ASX 200 (Australian 200 Index) at a Glance

- The ASX 200 cash index snapped a 7-day winning streak on Monday, marking the end of its best run since September

- All 11 ASX 200 sectors closed lower, led by energy and financials

- 123 ASX 200 stocks declined, 56 advanced, 2 were flat

- ASX 200 futures (SPI 200) were -21 points lower overnight, indicating a weak open for the ASX cash market today

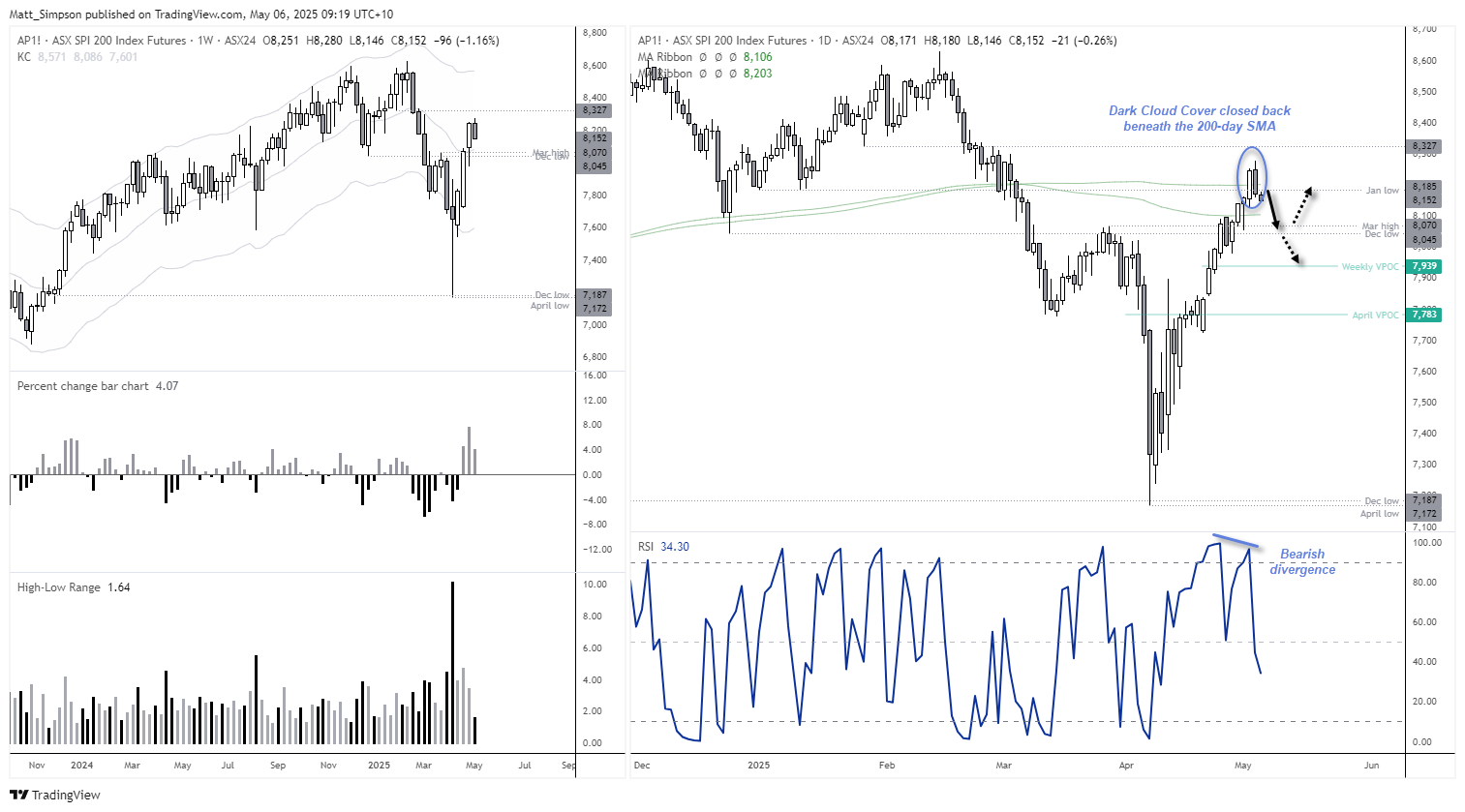

ASX 200 Index Futures (Australian 200 Index) Technical Analysis

ASX bulls have enjoyed a 15.5% rally over the past 18 trading days, from the April low to Monday’s high. In fact, the ASX 200 has just recorded its strongest three-week rally since November 2020. However, Monday’s -0.9% decline marked its worst daily loss in nearly three weeks and may signal a potential change in character for this leg of the rally.

ASX 200 futures also formed a two-bar bearish reversal pattern known as a dark cloud cover, which closed back beneath the 200-day SMA (simple moving average). Meanwhile, the daily RSI (2) has developed a bearish divergence in overbought territory and closed below 50—an early warning sign of waning momentum. Perhaps we’re finally about to see the pullback I had anticipated last week.

- For today, bears may seek a move to retest the 200-day EMA (exponential moving average) at 8106.

- Note potential support levels around the December low (8045) and March high (8070) if prices break beneath 8100.

- A move below 8045 could see the ASX 200 head towards the weekly VPOC (volume point of control) at 7939.

Economic Events in Focus (AEST / GMT+10)

Public holiday in Japan, South Korea

- 11:00 – New Zealand commodity price index (ANZ)

- 11:30 – Australian building approvals

- 11:45 – Chinese services PMI (Caixin)

- 15:45 – Swiss unemployment

- 17:35 – Swiss National Bank (SNB) Vice Chairman Schlegel Speaks

- 18:00 – EU HCOB Eurozone Composite PMI (Apr)

- 18:30 – UK S&P Global Composite PMI (Apr)

- 19:00 – EU PPI (MoM) (Mar)

- 22:30 – Canadian trade balance (Mar)

- 00:00 – Canadian Ivey PMI (Apr)

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge