WTI crude oil has rallied 22% since April on improved sentiment, OPEC’s supply cuts, and US–China trade optimism. However, with the World Bank downgrading global growth and the EIA cutting its oil forecast, signs of exhaustion near $66 suggest upside may be limited.

View related analysis:

- USD/CAD, AUD/JPY Outlook: Trade Hopes Fuel Commodity FX Strength

- US Dollar Outlook: Don’t Write Off the USD Just Yet

- Gold Outlook: Seasonal Weakness and Fading Momentum Hint at June Pullback

WTI Crude Oil Rally Stalls as Growth Downgrades Challenge Trade Optimism

Oil prices have been supported in recent weeks thanks to improved investor sentiment, the US driving season, and OPEC’s tapered production cuts. US-China trade talks appear to have gone well, with the US Commerce Secretary announcing that a “framework” has been agreed between negotiators. Details are vague, to say the least, and Trump and Xi will have to approve this alleged framework before a deal is struck. But should the US and China close a deal, it could benefit oil prices — at least to a degree.

However, the World Bank has downgraded global growth for 2025 to 1.4% (-0.9%). And while they do not predict a recession, they have also reduced growth forecasts for 70% of nations. The Energy Information Administration (EIA) also lowered their end-of-year crude oil forecast to $60 due to a reduction in drilling rigs and higher inventories. Their short-term outlook report cited active rigs falling faster than expected in recent Baker Hughes data.

This paints a murkier picture for oil prices overall. And given crude oil has already risen 22% from the April low and hit a technical speed bump in the bullish road on Tuesday, traders may want to tread carefully around these cycle highs.

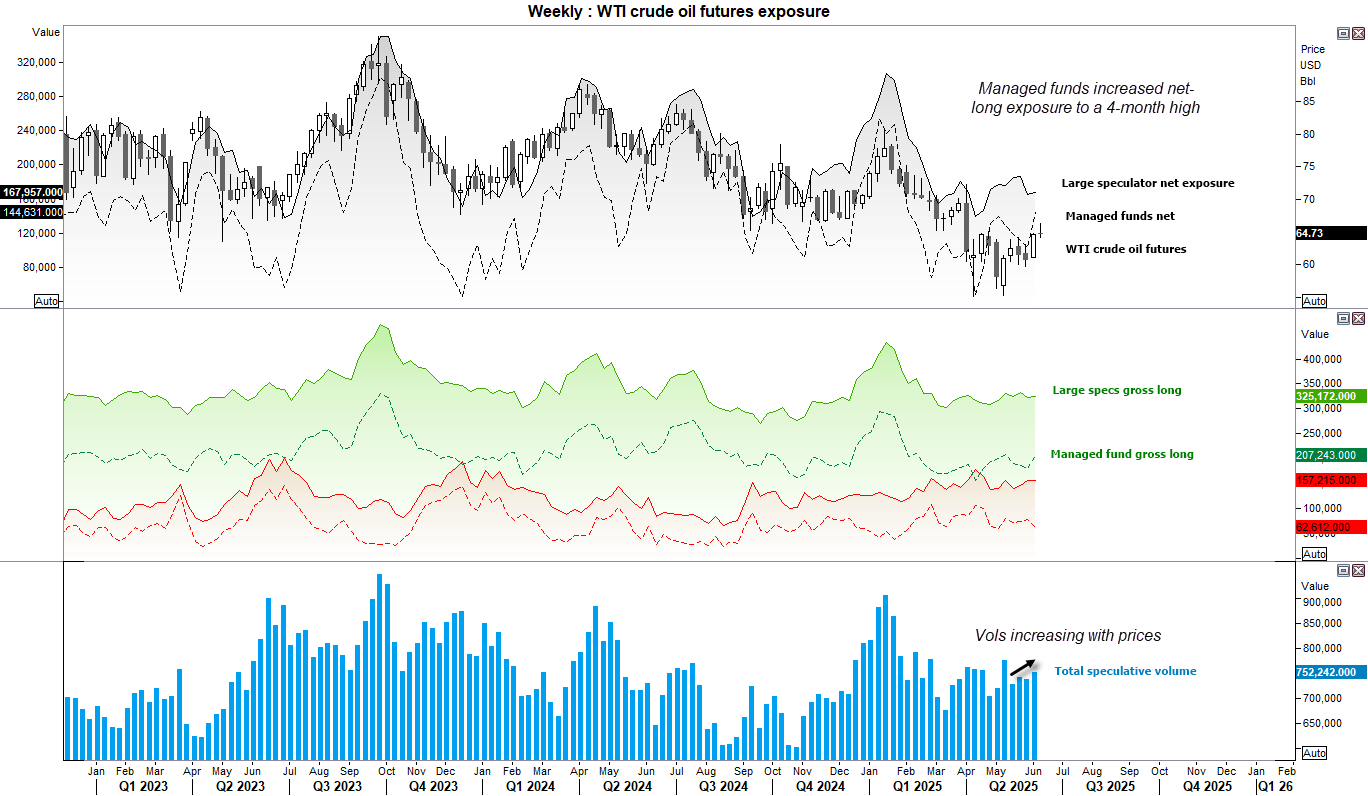

WTI Crude Oil Positioning (CL): Weekly COT Report Analysis

- Manage funds increased their net-long exposure to crude oil futures to a 4-month high (+40.7k contracts)

- They increased gross-longs by 25.9k and reduced shorts by -14.8k contracts

- Speculative volumes (managed funds and large specs combined) has moved higher alongside prices to suggest bullish initiation

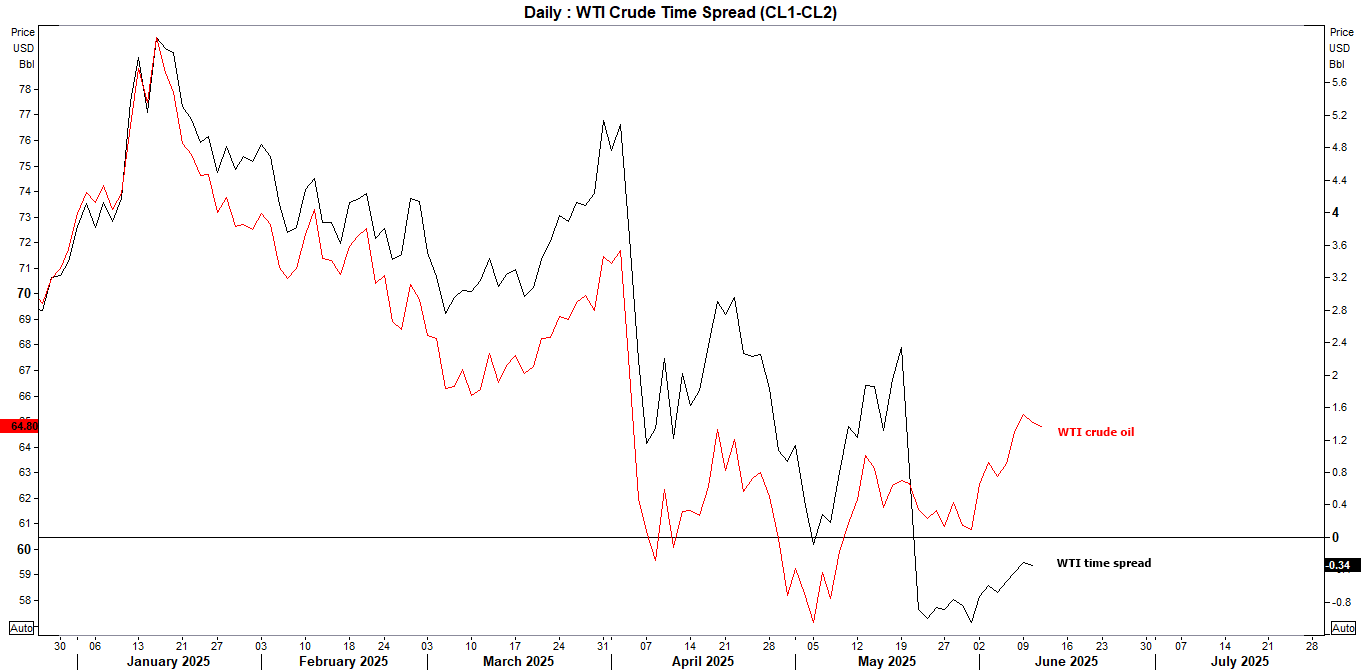

WTI Crude Oil Futures: Time Spread Analysis

The time spread of WTI crude oil refers to the price differential between the front-month contract and the second-month contract. Traders use it to identify contango (when the second-month contract is higher) or backwardation (when the second-month contract is lower).

- A rising WTI time spread therefore implies expectations of lower near-term demand or oversupply (contango)

- A falling spread implies tightening supply or higher near-term demand (backwardation)

While the WTI crude oil time spread has been rising alongside oil prices in recent weeks, it has not rebounded at the same as prices and only recouped around a quarter of its prior decline. This could suggest that prices have got ahead of themselves, and the upside could be limited. Meanwhile, price action on the daily chart could suggest a pullback.

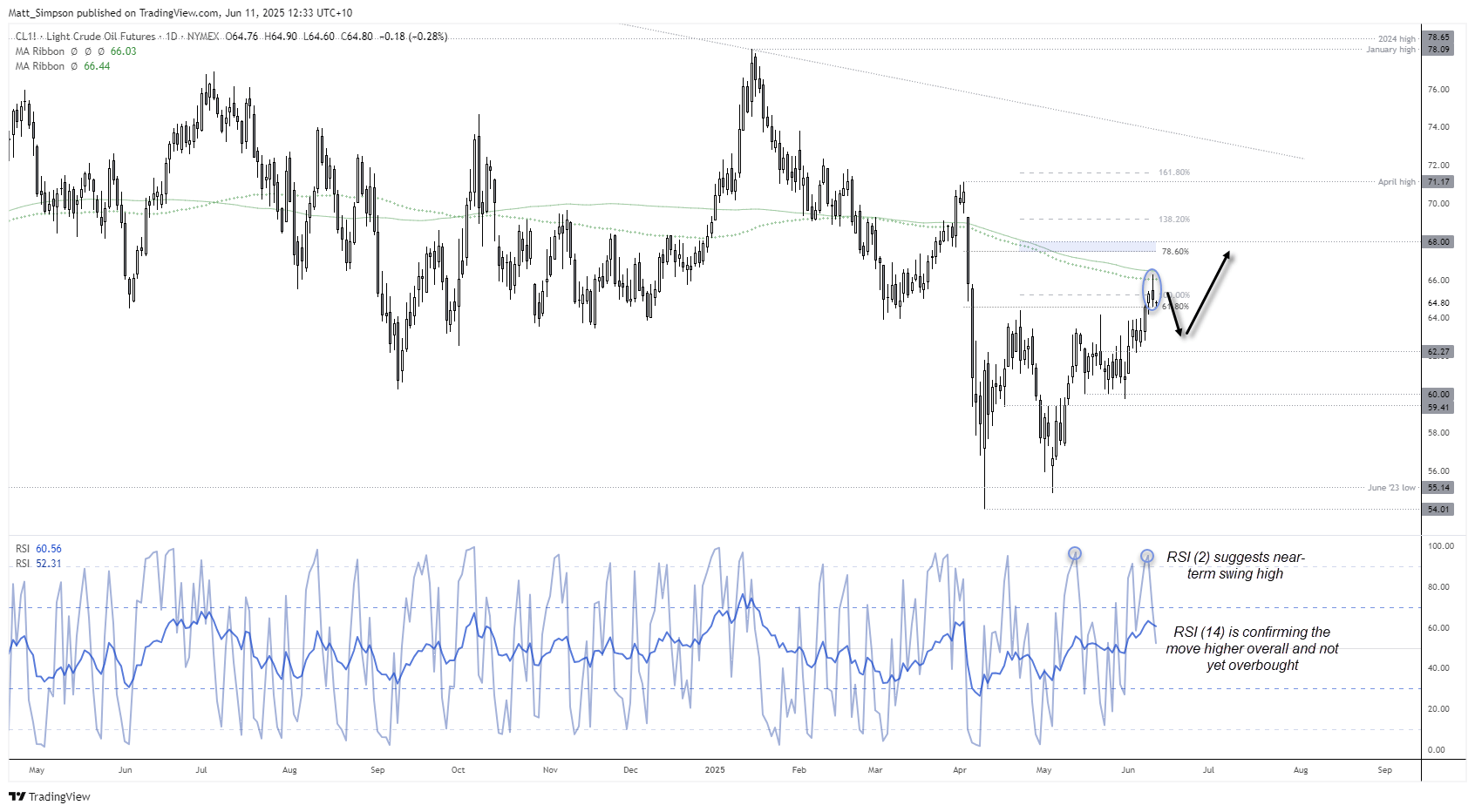

WTI Crude Oil Futures (CL): Technical Analysis

The daily chart shows a strong bullish move emerging around the June 2023 low. WTI crude oil broke out of a bull flag pattern on June 2 and has since reached the 100% price objective, measured from the ‘mast’ of the alleged flag. However, a sharp reversal formed around $66 on Tuesday, hinting at a potential swing high.

The $66 resistance area also carries some weight, given it's near the 20-day EMA (66.03) and 200-day SMA (66.40). The daily RSI (2) was also at its most overbought level since May 13, which adds weight to the swing high case. That said, the daily RSI (14) is confirming the rally, has not reached overbought territory, and no bearish divergence is present.

Given these clues, the bias is for a pullback from current levels while prices remain beneath 66.50. Beyond that, traders could seek dips around lower support levels, taking into account the bullish clues from managed funds on the futures market, the predominantly bullish trend structure on the daily chart, and the potential for the US and China to close a trade deal.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge