Key Events to Watch

- US GDP and Unemployment Claims (Thursday)

- April Tariff Quotas and Their Impact on Market Sentiment

- Tokyo Core CPI and US Core PCE Reports (Friday)

- Bitcoin’s Correlation with US Indices and Market Sentiment vs. Skepticism over Government Reserve Considerations

Technical Analysis: Quantifying Uncertainties

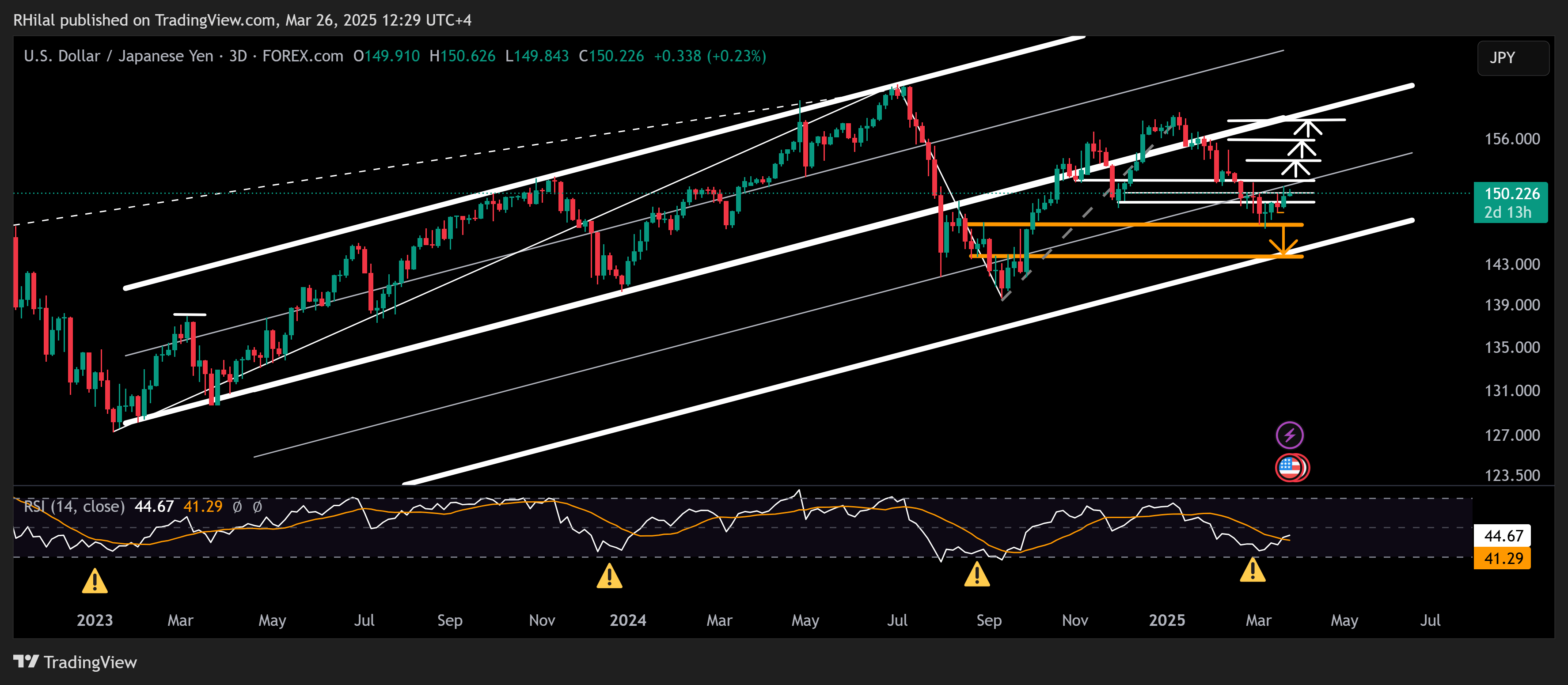

USDJPY Outlook: 3-Day Time Frame – Log Scale

Source: Tradingview

Taking a zoomed-out view on the 3-day chart, the rebound in the Relative Strength Index (RSI) from oversold levels has historically supported notable and longer-term price recoveries. The most recent rebound from the March 2025 lows has led to a 400-point rally, moving from 146.90 to around 150.90.

As price approaches the mid-zone of the duplicated channel, derived from the primary uptrend between January 2023 and July 2024, caution for further highs is warranted. This aligns with the current cautious tone across global markets, especially with upcoming April tariff quotas and evolving White House trade policies.

Volatility risks are heightened as Tokyo CPI data is set to be released on Friday. Market expectations suggest inflation will hold at 2.2%, maintaining a neutral to bullish outlook on the pair, supported by the US Dollar Index trading above the 104 level.

A break above 151 could extend gains towards potential resistance levels at 151.60, 153.60, 155.80, and 158, aligning with both the upper border of the current channel and the lower boundary of the previous channel that originated from the January 2023 lows.

On the downside, as long as the pair holds above 146.90—which aligns with the 0.618 Fibonacci retracement of the uptrend from September 2024 to January 2025—the next key support to watch is 143.70, in line with the 0.786 retracement and the lower border of the duplicated channel.

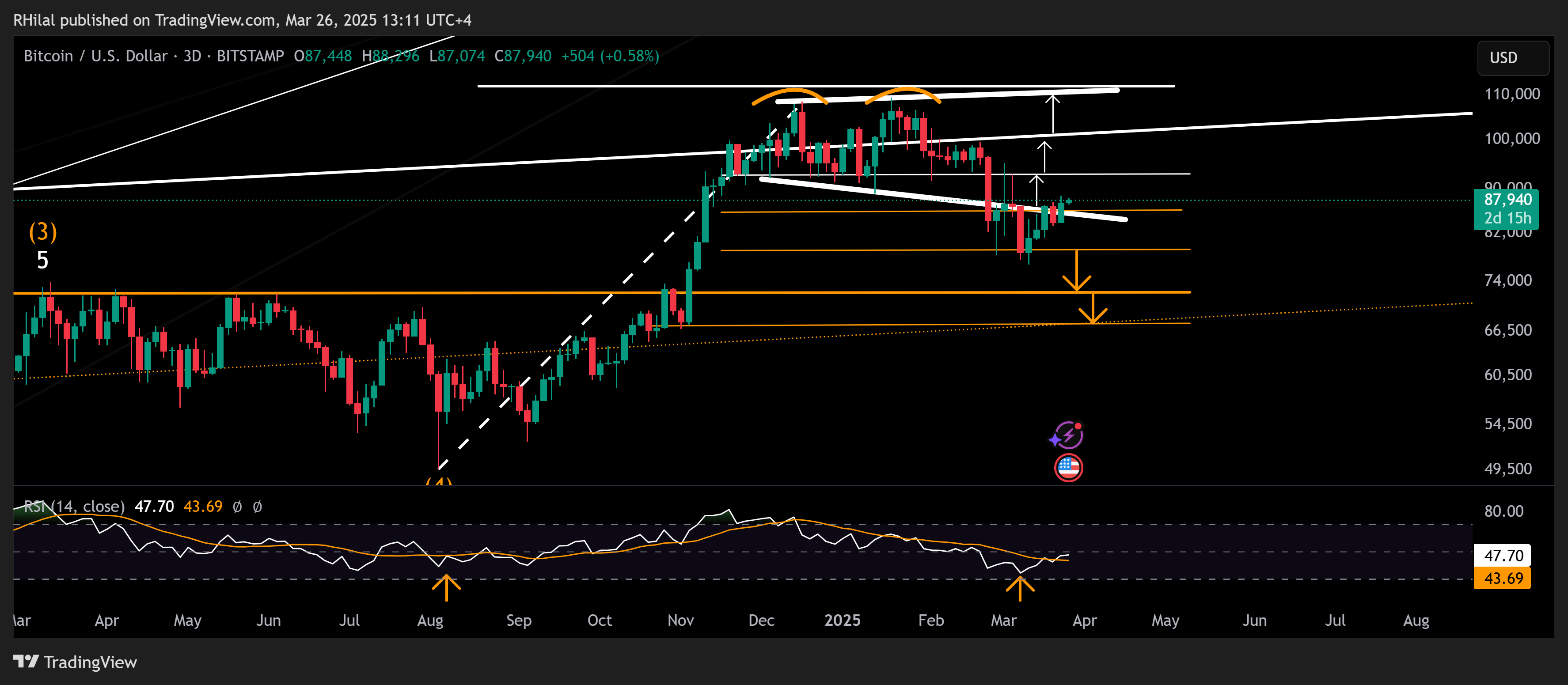

Bitcoin Forecast: 3-Day Time Frame – Log Scale

Source: Tradingview

Amid the buzz around Bitcoin potentially becoming a reserve asset—balanced by ongoing skepticism—Bitcoin is rebounding from exhausted momentum levels, last seen in August 2024. The cryptocurrency has gained more than 10,000 points from its March 2025 lows, moving in tandem with broader US equity market sentiment.

A clean hold above 89,000 may open the door for further gains toward 93,000, with increased volatility expected between the psychological 100,000 level and record highs near 109,000. On the downside, if Bitcoin drops back below 86,000, then 78,000 and 72,000 become critical levels to watch, corresponding with the 50% and 0.618 Fibonacci retracement levels of the uptrend from August 2024 to January 2025.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves