Despite the sharp declines seen in USD/JPY in recent sessions, a recovery of nearly 1% has been observed, favoring the U.S. dollar. This rebound came shortly after the release of the Non-Farm Payroll (NFP) data in the United States. However, economic uncertainty remains elevated and may continue to impact the pair’s short-term movements.

NFP Day Arrives

The U.S. Non-Farm Payrolls report surprised the market with the addition of 228,000 new jobs, far exceeding the 137,000 expected. This also marks an increase from the 117,000 jobs reported in March.

The market reacted quickly, as the improvement in employment figures has fueled speculation about upcoming Federal Reserve decisions. According to recent statements by Fed Chair Jerome Powell, one of the possible side effects of the current trade war could be a rise in inflation. The stronger labor market may further stimulate domestic consumption, adding pressure to already rising inflation levels. As a result, the Fed is expected to maintain a neutral monetary policy stance in the near term, aiming to contain inflation within its 2% target.

In this context, the CME Group’s FedWatch Tool currently shows a 68.2% probability that the interest rate will remain within the 4.25%–4.5% range at the upcoming May 7 meeting.

Source: CME Group

A steady rate outlook in the U.S. suggests that fixed-income returns may remain attractive in the short term, which has supported renewed demand for the dollar. However, it’s important to note that the Japanese yen is also considered a safe haven asset, especially during periods of heightened uncertainty. The evolution of USD/JPY will largely depend on how investors seek safety if uncertainty continues to rise.

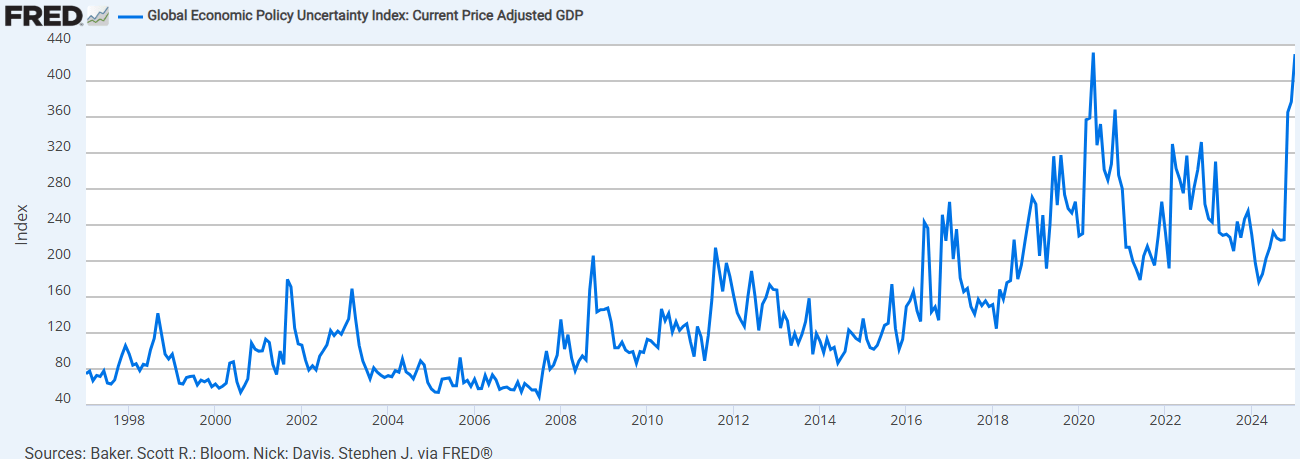

Confidence and Risk Perception

The Global Economic Policy Uncertainty Index, which tracks global economic and political uncertainty, recently exceeded 400 points — a level not seen since 2020. Generally, readings above 200 already reflect a highly uncertain market environment.

Source: FRED

In this context, the Japanese yen could once again gain strength as a preferred safe haven. If global uncertainty persists and investors begin to view the U.S. as a riskier market, the yen could regain appeal, exerting renewed downward pressure on USD/JPY — even though that pressure has eased slightly following the recent NFP data.

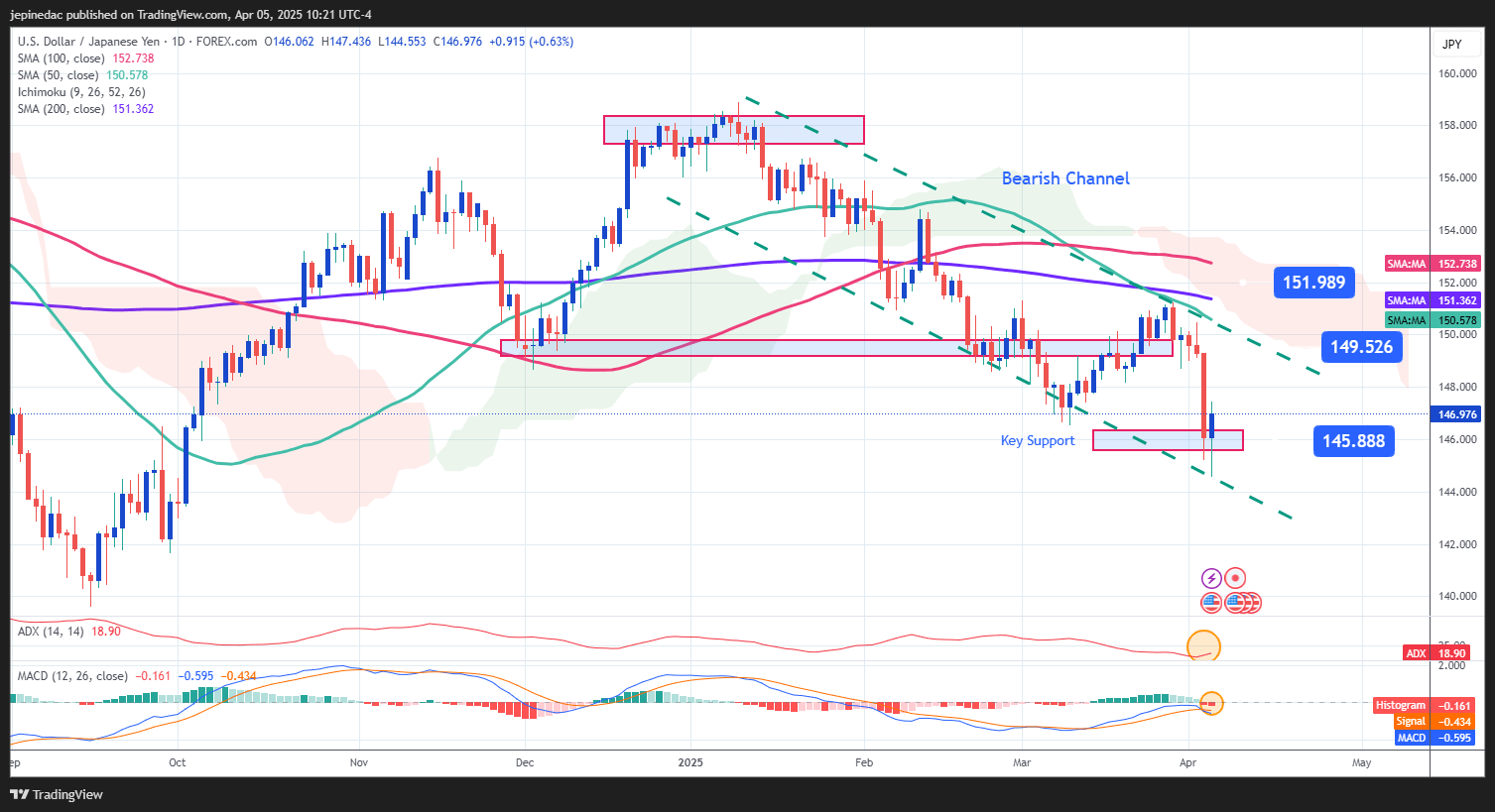

USD/JPY Technical Outlook

Source: StoneX, Tradingview

- Bearish Channel Remains Intact: Since January 2025, USD/JPY has traded within a clear descending channel, with no bullish momentum strong enough to break above it. Currently, the price is undergoing a mild upward correction, which has led to a neutral phase around a key technical area. However, the current buying pressure appears insufficient to invalidate the bearish structure in the short term.

- ADX: The ADX line continues to rise gradually and is approaching the neutral threshold of 20, indicating that bearish pressure may gain strength and lead to the formation of a clear trend if the slope continues.

- MACD: The MACD histogram has crossed above the zero line for the first time in several sessions, signaling the start of a bearish bias in the average strength of the moving averages. If the histogram continues to move away from zero, selling pressure on USD/JPY could intensify in the coming sessions.

Key Levels:

- 149.526 – Near resistance: This level lies at the top of the descending channel. It may act as a short-term resistance area if buying sentiment stabilizes.

- 151.989 – Distant resistance: This zone aligns with the 100- and 200-period moving averages, along with the Ichimoku cloud. Price action near this level could challenge the current bearish formation.

- 145.888 – Key support: This marks the lower bound of the descending channel. A break below this level would reinforce the downtrend, signaling a more sustained bearish move.

Written by Julian Pineda, CFA – Market Analyst