USD/JPY Under Pressure as Safe-Haven Demand Lifts Japanese Yen

The Swiss franc (CHF) and Japanese yen (JPY) are the strongest-performing currencies in Asia today, benefiting from a mild risk-off tone. Escalating tensions between the United States and Iran drove crude oil prices 4.8% higher on Wednesday, with an additional 2% gain seen in early Asian trade. Although those gains have since been partially retraced, the sharp price action out of the Middle East has overshadowed optimism from the US–China trade deal.

As a result, US Treasury yields have edged lower, with investors rotating into traditional safe havens such as the Japanese yen, Swiss franc, gold, and US bonds. The risk-averse mood has added further weight to the US dollar, while amplifying support for the CHF and JPY across the forex majors.

View related analysis:

- AUD/USD Outlook: Headwinds from China Data and RBA Policy

- US Dollar Outlook: Don’t Write Off the USD Just Yet

- Gold Outlook: Seasonal Weakness and Fading Momentum Hint at June Pullback

- USD/CAD, AUD/JPY Outlook: Trade Hopes Fuel Commodity FX Strength

USD/JPY Technical Analysis: Japanese Yen Gains as Reversal Deepens

The 1-hour chart for USD/JPY reveals a strong bearish reversal candle at 146.47, followed by a sharp downside move with only a shallow pullback along the way. The US dollar has since fallen below the weekly pivot point at 144.08 and breached the key 144.00 support level, signalling increasing downside momentum for USD/JPY.

However, some support has emerged from the weekly value area high (VAH) at 143.78. Additionally, the 1-hour RSI (2) is now deeply oversold, while the RSI (14) is touching oversold territory. This suggests that Japanese yen strength may pause near current levels. Bears could seek to fade into minor bounces from current support levels or wait for a period of consolidation before entering.

But given the strength of the move from yesterday’s high, a break below 143.78 is favoured and for a run down to 143, near the weekly S1 pivot and weekly and monthly VPOCs.

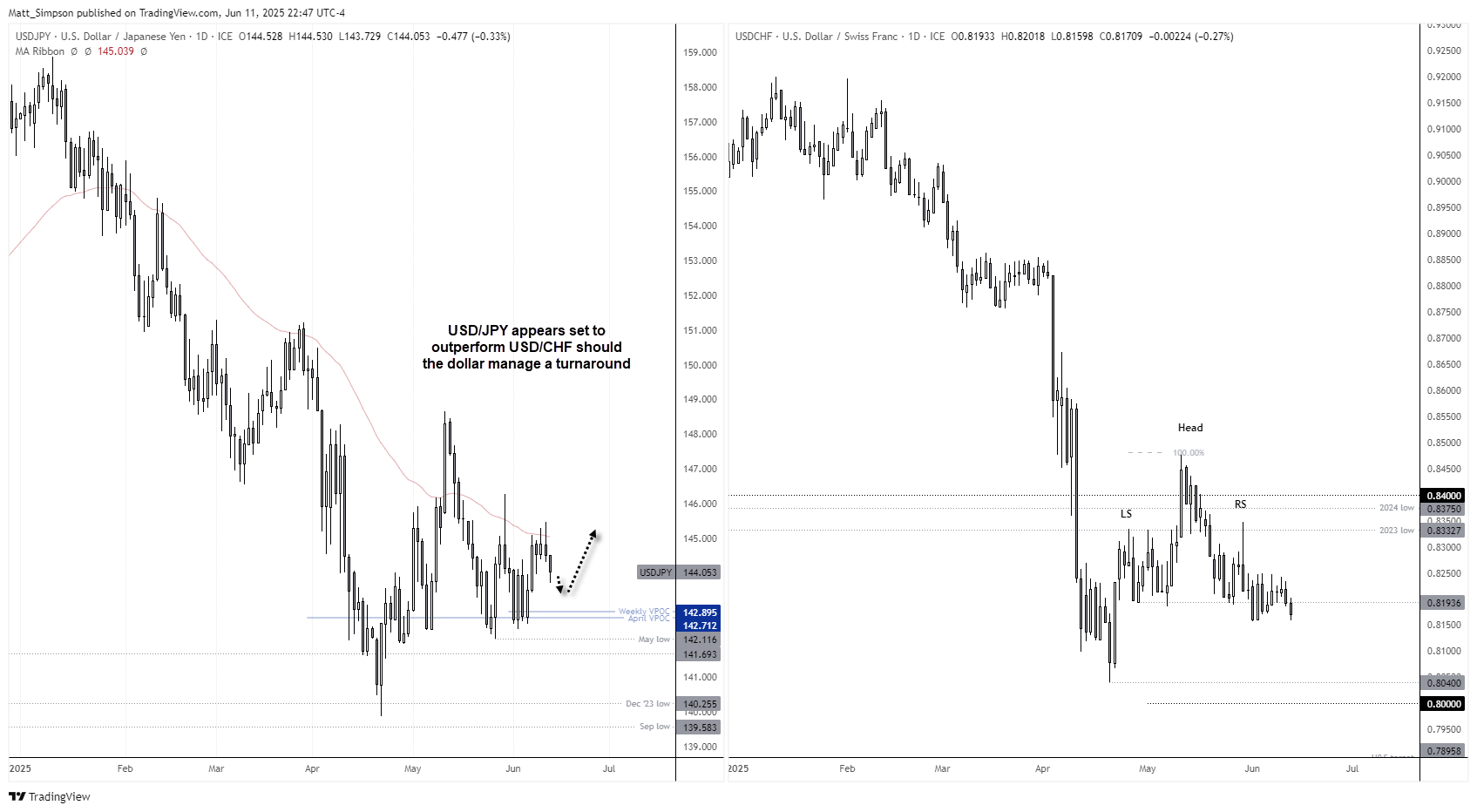

USD/JPY Technical Analysis: Daily Chart

Zooming out to the bigger picture reveals a strong cluster of support levels just above the May low, below 143. Breaking through these levels would likely require a hawkish outcome from the Bank of Japan (BOJ) meeting. But with Reuters reporting that the BOJ is likely to hold steady, meaningful action on Friday appears to be a long shot.

As I noted in my article “Don’t Write Off the US Dollar Just Yet”, the USD bounce against the Japanese yen has been more successful than against the Swiss franc. My bias, therefore, remains for the US dollar to resume its recovery once the anticipated retracement lower on the 1-hour timeframe is complete.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge