Nvidia Q2 earnings preview

Nvidia reports after the close on Wednesday, May 28. Investors will be looking for an update from the AI chip maker, which has been caught up in Trump’s trade policy turmoil. Last quarter, the AI darling broke records by reporting almost $40 billion in revenue.

Nvidia CEO Jensen Huang has previously warned of a “tremendous loss” as export controls limit US access to China's market. Looking at the numbers, Nvidia has warned of $5.5 billion in charges in the first quarter 2026 related to H20 products as the US requires a license now to export to China.

Q1 expectations are for EPS of $0.92 and revenue of $43.09 billion. Data centres are still considered the key revenue driver at $39.07 billion. Profit margins are expected at 71%. Meanwhile, the outlook for Q2 revenue is $46.59 billion with EPS of $1.01.

How to trade NVDA?

Nvidia has recovered from its 86.60 2025 low, extending gains above the 200 SMA and the falling trendline dating back to the record high of 152, to a recent peak of 137.40 last week, before easing lower. The price holds above its 200 SMA but failed to retake 143, the February high. Buyers will need to take 137.40 and 143.00. Support is seen at 126, the 200 SMA, and 120, the falling trendline support.

Salesforce Q1 earnings preview

Salesforce will release Q1 fiscal results 2026 on May 28th and expectations are high. The firm continues to benefit from the growing trend of digital transformation, with more businesses moving to the cloud and looking for ways to integrate AI into their operations.

Even though the broader economy is facing headwinds from several directions, the company has been selected to post reasonable revenue profit growth, particularly as it is also gaining traction in international markets.

Salesforce AI tools, especially its Einstein analytics platform, are expected to be a key growth driver for Q1. More companies are turning to AI for customer service, sales forecasting, and operational efficiency, and sales forces are moving quickly in this field.

However, Salesforce is not completely sheltered from the broader economic slowdown, and small businesses, which are a big part of its customer base, are watching their budgets more closely.

Expectations are for EPS of 2.55, up 4.5% from a year ago, on revenue of 9.75 billion, up 6.8% from a year ago. Share prices are down 18% year to date.

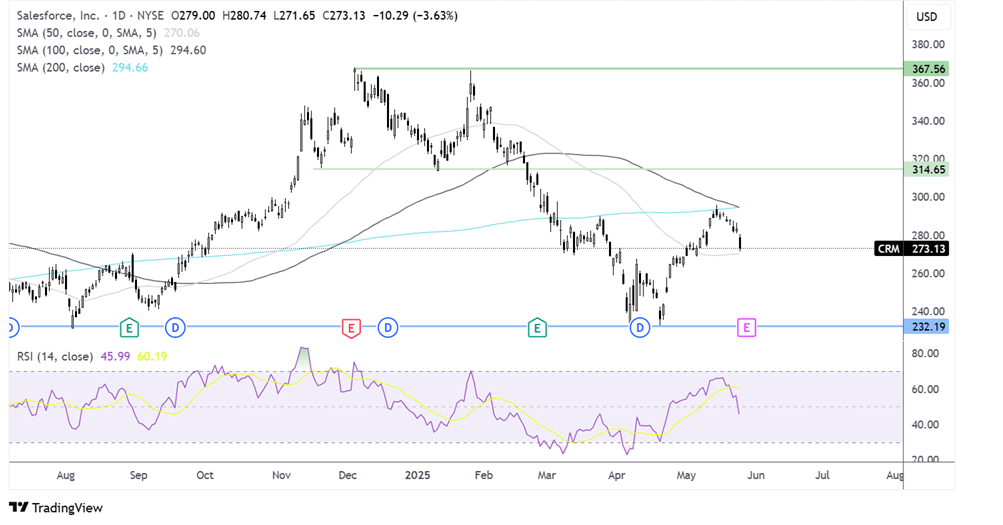

How to trade CRM’s earnings?

The share price recovered from the 230 low, rising to the 200 SMA before falling back to 273. The price trades caught between the 200 & 50 SMA. The RSI below 50 favours sellers. A break below the 50 SMA at 270 opens the door to a deeper decline towards 232.

Buyers will need to rise above the 200 SMA at 294 to create a higher high, and open the door to 315.

Kingfisher Q1 trading update

The B&Q and Screwfix owner will give a Q1 trading update on Wednesday, May 28. The update comes after retail sales unexpectedly jumped 1.2% MoM in April, well ahead of forecasts pointing to strength in consumption, thanks in part to the warmer weather.

This bodes well for the Kingfisher update, as customers are likely to have cheered the warmer temperatures by updating and refreshing their homes and gardens. Furthermore, the end of the stamp duty holiday could also bring a short-term boost to Kingfisher. However, given the deteriorating economic outlook for the UK economy, these boosts could be short-lived.

Meanwhile, consumer confidence in France, another key market, has fallen to a 3-month low.

In the previous financial year, Kingfisher posted a 35% increase in pre-tax profits to £307 million, and a 1.5% increase in sales.

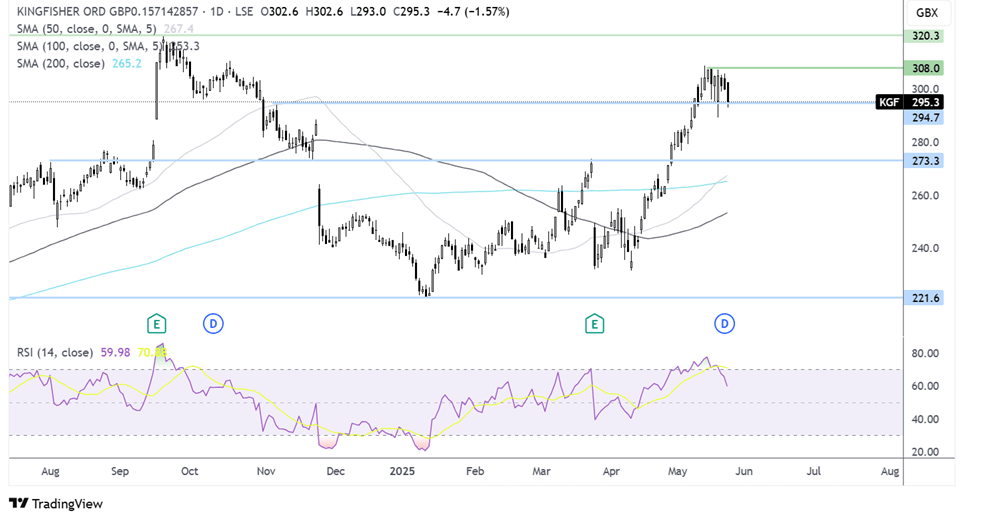

How to trade KGF trading update?

Kingfisher has risen from the 231.50 low, rising to 309, the 2025 high, before easing lower to current levels of 295. The easing lower has brought the RSI out of overbought territory, and the 50 SMA is crossing above the 200 SMA in a golden cross bullish signal.

Buyers will look to rise above 308 to break out of range and head towards 320, the September 2014 high.

Sellers will look to break below 295 support to test 290, last week’s low. Below here 275 comes into focus.