Q2 2025 USD/CAD USD/MXN Outlook

As key players in North America's economy, the Mexican and Canadian currencies play a crucial role in regional trade and financial stability. As Q2 2025 approaches, USD/CAD and USD/MXN face a landscape of economic and political uncertainty. So far in 2025, both the Mexican peso and the Canadian dollar have maintained a largely neutral bias against the U.S. dollar.

What’s Happening with Central Banks?

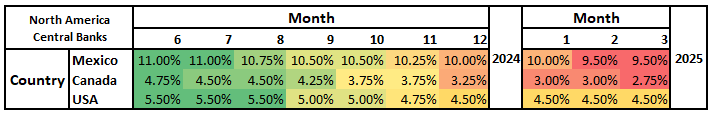

As of this writing, North American central banks have maintained a strong dovish bias, with continuous interest rate cuts since June 2024. The Bank of Mexico initially held its rate at 11% but has since reduced it to 9.5%—a 1.5% decrease over 10 month, following a consistent easing cycle. The Bank of Canada has taken a similar approach, cutting rates from 4.75% in June 2024 to 2.75%, marking a 2% reduction over 10 months.

The Federal Reserve, however, has deviated from this trend. While its rate stood at 5.5% in June 2024, it has remained unchanged at 4.5% since December 2024, resulting in a more modest 1% reduction, significantly less than its counterparts.

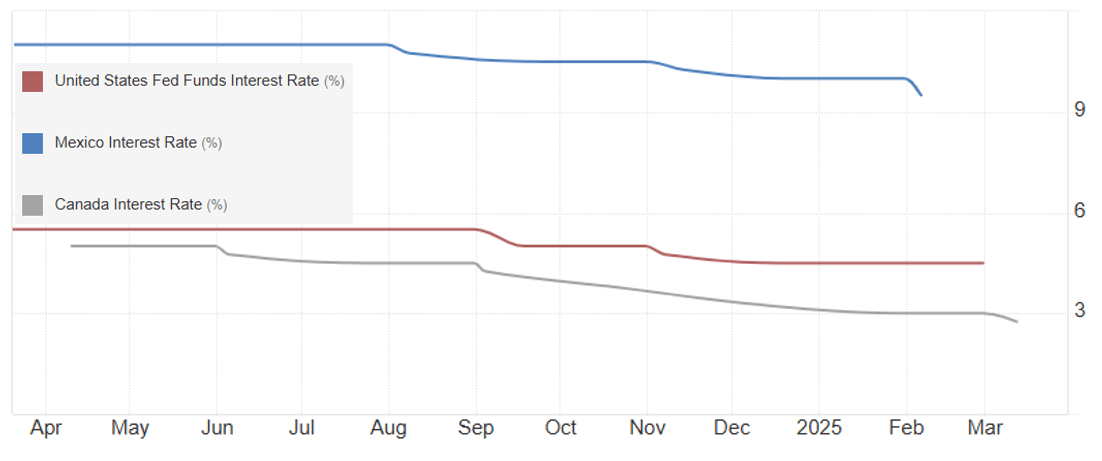

This divergence is crucial, as Mexico and Canada have shown a clear dovish bias in their monetary policies, while the U.S. has maintained a neutral stance with stable interest rates in the short term. This suggests that the Fed is taking a more aggressive approach compared to the other two central banks, which has been a key driver of sustained demand for the U.S. dollar in the last months.

North American Interest Rate Table 2024-2025

Colors: Green to red. Green for higher rates and red for lower rates in each country.

Source : Data – Trading E conomics

North American Interest Rate Chart 2024-2025

Source : Trading E conomics

It is also important to note that investments in Canada and Mexico are considered riskier compared to those in the United States. As a result, a neutral policy with stable interest rates in the U.S. can remain attractive for capital inflows, offering a steady 4.5% rate with a significantly lower risk perception than the other two countries.

The key question now is how monetary policy will evolve in the coming months, as this will be a crucial factor in determining the long-term strength of North American currencies.

During its latest rate cut on March 12, 2025, the Bank of Canada stated that inflation is below to its 2% target. This could allow room for further rate cuts throughout the year, keeping the outlook firmly in dovish territory for the time being.

The last interest rate cut by the Bank of Mexico took place on February 6. The institution stated that while inflation still requires adjustments, the country's ongoing economic slowdown may ne ed further rate reductions to support short-term economic growth. This reinforces a dovish outlook.

The Federal Reserve maintains a slightly different stance, as in its March 19 decision, the central bank decided to keep the rate steady at 4.5%. Shortly after, Chair Jerome Powell stated that inflation has eased significantly over the past two years but remains somewhat elevated relative to the long-term 2% target, indicating that, for now, there are no plans to change the neutral monetary policy stance in the short term.

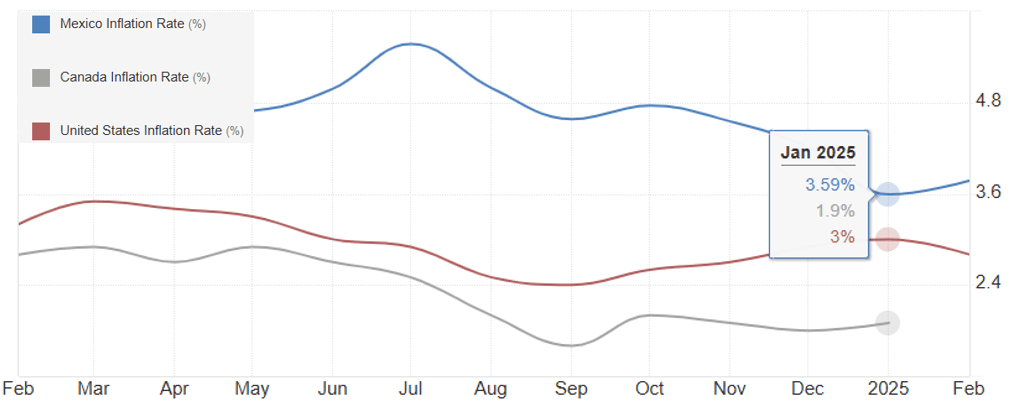

As the numbers show, inflation in Canada has remained stable at around 1.9%, close to the Bank of Canada's 2% target. In Mexico, inflation is slightly higher at 3.6%, compared to the Bank of Mexico's target of 3.1%. The situation in the United States is somewhat different, as the Federal Reserve's target remains at 2%, but the latest data from February shows inflation at 2.8%, still above the intended level.

North American Inflation Trends 2024-2025

Source : Trading E conomics

The recent comments of central banks and inflation rate changes could indicate that while Mexico and Canada have room to maintain a more flexible interest rate policy, as their inflation levels are not far from their target, the Federal Reserve faces a different scenario. Since its current inflation rate remains significantly above the 2% target, it suggests that a more aggressive monetary stance could persist in the coming months.

This divergence is crucial for capital flows, as investors are likely to see the stable U.S. rate as an attractive option, leading to continued demand for U.S. Treasury bonds over the coming months. In turn, this could sustain the ongoing demand for the U.S. dollar.

If U.S. monetary policy remains neutral, upward pressure on USD/CAD and USD/MXN could regain relevance. The dovish stance of the Bank of Canada and the Bank of Mexico has yet to draw strong investor interest in their fixed-income markets. As a result, demand for their currencies may remain weak, while the U.S. dollar remains the preferred choice for investors.

The Big Surprise: Trade War

On February 1, 2025, U.S. President Donald Trump signed a series of executive orders imposing a 25% tariff on imports from Canada and Mexico, apart from Canadian oil, which faces a 10% tariff. These measures officially took effect on March 4, but Mexico still has a negotiation window before full implementation.

The primary goal of the new trade war is to establish the United States as a leading production hub while reducing the advantages of foreign products. Additionally, it seeks to address migration and drug trafficking issues, which remain ongoing challenges at the U.S. border.

In response to the new trade barriers, Canada was among the first to retaliate. As of this writing March 20, the country has imposed 25% tariffs on U.S. imports, calling the measures unjustified and describing them as a betrayal of the historically strong economic ties between the two nations.

Mexico, for its part, announced retaliatory measures against the new tariffs but has not specified the exact rates or which U.S. products will face higher duties. In contrast, President Claudia Sheinbaum has taken a more measured approach, prioritizing ongoing negotiations with the White House to reach an agreement on the new tariffs.

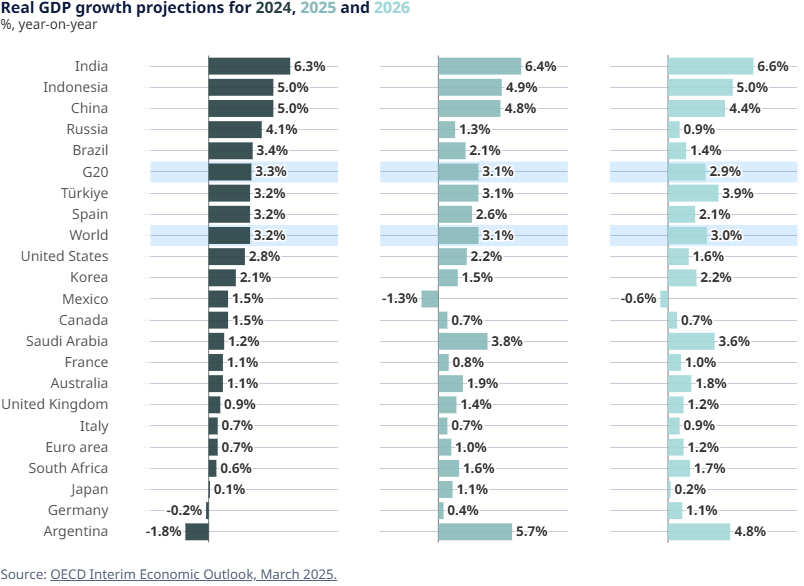

However, the impact on market confidence has been significant, affecting fluctuations in both the Canadian dollar and the Mexican peso. A new trade war presents direct challenges for both economies in the coming months. According to forecasts from the Organization for Economic Cooperation and Development (OECD), the new U.S. tariffs could push Mexico into a potential recession in 2025, with a projected GDP contraction of 1.6% for the year and 0.6% in 2026. Meanwhile, Canada’s GDP outlook has been revised downward, with projected growth of just 0.7% for 2025-2026.

Source: OECD

As of this writing, there is still no diplomatic resolution to the new trade war initiated by the White House. It is important to note that approximately 76% of Canada’s total exports and 80% of Mexico’s total exports are destined for the United States. Therefore, the implementation of tariffs would inevitably weaken economic expectations for both countries and create a persistent sense of uncertainty in th ese markets.

In this scenario, confidence in the Mexican peso and the Canadian dollar could be significantly affected. If there is no real diplomatic resolution to this trade conflict, upward pressure on USD/MXN and USD/CAD could become increasingly relevant in the coming months.

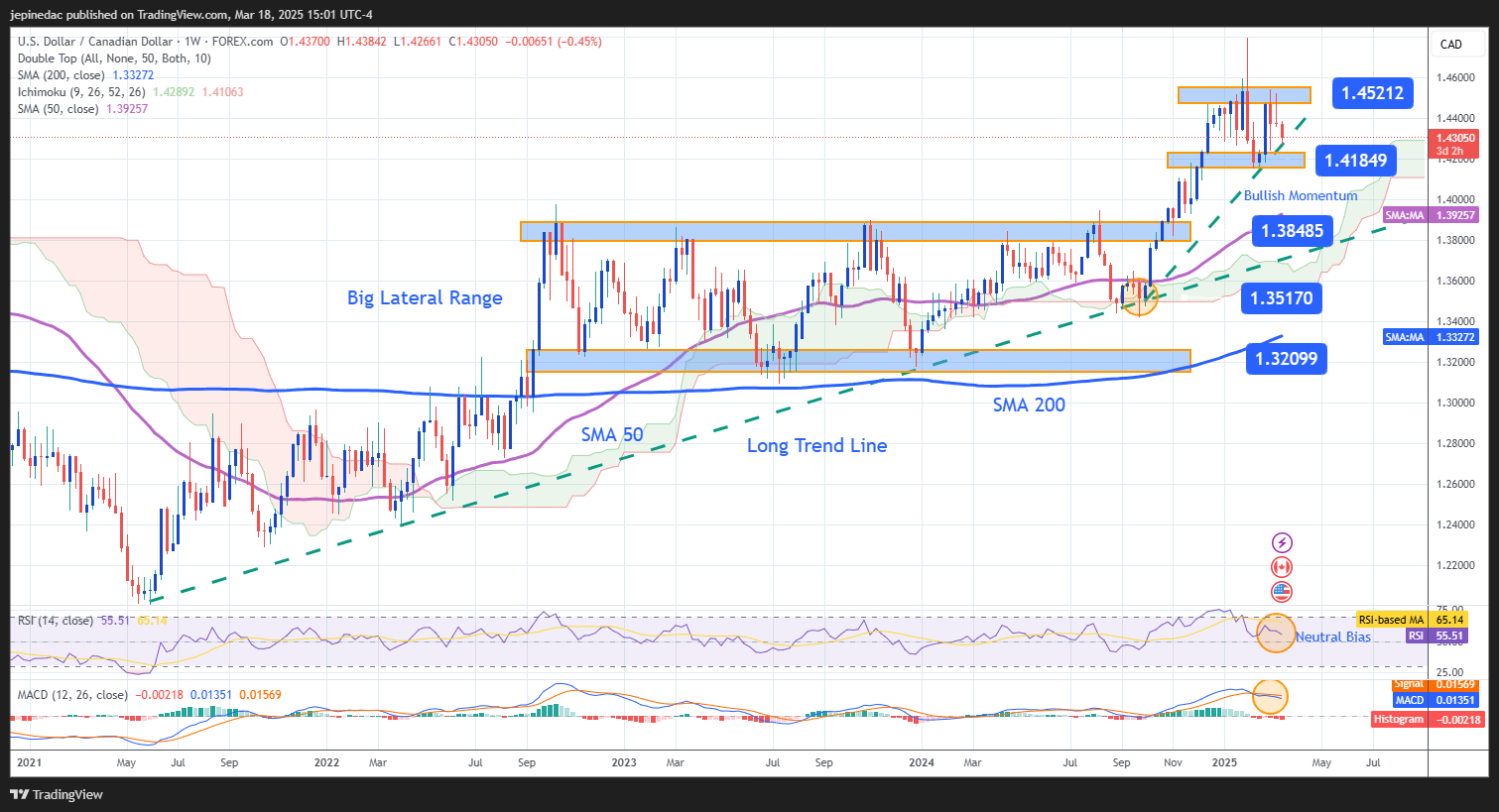

USD/ CAD Forecast

Source : StoneX, Tradingview

- Long-Term Uptrend: Since May 2021, the USD/CAD pair has maintained a long-term bullish trend, which gained momentum in September 2024, driving further buying interest. However, in recent months, a short-term trend has developed, leading to increased price neutrality in the past few weeks.

- If this neutral phase persists, it may disrupt the short-term uptrend, but the long-term bullish structure since 2021 remains intact. The 50- and 200-period moving averages continue to trend upward, reinforcing strong long-term buying momentum.

- Indicators:

- RSI: The RSI line has been gradually declining, nearing the neutral 50 level. If it continues oscillating around this zone, it may signal a balance between buying and selling pressure, reinforcing the sideways range established since December 2024, between 1.45212 and 1.41849.

- MACD: The MACD histogram remains slightly bearish near the neutral 0 line, signaling uncertainty in the moving average trend. If price movements stay close to this level, the sideways range is likely to persist and extend further.

- Key Levels:

- 1.45212 – Near-Term Resistance: This level remains at the highs reached during the first part of 2025. Sustained movements above this level could revitalize the short-term accelerated uptrend, reinforcing bullish momentum.

- 1.41849 – Near-Term Support: This level represents the lower boundary of the current small sideways range. Movements below this level could break the short-term uptrend, potentially leading to faster selling pressure in the market.

- 1.38485 – Critical Support: This level aligns with the upper boundary of a large sideways range from previous months. Price movements approaching this level could reactivate the broader lateral range in the long term.

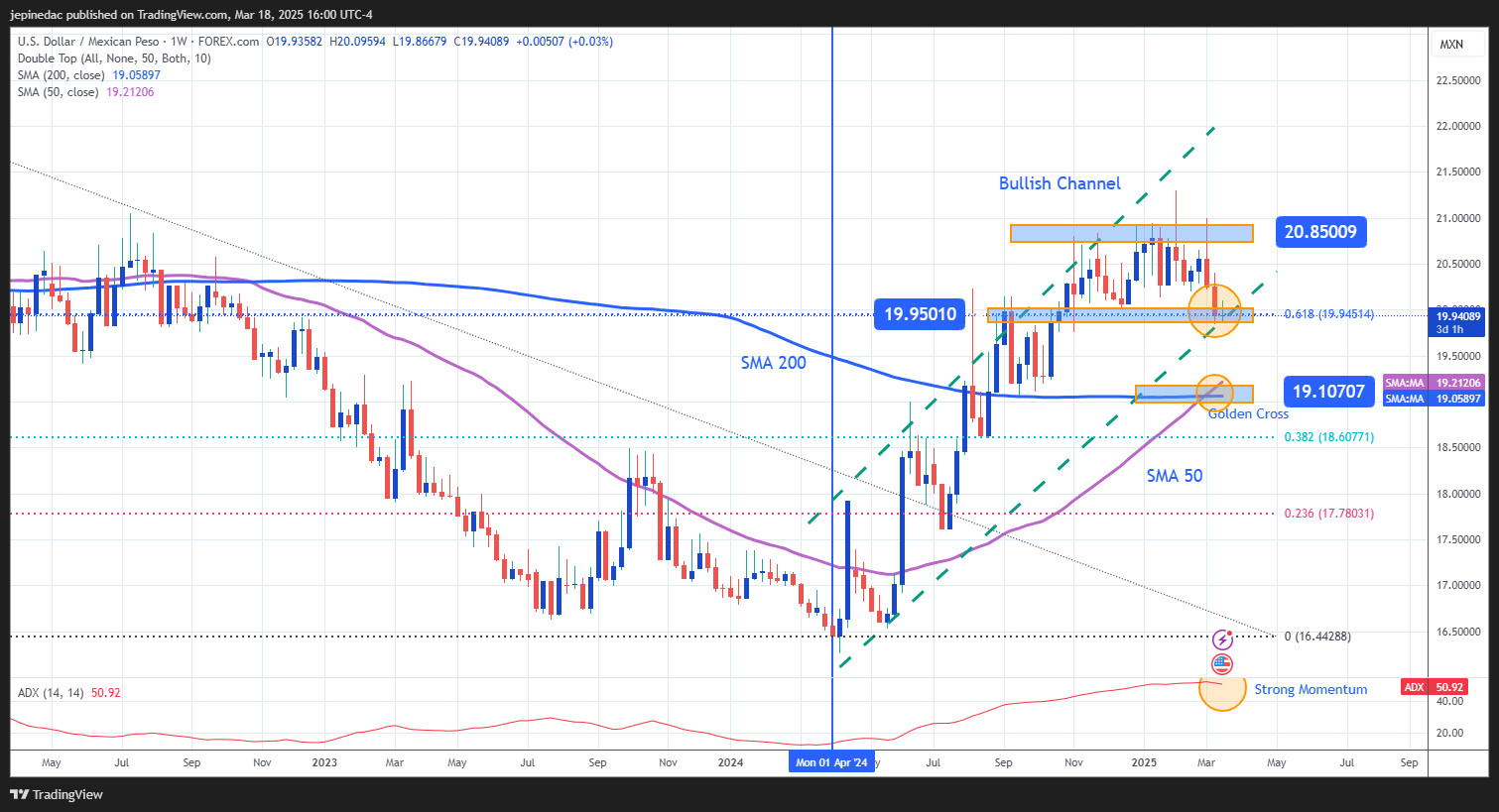

USD/ MXN Forecast

Source : StoneX, Tradingview

- Bullish Channel: Since April 2024, a bullish channel has developed, weakening the Mexican peso. The price is now testing the lower boundary, but selling pressure remains insufficient to break the bullish structure.

- Golden Cross: The 50-period simple moving average has crossed above the 200-period SMA, forming a Golden Cross. This indicates strong long-term bullish momentum, which could lead to more sustained buying pressure in the coming months.

- ADX: The ADX line is at its highest levels in over two years, signaling strong momentum in USD/MXN. However, its steady decline suggests that the recent bearish move has hit a key support level, which will be crucial in determining whether the bullish channel holds in the long term.

- Key Levels:

- 20.85 – Critical Resistance: This level represents the highest zone reached by USD/MXN in recent years. Sustained movements above this level could reinforce the bullish strength of the ascending channel and further validate the Golden Cross formation.

- 19.95 – Current Support: This level corresponds to the lower boundary of the bullish channel and the 61.8% Fibonacci retracement level. A sustained break below could weaken the bullish structure, potentially shifting the trend to a more neutral stance in the coming months.

- 19.10 – Final Support Zone: This level aligns with the 50- and 200-period moving averages. If the price drops to this level, it could signal the end of the long-standing bullish trend in USD/MXN, potentially leading to a significant bearish movement.

Written by Julian Pineda, CFA – Market Analyst

Follow Julian on X: @julianpineda25