US Dollar Outlook: USD/JPY

USD/JPY consolidates ahead of the Federal Reserve rate decision as the central bank is widely expected to retain the current policy, but the exchange rate may extend the advance from the start of the week if Fed officials show a greater willingness to keep US interest rates higher for longer.

USD/JPY Consolidates with Fed Expected to Keep US Rates on Hold

Keep in mind, USD/JPY showed a limited reaction to the Bank of Japan (BoJ) meeting as the board voted unanimously to keep its benchmark interest rate at 0.50%, and the central bank appears to be in no rush to switch gears as Governor Kazuo Ueda and Co. announce that its purchases of Japanese government bonds (JGBs) ‘will be cut down, in principle, by about 400 billion yen each calendar quarter until January-March 2026, and by about 200 billion yen each calendar quarter from April-June 2026.’

US Economic Calendar

In turn, swings in the carry trade may sway USD/JPY as the Federal Open Market Committee (FOMC) is also expected to retain the current policy, and the central bank may stick to the sidelines throughout the summer as the ongoing shift in US trade policy clouds the outlook for growth and inflation.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

However, the FOMC may stay on track to further unwind its restrictive policy as the ‘median participant projects that the appropriate level of the federal funds rate will be 3.9 percent at the end of this year,’ and more of the same from Fed officials may drag on the US Dollar should the update to the Summary of Economic Projections (SEP) fuel speculation for lower US interest rates.

With that said, USD/JPY may snap the recent series of higher highs and lows as it pulls back ahead of the monthly high (145.47), but the exchange rate may further retrace the decline from the May high (148.65) if it defends the advance from the start of the week.

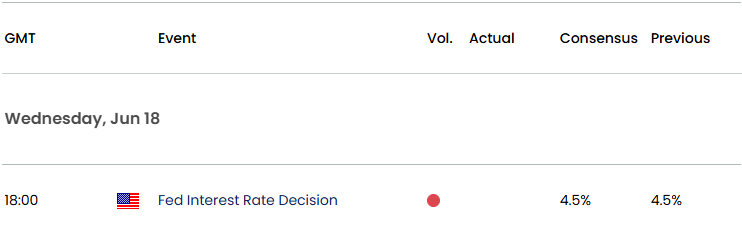

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/JPY on TradingView

- The recent rally in USD/JPY seems to have stalled ahead of the monthly high (145.47) as it pulls back from a fresh weekly high (145.44), and lack of momentum to hold above the 144.40 (23.6% Fibonacci retracement) to 144.60 (50% Fibonacci extension) region may push the exchange rate back toward the monthly low (142.38).

- Failure to defend the May low (142.12) may lead to a test of the 140.50 (61.8% Fibonacci retracement) to 141.50 (38.2% Fibonacci extension) zone, with the next area of interest coming in around the April low (139.89).

- At the same time, a move/close above 145.90 (50% Fibonacci extension) may push USD/JPY toward 147.10 (38.2% Fibonacci retracement), with the next area of interest coming in around the May high (148.65).

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Reverses Ahead of October Low

AUD/USD Coils After Trading to Fresh 2025 High

GBP/USD Susceptible to Slowing UK CPI Ahead of BoE Meeting

EUR/USD Outlook Hinges on Federal Reserve Forward Guidance

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong