USD/JPY, USD Talking Points:

- A bit of calm in the tariff topic has allowed the US Dollar to put in a notable move of strength, helped along by a massive breakout in USD/JPY. After finding support at 145.00 on Friday, the pair is already trading through the 148.00 level and sets up the 150.00 level as the next major spot sitting overhead.

- It’s a big week for the USD as CPI data tomorrow morning leads into a busy Thursday, with retail sales, PPI and a speech from Chair Powell. And then Friday brings U of Mich Consumer Sentiment. Perhaps more notable, however, is the position on the chart after the USD finished a third consecutive week of gains last week.

- I’ll be looking at both USD and USD/JPY in-depth in the weekly webinar. Click here to register.

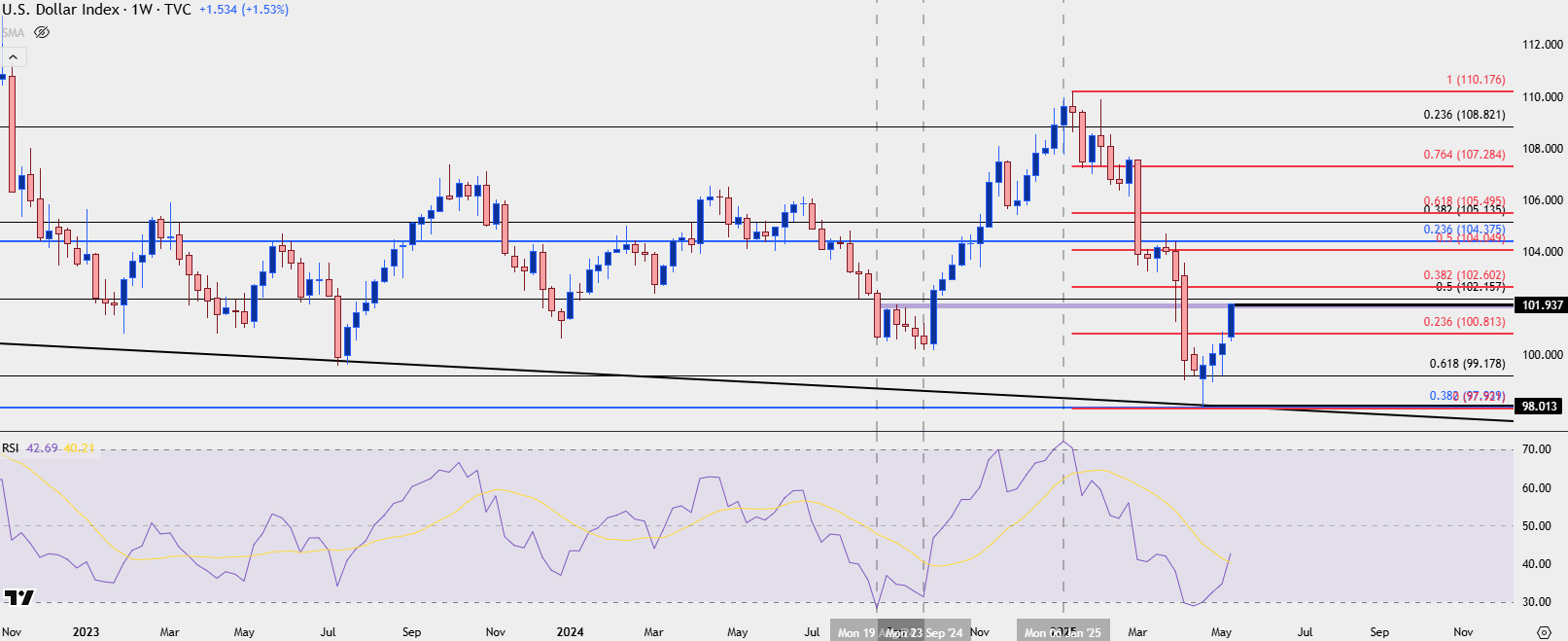

The USD is getting off to a fast start for the week and this comes in stark contrast to the currency’s behavior just a month ago, when sellers were pushing DXY into oversold territory on the weekly chart for only the second time in the past six years.

A major spot of support came into play from the monthly chart on Easter Monday, and it was a slow build but eventually bulls were able to push a series of higher-highs and higher-lows and then last week’s FOMC meeting helped to bring more urgency to the matter.

But even at the end of last week, it was early-stage as price had only retraced 23.6% of the 2025 sell-off. It was the news around tariffs this weekend that helped to drive USD bulls in a move that’s taken on a new form of strength. Making matters more interesting is the fact that this week is loaded with USD-drivers on the calendar, such as tomorrow’s CPI report or Thursday’s outlay of PPI, retail sales and a speech from FOMC Chair Jerome Powell.

US Dollar Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

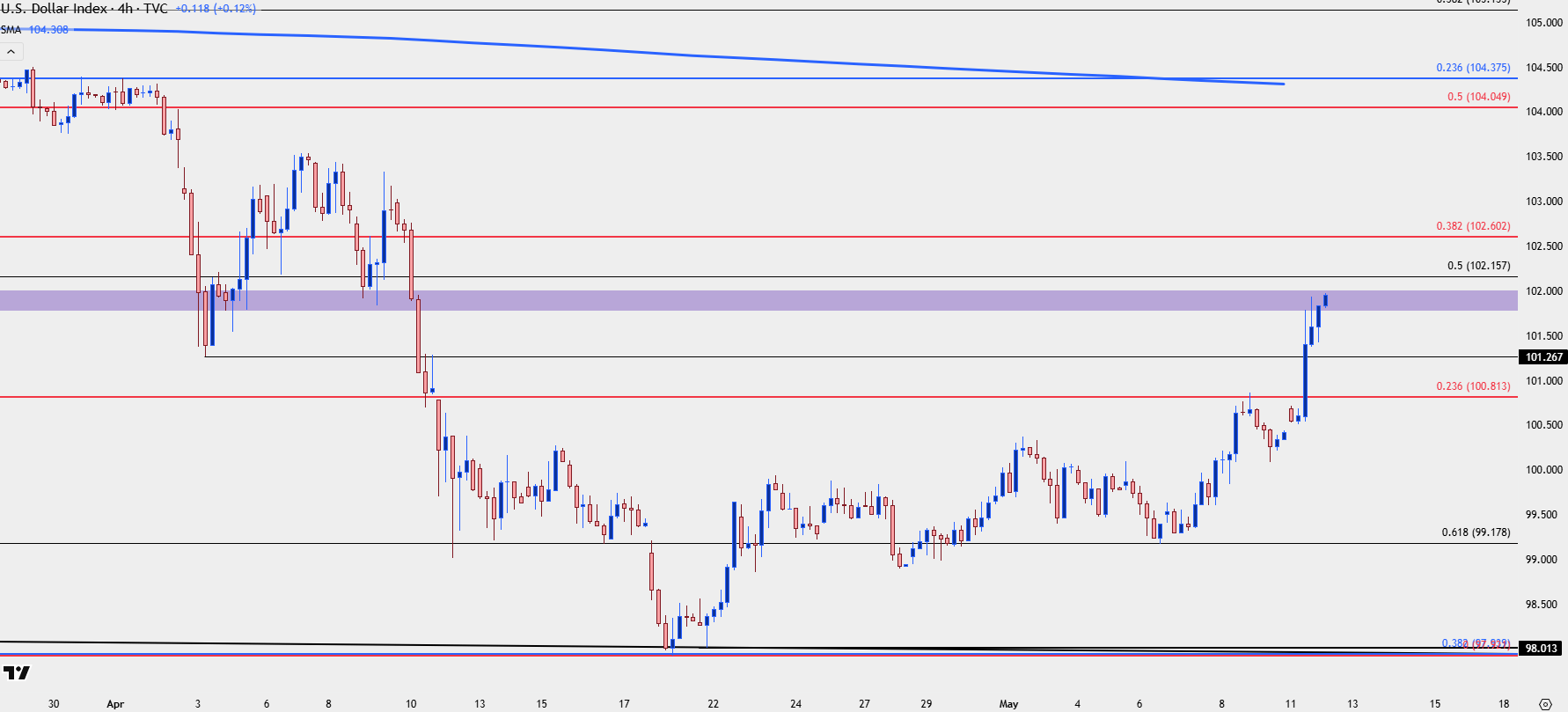

USD Shorter-Term Strategy

The week has shown a sizable breakout beyond that 23.6% Fibonacci retracement, and there’s some nearby resistance as the pair pushes towards the 102.00 handle in DXY.

But there’s also some drive on the economic calendar in the form of CPI for tomorrow morning, and this sets the stage for some possible pullback potential. Prior resistance at the retracement of 100.81 remains of interest. But perhaps more attractive than that would be bulls not even allowing for price to stretch back to that level, with a hold around 101.27.

U.S. Dollar Four-Hour

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

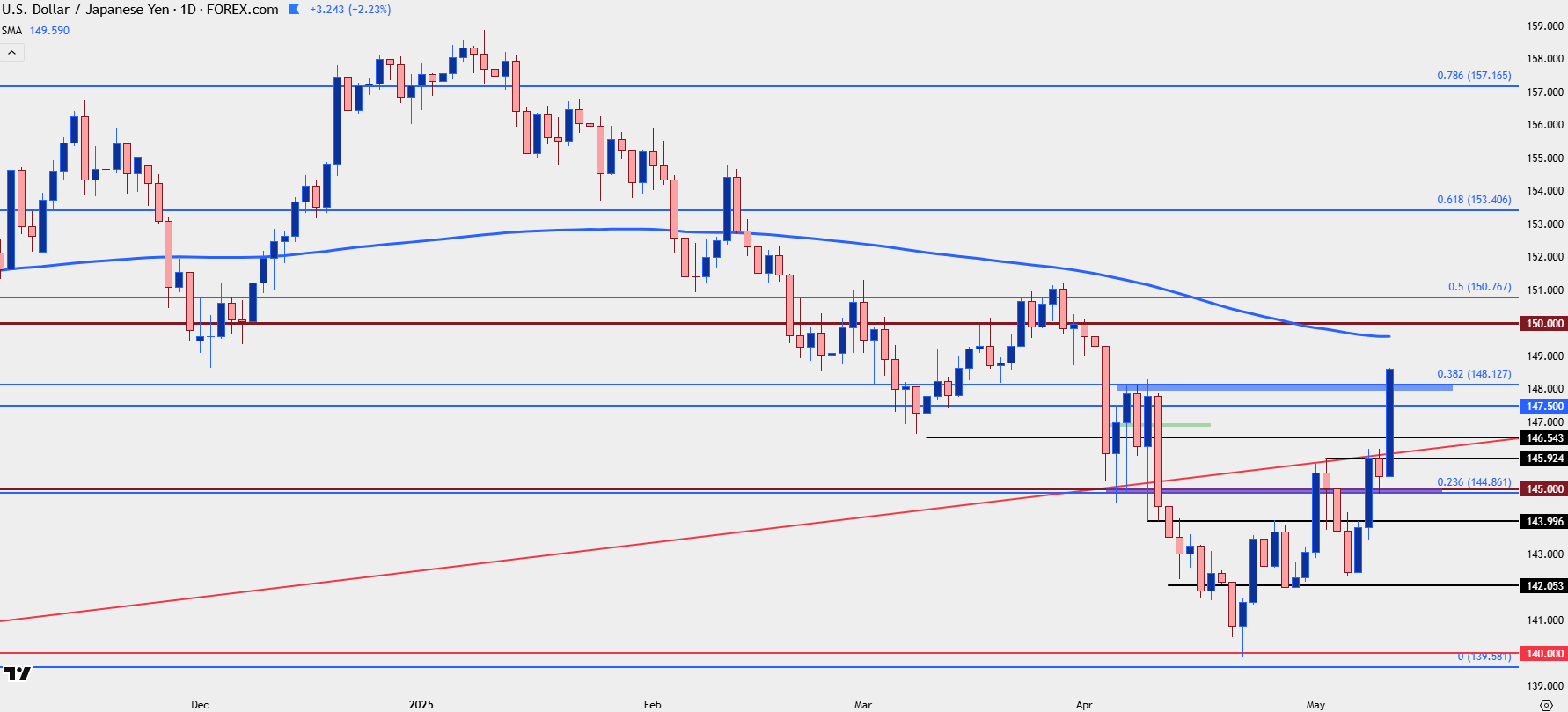

USD/JPY

This move in the USD is being fueled from a couple of other currencies but the breakout in USD/JPY seems even more aggressive than what was looked at above in DXY. After showing support at 145.00 in late-trade last week, the pair has already broken-out past the 148.00 level, and the daily candle is showing no signs of letting up just yet. Like USD above, this is an attractive short-term trend that can offer bias of some degree; but chasing still feels challenging especially now that price is more than 300 pips away from Friday’s low.

There is some higher-low support potential, and this feels like a matter that would need some help from the calendar this week, perhaps in the form of a soft CPI report tomorrow, but there’s now support potential at the prior swing low of 146.54 or the prior point of resistance at 145.92.

On a more aggressive basis and something that could be utilized with shorter-term strategies, the 147.50 psychological level or perhaps even the 148.13 Fibonacci level could be looked to as that potential higher-low support for bullish continuation scenarios in USD/JPY.

USD/JPY Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist