US Dollar Outlook: USD/JPY

USD/JPY extends the series of lower highs and lows from last week as Moody’s cuts its US credit rating from Aaa to Aa1, and the exchange rate may continue to give back rebound from the monthly low (142.36) as the ongoing shift in US fiscal policy clouds the outlook for the economy.

USD/JPY Decline Persists amid US Credit Rating Downgrade

USD/JPY trades back below the 50-Day SMA (146.10) as Moody’s warns that ‘the US' fiscal performance is likely to deteriorate relative to its own past and compared to other highly-rated sovereigns,’ and it seems as though the push above the moving average was temporary as the exchange rate reverses ahead of the April high (150.49).

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, USD/JPY may continue to reflect a bearish price series as fears of a slowing economy puts pressure on the Federal Reserve to further unwind its restrictive policy, and the US Dollar may face additional headwinds ahead of the next Fed meeting in June even as the Trump administration tries to avoid a trade war.

With that said, the decline in USD/JPY may persist as the downgrade in the US credit rating drags on the Greenback, but the exchange rate may threaten the bearish price series should it defend the advance from the monthly low (142.36).

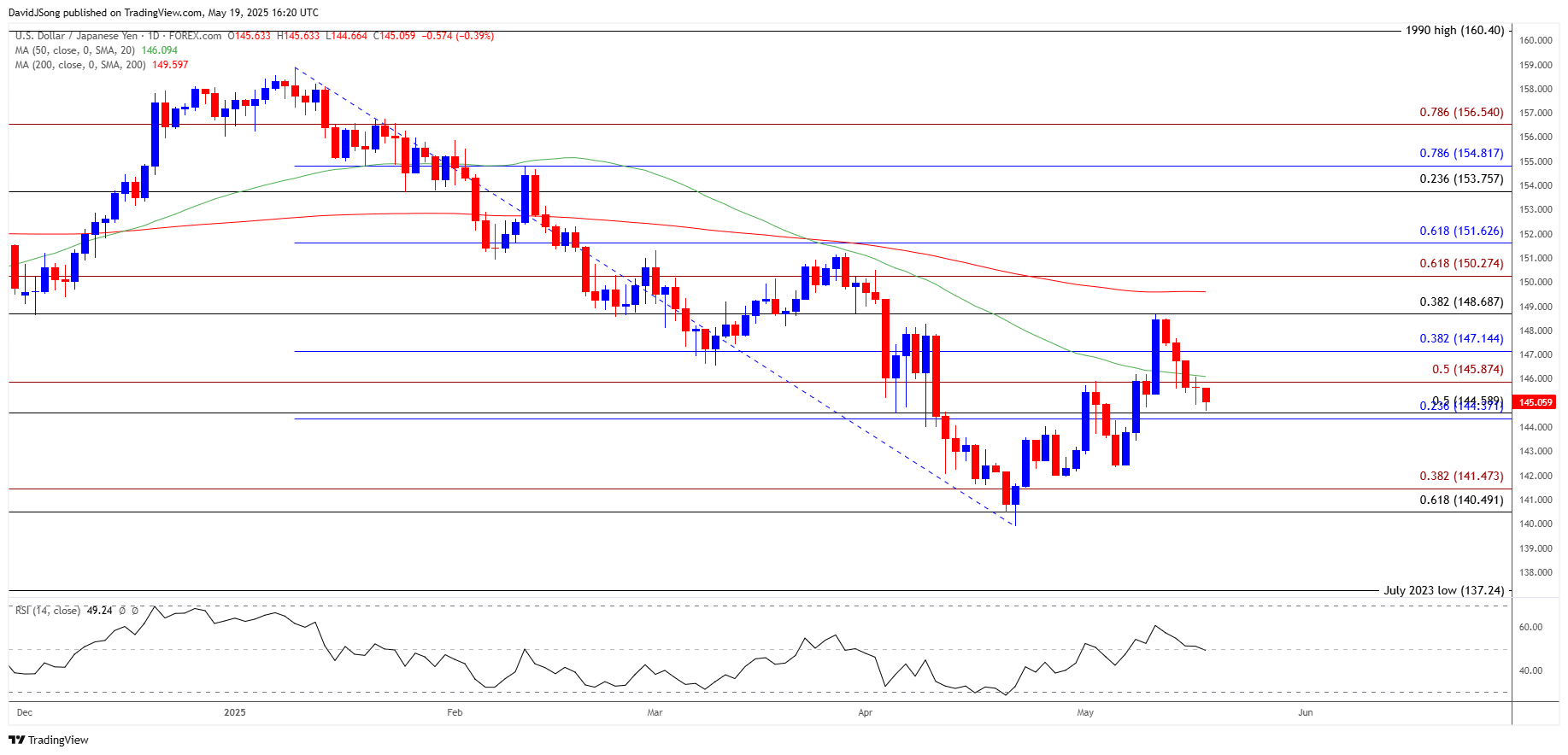

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/JPY on TradingView

- USD/JPY carves a series of lower highs and lows after struggling to push above the 148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension) zone, and lack of momentum to hold above the 144.40 (23.6% Fibonacci retracement) to 145.90 (50% Fibonacci extension) region may push the exchange rate toward the monthly low (142.36).

- Next area of interest comes in around 140.50 (61.8% Fibonacci retracement) to 141.50 (38.2% Fibonacci extension), but USD/JPY may consolidate over the coming days should it defend the advance from the monthly low (142.36).

- Need a move above 145.90 (50% Fibonacci extension) for USD/JPY to threaten the bearish price series, with a move above 147.10 (38.2% Fibonacci retracement) bringing the monthly high (148.65) on the radar.

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Defends Weekly Low Ahead of Canada CPI

Gold Price Struggles to Close Below 50-Day SMA

GBP/USD Defends Rebound from Weekly Low to Hold Above 50-Day SMA

Australian Dollar Forecast: AUD/USD Defends V-Shape Recovery

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong