The Mexican peso has now posted more than two consecutive sessions of gains against the U.S. dollar, with the USD/MXN currently retreating by nearly 1%, holding at the key support level of 19.50 pesos per dollar. The bearish pressure has remained steady following the most recent decision by the U.S. Federal Reserve. The market appears to remain focused on the evolving political and economic uncertainty, which has reinforced the bearish outlook for the dollar.

Uncertainty Persists

The continued weakness of the U.S. dollar seems to be driven by the increasing political and economic risk in the United States. Despite President Trump’s efforts to make progress in trade negotiations, the lack of clarity surrounding the resolution of the trade war has started to raise concerns about a possible economic slowdown.

At the same time, regions like Europe are reportedly considering imposing up to $100 billion in tariffs on the U.S. if negotiations fail to reach a meaningful outcome. This has intensified concerns about the U.S. economy and further eroded short-term confidence in the dollar.

In this context, Mexico appears to be benefiting in the short term, as the peso is viewed as one of the emerging market currencies best positioned to absorb dollar volatility. Additionally, the growing attention to the nearshoring phenomenon—the relocation of production processes to Mexico to export goods to the U.S. at lower costs—is driving a significant increase in foreign direct investment and improving the country’s economic outlook. This has strengthened confidence in the peso and become a key factor in maintaining bearish pressure on the USD/MXN. If these conditions persist, selling pressure could intensify further.

Is the Fed No Longer Enough to Support the Dollar?

The Federal Reserve released its monetary policy decision yesterday, keeping the interest rate steady at 4.5%. The central bank stated that this neutral stance is necessary due to the risk that trade tensions could spark inflation, which it is not willing to tolerate.

However, it was also noted that the U.S. economy could face stagflation, a scenario characterized by simultaneous high inflation and rising unemployment. These comments have added to the growing skepticism about the U.S. economic outlook, giving investors enough reason to reduce their exposure to the dollar.

In contrast, the situation in Mexico is different. Banxico is set to release its next interest rate decision on May 15, and has indicated it may continue cutting rates, as it has done in previous meetings. The benchmark rate currently stands at 9%, with further cuts likely, reinforcing expectations for a more flexible monetary cycle in the short term.

As of now, the rate differential—9% in Mexico vs. 4.5% in the U.S.—has increased the appeal of the peso versus the dollar, especially in light of the more fragile outlook for the U.S. economy. This could be a key driver of peso strength in upcoming sessions.

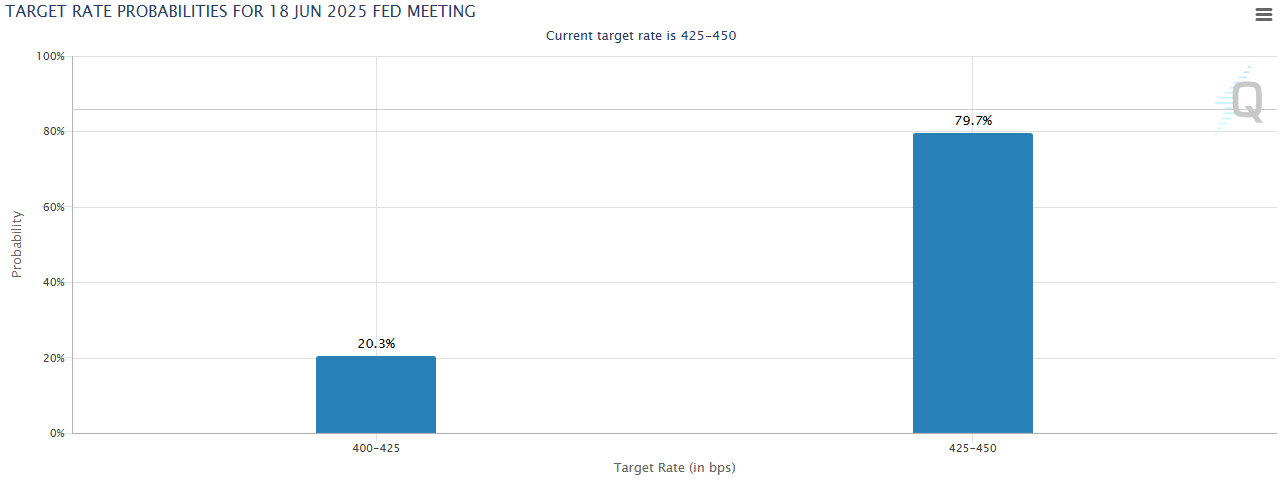

In the longer term, however, things could change. The U.S. still maintains a hawkish interest rate outlook, and CME Group shows a 79.7% probability that the Fed will hold the rate at 4.5% at its June 18 meeting. Meanwhile, Banxico has maintained a dovish stance, and if this continues, Mexico's rate could decline further over time.

Source: CME Group

With this in mind, a potential turning point could emerge if demand for U.S. Treasury bonds rises again, supported by stable rates in the U.S. while Mexico continues cutting. This combination could boost the relative appeal of dollar-denominated assets, reigniting demand for the U.S. dollar and helping to counteract its current weakness in the coming months.

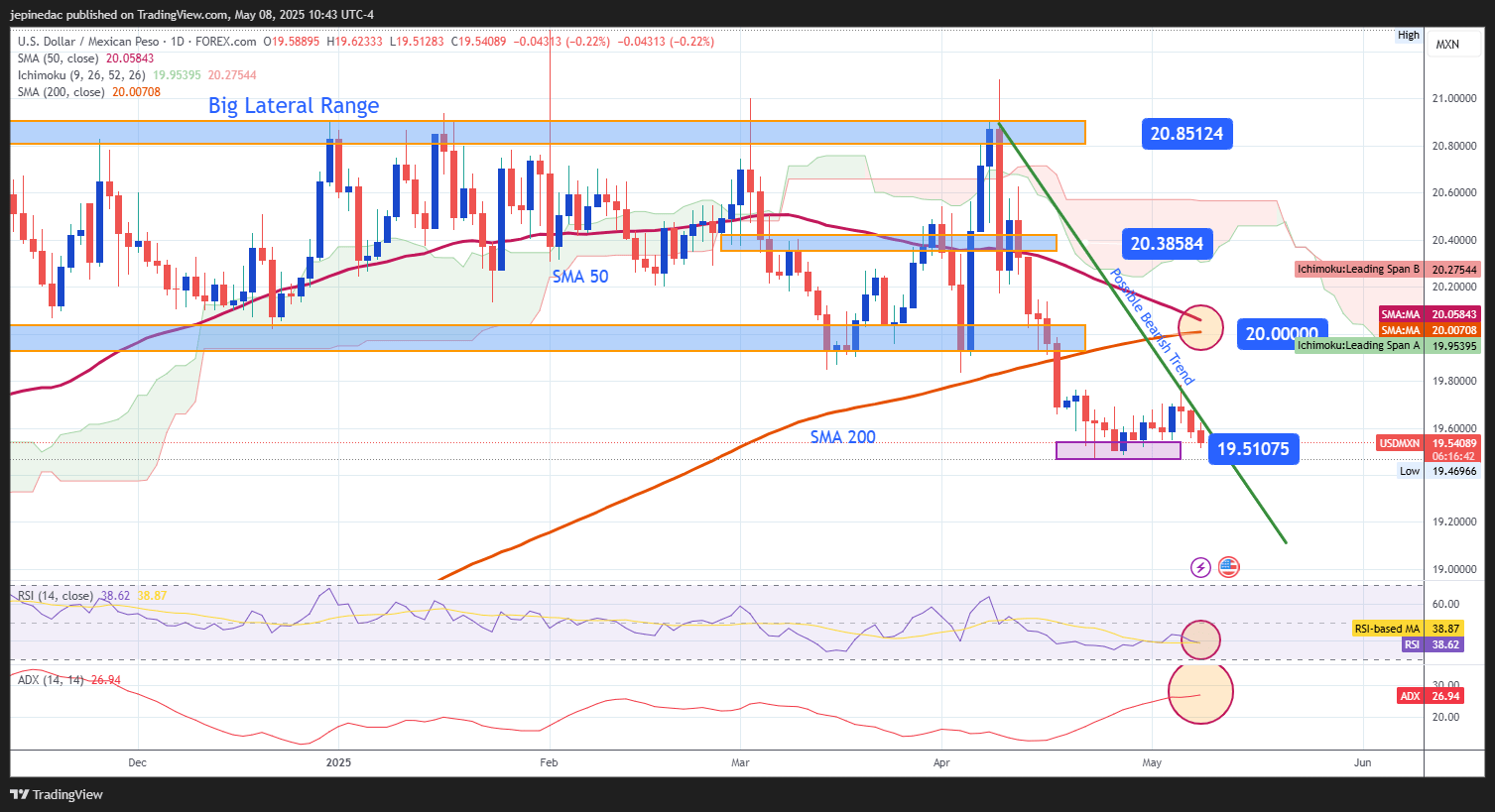

USD/MXN Technical Outlook

Source: StoneX, Tradingview

- Persistent Downtrend: Since April 9, a clear downtrend has developed, with price holding below the 20 pesos per dollar mark. However, this trend now appears to be entering a consolidation phase near the current support level. If this neutrality persists, we may see a pause in the downward trend in the short term.

- Possible Death Cross: Currently, the 50-period moving average maintains a downward slope and is approaching the 200-period moving average. If this move continues, a death cross could form in the coming sessions—an important technical signal that could strengthen selling pressure and revitalize the bearish trend.

- RSI: The RSI line remains below the neutral 50 level, indicating that bearish momentum continues to dominate. If this pattern holds, it could further fuel downside pressure on USD/MXN.

- ADX: The ADX remains above the neutral 20 level, suggesting that volatility could increase, favoring broader price swings in the pair.

Key Levels to Watch:

- 20.38 – Key Resistance: Aligns with the midpoint of the former lateral channel that held for several months. A rebound to this level could reignite strong bullish momentum.

- 20.00 – Nearby Resistance: A key psychological level, aligned with both the 200-period and 50-period moving averages. A move toward this zone could break the current downtrend and signal a new bullish phase.

- 19.50 – Crucial Support: Represents recent lows and has acted as a barrier to selling pressure. A sustained break below this level could reactivate the bearish bias and trigger a new leg down in USD/MXN.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25