USD/JPY falls after the BoJ leaves rates unchanged & on safe haven flows

- BoJ left rates unchanged at 0.5% & plans to slow JGB tapering

- USD looks to retail sales data with -0.7% MoM fall expected

- USD/JPY trades in a holding pattern

USD/JPY is edging lower after the Bank of Japan left interest rates unchanged at 0.5%, in line with expectations. The central bank also left its existing bond taper plan unchanged through March 2026 but set out a new plan beyond April next year to slow the pace of its balance sheet drawdown.

The BoJ had been trying to shrink JGB purchases, but weak demand in recent auctions has caused a surge in super long-dated yields. The central bank is supporting the bond market by slowing down its tapering. The yen has ticked a few points higher.

The USD dollar is rising versus its major peers on safe haven flows as the conflict in the Middle East enters its fifth straight day, showing few signs of slowing.

On the data front, attention will be on US retail sales, which are expected to fall 0.7% month on month in May after rising 0.1% in April. Weak sales come as US consumer confidence has deteriorated in recent months, owing to signs of a slowing labour market and uncertainty amid Trump's erratic tariff policy.

Weaker-than-expected US retail sales could raise concerns over the health of the US economy, and cold pull the USD lower while boosting the safe-haven yen.

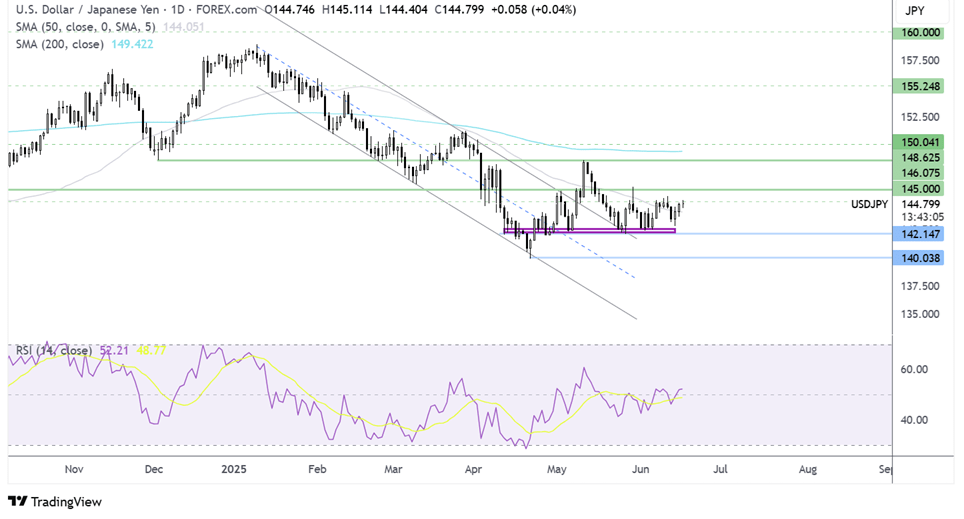

USD/JPY technical analysis

USD/JPY continues to trade in a holding pattern capped at 145 on the upside and 142 on the downside. The pair trades towards the upper end of the channel, above the 50 SMA, and the RSI is mostly above 50.

Buyers will need to rise above 145 to create a higher high and aim towards 148.65 the May high.

Should sellers break below the 50 SMA at 144 and the 142.509 support zone, a lower low is formed, bringing 140.00 into focus.

DAX falls as Israel–Iran conflict continues

- Israel-Iran conflict enters fifth day

- German ZEW economic sentiment is due

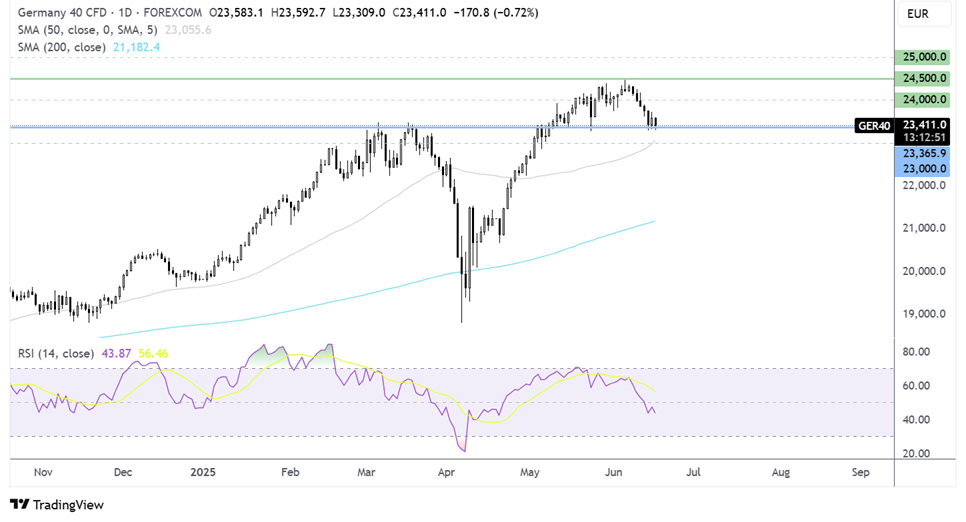

- DAX tests 23,3000 support after falling from its record high

The DAX, along with its European peers, has opened lower on Tuesday as the war between Iran and Israel enters its fifth day, raising concerns of further unrest and driving safe haven demand.

As the Middle Eastern conflict enters its fifth day, President Trump urged Iranians to evacuate Tehran. Meanwhile, Trump also departed the G7 Summit in Canada early, and a separate report suggested that Trump asked for the National Security Council to be prepared in the situation room. These developments sparked a wave of risk-off trade, pulling equities lower, while safe-haven gold is pushing higher.

Oil price is once again rising as the risk premium on oil increases; energy shares will be in focus. However, rising oil prices also raise concerns over sticky inflation.

On the data front, German ZEW economic sentiment is due shortly and is expected to show that morale improved to 35, up from 25.2 in May. The current situation is also expected to show improvement to -74 from -82.

There have been no developments surrounding trade negotiations, and the July 9 unilateral tariff day is drawing closer, which could keep investors in a cautious mood.

DAX technical analysis

After reaching an all-time high of 24,490, the DAX has corrected lower to the 23,300 support zone, which is the May 26 low and the March high. The RSI is below 50, favouring the sellers.

Should sellers break below this support level, they could gain traction towards 23,000, the round number and the 50 SMA.

Should 23,300 support hold, buyers could look to rise back towards 24,000 and 24,490 for fresh record highs.