USD/JPY rises ahead of the FOMC rate decision

- USD rises as US-China plan trade talks

- The Fed is expected to leave rates unchanged

- USD/JPY trades within a falling channel.

USD/JPY is falling as the de-escalation of US-China trade continues. Representatives from both countries will meet in Switzerland in the coming days to begin discussions.

This is welcome news after the USD came under pressure at the start of the week following disappointing tariff headlines. Trump announced 100% tariffs on movies made in the US and warned that pharmaceutical tariffs would be announced shortly.

Today, attention is on the FOMC policy decision. The Fed is set to keep interest rates unchanged and could even push back against dovish market pricing, which may boost the US dollar in the near term. Despite the US labour market remaining solid and inflation still above target, the market is pricing in 79 basis points worth of cuts from the Fed this year, with the first reduction in July.

Global events rather than domestic fundamentals have mainly driven the yen. The JPY and the Swiss franc have been favoured safe havens in the FX space amid trade tariff uncertainty.

On the monetary policy front, the BoJ left interest rates unchanged in line with expectations and delivered a dovish message. BoJ governor Ueda put strong emphasis on trade developments. Say in the case of a good trade deal with the US, the central bank may hike rates faster.

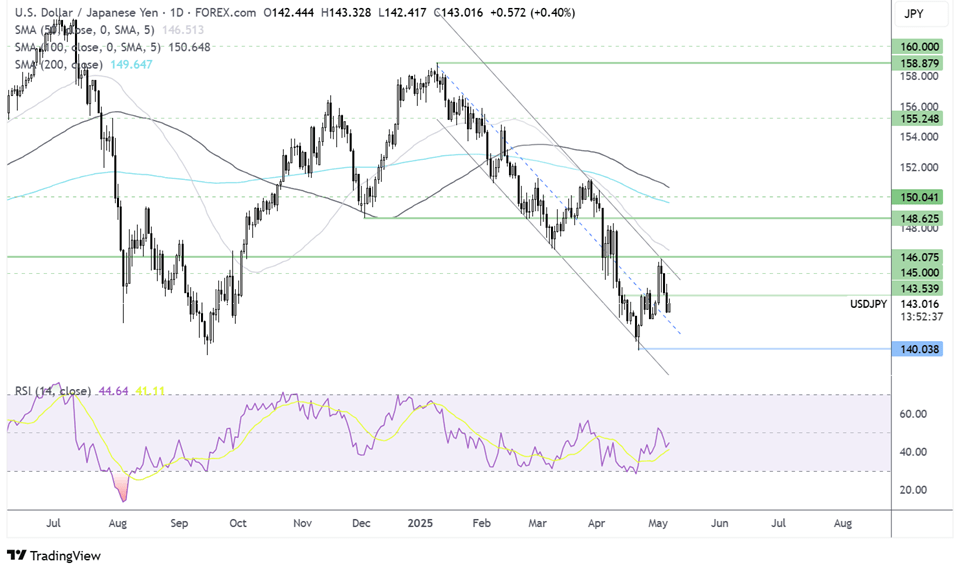

USD/JPY forecast – technical analysis

USD/JPY trades within a falling channel dating back to the start of the year. The recent recovery from the 139.90 low ran into resistance at 146.00, the upper band of the falling channel, and the price has corrected lower to 143.00.

Sellers need to break below 141.60 and 140.00 to create a lower low.

Buyers, meanwhile, would need to rise above 134.50 and 145.00, the upper band of the falling channel, to bring 146.00 into focus. A rise above here creates a higher high.

FTSE 100 to end record winning run despite US & India trade developments

- UK & India agree a trade deal, the largest since Brexit

- US- UK & US- China trade talks in focus

- FTSE set to end a 17-day record winning run

The FTSE is falling, setting stocks on track to end a record 17 straight sessions of gains.

The fall in the FTSE comes as the UK and the US are holding intensive discussions surrounding an economic agreement that could reduce the impact of some of Trump's trade tariffs. The talks come after the UK struck a trade deal with India, marking its largest deal since Brexit.

The deal is set to see Indian tariffs on gin, whiskey, and car exports fall significantly, while tariffs on Indian textiles into the UK will be wiped out completely. The trade deal aims to double trade between the UK and India to $120 billion by 2030. Diageo rose yesterday and is pushing higher again today, outperforming the broader market.

Meanwhile, trade talks between the US and China are also expected to start this week in Switzerland as the two try to de-escalate tensions, which have rattled risk sentiment. Miners are top of the FTSE leader board, with oil majors also tracking oil prices higher. Encouraging developments between the US and China are boosting demand for US futures, weighing on the FTSE. This is more of a positive US narrative rather than a fundamental negative story for the UK.

In corporate news, BAE Systems held its financial guidance as it continues to benefit from a jump in defence spending globally. The firm expects sales to rise 7 to 9% this year and earnings to grow between 8 and 10%.

Pub chain JD Wetherspoons posted a 5.6% increase in like-for-like sales in the 13 weeks to the end of April, helped by nicer weather. The pub chain plans to open four or five pubs this financial year and approximately 10 new pubs in the coming financial year.

Attention will also turn towards the Bank of England interest rate decision tomorrow. The central bank is expected to cut rates by 25 basis points to 4.25%, which could signal a more aggressive pace of rate cuts across the year, owing to concerns surrounding global growth.

A more dovish Bank of England could boost domestic-focused stocks such as housebuilders and retailers.

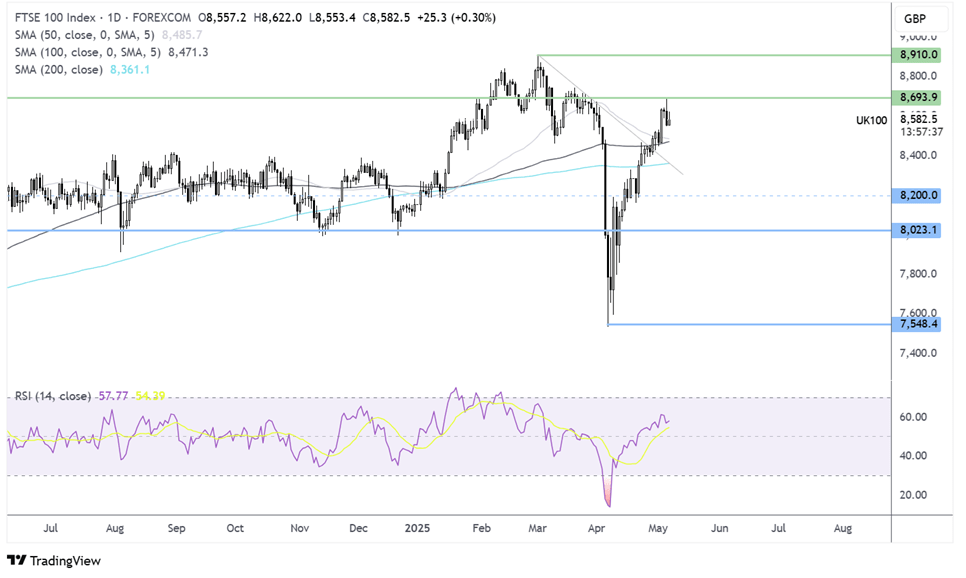

FTSE 100 forecast – technical analysis

The FTSE extended its recovery from its 7535 low, running into resistance at 8680 before easing back to its current level of 8585. The price holds above its 50, 100, and 200 SMAs, and the RSI is above 50, keeping buyers hopeful of further gains.

Buyers will look to rise back above 8600 to bring 8680 back into focus ahead of 8900 and fresh record highs.

Immediate support is seen at 8550, yesterday’s low. A break below here exposes the 50 and 100 SMAs at 8470. A break below 8365 would negate the near-term uptrend.