View related analysis:

- USD/JPY Drops Before FOMC as Taiwan Dollar Surge Lifts Haven Flows

- ASX 200 Technical Outlook: Index Pulls Back as Bears Eye Support

- Gold Rebounds, Crude Oil Tests Support as Markets Eye Fed, Trade Talks

The ASX 200 Index eased for a second consecutive session on Tuesday, slipping 0.08% to settle near 7,742. Market sentiment remained cautious ahead of key US economic data and earnings updates.

Among the 200 constituents, 115 stocks advanced, 68 declined, and 17 closed unchanged — pointing to a slightly bullish breadth despite the index’s modest decline.

ASX 200 Snapshot: Sector Leaders and Laggards

- Advancers: 115 stocks

- Decliners: 68 stocks

- Unchanged: 17 stocks

Sector Performance

- Winners: 7 of the 11 ASX sectors advanced, led by energy and real estate.

- Losers: 4 sectors closed lower, with healthcare and consumer staples underperforming.

ASX 200 Futures (SPI 200) Technical Outlook: Wall Street Rebound May Lift Local Sentiment

ASX 200 futures (SPI 200) slipped 0.385% overnight, mirroring earlier weakness in Wall Street futures and reflecting cautious investor sentiment. However, a late-session rebound in S&P 500, Nasdaq 100, and Dow Jones futures lifted broader risk appetite, following headlines that US and Chinese officials will meet in Geneva this week.

Expectations of progress toward a potential US–China trade agreement helped buoy US equity futures into their close, and could provide a near-term tailwind for Australian markets.

While downside risks remain should talks stall, a positive outcome would likely boost global risk sentiment and support a rebound in the ASX 200 Index. Even in the absence of concrete progress, local equities may open firmer today as they look to close the gap with Wall Street’s overnight strength.

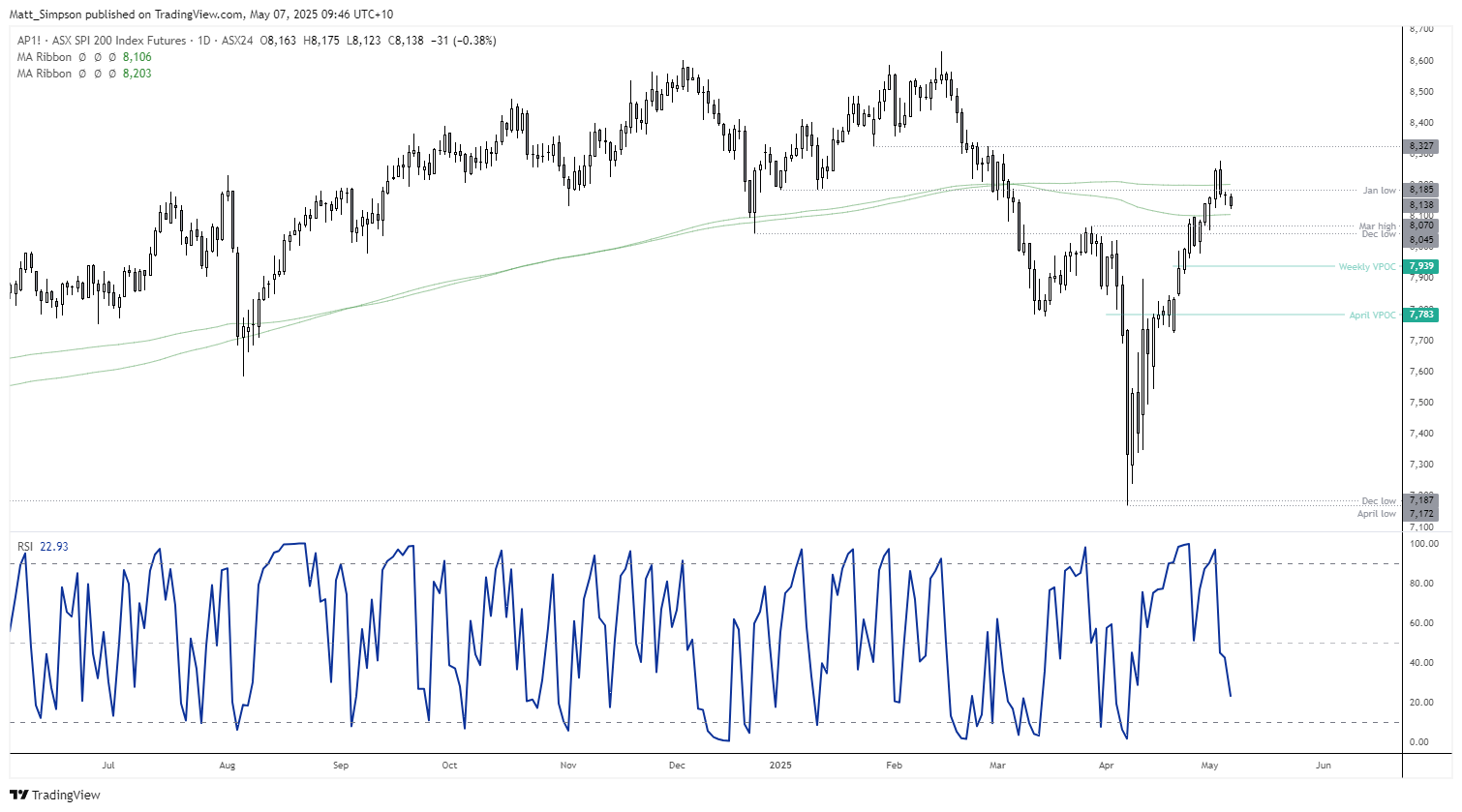

ASX 200 Futures: Daily Chart

The daily chart shows the ASX is trading below its 200-day simple moving average (SMA) but holding above its 200-day exponential moving average (EMA) and the 8100 handle. We have clearly not seen the bearish follow-through I had envisaged yesterday, and trade headlines now risk prompting a move higher in the near term. The 200-day SMA (8203) and Monday’s high present potential upside targets for bulls. However, the index’s ability to break higher and retest 8300 is likely in the hands of US and Chinese officials.

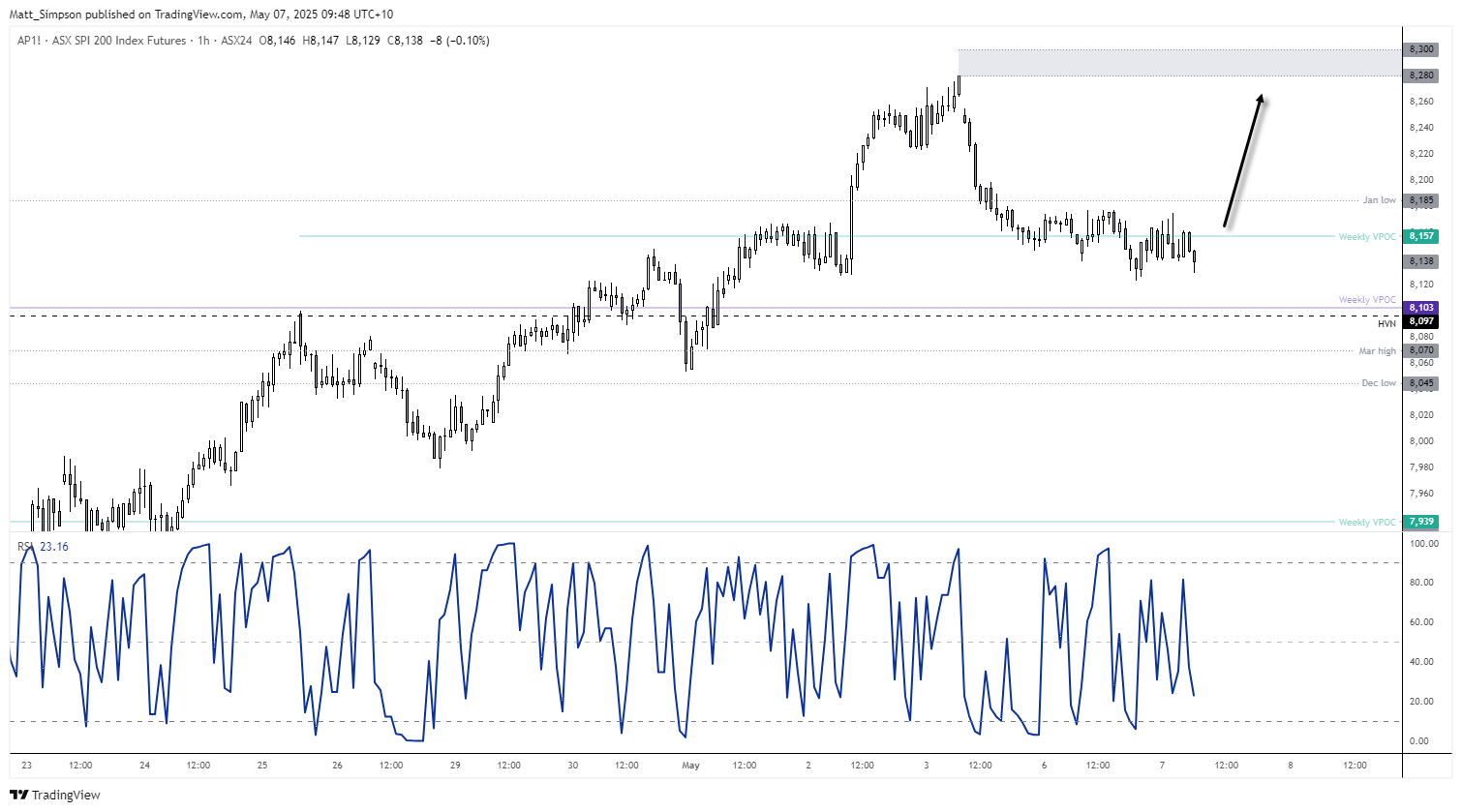

ASX 200 Futures: 1-hour Chart

The 1-hour chart shows the ASX 200 is meandering around last week’s volume point of control (VPOC). Given yesterday’s narrow range and the recent consolidation, I am inclined to suspect that a swing low is near on this timeframe—if it hasn’t already formed.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge