BP & oil majors in focus as oil remains volatile

BP surged 6% last week, its strongest weekly performance since mid-April, as oil prices soared. Oil jumped 13% last week, adding to 6% gains in the week before, as tensions in the Middle East ramped up.

At the end of last week, Israel launched an attack on Iran's nuclear and ballistic missile sites. Iran retaliated across the weekend, launching missiles at parts of central and northern Israel. The escalation of tensions has raised concerns about potential disruption to oil and gas supplies in the Middle East, lifting the price on Friday, with further gains possible at the start of the week.

The market will continue watching developments here closely. Should tensions escalate further, the oil price could push higher, and oil majors would likely track oil prices higher.

Any sense that the situation is de-escalating could see the risk premium on oil prices ease, pulling the price lower. Oil majors could fall under these circumstances.

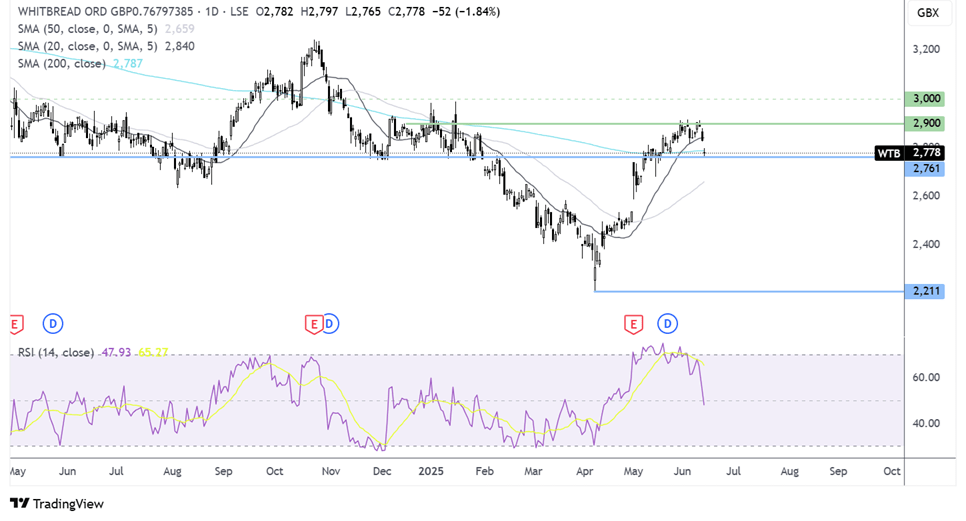

How to trade BP amid volatile oil prices?

BP has recovered from support at 346, rising above the 50 and 200 SMA as buyers look towards 400p. The aggressive break above the 200 SMA, combined with the RRSI above 50, keeps buyers hopeful. A rise above 400 opens the door to 445p, the March high, and beyond there, 455p, the February high, comes into focus.

On the downside, immediate support is at the 200 SMA at 390p. Below here, 355p comes into play ahead of 346p, the 2025 low.

Berkeley Group

Berkeley Group's share price could experience some volatility this coming week, with the BoE rate decision on Thursday and its full-year results on Friday, June 20. The housebuilder's share price is up 10% year to date.

The Bank of England is expected to leave interest rates unchanged at 4.25% and will likely retain its guidance of careful, gradual, meeting-by-meeting rate cuts in light of the outlook uncertainty and following hotter-than-expected inflation data. However, there are signs of weakness in the UK labour market, particularly as wage growth slowed more than expected. Any sense of a more dovish stance from the central bank could raise BoE rate cut expectations and boost house builders.

Meanwhile, in the trading update in March, Berkeley reaffirmed its earnings guidance of delivering £975 million in pretax profits in its 2025 and 2026 fiscal year, which is expected to be £525 million this year and £450 million for the coming year. Completions are expected to be around 4000 in each of the years versus 3521 last year; however, the average selling price is expected to have fallen from £611,000 this year to £568,000 next year. Any updates surrounding its cash return plans will also be watched closely, with the firm currently aiming to return £238 million to shareholders via buybacks and dividends.

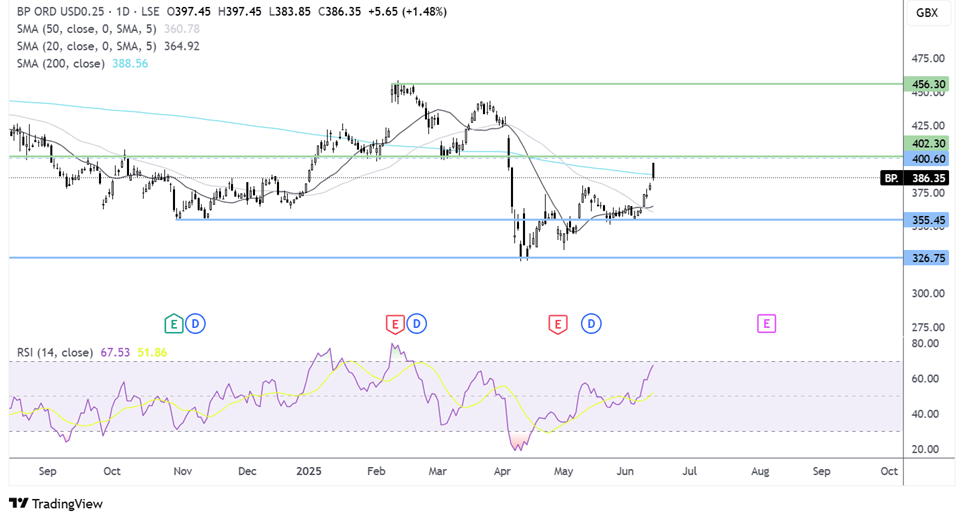

How to trade BKG results?

The share price has recovered from the 3750p April low, rising above the falling trendline dating back to August last year and the 200 SMA to a peak of 4370. The price is setting resistance here, with a rise above this level needed to extend gains towards the 4600p round number and 4860, the October 2024 high.

Whitbread trading update

According to numbers released in May, the Premier Inn owner, Whitbread, saw profits fall in its 2025 fiscal year. The hotel owner highlighted rising costs due and the impact of its accelerated growth plan. Adjusted pre-tax profits fell 14% to £483 million, whilst revenue was down 1% for the year at £2.92 billion.

Whitbread also reported a softer start to the current year, with UK accommodation sales falling 1% in the first seven weeks of trading. However, Whitbread noted that forward-booked positions were ahead of the previous year.

However, it's worth noting that the sector peer Travelodge's first quarter update was less than encouraging. This suggests that Whitbread's trading statement this week may not show any improving trends as hotel prices show some softness.

The German division was much stronger last year, and investors will be keen to see if it's still on track to deliver a strong contribution this financial year.

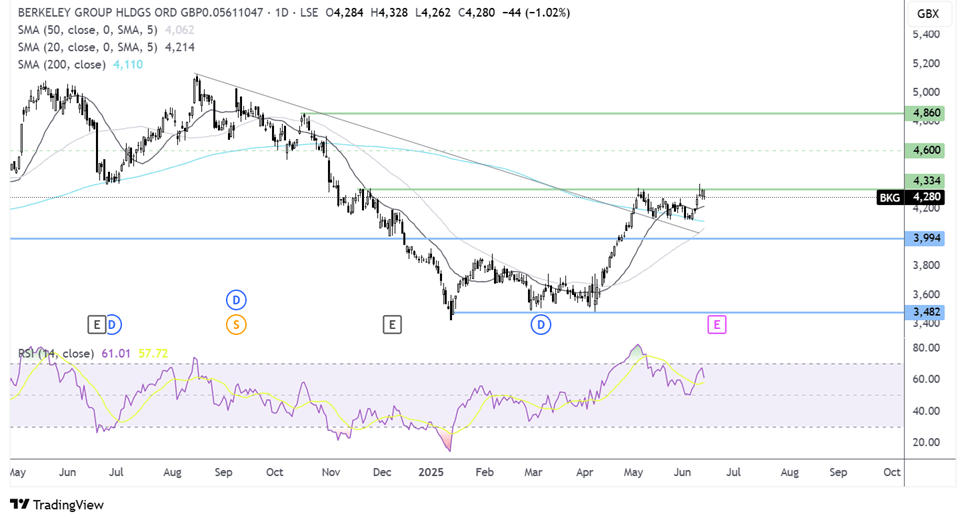

How to trade WTB update?

The Whitbread share price recovered from the 2320 April low, rising to 2915 before easing lower. The price is testing the 200 SMA support around 2800. A break below here at 2760 horizontal support could pave the way for a deeper selloff to the 50 SMA at 2650.

Should buyers successfully defend the 200 SMA, buyers will need to rise above 2900 to createa higher high and extend gains towards 3000.