BOJ Keeps Rates Steady:

- Interest rates held at 0.5% in a unanimous decision

- BOJ reaffirmed commitment to raising rates if economic and price forecasts materialise

- BOJ downgraded GDP growth forecasts for fiscal years 2025 and 2026

- Inflation is still expected to hover around the 2% target through FY2027

- GBP/JPY and USD/JPY look set to break higher

The Bank of Japan (BoJ) kept its monetary policy unchanged on Thursday, holding interest rates at 0.5%. While market pricing had suggested a ~97% chance of no change today, the BoJ is a central bank known for going against consensus from time to time.

The board left its inflation outlook unchanged but lowered growth forecasts for fiscal years 2025 and 2026, citing uncertainty over US tariffs and broader trade tensions. Core CPI was slightly lower, and headline CPI is expected to hover around the BoJ’s 2% target through to FY2027.

Trump’s Tariffs Could Delay, Not Derail, Further BoJ Hikes

Lower growth expectations and rising concerns over trade could be taken as a sign that the BoJ is losing its appetite for further rate hikes this year. However, the accompanying statement noted that “we will continue to raise our policy rate” if the economic outlook plays out as expected. Yet with the Japanese yen weaker across the board, traders are no doubt questioning whether further hikes will materialise.

View related analysis:

- Japanese Yen (JPY) Sentiment Could Be at an Extreme: COT Report

- USD/JPY, USD/CHF, EUR/USD Analysis: USD Reversal Grinds Away

- AUD/USD, AUD/CAD, GBP/AUD Analysis: Australian Dollar Falters

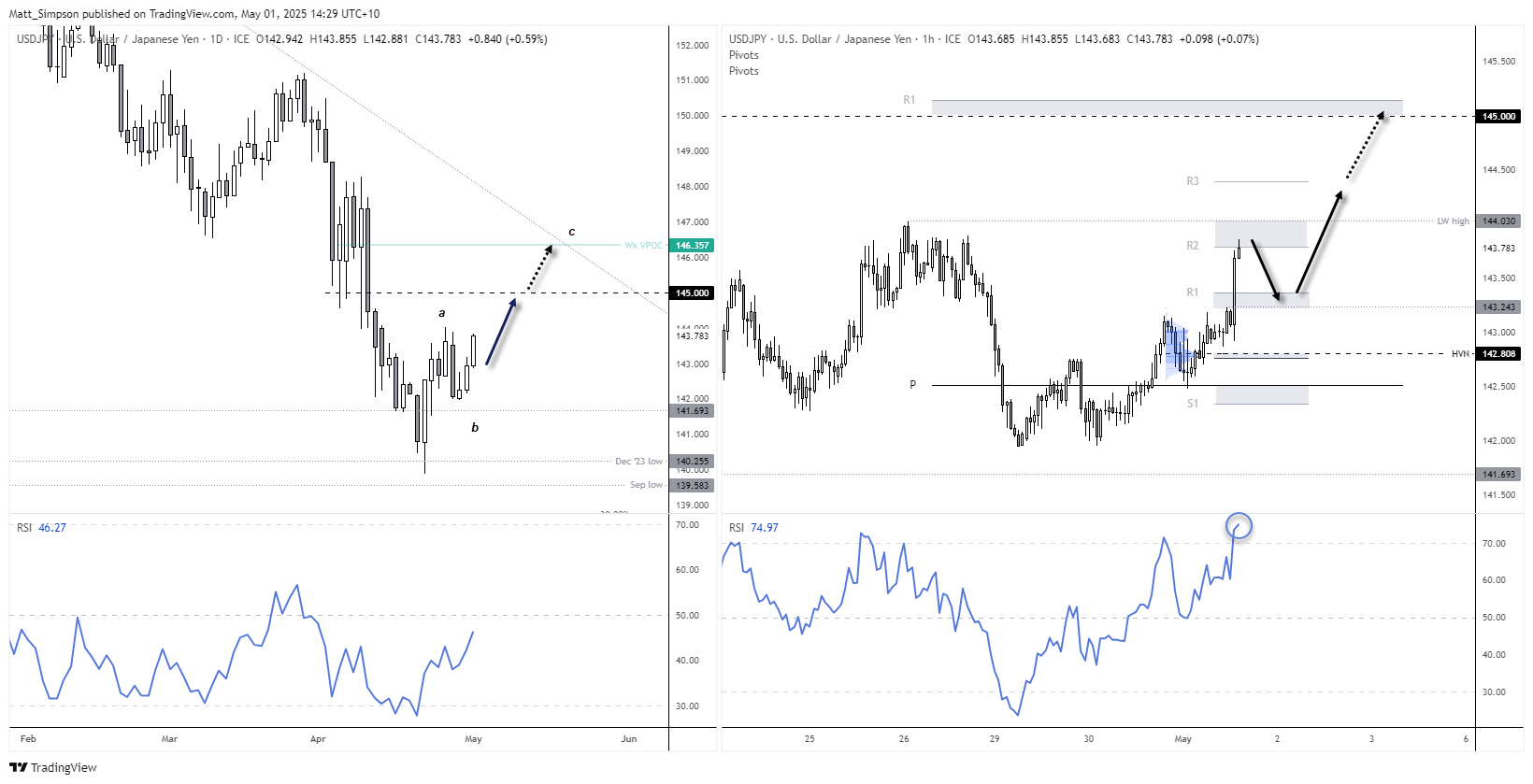

USD/JPY Technical Analysis: US Dollar vs Japanese Yen

I outlined a bullish case for the US dollar in several articles over the past couple of weeks (see links above). More specifically, USD/JPY appears to be rising in line with my call for an ABC correction higher. The daily chart shows it is nearing last week’s high, so a pullback may be due. However, a break above last week’s high would assume a run to 145, with a break above that bringing the 146 handle into focus — near the weekly VPOC and trend resistance.

USD/JPY 1-hour chart

The intraday chart shows prices have reached the daily R2 pivot and are now approaching last week’s high (LW high). The RSI (14) is also overbought, so these are not levels I would personally be seeking longs around. However, if prices do retrace lower, bulls could look for evidence of a swing low around the daily R2 or the

143.24 high. My bias remains bullish above the 142.80 high-volume node (HVN).

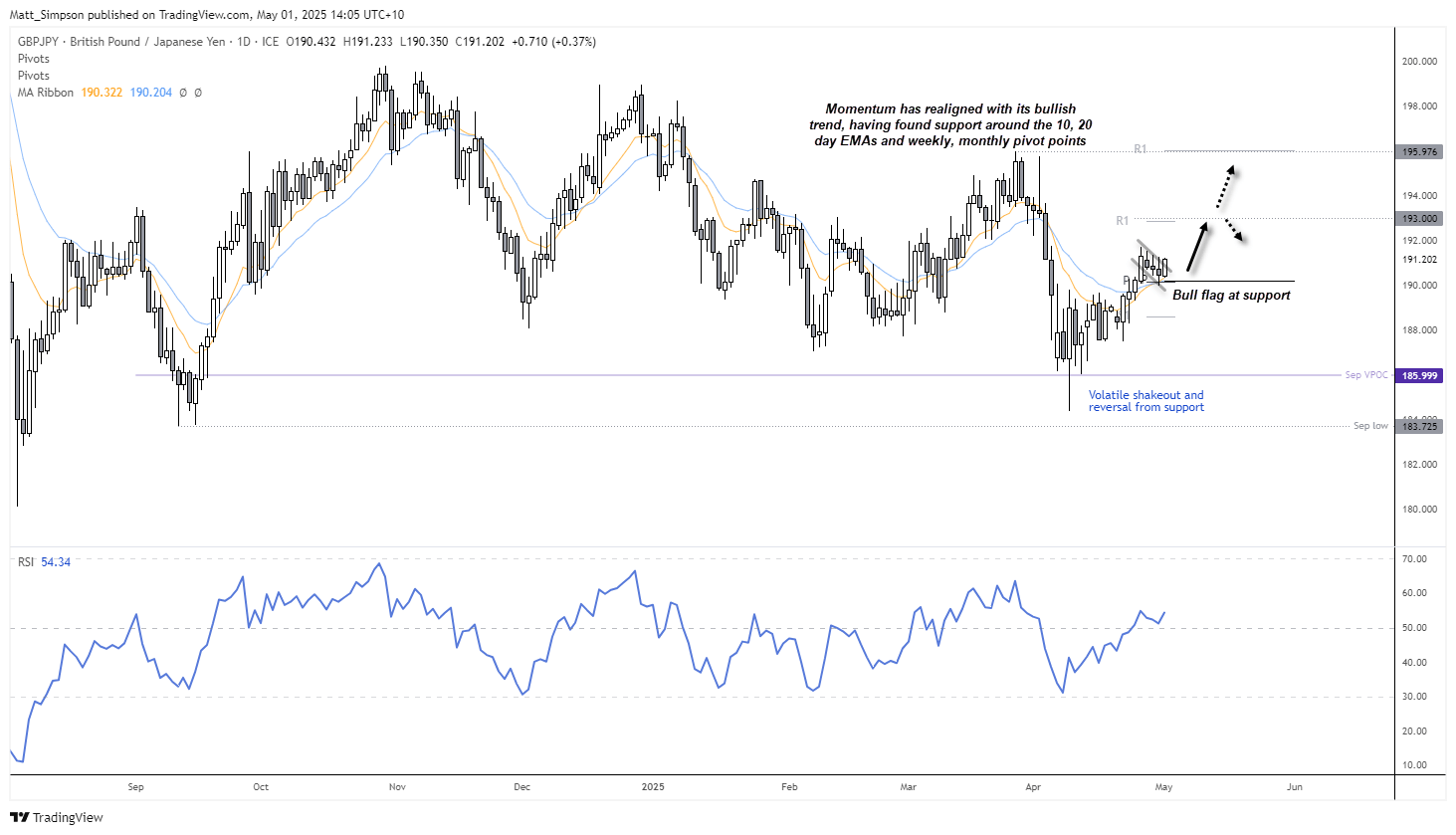

GBP/JPY Technical Analysis: British Pound vs Japanese Yen

The daily chart has been trending higher since GBP/JPY staged a volatile shakeout and reversal around the 186 support level. While GBP/JPY has printed three down days since Friday’s high, they appear to be part of an orderly and shallow correction within a strong bullish trend. Support was also found around the 10- and 20-day EMAs, as well as the weekly and monthly pivot points.

Momentum has clearly realigned with the bullish trend, so I’m now on guard for GBP/JPY to break to a new cycle high. The bias is for a move towards 193, near the weekly R1 pivot.

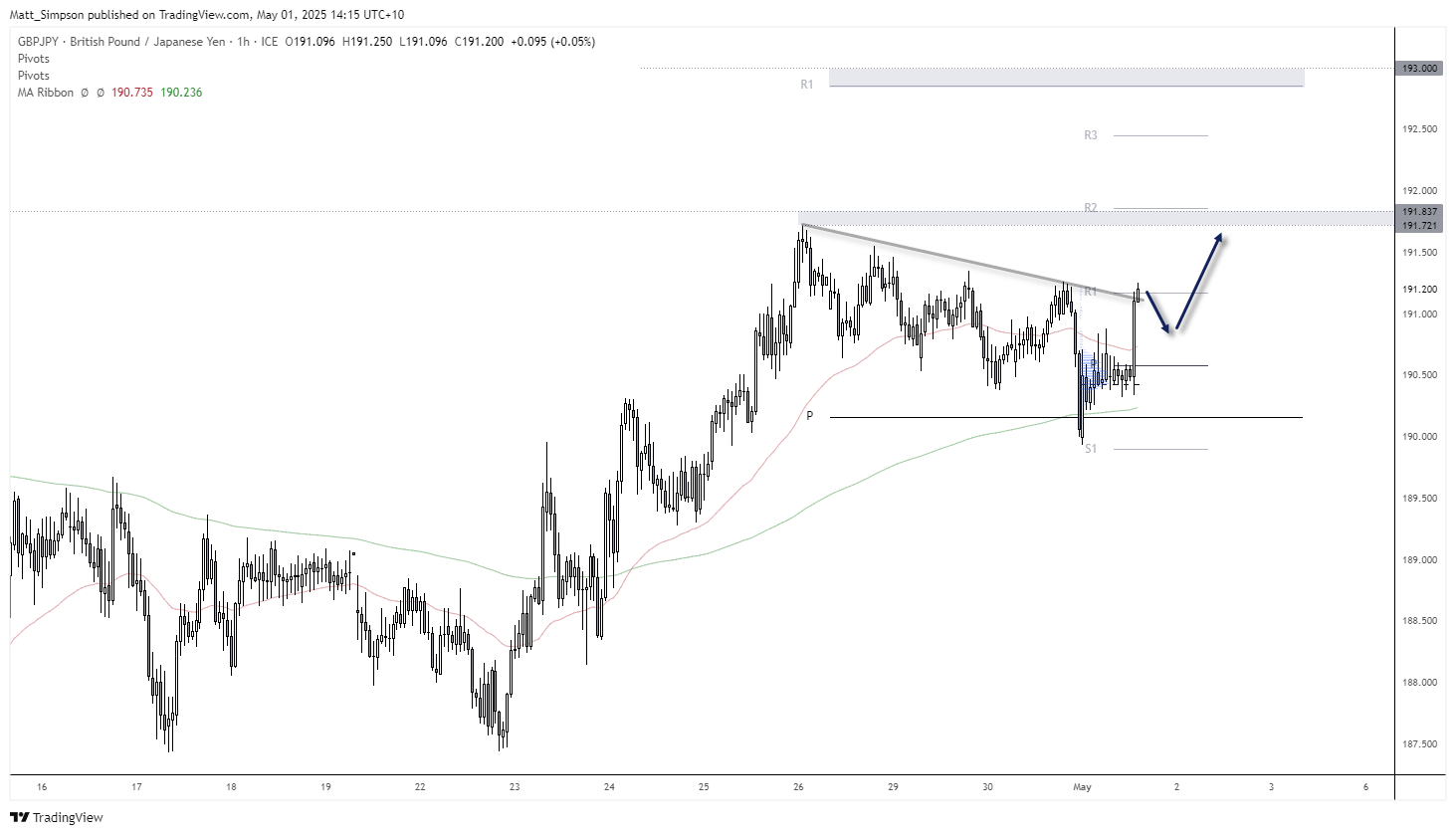

GBP/JPY 1-hour chart

The 1-hour chart highlights the burst of bullish momentum following the BoJ decision. Notably, support was found around the 200-day EMA before bulls regained control.

Resistance has been met around the daily R1 pivot (191.60) and the 191.27 highs, so perhaps GBP/JPY will offer bulls a pullback opportunity — either to reload or to join the move higher. Note that the daily R2 pivot sits just above the 191.72 and 191.84 highs, making it a viable target for bulls ahead of a larger move to 193.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge