USD/JPY Talking Points:

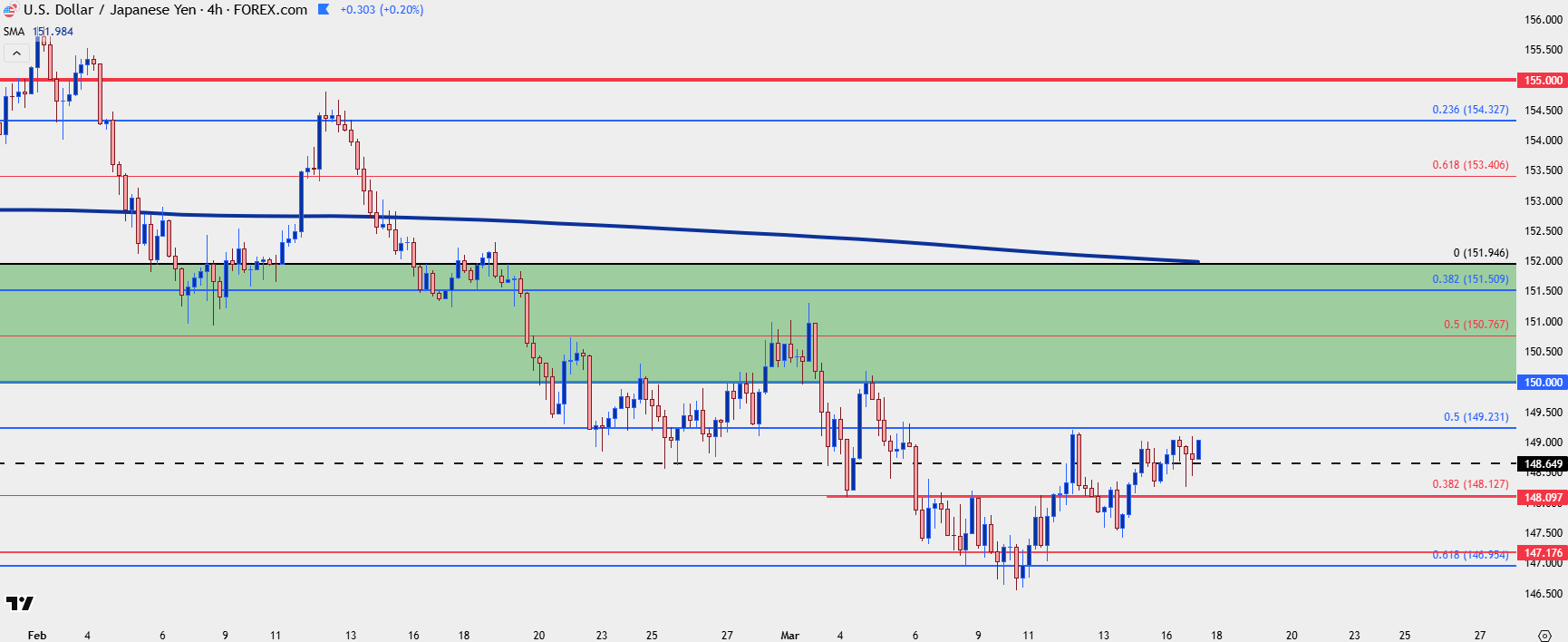

- Despite continued U.S. Dollar weakness, USD/JPY is continuing a pullback while holding short-term higher-highs and lows on the four-hour chart.

- This week brings both a Bank of Japan rate decision and an FOMC rate decision. While USD/JPY has been in a grinding bearish trend for most of this year, there’s been several bear traps brewed along the way, making it even more dangerous to chase the pair lower.

USD/JPY has been in a grinding bearish trend since January 10th, with the pair topping a few days ahead of the recent high in DXY that showed up on the 13th of that month. But despite the continued sell-off which has held with a degree of consistency, it hasn’t exactly been simple for traders as there’s been several bear traps brewed along the way, with bears failing to force continued breakdowns on numerous prints of fresh lows.

This week brings the potential for change: The Bank of Japan hosts a rate decision on Tuesday night/Wednesday morning, and the Fed follows on Wednesday afternoon. Neither bank is expected to make any actual changes to rates, but this is where the innuendo can become important as traders will be looking for any signs of possible change down-the-road.

Around the Bank of Japan, the expectation seems to be aligning for another rate hike in the second half of this year. Around the Fed, the expectation for cuts has been increasing of late, although inflation still adds a massive question mark around when, how or even if the Fed will be able to cut anytime soon.

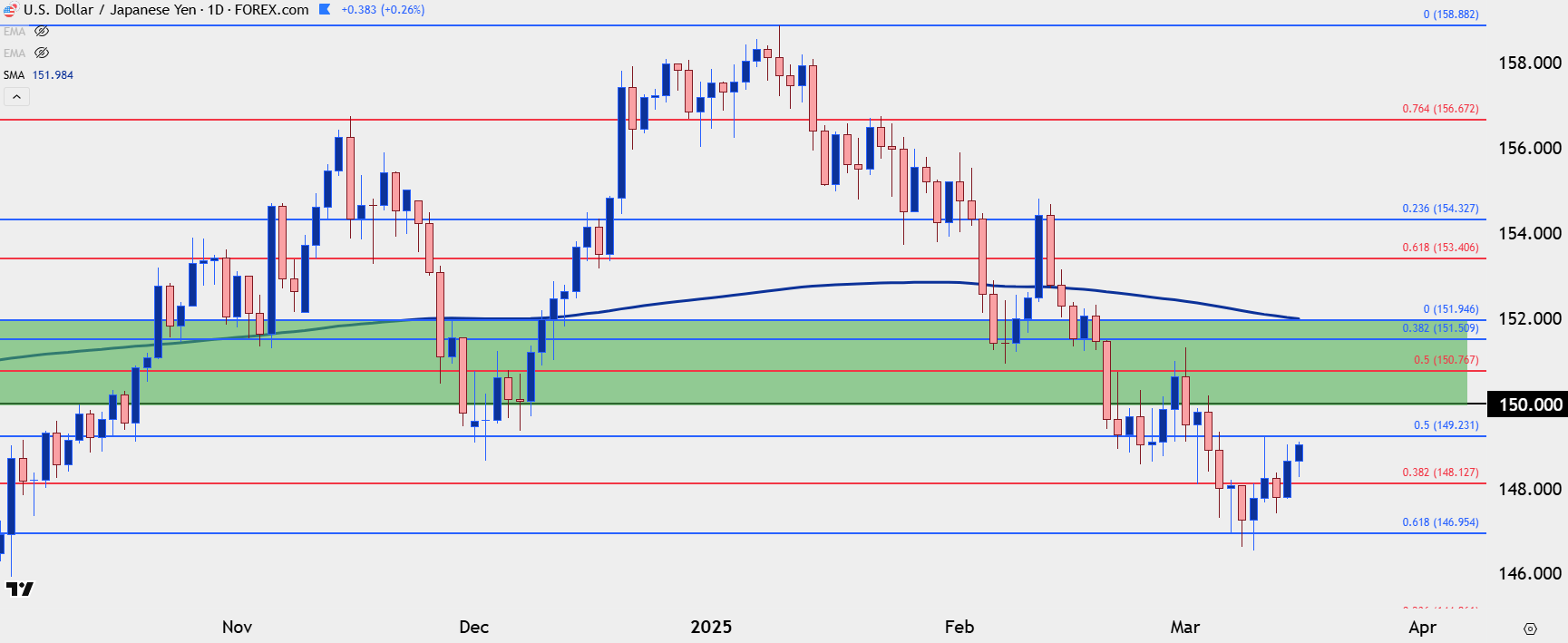

In USD/JPY, the price action so far this year has been clear with a consistent sell-off that’s run for the past two months. Despite the consistency, it still hasn’t been a simple or easy move to work with as there’s been a penchant for support to show soon after breakdowns, leading to pullbacks in the pair, like what’s showing right now after last week’s hold around the 147.00 level.

USD/JPY Daily Price Chart

USD/JPY Bearish Trend Potential

At this point USD/JPY is pulling back even as the U.S. Dollar sits near recent lows, and this highlights a bit of Yen-weakness in the mix. This doesn’t necessarily preclude bearish continuation in the pair, but as I’ve been discussing, it does highlight the need to have respect for the bear traps that have shown up of late; and rather than chasing the pair lower, a more attractive way forward could be waiting for an area of lower-high resistance to come into play.

Last week showed a lower-high at a Fibonacci level that was previously support, plotted at 149.23. But the sell-off from that level has held a higher-low, and that keeps the door open for a push-higher.

If 149.23 is going to hold lower-high resistance, there would need to be a strong showing from bears to indicate that it may hold, otherwise, the look for resistance goes-higher with the 150.00 psychological level sitting overhead. Above that, Fibonacci levels at 150.77, 151.51 and 151.95 loom large, with that last price nearing confluence with the 200-day moving average.

If we do see that final level come into play the shorter-term chart is probably going to look pretty bullish at that point, but keep in mind, the two rate decisions this week present a host of unknowns, and a pullback of that nature could turn out to be a short squeeze type of scenario on a shorter time frame.

USD/JPY Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist