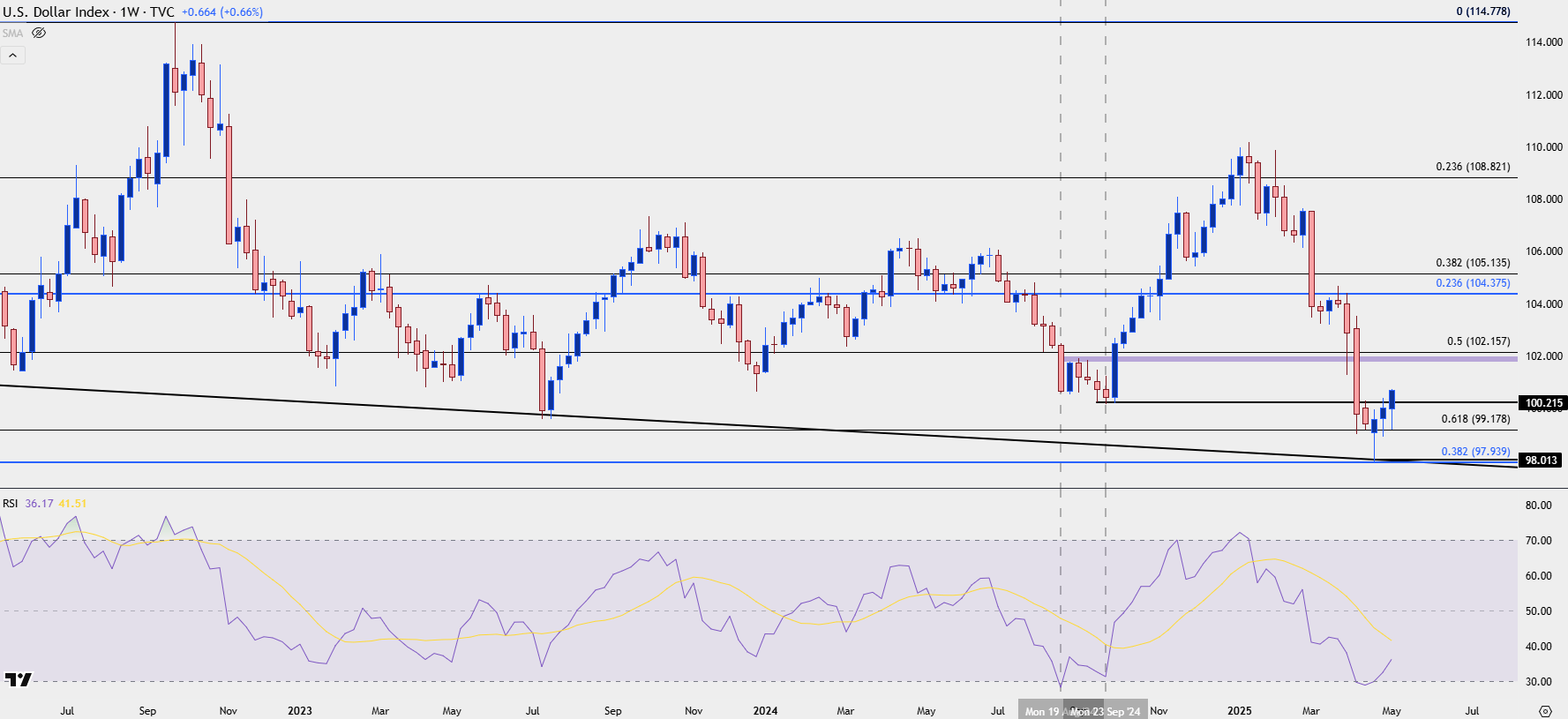

There’s still a little more than a day left in this week but the weekly DXY bar is looking more and more attractive for a continued turn. This boost in the Dollar has been helped along by a pullback in EUR/USD and a continued rally in USD/JPY, and given the backdrop that’s produced this move over the past few weeks, the door opens to continuation potential.

U.S. Dollar Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

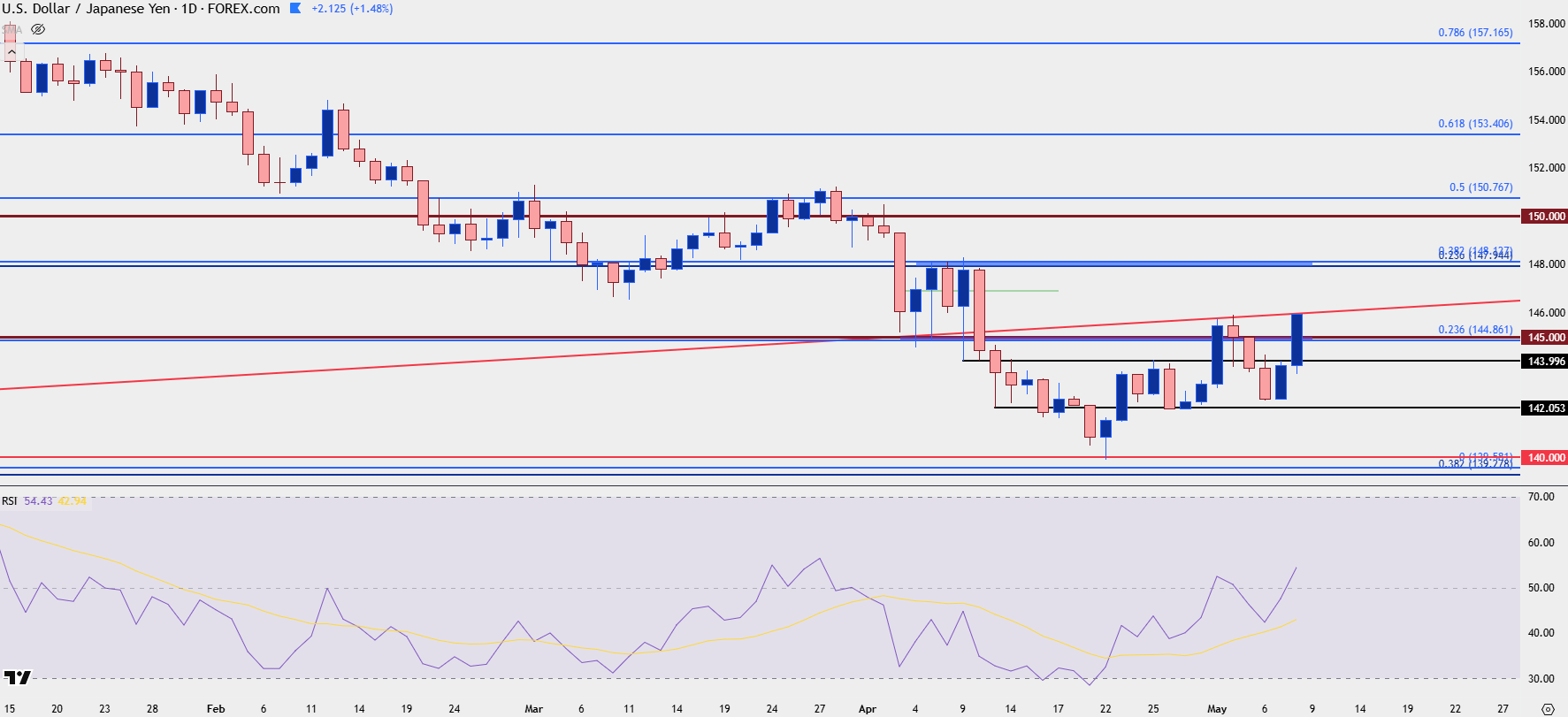

JPY has been tricky this year as there’s been a series of traps brewed on either side of USD/JPY, like the 140.00 false breakout in late-April or the 145.00 breakout last week. But the pullback that ran through the early part of this week has since held higher-low support, and buyers are pressing back up to the underside of the trendline projection that held resistance on both Thursday and Friday of last week.

USD/JPY Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

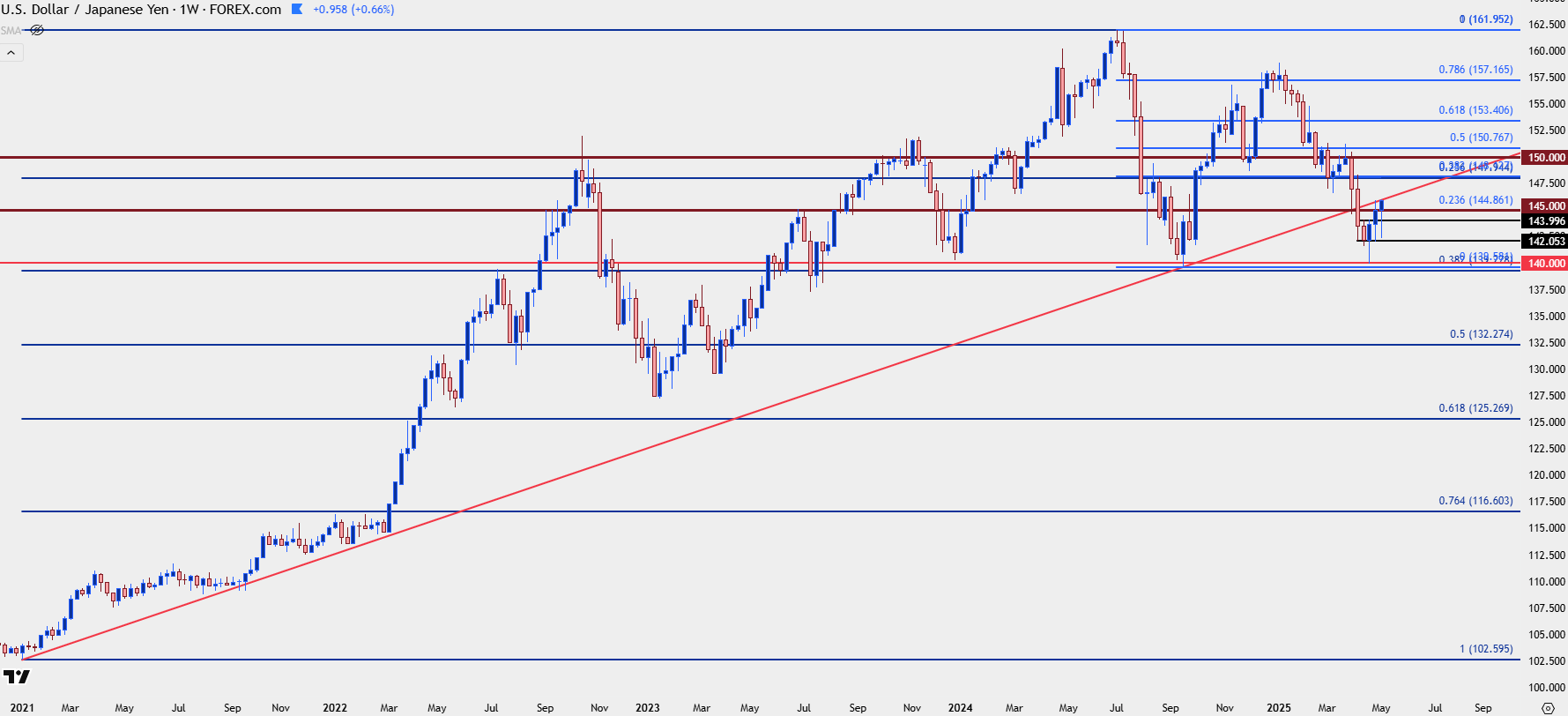

USD/JPY Weekly

The weekly chart of USD/JPY is similarly impressive as the USD chart looked at above, but the complication here is the prospect of chasing an already well-developed move. On a shorter-term basis, this opens the door for higher-low support at either 144 or 145, both levels that have had relevance of late. And for next resistance, it’s that spot around the 148.00 handle that sellers defended a few weeks ago that looms large overhead.

USD/JPY Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

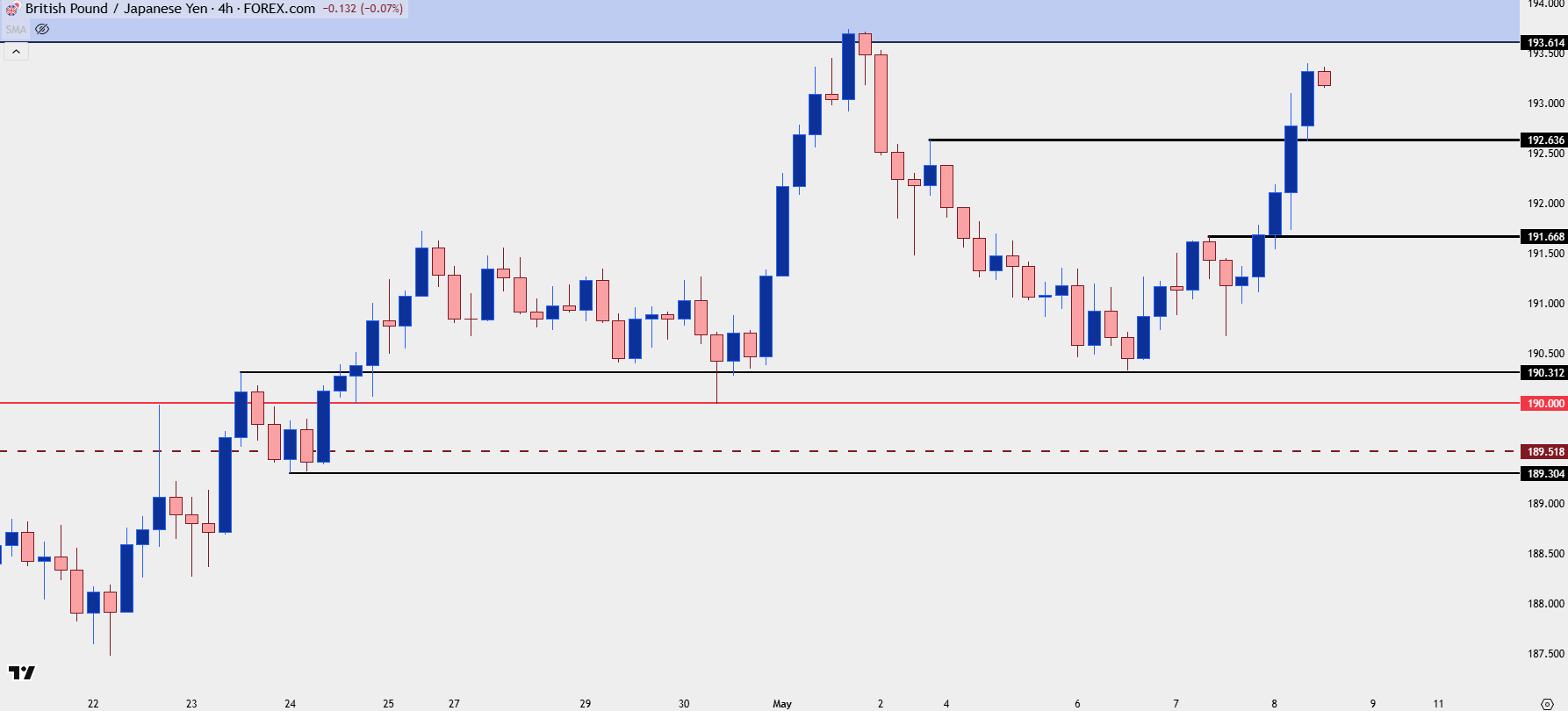

GBP/JPY

GBP/JPY has retained a clean technical backdrop since the ascending triangle looked at a few weeks ago. The 190.00 level was initially a point of resistance, but bulls slowly gained acceptance above that level and then this week, we saw a higher-low develop at the prior swing high of 190.31, highlighting an element of bullish anticipation as buyers wouldn’t even allow for a test of the big figure 31 pips below.

The challenge now is trying to avoid chasing with price already near the 193.61 resistance level, and as shown in the video, there’s higher-low support potential at 193.64 and if that doesn’t hold, 191.67.

GBP/JPY Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

EUR/JPY

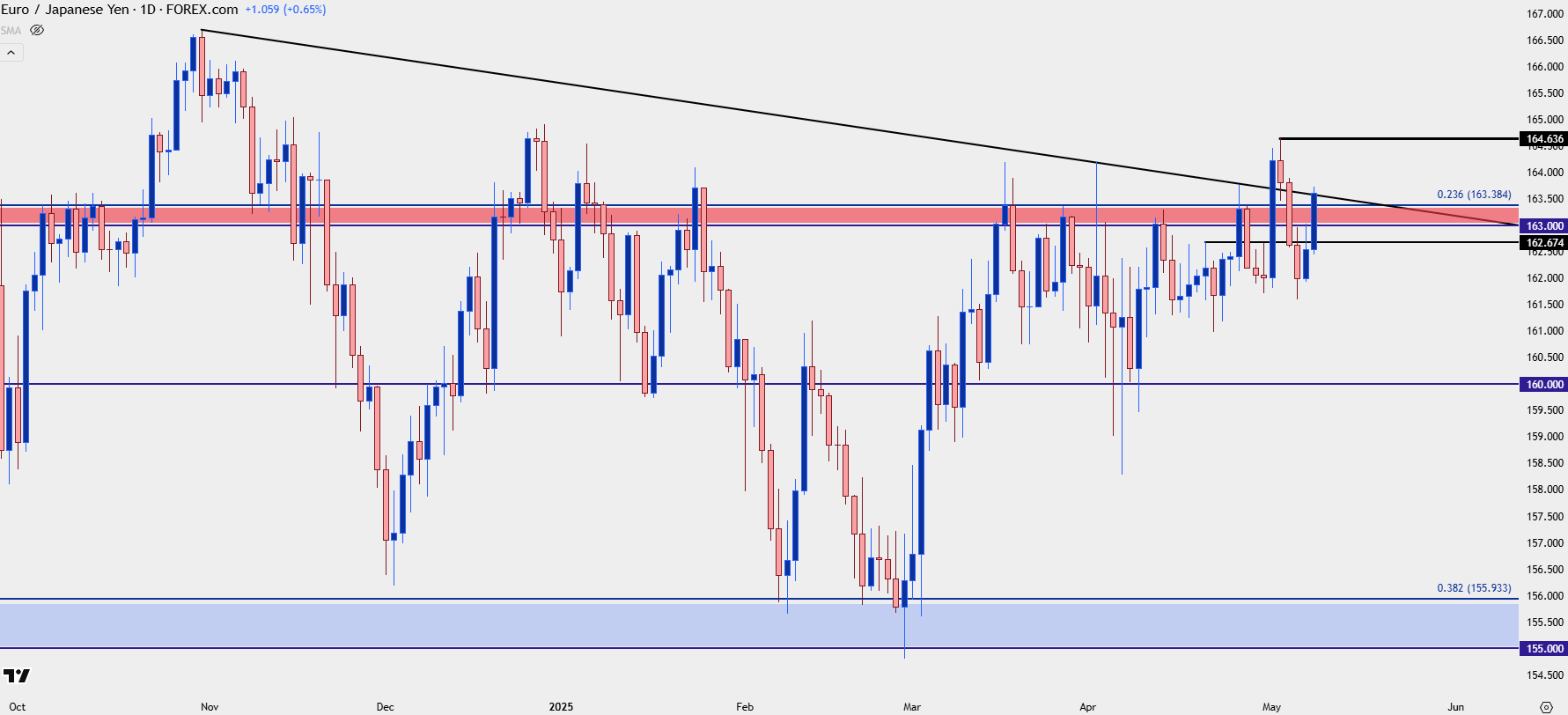

If looking to fade this recent run of Yen-weakness, I still think EUR/JPY is situated as one of the more attractive JPY-strength scenarios. The pair has now spent eight weeks battling the 163-163.38 zone, and so far this week, we have the prospect of a lower-high below last Friday’s swing.

I wouldn’t quite say that the chart below looks bearish but on a deductive basis, it also doesn’t bear the same element of strength as USD/JPY or GBP/JPY, and given proximity to resistance in each of those Yen markets, pullback scenarios could look more attractive against a Euro that’s been weak in other areas such as against the USD.

EUR/JPY Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist