Broadcom earnings forecast

Broadcom will release earnings after the close on Thursday. They come after Nvidia jumped last week following another blowout quarter, despite a warning over the impact of export controls limiting chip sales to China.

Nvidia posting revenue ahead of expectations shows that demand remains strong amid the rollout of AI and that Nvidia remains the dominant force in the market. However, the market could well be showing signs that it's large enough to accommodate more than just one player, so Broadcom's chips could help it grow its market share.

The forecast for Broadcom Q2 revenue is broadly in line with the company's guidance of $14.9 billion, up around 19% from the same period last year. While AI represents a growing share of Broadcom's revenue base, more sales are still coming from non-AI workloads, which leaves the firm exposed to cyclical trends. Over 20% of revenue comes from China, so investors will be keen to hear of the potential impact of US restrictions and tariffs.

Broadcom shares jumped after its March Q1 results, which beat on both the top and bottom line thanks to AI chip sales. However, the share price has since given up gains and is up just 4.4% year to date.

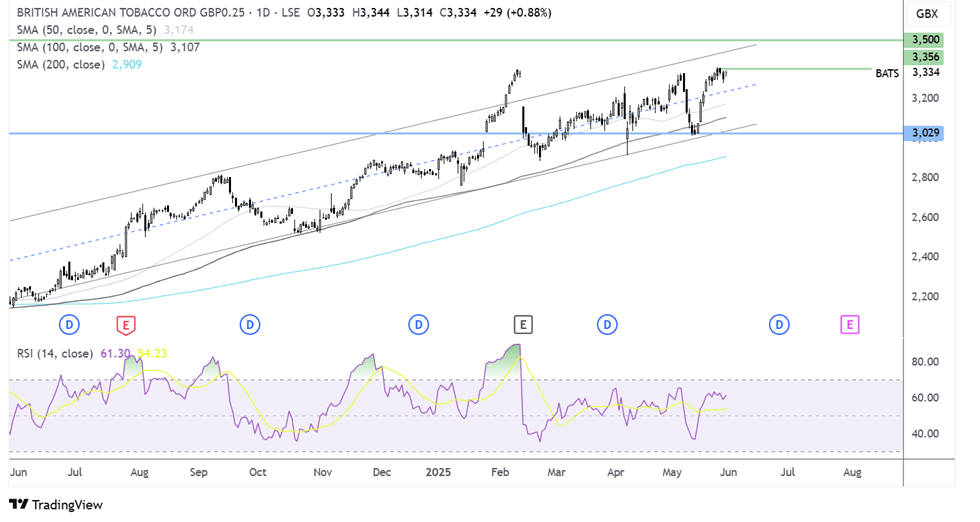

How to trade AVGO earnings?

Broadcom's share price has recovered from the 153 April low, rising above the 200 SMA to a peak of 246. However, the RSI is deeply overbought, so buyers should be cautious. There could be some confirmation or a pull lower on the cards. While the price holds above 220, the uptrend remains intact. Buyers will look to rise above 250 to fresh record highs.

Lululemon earnings preview

The athletic wear retailer will post first quarter results on Thursday, June 5, as the share price trades down year to date. The Lululemon share price dropped sharply after its earnings outlook disappointed investors despite the firm posting stronger-than-forecast quarterly profit. The share price dropped after disappointing earnings guidance. For the fiscal year, expectations are for EPS in the range of $14.95 to $15.15, which was below expectations of $15.37.

Expectations for the current quarter are for EPS to be $2.58, up 1.6% from the year-ago quarter. Revenue is expected to be between $11.15 and $11.3 billion. The firm said in the previous earnings call that they were not expecting store traffic to improve this year after soft numbers in Q1.

The earnings come amid concerns over deteriorating consumer confidence and reduced personal spending, which were seen in Friday's data. The market will be looking closely at management's comments about consumer spending and US traffic.

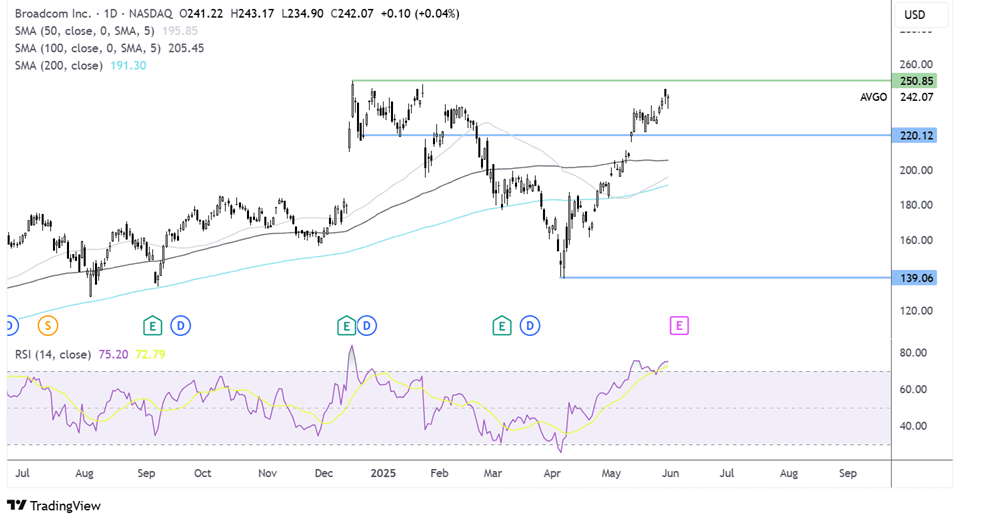

How to trade LULU earnings?

The share price recovered from the 234 April low, rising above the multi-month falling trendline. However, it ran into resistance at 331 before easing back to around the 200 SMA at 317. The recovery is showing signs of running out of steam, as the RSI points lower.

Should the price drop back below the 200 SMA, this opens the door to 285, the falling trendline support.

Should buyers hold above the 200 SMA, the 230 resistance comes into focus. A rise above here would create a higher high towards 350.

British American Tobacco trading update

BATS ' half-year trading announcement will come on Tuesday, June 3, amid a challenging backdrop.

Expectations are for around a 1% revenue growth for 2025, and adjusted operating profit is forecast to rise between 1.5% and 2.5%. This is amid ongoing pressures, including increased taxes in and Bangladesh and stricter tobacco regulations in Australia.

The firm forecasts a 2% decline in global tobacco industry volumes this year due to declining consumption in developed markets and increased regulatory pressures worldwide.

Meanwhile, the firm continues to invest in “new categories”, including vaping products. Its goal is to become smoke-free by 2035 in pivot towards reduced-risk products.

Still, those products face intense competition, and market gains or losses will be closely monitored as the firm leans more heavily on this area, which grew 8.9% last year.

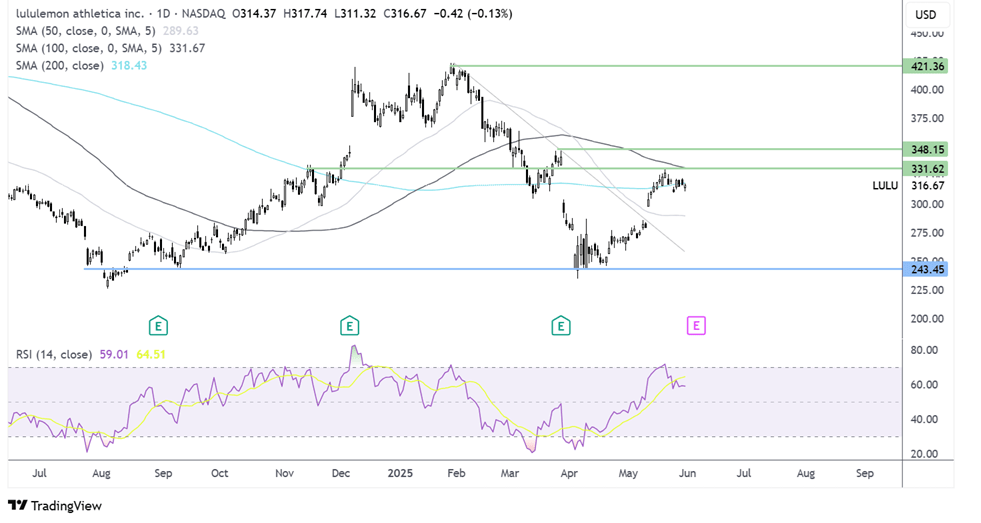

How to trade BATS trading update?

BATS continues to trade in a rising channel, reaching a record high of 3360 this week. The price trades above its upward-sloping 50, 100, and 200 SMAs, and the RSI is above 50, supporting further upside. Buyers will look to extend gains towards 3500 and beyond towards 4000.

Support can be seen at 3240, the midpoint of the rising channel and 3000, the psychological level & the lower band of the rising channel